Any entrepreneur knows that financial statements are a vital part of understanding a company’s financial health and performance. Therefore, in this article, we provide you with a comprehensive guide to financial statement reports, their concept, and their importance in making critical decisions and providing managers and investors with a comprehensive view of the facility’s financial position. We also explain to you the four main types of financial statements, detailing their contents and the information they provide. Follow along with us.

What are financial statements?

Financial statements are a set of written reports containing financial data and information for the facility, prepared using specific accounting standards that are a common language between preparers and users of corporate financial statements. These reports summarize the financial status of the facility during a certain period of time and aim to provide a comprehensive and accurate overview of the company’s financial performance and the extent to which it achieves its financial and economic goals. Thus, financial statement reports help their users understand the facility’s condition and evaluate its financial performance to make sound decisions.

The importance of financial statements

The main goal of preparing financial statement reports is to provide transparent and accurate information about the financial position of the company or facility, which contributes to the following:

1. Enhance decision-making

Providing accurate financial information about the facility’s status helps managers and decision-makers make sound strategic and tactical decisions based on the financial analysis of the financial statements. It also helps in making decisions related to the entity’s resources, such as decisions to buy or sell debt instruments, equity instruments, and decisions regarding the settlement of loans and other forms of credit.

2. Attracting and retaining investors

Financial statement reports serve as a tool to retain current investors and lenders and attract potential investors and lenders by providing transparent financial information about the facility that allows them to evaluate the strength of the facility and the possibility of achieving the desired financial return and make decisions regarding investment in the facility.

Types of financial statement reports

There are several types of financial statement reports, which can be classified according to the time period they cover into two parts: primary financial statements that cover periods of less than a year (quarterly or semi-annually), which can include a complete or abbreviated set of financial statements. Annual financial statements covering a full-year period. Types of financial statements differ in their contents and the information they provide. Here are the four main types:

1. Statement of financial position

It is considered one of the most important financial documents because it presents the company’s financial condition at a specific point in time. It is used to understand how assets, liabilities, and shareholders’ equity are distributed in an organization, as well as to illustrate long-term trends in investment and financing. The elements of the statement of financial position include three main components that are linked together in a simple mathematical equation: assets = liabilities + ownership equity (shareholders’ equity). Here’s the detail: Assets are the economic resources that an organization owns that generate returns or help provide future benefits, such as:

- Inventory.

- Real estate.

- Cash.

- Investments in other companies.

- Intangible assets, such as a brand.

Liabilities (commitments): are the financial obligations that must be paid by the facility to other parties, such as:

- Bank loans.

- Payable expenses.

Shareholders’ equity is the money invested by the owners of an entity’s shares along with the company’s accumulated profits and losses since its launch. It is simply the remaining share in the assets after subtracting the liabilities from them. The company sometimes distributes these profits in a process called (dividends.

2: Statement of profits, losses, and comprehensive income

This list is divided into two parts: the profit and loss statement or income statement, which is a list that provides a summary of the company’s performance in achieving profit or loss during a specific period of time as it displays the recognized revenues and expenses. The other section is the statement of comprehensive income, which is considered an expansion of the income statement. It displays total comprehensive income, starting with the net profit or loss in the income statement and continuing with other components of comprehensive income. Contains non-recurring and unusual items, such as revaluation surpluses of unrealized gains on financial assets, currency translation differences, and changes in fair value. The statement of income and other comprehensive income details all of a company’s sources of profit from the sale of products, provision of services, or investment returns and is therefore the most analytical part of financial statement reports. In general, the income statement depends on deducting total expenses from revenues, but it is not limited to that alone, as the income statement items include the following:

- Cost of revenue.

- Total profits.

- Net profits or losses.

- Operating profits are the income from the entity’s main operating operations.

- Profits and losses from non-core operations.

- Gains and losses from stocks.

- Net income is one of the most important items in the list, as it reflects the results of the facility’s operations during the period specified in the list and helps in knowing the results of investments in the facility by knowing the return on shares. Knowing the sources of profits, whether operational or from occasional work, helps in correctly evaluating the facility’s performance.

3-Statement of Cash Flows

It is a financial statement that shows the volume of cash flows entering the facility, along with its sources, and exiting it, along with the methods of spending and employing them. Cash is the primary key to an organization’s success, as it uses it to pay operating expenses, finance its investments, pay debts, etc., which increases the importance of the cash flow statement. This type of financial statement report helps predict the organization’s future performance in order to make the right investment decisions. The menu contains three main components: Cash flows from operating activities show the movement of cash to and from an entity’s operating activities. It is good that these flows enter the facility in a large proportion. Cash flows from financing activities: It shows the movement of cash to and from the issuance or sale of shares, debt instruments, loans, etc. Cash flows from investing activities show the movement of cash to and from an entity’s investments. It is important to know that the presence of high profits does not necessarily mean that the cash flow is positive, as there are items in the profit and loss statement that can raise profits without being cash. Negative cash flows also do not mean a negative indicator, as the company can spend a lot on investments to support the expansion of its activities in the future.

4: Statement of changes in shareholders’ equity

The statement of changes in equity is a financial document that reflects changes in a company’s shareholders’ equity during a specified period, usually annually. Shareholders’ rights are the obligations owed by the company towards its shareholders (owners). Shareholders’ equity increases when capital increases or undistributed profits occur and decreases when capital decreases or profits or losses are distributed. The most important items on this list are the following: capital. Reserves are sums of money from an organization’s profits that are reserved for use in achieving specific goals such as investment, expansion, or strengthening the financial position. Undistributed profits: These are profits retained in the enterprise that are reinvested instead of distributing them to shareholders.

