In a world of accelerating innovation and technological development, inventory management is crucial to the success of companies and institutions in multiple fields. Among those advanced patterns of inventory management, the concept of periodic and perpetual inventory stands out as one of the most effective and innovative methods for achieving efficiency and improving the operational performance of organizations, as it represents a revolutionary approach. In inventory management, it goes beyond the traditional system of annual or periodic inventory and requires continuous and updated monitoring of inventory. It is worth noting that the primary goal of this approach is to achieve an optimal balance between available inventory and actual demand through an advanced methodology that relies on sensing needs and continuous analysis of data. Instead of waiting until the end of the year or specific time periods to take a comprehensive inventory, this inventory relies on an accurate tracking system that allows organizations to know the quantities of inventory available at any time.

Periodic and perpetual inventory

What is the concept of a periodic inventory?

It is an important inventory management system that helps companies and stores track inventory accurately and efficiently, as it contributes to achieving the ideal balance between available materials and demand and provides important information for making strategic decisions related to inventory.

The importance of periodic inventory depends on achieving several benefits for companies and stores. By monitoring inventory on a regular and organized basis, companies can achieve better control over inventory levels and avoid unwanted shortages or surpluses. It also helps improve preparation and planning processes for purchases and sales, as it provides accurate information about demand. Thus, companies can improve the efficiency of supply and distribution, in addition to reducing inventory costs.

What is a perpetual inventory?

Perpetual inventory is a system that allows inventory to be updated immediately and regularly, as every trading transaction in inventory is recorded as soon as it occurs, whether it is a sale, purchase, or movement within the inventory. This type of inventory is used in industries that require continuous and accurate monitoring of inventory, such as pharmaceutical industries and food industries.

In the perpetual inventory system, advanced technologies are used, such as barcodes, to update inventory in an accurate and efficient manner. When a commodity is purchased or sold, the associated barcode is scanned using a barcode reader, and the inventory is automatically updated in the system. Hence, this ensures that the inventory is accurate and updated in real time.

Types of inventory counts

Companies and institutions use many inventory systems and types to calculate their inventory. So here we are going to talk about the types of inventory counts, which can be summarized as follows:

- Periodic inventory.

- perpetual inventory system.

- Annual inventory.

- Surprise inventory system.

What is the difference between periodic and perpetual inventory systems?

Periodic and perpetual inventory are two types of inventory in accounting, and understanding the basic differences between them helps you in many matters. These differences can be summarized in the following points:

Periodic inventory

- Periodic inventory is updated at the end of each accounting period, usually monthly or annually.

- The cost of goods sold is calculated at the end of each accounting period.

- Closings are included in periodic inventory but are not necessary in perpetual inventory.

- Stock on hand is actually counted by employees.

- An entry for the cost of goods sold is added when the physical count is conducted at the end of the reporting period.

- Determines the cost of goods sold in a given period.

- Periodic inventory requires less money and labor than continuous inventory.

Periodic inventory conditions

- The ability to carry out the process of inventorying units every accounting period.

- Provide sufficient time and resources to conduct a physical inventory and calculate the cost of goods sold.

perpetual inventory

- Perpetual inventory occurs instantly after each sale.

- The cost of goods sold can be calculated accurately.

- No closing entries are required in perpetual inventory.

- It uses a computer system to track available products in real time.

- Record purchases in the general ledger, and update the unit inventory entry individually.

- It helps ensure that the units available in the store match the records.

- It requires higher costs, specialized personnel, and the purchase of software that facilitates the inventory process.

- Update inventory records on a regular basis.

As for the conditions necessary to complete each type, they may include:

Perpetual inventory conditions

- Provides an advanced computer system and specialized software to track products in real time.

- The presence of trained and specialized employees in perpetual inventory management.

- The company’s ability to bear the cost of implementing and maintaining the system necessary for perpetual inventory.

