| Expert

This article outlines major accounting errors and their severe repercussions on companies and investors worldwide, analyzing the causes, differentiating between error and fraud, and drawing lessons in governance and disclosure. It is essential reading for finance professionals, accountants, and SMEs aiming to enhance financial control and quality. |

Major accounting errors occupy a central place in the business world, representing a continuous challenge for organizations regardless of their size or experience. Discussing accounting errors is not merely about immediate financial losses or direct negative outcomes; their impact extends to compromise a company’s reputation, erode investor and customer trust, and even destabilize the financial market itself. Every small mistake recorded in the books, whether unintentional or resulting from negligence, can contribute to the distortion of financial reports, leading to incorrect decisions that affect all stakeholders.

The reason for writing about major accounting errors is the crucial importance of awareness regarding their risks and the necessity of enhancing governance and transparency. It reinforces the collective understanding that accuracy is not just a technical procedure but a strategic pillar for protecting our companies and economies from the repercussions of accounting misstatements and oversights. It is not surprising to see the effects of accounting errors manifesting as massive fines, legal penalties, or even the collapse of major corporations, as evidenced in notorious real-life cases such as the American “Enron” scandal.

Professionally, analyzing the stories of major accounting errors gives us a lens to understand how technology, expertise, oversight, and ethical values integrate to address such risks. This article establishes the importance for businesses, particularly small and medium-sized businesses (SMEs) utilizing cloud accounting systems like Qoyod Accounting Software, to adopt effective internal and external audit procedures. They must also activate smart technologies to detect violations and correct deviations from the outset, thus safeguarding the accuracy of financial reports, ensuring sustainable growth, and bolstering trust in the financial system.

Watch Qoyod video on accounting errors

Defining Accounting Errors and Their Common Types

Accounting errors are discrepancies or deviations that occur during the process of recording, processing, or posting financial data. These lead to inaccurate or misleading information in financial reports, negatively impacting financial decision-making, tax compliance, and the reliability of financial disclosure.

Types of Accounting Errors and Their Common Causes

| Type of Error | Brief Description | Common Cause | Impact |

| Error of Original Entry | Entering an incorrect amount or transposing numbers from the start (e.g., recording 10,000 instead of 1,000). | Distraction or negligence in verifying numbers. | Incorrect final statement figures. |

| Duplication Error | Recording the same transaction twice, such as entering an expense or income invoice multiple times in the system. | Duplication of effort or lack of entry review. | Inflates figures unrealistically in financial reports. |

| Error of Omission | Failing to record a financial transaction completely, such as overlooking a supplier invoice or a specific income. | Loss of documents or forgetting to input data. | Incomplete accounts and inaccurate results. |

| Error of Commission | Entering the correct amount into the wrong or inappropriate sub-account (e.g., posting a payment for customer “A” to customer “B”‘s account). | Lack of understanding of the chart of accounts or work pressure. | Confuses detailed information like customer or supplier debts. |

| Transposition Error | Swapping two digits during input (e.g., recording 396 instead of 369). | Fast typing or lack of rigorous checking. | Creates small discrepancies difficult to notice without detailed reconciliation. |

| Error of Principle | Recording a financial transaction in a manner that violates accepted accounting principles/standards (e.g., treating a personal expense as a company expense). | Lack of experience or knowledge of standards (e.g., IFRS). | Highly sensitive for tax and international standards compliance. |

| Entry Reversal Error | Recording a transaction the wrong way around (treating an expense as income or income as an expense). | Haste or failure to review. | Distorts the financial performance picture, changing profit/loss results. |

| Reconciliation Error | Discrepancies found when matching accounting records with actual bank accounts or ledgers, indicating a wrong or missing entry. | Weak periodic reconciliation mechanisms or lack of oversight. | Affects the accuracy of the final balance. |

| Compensating Error | The accidental occurrence of two errors that cancel each other out (e.g., inflating an expense and an income by the same value). | Random chance. | Difficult to detect as final results show no variance, but affects financial analysis. |

