Stock-taking means physically checking stock levels for the products and materials you sell to ensure your data is up-to-date and accurate.

To ensure that your business grows, it is important to have a good understanding of inventory management. Without inventory tracking, you can’t run your business efficiently.

Conducting a stock take can be a minefield without the right tools, a well-thought-out strategy, and inventory control policies. Read on to learn more.

What is a stock take?

Stock take calculates the number of materials in warehouses that the company may use in manufacturing or the number of products in warehouses and what has been sold according to stock take policies.

The main goal of stocktaking is for the company to ensure that it has enough stock, know if a shortage is occurring, and avoid it as much as possible.

During the stock take process, we review the items in the warehouse in an organized manner, either at different periods or suddenly, to determine their quantity and their compliance with the necessary records and statements.

The stock-take process often occurs once or twice a year to ensure that the number of materials and products is correct by comparing current inventory reports with written reports.

What are the types of stock to take?

Companies use various stock-taking methods in their warehouses to ensure the accuracy and safety of their operations. Commercial institutions most commonly adopt the following types of stock-taking:

Perpetual Inventory

Perpetual inventory is an important tool that enables management to know the stock value at any moment. In this system, every sale or purchase is recorded as soon as it occurs, allowing stock data to be updated in real-time.

It is worth noting that this method allows accurate monitoring of stock and helps determine material levels immediately, which contributes to improving stock management and reducing waste and spoilage.

Periodic Inventory

It is conducted at specific periods or when preparing a company’s financial position statement instead of updating the stock with every sale or purchase. This system conducts a physical inventory of stock at the end of each specific period, calculating the warehouse’s stock amount and matching it with book records.

Companies that do not need to track inventory on a daily basis typically use this type of inventory. It helps discover differences between actual and recorded inventory.

Sudden Inventory

We carry out this inventory without prior announcement, with the aim of detecting theft and embezzlement, verifying the expiration dates of products, and identifying damaged ones. It also verifies warehouse contents against book records. It is also an effective means of strengthening internal control.

What is the benefit of taking stock?

Stock-taking is a critical activity in commercial enterprise management. It aims to determine the quantity of goods and products available for sale and evaluate the available raw materials. Inventory is usually conducted at the end of the financial year to calculate the cost of goods sold and the cost of unsold inventory.

Find out the total profits.

Stocktake plays a pivotal role in determining the value of the company’s total profits. It is worth noting that gross profit is the difference between the volume of sales and the cost of goods sold. To determine this profit, the cost of goods sold is matched with the accounting period’s revenue using the following equation:

Cost of goods sold = opening stock + purchases minus closing stock

This equation shows how the quantity and value of stock affect the total cost that the company bears in production and, thus, the profits it achieves at the end of the financial year.

Verifying the financial position

Determining the closing value of stock on the balance sheet is essential for determining the company’s financial position, and overestimating or underestimating stock may provide an inaccurate picture of the company’s working capital and general financial position. Therefore, accuracy in stock take contributes to providing a true assessment of the organization’s financial position.

Detection of theft and embezzlement

Regular stock-taking helps prevent or detect theft and embezzlement quickly. Therefore, companies must conduct periodic inventory and match actual warehouse assets with accounting records.

It is worth noting that sudden inventories conducted without employees’ knowledge can help detect tampering or theft within the organization.

Ensuring the accuracy of accounting data

Periodic inventory and sudden inventory play major roles in ensuring the accuracy of accounting data and the integrity of internal operations. Although periodic inventory gives organizations the opportunity to correct errors and irregularities in a timely manner, sudden inventory adds a layer of security and trust by detecting any illegal transactions or manipulation of the stock.

Why should you take stock at the end of the year?

Each company determines the appropriate time to make an inventory and the types of stock-taking, depending on the method it follows in management.

Therefore, we find that some companies prefer that stock taking occur monthly, while others prefer that it occur at the end of the year, in the last quarter of the financial year.

Inventory counts are conducted at the end of the year to calculate the value of the goods still available for sale, which the company holds at the end of the accounting period. Taking a physical inventory may make the final inventory more accurate.

How do you stock up?

Companies use more than one method to stock materials in their warehouses, but they share some steps, including:

1-Choose the right time.

You must choose the right time to take inventory so that you do not choose a time that may hurt your profits. Therefore, choosing appropriate times, such as slow sales cycle periods or outside normal business operations, is best.

2-Organizing stock before starting stock take

This step will facilitate the process of counting and calculating stock accurately and easily and will also reduce the possibility of errors in the calculation.

