Are you tired of thinking about how to organize your financial information and ensure you comply with tax laws? Then you must learn about tax returns, which will relieve you of this burden! Tax returns are the starting point for understanding and organizing your personal or business financial situation. Tax returns contribute to providing accurate and transparent information to the tax authorities and allow you to determine the tax amounts due or refunded based on the total sales tax and the total input tax. In addition, a tax return is an opportunity for comprehensive financial analysis, where you can identify the strengths and weaknesses of your financial situation and develop strategies to improve them. In this article, we present to you a comprehensive guide to everything you need to know about the tax return, its definition, its importance, and how to prepare it. We also provide you with a downloadable form that contains all the information necessary for a proper Tax return to facilitate the process of collecting information for you and preparing the return with ease!

What is a tax return?

A tax return, or tax declaration, is an official document that individuals or companies subject to value-added tax submit to the tax authorities to provide accurate information about their income, expenses, and other financial activities during a specific tax time period. The tax return form contains details regarding an individual or company’s sales and purchases and the VAT amounts collected and paid during that period. A tax return is used to calculate the amounts that must be paid in accordance with the tax legislation in force in the country in question. A tax return must be neat and accurate to avoid legal problems and tax penalties.

Importance of Tax Returns

Tax returns are important for both companies, individuals, and tax authorities, as their importance is represented by several points, as follows:

-

Tax and legal compliance

A tax return is a way to comply with tax laws and regulations in the country in which the company or individual does business. By submitting the return, attention is drawn to the legal responsibility of individuals and companies to provide accurate and transparent information to the tax authorities. This also exempts them from fines or severe penalties that may be imposed on them if they fail to file a tax return. A tax return also helps maintain a clean tax record by being filed regularly and correctly to reduce the risk of tax penalties.

-

Determine the tax amounts due.

A tax return helps calculate the tax amounts due in an accurate manner in accordance with tax legislation. This helps avoid disputes and problems with tax authorities and ensures proper tax compliance. In addition to facilitating the process of claiming a VAT refund if the company pays more tax than the value imposed on it,.

-

Record keeping

Tax returns contain details of information relating to a company’s sales and purchases and, therefore, provide an accurate record of this important information, which can be consulted for accounting and tax purposes.

-

Cash flow management

Tax returns help you plan and manage cash flow effectively and determine the necessary sources and uses of funds. It also enables companies to recover the value-added tax on their purchases and calculate it against the value-added tax charged on their sales.

-

Achieving transparency and credibility

By submitting tax returns on time, individuals and companies demonstrate their commitment to transparency and credibility in disclosing their income and financial activities. This enhances confidence among stakeholders such as investors, banks, and business partners.

-

Identify the strengths and weaknesses of the business.

Analysis of the financial data provided in the tax return may help identify the strengths and weaknesses of the business and identify opportunities to improve financial performance and future tax planning.

Information contained in a tax return

There is certain information that must be provided in the tax return, which is determined by the tax authorities in the country. They include the following:

- VAT registration number for the individual or company.

- The time period for VAT in the return.

- The value of the value-added tax on the sales of an individual or company.

- The value of the value-added tax on the purchases of an individual or company.

- The total VAT amount, which represents the amount due or refundable,.

- Any corrections or amendments to previous tax returns can be included.

Tax return form

The Zakat and Income Authority has clarified the necessity of submitting tax returns and disclosing taxable sales and purchase transactions to taxpayers. Therefore, we provide you with a downloadable tax return form in Saudi Arabia that contains all the necessary information. Click here: Tax return form for Saudi value-added tax.

How to set up a tax return

Now that you know what the VAT declaration form looks like, here is how to prepare it step by step, making it easier for you to make it difficult and complicated and ensuring that you create it correctly to avoid penalties by ensuring that your company’s VAT obligations are reported:

- Start by choosing a tax declaration form that complies with the requirements and laws of the tax authorities in your country and downloading this form.

- Fill out the necessary fields in the form, which include the following:

- The tax period you wish to cover in the tax return.

- Your or your company’s VAT registration number.

- Total sales value with the amount of tax due on it.

- The total value of purchases, along with the amount of tax due on them.

- Calculate the difference between the value-added tax on sales and the value-added tax on purchases using the following calculation:

- Tax due = total sales tax minus total purchase tax

- The result is the tax payable or recoverable.

- Correct and amend the tax return for the previous period.

- Review the form and the information you filled in, and ensure that it is completely accurate.

- Submit the return to the tax authority or the relevant authority before the application deadline date.

How to calculate a tax return

Here’s how to calculate a tax return with restrictions:

Calculate the tax return.

| The product tax value in the invoice | |||

| 0% | more than 0% | ||

| Product Type | Value-added tax | Tax exempt | Value-added tax |

| Zero tax | Zero tax | Value-added tax | |

| Tax exempt | Tax exempt | Value-added tax | |

When was the VAT return submitted?

A tax return is submitted for a specific period of time, as we mentioned previously, and this time period may be monthly or quarterly (i.e., every 3 months). The period for submitting the declaration is determined according to the annual sales volume of the company or individual, as follows:

- Monthly: Taxpayers whose annual sales subject to value-added tax exceed 40 million Saudi riyals.

- Quarterly: Taxpayers whose sales are subject to value-added tax are less than 40 million Saudi riyals.

It is necessary to know that filing the tax return for each tax period must be done in the time period between the first day and the last day of the month following the end of the tax period, meaning that if you want to submit a tax return for the second quarter of 2024 (from April to June 2024), you must submit it before July 31, 2024.