Inventory management software

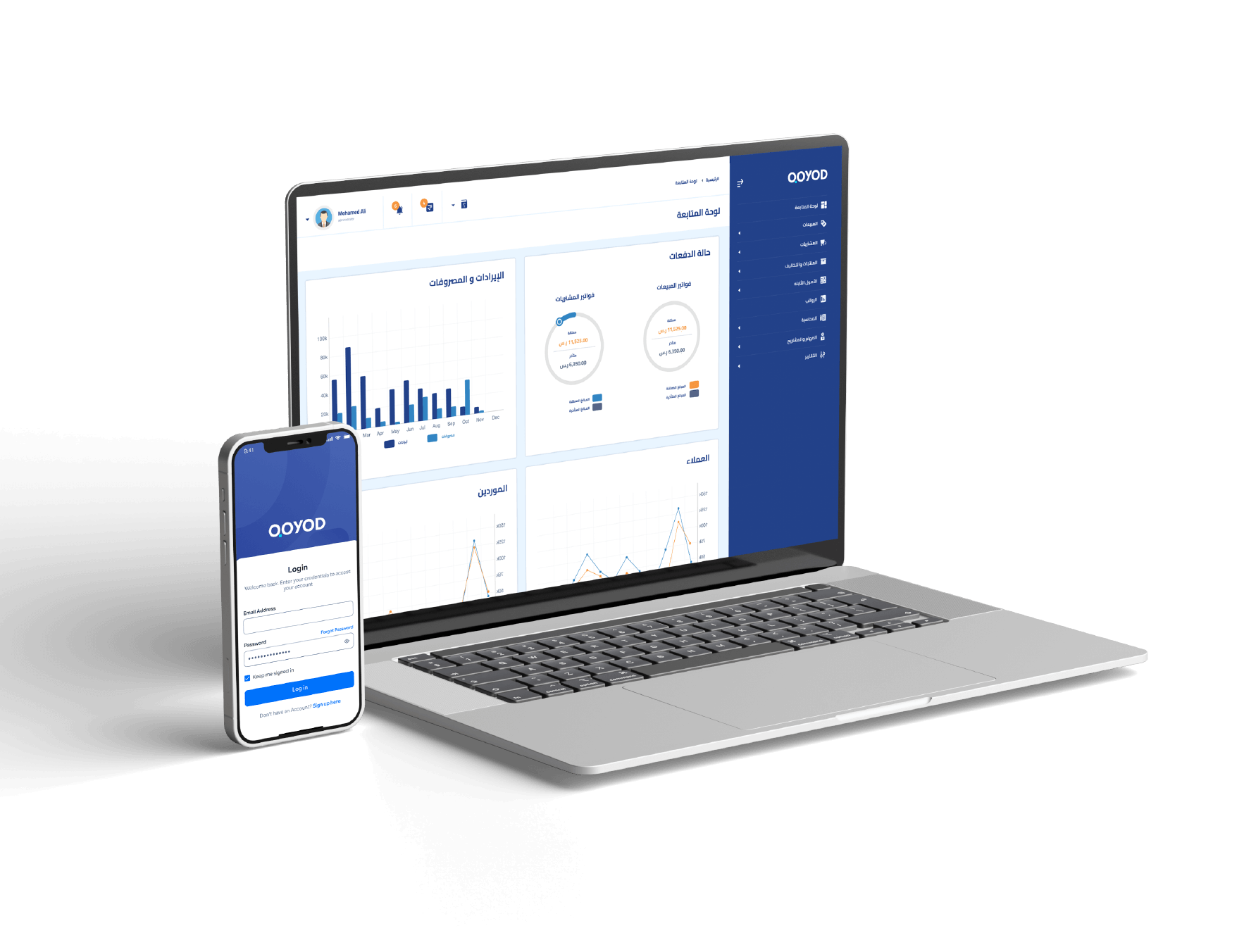

If you are wondering about an inventory management program, it is Qoyod, as it provides many benefits and features that help facilitate this process, such as:

Carrying out different types of inventory

One of the essential aspects of Qoyod’s inventory management software is its flexibility and ability to perform different types of inventory counting, regardless of whether it is periodic, perpetual, or any other type.

Easily adapt to your needs.

The software can easily adapt to your needs and help you carry out a periodic inventory every 3 months, annually, or even a daily inventory. This therefore allows you the flexibility to determine the appropriate time to conduct inventory according to the circumstances and needs of your business.

Compare actual inventory with recorded inventory.

With Qoyod inventory management software, you can easily compare physical inventory with inventory recorded in the system and accounting books. This helps you identify any discrepancies or errors in records and act quickly to address them. When a stock shortage is detected, you can take immediate action to identify the causes and correct the situation.

Detecting accounting errors

In addition, the program can be used to detect any potential accounting errors or cases of manipulation, which helps ensure the accuracy of accounting data and maintain the integrity of financial operations.

Achieve greater efficiency.

By relying on Qoyod inventory management software, you can also achieve greater efficiency in the periodic and perpetual inventory processes. The program provides functions and tools that help organize the inventory process, such as determining inventory locations and required inventory quantities and tracking stored items. Therefore, this helps save time and effort spent on the inventory process and reduces potential human errors.

Periodic and perpetual inventory entries

periodic inventory entries

Speaking of periodic and perpetual inventory entries, periodic inventory is simpler compared to the perpetual inventory system, as it does not need to make daily accounting entries when dispensing or adding goods from the warehouse but rather only records collections from customers, sales and purchase entries, and payments to suppliers.

