| Excerpt

The Saudi Tax ID (VAT ID) is a mandatory 15-digit identifier essential for ZATCA compliance and the e-invoicing system. Obtain and verify yours easily via the official ZATCA portal to protect your SME from severe penalties. |

In a world filled with complex financial terms and figures, the Tax Identification Number (TIN) in Saudi Arabia stands out as a vital identifier that individuals and companies in the Kingdom must prioritise in 2026. It’s more than just a number; it’s a financial identity that signifies crucial legal and fiscal responsibilities. The Tax ID in Saudi Arabia (or VAT ID) is essential for regulating tax systems, ensuring fairness in tax collection, and reflecting the commitment of businesses, especially small/medium-sized businesses (SMEs) in Saudi Arabia, to the nation’s financial laws. This adherence is key to supporting the national economy by funding vital government projects.

Given the significant technological advancements in the Kingdom, particularly the mandatory e-invoicing system in Saudi Arabia enforced by the Zakat, Tax, and Customs Authority (ZATCA), obtaining your Tax ID in Saudi Arabia has become a straightforward electronic process via trusted official platforms. This ease of compliance promotes financial transparency and efficient operation for every business, from start-ups in Riyadh to established firms in Jeddah and the Eastern Province.

What is the Tax ID in Saudi Arabia?

The Tax ID in Saudi Arabia is a fundamental component of the Kingdom’s tax framework, issued to individuals and establishments registered with the Zakat, Tax, and Customs Authority (ZATCA).This number plays a crucial role in regulating the relationship between taxpayers and the relevant government bodies. It acts as a tax identity that documents the establishment’s or individual’s compliance with all prevailing tax laws and regulations.

The Tax ID in Saudi Arabia allows establishments to interact with the tax system easily and transparently, enabling the authorities to accurately track economic activities and analyze financial data. By doing so, the Tax ID enhances trust and credibility between companies and regulatory bodies, supporting the Kingdom’s efforts to achieve an effective and equitable tax system.

The Importance and Diverse Roles of the Tax ID

The Tax ID in Saudi Arabia plays a central role in facilitating financial and administrative processes between companies and government agencies. Registered companies use their Tax ID when filing tax returns, which significantly improves procedural efficiency, reduces reliance on manual paperwork, and accelerates transactions.

Moreover, the Tax ID is considered an important official document requested by financial institutions like banks and investors, serving as proof of the company’s compliance with tax laws. Therefore, obtaining the Tax ID is a positive sign that boosts client and investor confidence, affirming the company’s commitment to legal and tax frameworks.

