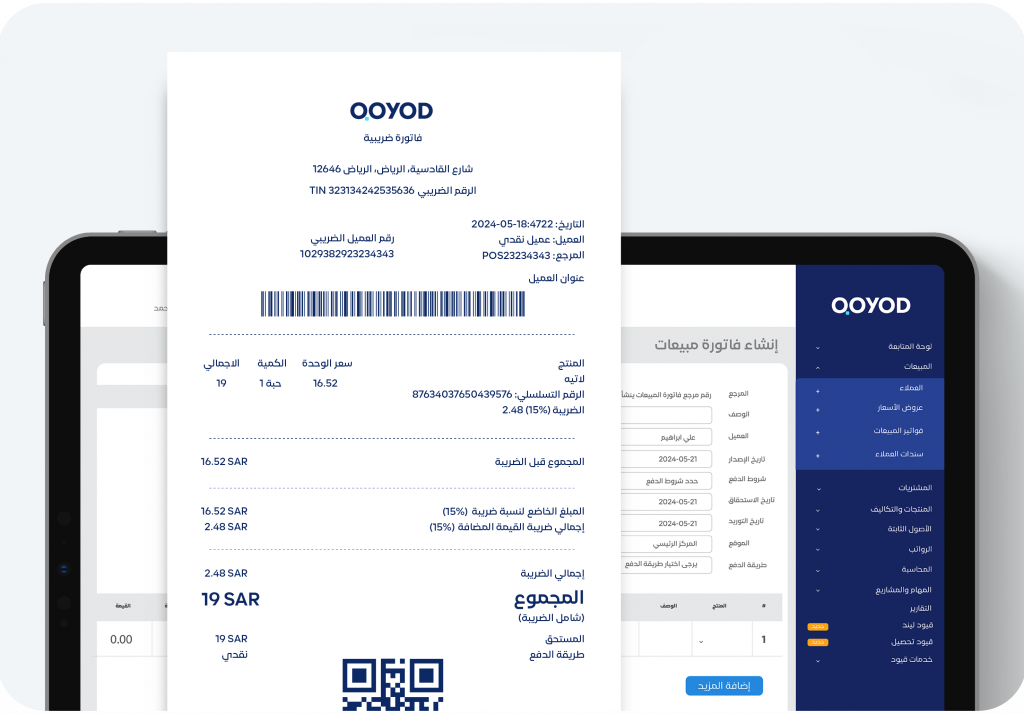

The printed barcode from Qoyod conforms to all the security specifications required by the Zakat, Tax and Customs Authority, and you can view it in Clause 4.1 of the electronic requirements file through the link from here

The data printed in the barcode must be converted first to TLV format and then to Base64 encoding and programs that print barcodes directly.

Without this transfer, it will not be in accordance with the security specifications of the electronic invoice, and the owner of the facility may be subject to a violation