In the case of a purchase

When the company purchases goods, the purchases are recorded as a debit, and at the same time, the supplier is recorded as a credit, so it is:

- (from purchases to supplier, bank, or fund).

| Entry in the case of purchasing | ||||

| Credit | debt | Subaccount | date | entry |

| – | Purchases | – | – | |

| – | the supplier | |||

Purchase expenses

Purchase expenses are calculated as a debit, and at the same time we make the supplier or cash a credit, so it is:

- (from purchase expenses to a supplier or cash).

| Entry in the case of purchase expenses | ||||

| Credit | debt | Subaccount | date | entry |

| – | Purchase expenses | – | – | |

| – | the supplier | |||

Refund of part of the goods

The cash or supplier account is a debit when part of the goods are returned, and the purchase returns account is a credit, so it is:

- (from supplier to purchase returns).

| Entry in refunding part of the goods | ||||

| Credit | debt | Subaccount | date | entry |

| – | the supplier | – | – | |

| – | Returns purchases | |||

Selling part of the goods

The customer account is a debit in this case, and the sales account is a credit, which is:

- (from customer to sales).

| Entry in the selling part of the goods | ||||

| Credit | debt | Subaccount | date | entry |

| – | Client | – | – | |

| – | the sales | |||

Closing Entries

When goods are recorded at the end of the period, they are considered debit, while purchases are credit, and they are:

- (from ending inventory to purchases).

| Closing Entries | ||||

| Credit | debt | Subaccount | date | entry |

| – | Ending inventory | – | – | |

| – | Purchases | |||

Perpetual inventory entry

There is a need to make daily accounting entries in the perpetual inventory entries when dispensing or adding something from the warehouse.

In the case of a purchase

The supplier is a credit, while the inventory is a debit, which is:

- (from stock to supplier).

| Entry in the case of purchasing | ||||

| Credit | debt | Subaccount | date | entry |

| – | Purchase expenses | – | – | |

| – | the supplier | |||

Purchase expenses

The purchase expenses borne by the buyer are recorded, and then the supplier is a credit and the inventory is the debt, and it is:

- (from stock to supplier).

| Entry in the case of purchase expenses | ||||

| Credit | debt | Subaccount | date | entry |

| – | Inventory | – | – | |

| – | the supplier | |||

Recording the sales process

In this case, the customer is considered a debit, and the sales account is a credit, which is:

- (from /customer to /sales)

| entry in the recording of the sale | ||||

| Credit | debt | Subaccount | date | entry |

| – | Client | – | – | |

| – | the sales | |||

Recording of the cost of goods sold

The inventory account is a credit, and the cost of goods sold is a debit, and it is:

- (from the cost of goods sold to the inventory)

| Entry in the recording of the cost of goods sold | ||||

| Credit | debt | Subaccount | date | entry |

| – | Cost of goods sold | – | – | |

| – | Inventory | |||

Sales returns

In this case, two entries must be made, namely:

the first

The customer account is the credit, and the sales returns account is the credit, and it is:

- (from sales returns to customers).

| Sales returns | ||||

| Credit | debt | Subaccount | date | entry |

| – | Sales returns | – | – | |

| – | Client | |||

the second

The cost of goods sold account is a credit, and the inventory account is a debit, which is:

- (from inventory to cost of goods sold).

| Sales returns | ||||

| Credit | debt | Subaccount | date | entry |

| – | Inventory | – | – | |

| – | Cost of goods sold | |||

Selling expenses

The cash account is a credit, while the sales expenses account is a debit, and it is:

(From/SSales Expenses To/CCash).

| Selling expenses | ||||

| Credit | debt | Subaccount | date | entry |

| – | Sales expenses | – | – | |

| – | Cash | |||

A model for periodic and perpetual inventory

If you are looking for a periodic and perpetual inventory template for you to use, all you have to do is click here.

Conclusion

One question that comes to mind is worth pondering: Can numbers be attractive? The answer lies in the world of accounting and in the concepts of periodic and perpetual inventory. Although they may seem like mere technical details, they reflect the power and analytical ability that lie in numbers. When we talk about periodic inventory, we realize the importance of determining the value of inventory at a specific point in time, which helps us make strategic financial decisions. On the other hand, perpetual inventory enhances our vision of business accurately and continuously, as it allows us to know the available quantities and control them better, and here lies the real attraction. These two methods are powerful tools that enable us to understand risks and achieve financial benefits effectively.

Understanding periodic and perpetual inventory is essential for any accountant or business leader seeking success, and there is no shorter path than using accounting software such as Qoyod. It helps you with everything you need, and it is worth noting that the program also provides all its clients: electronic invoice systems, as well as point-of-sale systems, stores, customers, and so on.

Dear reader, after knowing the difference between periodic and perpetual inventory, Try Qoyod now for free for 14 days. It is an accounting program approved by the Zakat and Tax Authority.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!