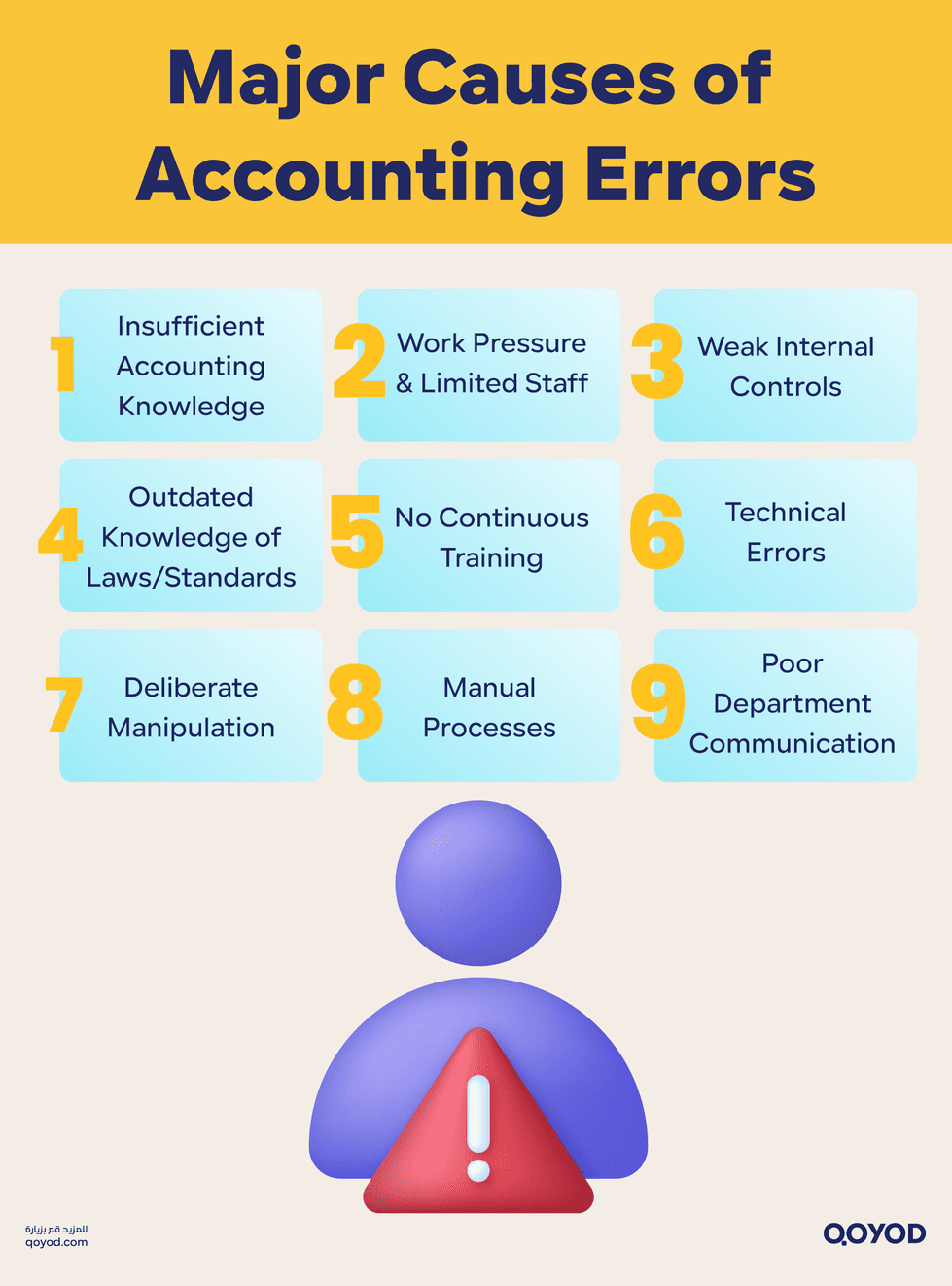

Detailed Causes of Major Accounting Errors

Understanding the root causes of major accounting errors is crucial for small and medium-sized businesses aiming for robust financial control and effective risk management.

1. Weak Professional Qualification and Accounting Comprehension

Accountants or financial management staff may commit errors due to insufficient knowledge of accounting standards, procedures, or a lack of proper understanding regarding the classification of financial transactions and the application of relevant rules for each type.

Check out Qoyod video about accounting mistak

2. Work Pressure and Limited Human Resources

A congested work environment, understaffing, or limited time often pressures accountants to complete tasks quickly, neglecting verification and review,especially at the end of financial periods or during busy accounting seasons. This leads to incorrect transaction recording or omission of entries.

