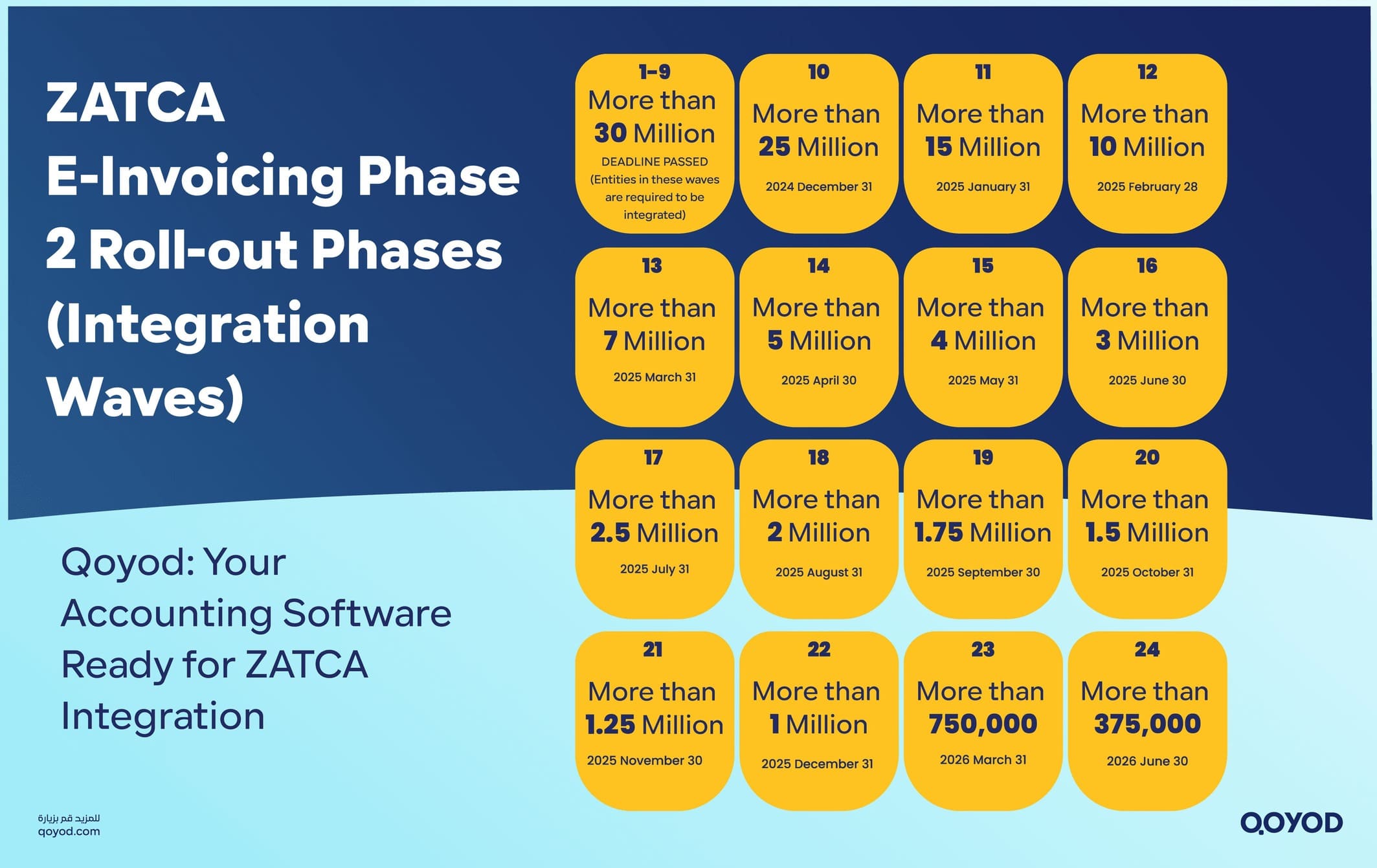

In a new stride towards deepening digital transformation across the Kingdom, the Zakat, Tax and Customs Authority (ZATCA) has announced the criteria for selecting businesses targeted in the twenty-fourth wave (Group 24) to implement the Integration and Linking Phase (Phase 2) of the e-invoicing system in Saudi Arabia. This announcement serves as a crucial call to action for the targeted small/medium-sized businesses (SMEs), urging them to prepare fully for compliance before the strict deadline. The shift to a fully integrated electronic system is mandatory for all businesses, from Riyadh to Jeddah and Dammam, requiring sophisticated accounting solutions. This article details the requirements and highlights how Qoyod Accounting Software offers the perfect, compliant solution.

ZATCA’s Mandate Expansion: Details of the New Decision

ZATCA clarified that the new Group 24 includes all entities whose VAT-taxable revenues exceed 375,000 Saudi Riyals (SAR) during any fiscal year (FY) of 2022, 2023, or 2024.

- The Authority will officially notify all businesses included in this wave.

- The mandated timeframe for businesses to link and integrate their accounting software with ZATCA’s Fatoora system is June 30, 2026.