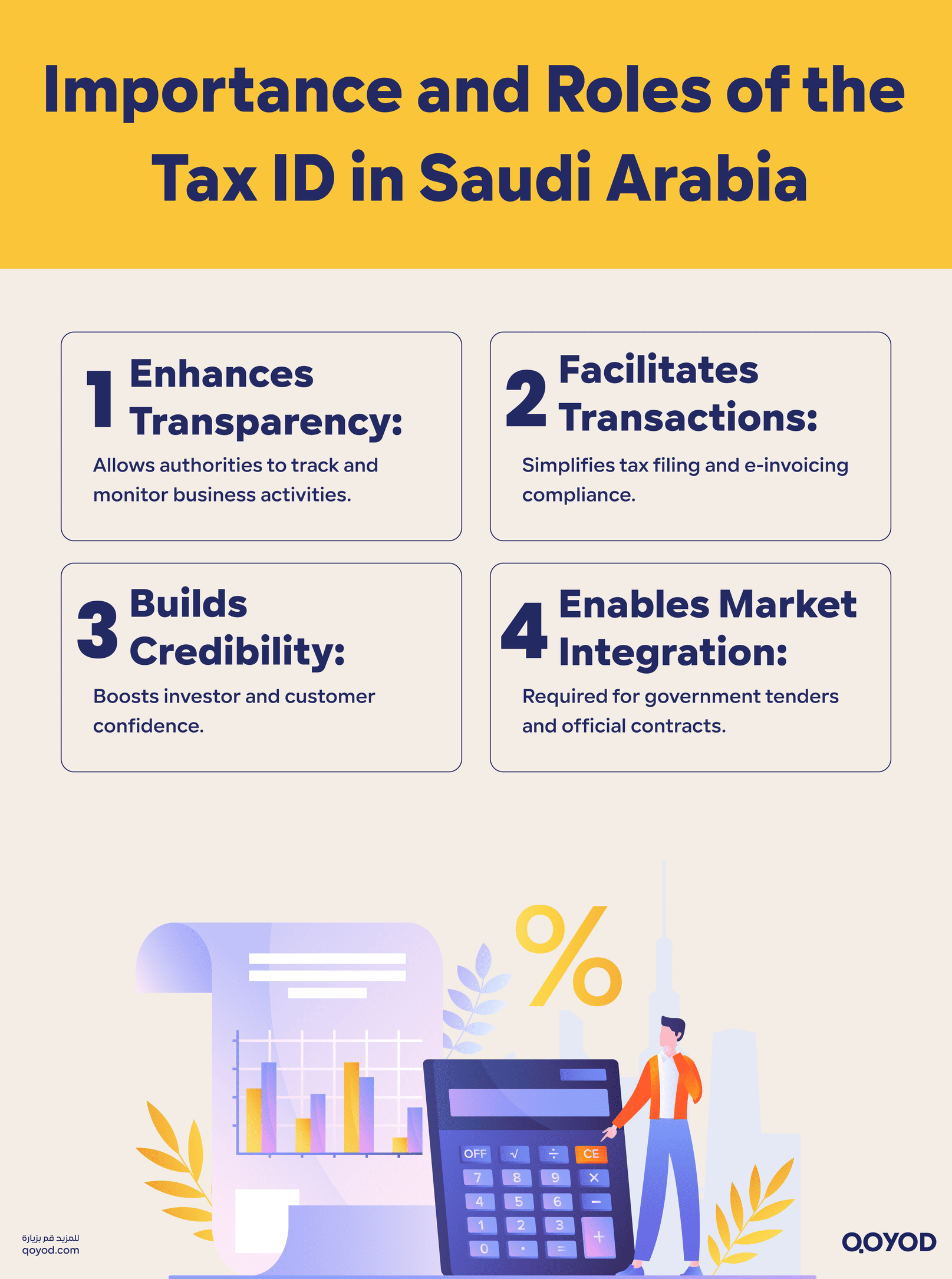

The key roles of the Tax ID in Saudi Arabia can be summarised as follows:

- Enhancing Transparency: Enables regulatory bodies to monitor economic activities, crucial for SMEs operating in Dammam or Khobar.

- Facilitating Financial Transactions: Simplifies processes such as submitting tax returns and complying with the e-invoicing system in Saudi Arabia.

- Building Credibility: Instils confidence in customers and investors for companies committed to the system.

- Market Integration: Essential for companies seeking to compete in government tenders and secure official contracts.

How many digits is the Tax ID in Saudi Arabia?

The Tax ID in Saudi Arabia consists of 15 unique digits, which serves as a distinct identifier for every taxpayer in the system. Taxpayers must include this number in all outgoing and incoming tax invoices to identify the payer and track their related commercial activities. Compliance with mentioning the Tax ID on invoices is an essential requirement of the Saudi tax system, bolstering transparency and ensuring the accuracy of financial transactions between all parties.