3. Weak Internal Control and Auditing

The absence of regular internal auditing and review mechanisms allows errors to occur and accumulate without detection, and also facilitates instances of financial manipulation or fraud within organizations.

4. Failure to Keep Pace with Changing Laws and Accounting Standards

Failure to follow continuous updates in legislation or international and local standards is a significant source of errors. Accountants may apply outdated rules that conflict with new regulations, affecting the valuation of assets and liabilities.

5. Lack of Guidance and Continuous Training:

The absence of ongoing training and development programs for staff leaves employees unqualified to deal with crises, modern software, or digital tools in financial data management.

6. Technical Errors and Misuse of Accounting Software:

Increased reliance on software can lead to errors due to incorrect input, system malfunctions, poor data integration, or loss of backup in the event of power outages.

7. Lack of Integrity or Intentional Manipulation:

In some institutions, errors occur deliberately, such as attempts to hide losses or inflate profits to deceive investors or regulators. These are considered the most dangerous types of errors and have the greatest impact on business sustainability and market trust.

8. Reliance on Traditional Manual Processes:

The presence of paper-based or manual accounting processes significantly increases the probability of errors in calculation or transfer.

9. Lack of Communication or Poor Coordination Between Company Departments:

This leads to inaccurate financial information not reaching different departments. It often occurs in cases of transfer between branches or projects, which impacts the accuracy of the final records.

Watch Qoyod video on accounting error

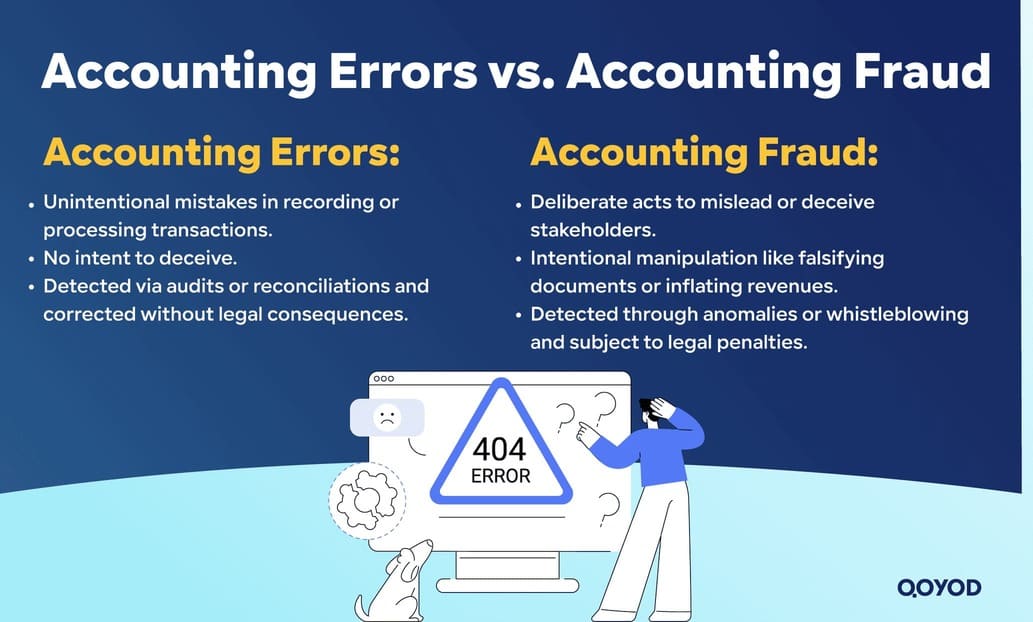

Accounting Errors vs. Accounting Fraud

The fundamental difference lies in intent and the resulting effect, a core distinction emphasized by global financial oversight bodies.

Accounting Errors

These are unintentional deviations that occur during the recording, processing, or posting of financial transactions. They typically result from oversight, negligence, lack of experience, or work pressure.

- Key Characteristic: Absence of premeditated intent to manipulate or deceive users or regulatory bodies.

- Detection: Usually discovered through periodic reconciliations or internal audits. They are corrected by journal adjustments or restating financial statements without direct legal accountability, unless the errors are material and significant.

