The Qoyod program is an innovative and reliable solution to carry out this process efficiently and accurately. The program provides an easy-to-use interface and advanced tools, which make it easier for users to estimate and calculate value-added tax in accordance with the legislation and regulations in force in the Kingdom. Learn in this article how to use the Qoyod program in this context and its role in improving efficiency and accuracy in tax operations.

With its flexibility and comprehensive capabilities, Qoyod software allows users to enter data easily, quickly, and accurately and perform complex VAT calculations. The software also provides detailed reports and comprehensive analyses that facilitate the understanding and monitoring of results, making it easier to comply with tax laws and submit tax reports accurately and effectively.

What is a value-added tax?

Value-added tax (VAT) is a type of tax that is imposed on goods and services at the stages of production and distribution. The tax is collected by adding it to the value of the goods and services at a specific rate at each stage of the business process. The goal of VAT is to collect a portion of A small amount of the value of goods and services that are traded is used to finance government expenditures and provide public services such as education, health, and infrastructure.

Value-added tax prices vary from one country to another, and the goods and services that are subject to this tax and those that are exempt from it also differ based on the local legislation and regulations of each country. The value-added tax system is considered one of the most common systems in many countries around the world, and it contributes to stimulating economic growth. Providing sources of income for governments effectively.

What are the procedures for calculating VAT in Saudi Arabia?

The following is an overview of tax calculation procedures and value-added tax laws in Saudi Arabia:

- Company Registration: Companies must register for VAT.

- Filing tax returns: Companies must file VAT returns according to the specified deadlines.

- Tax collection: Companies must collect the tax from customers and transfer it to the competent authority.

- Applying for a Refund: Eligible businesses can apply for a refund of tax paid on eligible purchases.

What are the VAT laws in Saudi Arabia?

- Tax scope: VAT is imposed on goods and services that comply with the terms of the law.