File a tax return form in Saudi Arabia professionally with Qoyod.

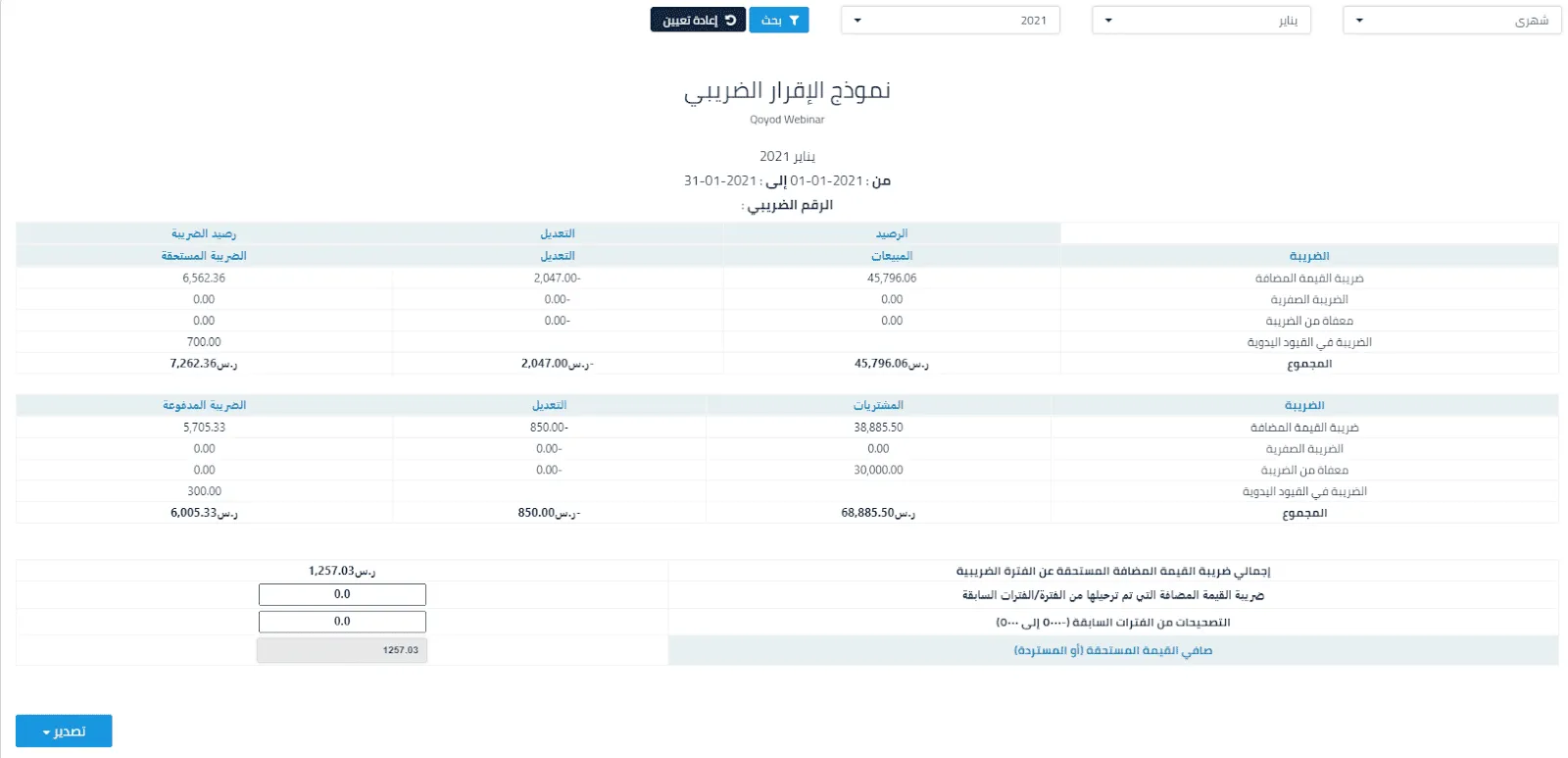

Among the many professional reports that the Qoyod accounting system provides to you on the reports page is the tax return report. It prepares it in the correct manner in accordance with the requirements of the General Authority of Zakat, Tax, and Customs regarding the contents of the declaration and its quarterly or monthly submission dates. Qoyod is approved by the authority as an accounting program. Distinct, and therefore you can submit the declaration to the authority quite easily on the specified date.

The tax return report generated by the Qoyod system helps to know the details of the tax received or paid by the establishment. It shows all the tax details that your daily purchase and sales invoice entries reflect on the tax return report, and the return also includes the tax due or refunded after Qoyod calculates it automatically.

Conclusion

Tax returns are an essential tool for individuals and businesses, allowing them to provide necessary financial information to the tax authorities. Through the tax return, the amounts of taxes due are determined, and compliance with tax laws is ensured. In addition, tax returns contribute to cash flow management for individuals and companies, as they help in financial planning and identify the necessary sources and uses of funds. It is important to commit to filing an accurate and timely tax return to avoid negative legal and financial consequences.

Here, the Qoyod accounting system stands out, which prepares your or your company’s tax return automatically, accurately, and professionally using the inputs of daily sales and purchase invoices. It is not limited to that alone but also provides you with an integrated set of professional accounting services that will facilitate the accounting and administrative processes in your facility. Do not hesitate and subscribe to the Qoyod accounting system, the easiest accounting program in Saudi Arabia that puts your facility at the forefront.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!