Accounting Fraud

This represents a deliberate action intended to deceive or mislead stakeholders. It often stems from management or employees seeking illicit personal or institutional gains.

- Key Characteristic: Intentional actions, such as document forgery, recording fictitious transactions, or deliberately hiding debts or inflating revenues. It typically exploits weaknesses in internal control.

- Detection: Often through analyzing large or unexplained changes in financial data, repeated corrective entries, or internal whistleblowing. It leads to legal action and severe penalties against those involved.

View Qoyod video on accounting errors

Case Studies: Major Accounting Scandals That Collapsed Companies

Mobily Saudi Arabia Case

This is considered one of the largest financial scandals in the history of the Saudi market. The crisis began in 2014 after the company was found to have inflated its revenues over six consecutive quarters by recognizing contracts not ready for service as due revenue, which violates international accounting standards. This led to Mobily’s stock collapsing from SAR 91 to SAR 61 in a short period, causing billions of riyals in losses for shareholders. Consequently, over a thousand shareholders filed lawsuits against five executive officials.

Subsequent investigations revealed that Mobily recorded revenue on capital lease contracts and services that were not actually available, aiming to present strong financial results even though the company was unable to fulfill those contracts. The scandal led to the suspension of stock trading for extended periods, the dismissal of the CEO, the appointment of new management, and the imposition of strict oversight by the Capital Market Authority for a comprehensive review of the financial statements.

In 2020, a court ruling mandated five former officials to pay total compensation exceeding SAR 1.2 billion to over a thousand affected parties. Despite this, shareholders faced difficulty in recovering their rights due to the defendants’ limited financial solvency and the parent company not being held directly responsible.

The lessons learned from the Mobily case emphasize the importance of accounting transparency, the role of both internal and external control, and the necessity for companies to adhere to global standards and be strict in revenue recognition. Furthermore, it underscored the need to enhance the disclosure and governance system to limit the recurrence of misstatements in the market.

Saad Group Saudi Arabia

The collapse of the Saad Group, founded by businessman Maan Al-Sanea, is classified as the largest financial tremor witnessed in Saudi Arabia and the Gulf region. The story began in 2009 when the Group and the Ahmed Hamad Al Gosaibi and Brothers Company defaulted on debts exceeding $22 billion, leading dozens of banks worldwide to pursue Al-Sanea legally. Al-Sanea relied on forging documents and establishing fictitious companies to exploit the Al Gosaibi family’s trade name, obtaining massive loans in their name without their actual knowledge, and directing the funds to build an international investment empire in real estate, aviation, and energy.

Investigations showed that the Group’s associated bank in Bahrain was a dummy front with no real clients, used only to transfer funds between accounts. In 2017, Saudi authorities froze Maan Al-Sanea’s assets, and auctions were organized to sell his properties, raising less than SAR 600 million, which represents only a small fraction of the outstanding debts. A Saudi court issued a judgment sentencing Al-Sanea to prison after convicting him of corruption and money laundering. This scandal highlighted the risks of weak governance and family control in large corporations, reinforcing the Kingdom’s move toward wide-ranging regulatory legislation and financial system reforms to boost confidence and transparency in the private sector.

Details of the Enron Collapse

Enron was one of the largest energy companies in the United States, established in 1985, and its operations expanded to include energy trading and financial services. During the 1990s, the management team, led by Kenneth Lay, Jeffrey Skilling, and CFO Andrew Fastow, resorted to implementing complex accounting schemes that involved concealing massive debts using off-balance-sheet Special Purpose Entities (SPEs). Enron relied on “creative accounting” techniques to record fictitious or inflated profits, and the external auditor, Arthur Andersen, played a prominent role in passing and legitimizing these practices without raising an alarm or issuing a refusal.

When the deception was exposed in October 2001, the company was forced to restate its financial statements for the years 1997-2000, reducing the declared profits by hundreds of millions of dollars. The scandal caused the stock to collapse from over $90 to less than $1, the loss of billions of dollars in shareholder savings, and endangered over 4,000 jobs.