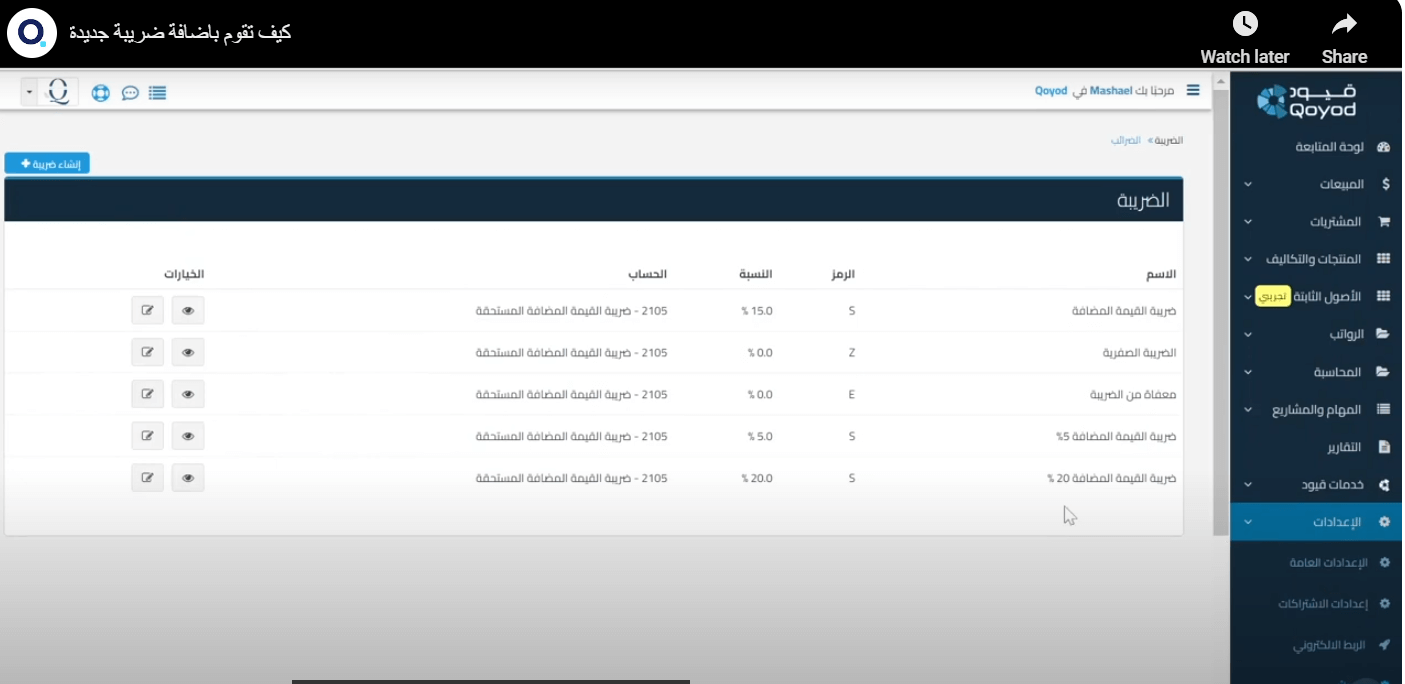

- Tax rates: There is a fixed rate of value-added tax in Saudi Arabia, which is 15%.

- Tax exemptions: There can be tax exemptions for some specific goods and services in accordance with the directives of the Zakat and Income Authority.

- Fines and Penalties: The law imposes penalties on companies that violate regulations and laws related to value-added tax.

How do I calculate VAT from the Qoyod VAT Calculator?

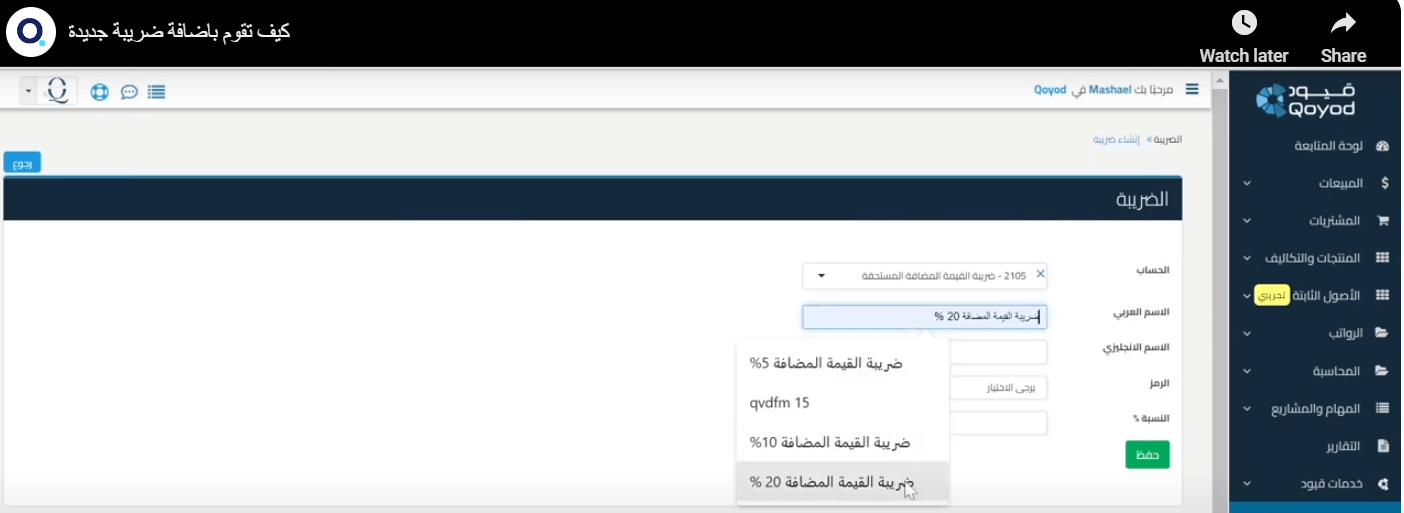

To calculate value-added tax (VAT) using a calculator in the Qoyod program, the following steps can be followed:

- Enter the basic data: Enter basic tax data, such as the value of the invoice or good or service sold and the value-added tax percentage.