How to Obtain the Tax ID in Saudi Arabia

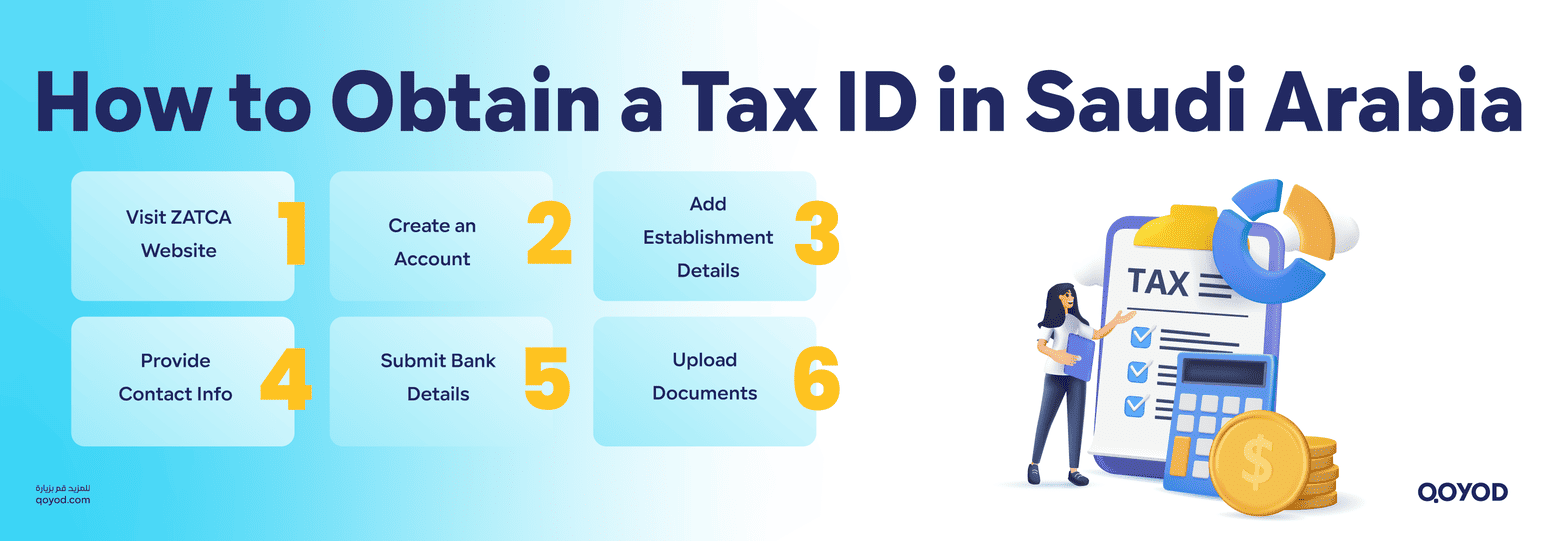

If you’re asking, “How do I get my Tax ID in Saudi Arabia?” the process is streamlined for businesses across the Kingdom, from Madinah to Riyadh. You can obtain the Tax ID by following these steps via the ZATCA website:

Steps to Obtain the Tax ID in Saudi Arabia:

Visit the Zakat, Tax, and Customs Authority (ZATCA) Website:

Start by visiting the official ZATCA website (https://zatca.gov.sa), where services for obtaining the Tax ID are provided electronically.

Create a New User Account:

If you don’t have an account, create a new one. You will need to enter basic information such as:

- Name

- National ID or Iqama Number

- Address

Add Establishment Information:

After logging in, add the details of the establishment for which you are obtaining the Tax ID, such as:

- Establishment Name

- Type of Commercial Activity

- Establishment Address

Provide Contact Information:

You will be asked to enter contact information, such as:

- Phone Number

- Email Address

Submit Bank Account Information:

You are required to provide your bank account details to facilitate tax payment or refund processes.

Upload Required Official Documents:

Some official documents must be uploaded, such as:

- Commercial Registration (CR)

- Tax Declaration

- Memorandum of Association (if applicable)

Note: Please refer to the official ZATCA website for the precise and up-to-date list of required documents to ensure a smooth application process.

How to Verify the Tax ID in Saudi Arabia (VAT ID Check)

Verifying the validity of a Tax ID in Saudi Arabia is crucial for both individuals and companies, especially when dealing with new suppliers or clients in Jeddah or any other city. Verification ensures the accuracy of a company’s or individual’s tax certificate.