Nortel’s Canadian Scandal

The Canadian company Nortel, a global telecommunications equipment manufacturing giant, witnessed one of the most serious accounting scandals between 2000 and 2003. Its management manipulated profits and revenues through fictitious financial reports for many years to achieve personal gains and present unrealistic profitability. Nortel used methods, most notably early revenue recognition and profit inflation by shifting financial reserves and converting expenses to later years, and including contracts not actually performed within revenues. All this was done so that senior executives could receive massive bonuses exceeding $70 million based on false results.

The scandal was uncovered after a meticulous investigation by external auditors and audit committees, leading to the mass dismissal of the senior management, including the CEO and CFO. Shareholders incurred huge losses with billions wiped off the market value and a plunge in the stock price. Thousands of employees lost their jobs as a result of the company’s bankruptcy in 2009. The company also paid $2.5 billion to settle shareholder lawsuits resulting from the deception and loss concealment, and its shares were permanently delisted from the Toronto Stock Exchange.

WorldCom Scandal

This is considered one of the largest accounting scandals that shook the telecommunications sector and the US economy at the turn of the millennium. The company was the second-largest telecommunications firm in the United States, characterized by an aggressive expansion policy through acquisitions. However, with market slowdown and fierce competition, danger signs began to appear when management resorted to deceptive accounting practices to conceal losses and inflate profits.

The company relied on recording over $3.8 billion of ordinary operating expenses as fictitious capital expenditures that could be depreciated over several years, allowing it to show artificial profits and maintain investor confidence. This manipulation continued for several financial periods until it was uncovered by internal audit, subsequently revealing the full extent of the overstatements, which exceeded $11 billion.

When the scandal became public in mid-2002, market confidence rapidly collapsed, triggering the largest bankruptcy process witnessed in the United States up to that date, with the company’s debts reaching nearly $41 billion. Thousands of employees were laid off, and investors’ and pension funds’ savings were lost. This collapse led to a sharp downturn in the telecommunications sector and global financial markets, prompting a fundamental re-evaluation of regulatory, financial disclosure, and governance requirements for listed companies.

Consequences of Accounting Errors: Impact on Shareholders, Market, and Economy

Major accounting errors have a direct and severe impact on shareholders, the market, and the economy as a whole.

1. Impact on Shareholders and Investors

Errors like revenue inflation or loss concealment deceive investors about the company’s true performance, leading to incorrect investment decisions and substantial losses. The resulting loss of value can be devastating.

2. Impact on the Market

Such scandals lead to a loss of trust in listed companies, prompting regulatory bodies to suspend stock trading to protect investors. They cause sharp stock price volatility and increase the demand for rigorous financial statement audits, consequently raising the cost of assurance services and heightening caution among traders.

3. Economic Impact

Economically, accounting scandals can cause sectoral recession and a decline in investments. They may threaten the stability of financial markets and impact the credit ratings of involved banks (as witnesses or financiers). Authorities globally are therefore tightening regulatory systems and reinforcing standards for disclosure and transparency.

In short, these errors cause the collapse of market value, loss of confidence, massive financial losses, a legislative and regulatory backlash, and a change in oversight and financial governance practices across the entire economy.

Lessons Learned: Modern Governance and Financial Disclosure Procedures

Major accounting scandals necessitate the development of robust governance and financial disclosure procedures within companies to ensure transparency and mitigate the risk of financial collapse.

Key Governance Takeaways

- Separation of Powers: The executive management must be separated from financial oversight, establishing independent internal audit committees to continuously scrutinize all operations.

- Strict Disclosure Policies: Disclosure policies must be strengthened to ensure all stakeholders have access to accurate and timely financial information, with severe penalties imposed for any attempt to conceal or falsify data.

- Digitalization and Automation: Regulatory bodies are increasingly requiring the activation of digital systems for automated auditing to detect deviations in records immediately upon occurrence. This is where a modern cloud accounting system proves invaluable.

- Risk Analysis and Training: Companies must adopt effective governance policies, including financial risk analysis, guaranteed audit independence, and employee training on financial disclosure ethics and transparency principles.

The conclusion is clear: institutional success depends not only on financial results but also on the commitment to governance and disclosure, as these are the cornerstones of investor confidence and macroeconomic stability.