You can create specific sections within the inventory by arranging specific items into specific sections to make inventory easier.

3-Organizing inventory tools before starting

You must ensure that you have a set of necessary tools that help you take stock, including:

- volumes

- Inventory documents

- paper

- Pens

- Calculators

- Barcode devices

- Laptops

4-Use the latest stock data.

Ensure to exclude items that have not been entered into your system and items that have been invoiced but have not yet shipped. The goal is to ensure accurate stock-take results.

5-Define clear goals and responsibilities.

To obtain accurate results and to conduct the inventory accurately, determine the goals you want to achieve from the inventory and make a list of what should be counted and what should be in the warehouses.

This will ensure accurate results regarding stock.

6-Count everything in stock.

Check all stock contents after each category so that you do not resort to guessing during the counting process. For example, if you have a box labeled as containing ten reels, open the box and make sure the number labeled matches the actual number of reels.

7-Develop appropriate solutions to stock problems.

During the actual count, you may discover that some items have been lost, damaged, never reported, or no longer fit for sale.

Therefore, methods that limit behaviors that expose the stock to harm should be developed.

Important steps

Some important steps constitute rules that help achieve the highest degree of order and accuracy in work, including the following:

- No goods leave the warehouse without an invoice.

- Ensure all invoices and vouchers are numbered sequentially, and review them constantly.

- Keep invoices and documents in a safe or locked place.

- Monitoring the entry and exit of employees in the warehouse and ensuring their permissions.

- Verify the professional history of employees before hiring them.

- Contracting with an insurance company for the warehouse.

- Place surveillance cameras in the warehouse.

- Select employees other than those responsible for custody and determine who is in charge of the stock-taking process.

What are the stock-take methods?

Companies and projects use several methods for stock take to determine the cost of available materials, sell them efficiently, and ensure the accuracy of financial accounts. Below, we review the most important methods used in stock take:

First in, first out (FIFO) method

The FIFO (First In, First Out) method is based on the premise that the first materials to enter the warehouse are the first to leave it. This method is ideal for companies that deal with products that are susceptible to perishability, such as food and medicines.

Companies rely on this method because of its ease of application and clarity of rules. Do not forget that during periods of inflation and high prices, this method allows products to be sold at a higher price than they were purchased for. This increases the profit margin, but it also results in an increase in tax liability because profits are higher.

Last in, first out (LIFO) method

The LIFO (Last In, First Out) method follows the principle that products recently entered into stock are sold first, while older products stay in stock longer. This method is suitable for non-perishable products but is rarely used because older products may lose their value, leading to losses.

In inflationary situations, this method can benefit businesses because it allows higher-cost products to be sold first, resulting in a higher cost of goods sold, a lower profit margin, and thus lower taxes payable.

Average cost method

The average cost method is based on calculating the cost of bulk products available in the warehouse. It is used when it is difficult to separate materials from each other, such as in the case of raw materials or bulk goods.

The average unit cost is calculated using the following equation:

Average unit cost = total cost of goods in inventory ^total number of units in stock.

This method provides a balanced view of inventory costs because it is based on average prices rather than being affected by large price fluctuations.

Compare the three methods.

The FIFO method is simple and effective for companies dealing with perishable products. The LIFO method is useful in inflationary environments to reduce taxes, despite its risks related to inventory value. The average cost method is a suitable option for companies dealing with large quantities of undifferentiated materials.

How to choose the most appropriate method

The choice of the stock-take method depends on the nature of the products, market conditions, and the company’s financial goals. Companies must balance the ease of applying the method with its accuracy in calculating costs and its impact on taxes and profitability.

stock-take objectives

The stock-take objectives of organizations are as follows, depending on the different types of warehouse inventory:

1-Calculate total profits.

The stock-take process is useful for identifying a company’s total profits by calculating the difference between the volume of sales and the cost of the goods sold.

2-Detecting cases of theft and embezzlement

Stock take helps prevent, or at least quickly detect, theft from warehouses, especially when a surprise inventory is taken without anyone knowing.

3-Improved cash flow

Stock Take helps you know which products are selling the most and rearrange the best-selling list. This leads to rationalizing money and directing it to the right place instead of spending it on products that are in low demand.