Steps to Verify the Tax ID:

- Visit the ZATCA Website:

Start the inquiry process by visiting the official ZATCA website Select the Appropriate Service:

Look for “Verify” or “Tax ID Verification” and select this service. - Choose VAT Registration Certificate Verification:

After selecting the inquiry service, choose the “Verify VAT Registration Certificate” option, as this is the common method for Tax ID verification. - Enter Required Data:

You will typically need to enter the Tax ID you wish to verify. Additional information, such as the company’s name or individual’s name, may also be requested. - Click Search:

Once the data is entered, click the “Search” button. The system will then check the validity of the Tax ID in Saudi Arabia and display the results.

Updating and Canceling Your Tax ID

Maintaining up-to-date information and following proper procedures for discontinuation is essential for ZATCA compliance.

Updating Tax ID Information Upon Commercial Changes

If any changes occur to the establishment’s commercial data, such as an address change or ownership change, the Saudi tax system mandates taxpayers to update their Tax ID data with ZATCA to ensure data accuracy for auditing and monitoring. Failure to update this information may lead to data conflicts or delays in official procedures.

Steps to Update Tax ID Information:

- Log in to the establishment’s account via the ZATCA portal.

- Submit an update request, entering the new data and clarifying the reason for the change (e.g., change of owner or relocation).

- Attach supporting documents that validate the changes, such as a new lease agreement or an updated Commercial Registration.

- Follow up on the request status until the update is officially confirmed by ZATCA.

How to Cancel the Tax ID in Saudi Arabia

Canceling the Tax ID in Saudi Arabia requires following specific procedures to ensure the company does not face legal accountability. A company must no longer be liable for the Tax ID or must have ceased its activity to proceed with cancellation.

- Log in to the ZATCA website and access the Tax Services.

- Select the service: “Cancellation of VAT Registration.”

- Complete the data and upload the required attachments to execute the cancellation service.

- Review all submitted data and confirm the cancellation request.

Note: These procedures must be completed according to the official guidelines provided by ZATCA to ensure compliance with applicable laws and regulations.

The Impact of Late Registration Penalties on Saudi Businesses

Late registration penalties for Value Added Tax (VAT) in the Kingdom are measures taken by ZATCA to ensure establishments comply with tax laws. These penalties have direct and indirect negative impacts on businesses, especially small/medium-sized businesses in Saudi Arabia.

| Impact Category | Detail |

| Financial Burden | A minimum fine of 10,000 SAR is imposed for late registration (within 30 days of reaching the mandatory threshold). This significantly impacts cash flow, particularly for start-ups in Riyadh or Dammam. |

| Impeded Government Dealings | The absence of a valid Tax ID can prevent an establishment from participating in government tenders or signing official contracts. |

| Decreased Trust | Companies non-compliant with tax registration may be perceived as disorganised or unreliable, weakening their chances of building partnerships or securing financing. |

| Legal Risks & Audits | Late registration exposes the establishment to the possibility of a surprise audit by ZATCA, potentially leading to the discovery of other violations and accumulated fines. |

Using the Tax ID in E-Invoicing and Tax Dealings

The Tax ID in Saudi Arabia is a mandatory element in the e-invoicing system in Saudi Arabia and the VAT framework. It must be clearly included in all electronic invoices to ensure compliance with ZATCA regulations.

Using the Tax ID in Electronic Invoices

The Tax ID must be displayed clearly on the electronic invoice, usually near the establishment’s details (name, CR number, address). An electronic invoice must include:

- Supplier’s name, address, and Tax ID

- Customer’s name (if tax registered)

- Date of issue and invoice number

- Description of goods/services

- Total amount before VAT, VAT value, and total amount inclusive of VAT

- QR code (for simplified tax invoices)

Important Alert: An invoice without the Tax ID is considered non-compliant and may result in financial penalties for businesses operating in Khobar or elsewhere.