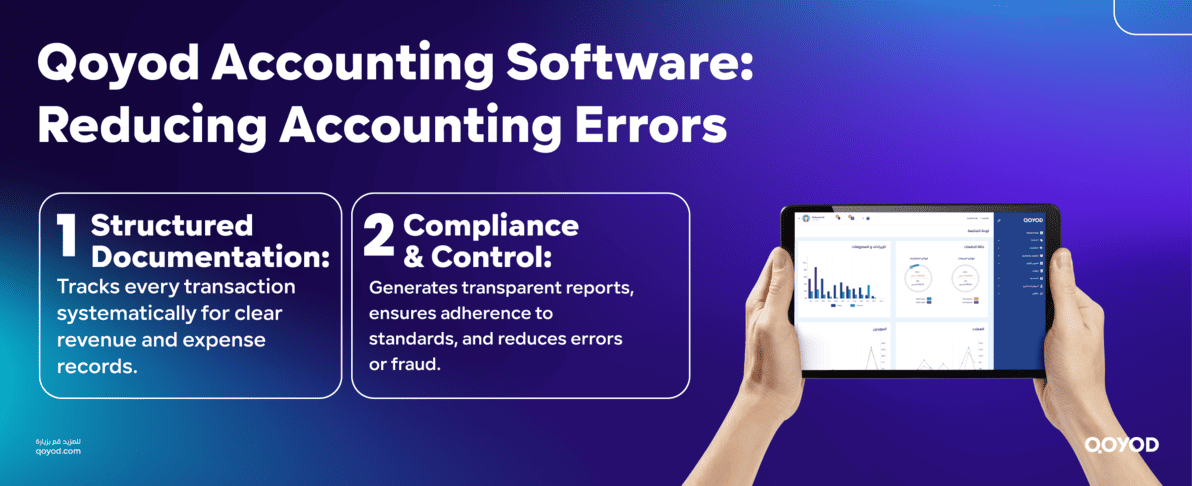

The Role of Qoyod Accounting Software in Reducing Accounting Errors

Qoyod Accounting Software plays a pivotal role in enhancing transparency and governance within organizations, forming the backbone for accurate financial documentation and recording.

- Structured Documentation: Qoyod ensures every financial transaction is systematically documented, allowing for precise tracking of revenue sources and expenditure, enabling decision-makers and investors to review performance and verify results whenever needed.

- Compliance and Control: Qoyod contributes to preparing transparent financial reports reflecting the true status of the organization, bolstering trust with regulators and investors. It supports compliance with international and local accounting standards, aids in enforcing internal policies, and reduces the chances of errors or fraud by tracking every financial movement.

Frequently Asked Questions (FAQ) about Accounting Errors

What is the difference between accounting errors and financial fraud?

Accounting errors are unintentional (due to oversight or inexperience), while fraud is deliberate, aiming to mislead users or regulators for illicit gain. Errors are usually detected internally, whereas fraud requires legal investigations and severe penalties.

What are the main types of accounting errors?

They include entry errors, duplication or omission of entries, transposition errors, lack of bank reconciliation, improper standard application, and inaccurate revenue or expense valuation. All affect the accuracy of a company’s reports and statements.

How do accounting errors affect investors?

Errors mislead investors about the company's financial status, leading to incorrect investment decisions and capital losses. In major cases, they can cause a loss of market confidence and a sharp decline in stock prices.

How can accounting errors be detected early?

Detection methods include performing periodic reconciliations, reviewing entries, using accurate software systems, training staff on auditing, and activating internal control and periodic external audits.

What is the impact of a lack of governance and disclosure?

A lack of governance and transparency makes companies vulnerable to errors and scandals, weakens oversight, increases the risk of manipulation and money laundering, erodes investor and market trust, and can result in legal and financial penalties for the company and management.

How do digital systems like Qoyod Accounting Software help?

Digital systems provide accurate and transparent recording of all financial transactions, facilitating internal and external auditing and reducing the likelihood of errors or repetition. They also allow for instant data analysis and deviation detection, contributing to enhanced institutional governance and control.

Conclusion: Fostering Transparency and Preventing Recurrent Accounting Disasters

Fostering transparency and preventing recurrent accounting disasters have become core objectives in modern financial systems, driven by the profound impact of past crises on market confidence. Regulatory bodies and companies alike understand that transparency is not merely a regulatory compliance issue but an institutional culture rooted in accurate, timely, and comprehensive disclosure of financial information and decisions affecting stakeholders.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.