What are the clarifications?

Clarifications are part of financial statement reports. They are appendices that contain more details of what is included in types of financial statements that do not appear directly in the body of the financial statements. This detailed information is important to shareholders and investors. The clarifications also contain an explanation of the accounting policies that were followed in preparing the financial statements, in addition to any subsequent events that occurred in the period between the end of the period specified in the statements and before their issuance, so that the effect of this event appears in the clarifications without affecting the results of the establishment’s position in the lists.

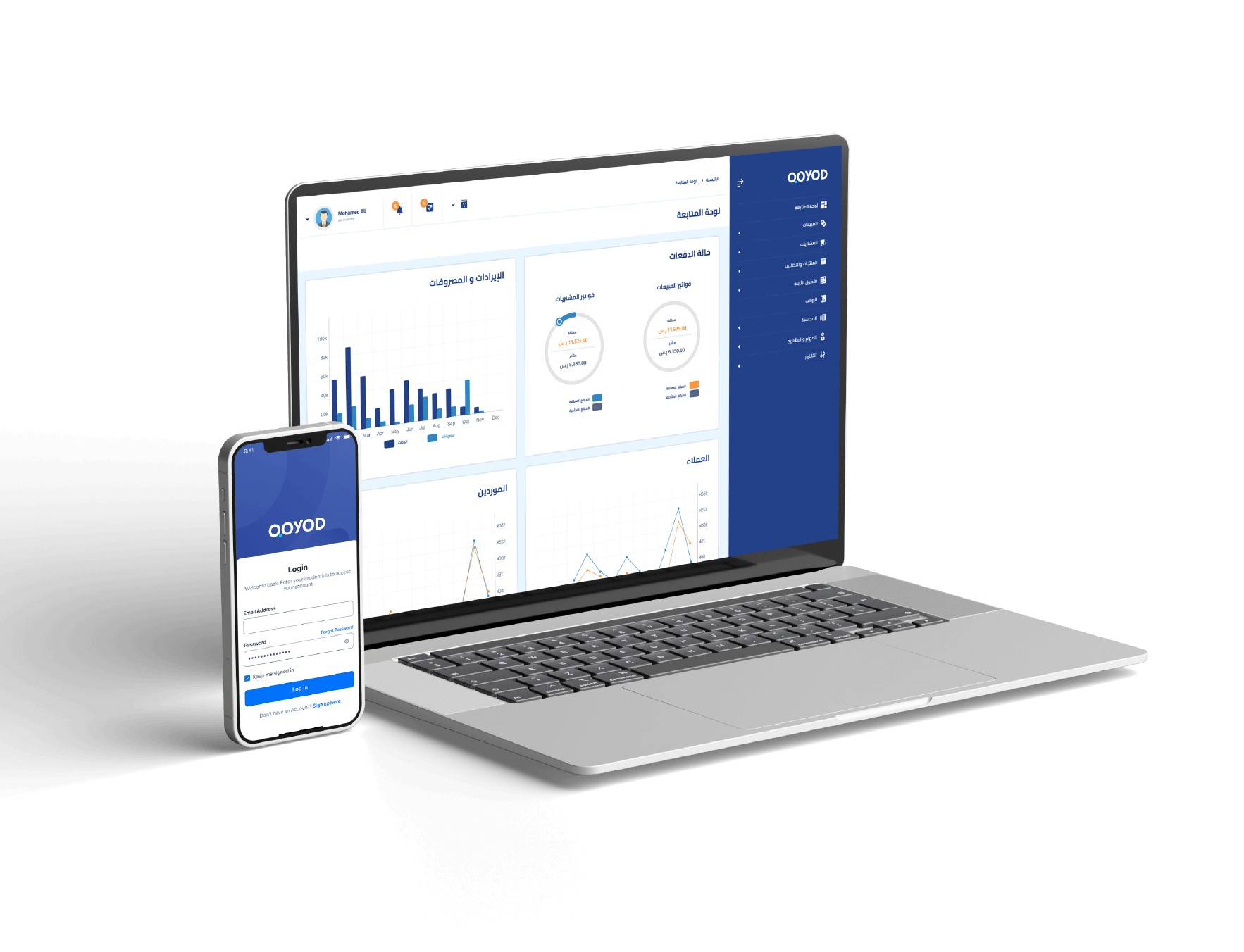

Qoyod system: accurate financial statements

Qoyod helps you prepare your facility’s financial statement reports, such as the income statement and cash flow statement, automatically and accurately, which saves time, effort, and cost. You can choose the time period for which you want to issue the lists, with the ability to compare different time periods in addition to the ability to specify account levels (up to level 7). Choose what is best for your facility and join the Qoyod accounting system today, the best and easiest cloud accounting program approved by the Zakat, Tax, and Customs Authority in Saudi Arabia, and get a free 14-day trial period.

Conclusion

Financial statement reports provide an accurate and comprehensive overview of an organization’s financial performance during a specific period of time. Despite the different types of financial statements, they are interconnected. For example, the cash flow statement provides additional information about the monetary assets present in the financial position statement, and changes in the assets and liabilities are reflected in the statement of financial position. Financial position based on revenues and expenses in the income statement. Therefore, it is important to look at all of them and not rely on just one to make good decisions.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!