- Calculating VAT: After entering the data, the Qoyod Calculator will automatically calculate the VAT amount based on the entered value and the specified tax percentage.

- Reports and Analytics: You can then use the reports and analytics available in Qoyod to view and analyze VAT data in detail, enabling you to monitor tax expenditures and improve financial performance.

- Corrections and amendments: In case of any errors or modifications to the data, you can make the necessary corrections in the calculator and recalculate the VAT according to the changes.

- Generate Tax Reports: You can also use Qoyod to generate required tax reports, such as VAT returns and tax audit reports, for submission to tax authorities and compliance with tax legislation.

When using Qoyod’s VAT calculator, businesses can simplify the tax calculation process and improve the accuracy and effectiveness of their financial and tax operations.

What are the advantages of Qoyod VAT calculation?

Here are some advantages to calculating VAT through Qoyod:

- Save time and effort: Qoyod provides an easy-to-use interface and tools that help automate the VAT calculation process, saving time and effort required in manual procedures.

- Accuracy and compatibility: Thanks to the advanced technologies available in the Qoyod software, it is possible to achieve high accuracy in calculating VAT and ensuring compliance with local tax legislation.

- Generating reports and analyses: The Qoyod program provides the ability to generate detailed reports and comprehensive analyses on the value-added tax calculation, which makes it easier to understand the data and make sound economic decisions.

- Flexibility and customization: Qoyod software allows customization of processes and settings according to a company’s specific needs, making the VAT calculation process more flexible and efficient.

- Continuous Updates: Qoyod ensures continuous updates and improvements, ensuring that the software is always up-to-date with the latest tax standards and legislation.

- Reduce Human Error: By using Qoyod software, human calculation error, which can lead to costly corrections and delays in tax reporting, can be reduced.

- Improved forecasting of tax expenditures: Qoyod software can provide analytical reports that help understand and estimate future tax expenditures, facilitating the company’s financial planning processes.

- Compliance with international standards: Qoyod software allows compliance with international standards regarding the estimation and calculation of VAT, making it easier for companies to deal with international trading partners efficiently.

- Tax date recording: Qoyod can accurately record the dates of tax transactions, facilitating verification and auditing by tax authorities.

- Technical support and ongoing training: The Qoyod program provides specialized technical support and ongoing training to users, which facilitates the process of transitioning to using the program and making the most of its features.

By using Qoyod VAT calculation software, companies can benefit from many advantages that facilitate the tax compliance process, improve the efficiency of their financial operations, and achieve efficiency and accuracy in their tax operations.

Why should I choose the Qoyod VAT Calculator?

You should choose Qoyod VAT calculator software for several reasons:

- Ease of use: Qoyod is designed in a simple and easy-to-use way, making the VAT calculation process easy for users.

- Accuracy and reliability: Qoyod software provides accurate and reliable calculations, ensuring compliance with tax legislation and accurate submission of data to the tax authorities.

- Generate Reports and Analytics: Qoyod can generate detailed reports and comprehensive analyses on VAT calculation, making it easier for users to understand the data and make strategic decisions.

- Flexibility in customization: Qoyod software allows customization of processes and settings according to a company’s specific needs, making it suitable for different types of businesses and industries.

By choosing Qoyod VAT Calculator software, you can benefit from ease of use, accuracy of calculations, and the generation of useful reports, facilitating the process of tax management and compliance for your company.

Conclusion

The VAT calculator is a powerful and necessary tool for individuals and companies alike. It makes it easier for us to understand and calculate the VAT on the products and services we purchase, helps avoid errors in calculations, and estimates costs accurately. This tool also enables us to plan financially and make smart decisions based on accurate information related to the added tax. Thus, the VAT calculator reflects the importance of transparency and financial responsibility in business operations.

On the other hand, Qoyod is considered the easiest accounting program to use. The program provides effective systems such as electronic invoices, point-of-sale systems, and warehouse and customer management, making it an ideal choice for companies at affordable prices. Try Qoyod now for free for a powerful and enjoyable experience for 14 days.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!