This phased approach ensures a smooth transition, building on the success of the initial Issuance and Storage Phase (Phase 1). Compliance is non-negotiable for businesses operating in areas like Khobar and Madinah.

Requirements of Phase 2: Deeper Digital Integration for Saudi Businesses

The Integration and Linking Phase (Phase 2) imposes more complex technical and legal requirements than the previous phase. These demands aim to secure transaction data and ensure instant validation with the ZATCA systems.

- Direct System Linking: Taxpayer’s e-invoicing system must be directly linked and integrated with ZATCA’s Fatoora platform.

- Standardized Format: Electronic invoices must be issued in a unified, precisely defined technical format (e.g., XML or PDF/A-3 with embedded XML).

- Mandatory Data: Inclusion of extra, specific elements in the e-invoice is required to guarantee full compatibility and compliance with ZATCA regulations.

Local Example: A trading SME in Riyadh must ensure its sales transactions are instantly reported to ZATCA upon invoice issuance, avoiding penalties for non-compliance.

Qoyod Accounting Software: Your Trusted Partner for Compliance and Financial Excellence

In light of this rapid regulatory development, choosing compliant accounting software is essential to ensure business continuity and avoid substantial penalties. Qoyod Accounting Software is the definitive answer for all targeted Saudi SMEs.

Why Qoyod is the Best Accounting Software in Saudi Arabia?

Qoyod Accounting Software is a cloud-based solution that guarantees complete alignment with the full spectrum of e-invoicing requirements, including the challenging Phase 2 Integration and Linking. Qoyod is designed to be more than just a financial tool,it is your ally in digital growth and financial compliance.

We strongly advise transitioning to Qoyod Accounting Software now to ensure your entity is fully prepared before the deadline. Qoyod provides instant and continuous updates to keep you perpetually current with any changes in the Authority’s requirements.

Qoyod Products to Support Your Saudi Business Growth

Qoyod offers a suite of products designed to empower your business operations:

| Product Name | Core Description and Feature |

| Qoyod Cloud Accounting (Core) | A fully integrated, ZATCA-compliant accounting software (Phase 2 ready), covering General Ledger, Inventory, Sales, and Point of Sale (POS). |

| Qoyod Collect (Tahseel) | A dedicated tool to monitor and accelerate the collection of outstanding debts and invoices, significantly improving your business’s cash flow. |

| Qoyod Lend

(Q Lend) |

Flexible and innovative financing solutions for small/medium-sized businesses (SMEs), providing the necessary capital for expansion and operational needs. |

| Qoyod Bookkeeping | Specialized service for professional and accurate bookkeeping and financial record management, saving businesses time and ensuring data integrity. |

Frequently Asked Questions (FAQ)

What is ZATCA Phase 24 in e-invoicing?

ZATCA Phase 24 refers to the 24th wave of the second phase of Saudi Arabia’s e-invoicing rollout, targeting VAT-registered businesses with revenues over 375,000 SAR in 2022, 2023, or 2024. These businesses must comply with integration and reporting requirements by June 30, 2026.

Who is required to implement e-invoicing in Saudi Arabia?

All VAT-registered businesses in Saudi Arabia must implement e-invoicing and use ZATCA-compliant digital invoicing systems for both B2B and B2C transactions.

What are the main differences between Phase 1 and Phase 2 of Saudi e-invoicing?

Phase 1 is about issuing and storing e-invoices. Phase 2 (integration phase) adds technical, real-time integration with the ZATCA Fatoora platform, stricter data and format requirements (XML or PDF/A-3), and immediate or near-immediate invoice reporting.

What are the penalties for non-compliance with ZATCA e-invoicing?

Penalties range from fines (SAR 1,000–40,000) to suspension of business operations for violations such as not issuing e-invoices, omitting required data, or using unauthorized invoicing systems.

How do I make my accounting or ERP software (like Qoyod) compliant?

Update your software to meet ZATCA’s technical standards (controls, XML/PDF/A-3 output, QR codes, security, real-time API integration). For Qoyod, simply enable e-invoicing through the system settings; it will automatically ensure compliance.

Do I need to issue a QR code on every invoice?

A QR code is mandatory on all B2C e-invoices and is optional (but recommended) for B2B invoices.

How far in advance will ZATCA notify my business about compliance deadlines?

ZATCA provides a six-month notice to qualifying businesses for each new implementation wave under Phase 2 (such as Phase 24).

Can businesses still issue paper invoices?

While e-invoices are mandatory, paper invoices can be provided for customer convenience. However, digital invoicing is required for compliance and must be stored electronically.

Conclusion: Invest in Your Digital Readiness Today

Do not delay your transition to an integrated technical solution! Compliance with Phase 2 of the e-invoicing system in Saudi Arabia requires preparation, configuration, and linking time. Ensuring your business is digitally compliant is an investment in its stability and future growth. Discover how Qoyod can make this process smooth and guaranteed.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for Saudi companies.