Ready for the 2nd phase of E-invoicing?Use Qoyod to generate and send invoices.

Using the Tax ID in Tax Dealings

- Tax Returns: The Tax ID is required when submitting tax returns through the ZATCA portal.

- Refunds and Adjustments: It is requested in transactions related to tax refunds, correction of returns, or objections.

- Compliance Verification: Other parties (suppliers or customers) can use the number to verify the establishment’s VAT registration through the official ZATCA verification link.

Tax ID vs. Unique ID: Key Differences

Understanding the differences between the Tax ID in Saudi Arabia and the Unique ID is vital for accurate financial reporting and compliance.

| Classification | Tax ID (VAT ID) | Unique ID |

| Definition | A 15-digit number for entities registered under Value Added Tax (VAT). | A 10-digit number assigned to any taxpayer (individual or entity) upon general registration with ZATCA. |

| Primary Purpose | Exclusive to VAT and tax compliance. | Used for Zakat, other non-VAT taxes, and general communication with ZATCA. |

| Recipients | Companies and entities subject to VAT. | Individuals and entities subject to Zakat or any other tax. |

| Key Uses | Issuing e-invoices & tax invoices, audits, government tenders, tax verification. | Opening a file with ZATCA, submitting Zakat returns, official correspondence, paying non-VAT dues. |

Tips and Mistakes to Avoid with the Tax ID

SMEs in Riyadh and across the Kingdom often make simple errors when handling their Tax ID that can result in fines. Follow these best practices for optimal compliance.

| Section | Best Practices / Common Mistakes |

| Tips for Compliance | Verify the Tax ID’s validity before including it in any invoice using the official ZATCA link. Include the Tax ID clearly on e-invoices next to the company name and CR number. Update your tax data immediately if there are changes in address or business activity. Follow up on returns and settle tax liabilities on time to avoid penalties. |

| Mistakes to Avoid | Entering an incorrect Tax ID or one belonging to another entity on invoices/contracts. Failing to include the Tax ID on invoices issued to customers, especially e-invoices. Delaying the update of the Tax ID after changes, causing official data discrepancies. Confusing the Tax ID with the Unique ID during correspondence or platform registration.Neglecting to verify the Tax ID when dealing with business partners. |

Conclusion: Streamline Your Tax Compliance with Qoyod

Reflect on the critical importance of the Tax ID in Saudi Arabia for 2026 and its impact on your financial life. This number carries significant responsibilities and reflects your commitment to the financial and tax laws of the Kingdom. Whether you are an individual complying with financial controls or a company aiming to organize its finances, obtaining and accurately managing your Tax ID in Saudi Arabia is essential.

For small/medium-sized businesses (SMEs) in Saudi Arabia, navigating these requirements, specialized tools are essential. Qoyod Accounting Software is a powerful solution designed to simplify compliance. It offers features tailored for the Kingdom, including seamless e-invoicing capabilities and compliance with all ZATCA requirements, as well as integrated modules for Point of Sale (POS), Inventory, and Customer Relationship Management.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for Saudi companies.

FAQ: Essential Tax ID Questions for Saudi Businesses

What is the Tax ID in Saudi Arabia?

It is a unique 15-digit identifier issued by ZATCA to individuals and establishments for tracking tax obligations and official dealings, crucial for VAT compliance.

When is registration mandatory?

When an establishment's annual revenues exceed the mandatory registration threshold of 375,000 SAR over the last 12 months. Registration must be initiated within 30 days of exceeding this limit.

How do I verify the Tax ID of any entity?

Use the verification service on the ZATCA website by entering the required number to view the registration status and data accuracy.

What are the penalties for late or non-compliance?

Fines starting at 10,000 SAR, potential suspension of certain activities, and risk of surprise audits.

How is the Tax ID used in e-invoices?

It must be clearly and prominently included in every electronic invoice (issued or received) next to the establishment’s data to be considered a system-compliant invoice.