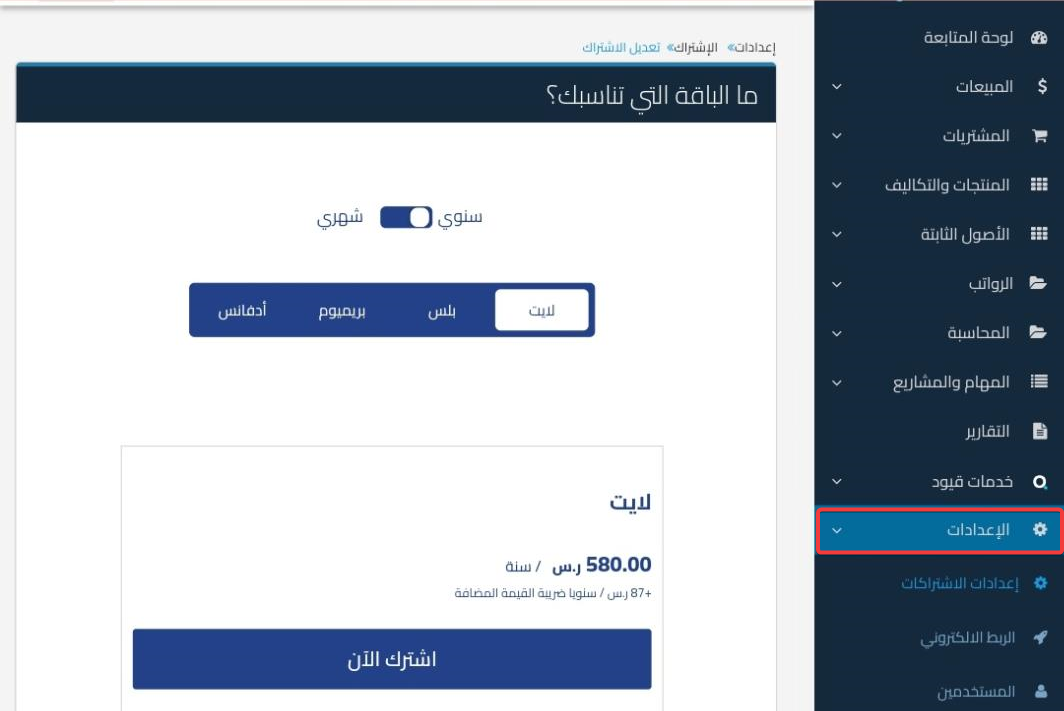

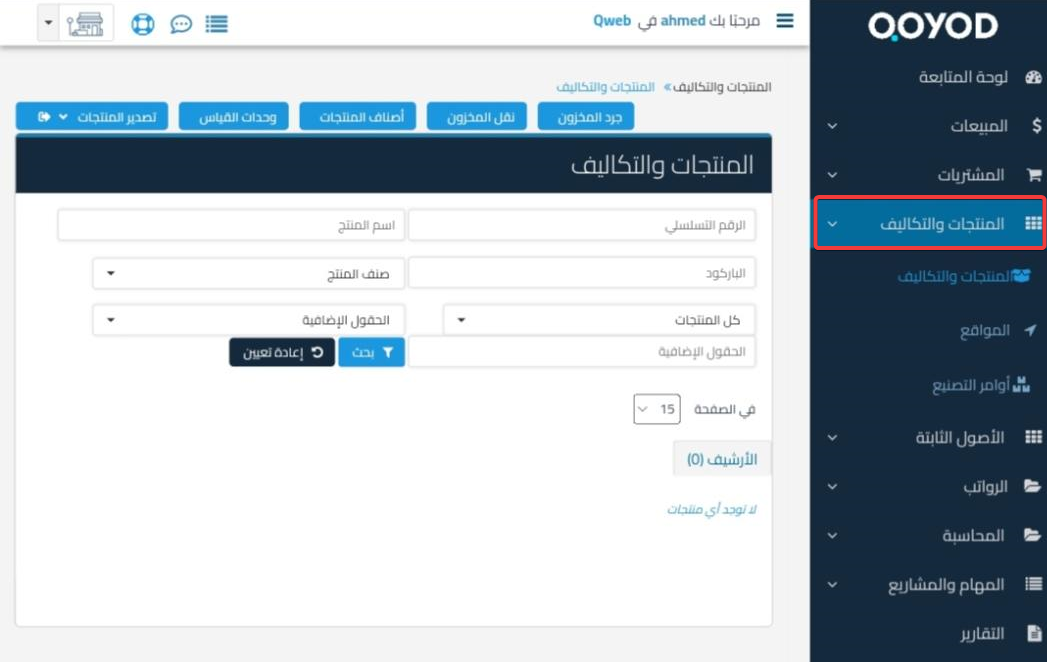

Stock take and inventory quantity adjustment on the Qoyod website

If the goods are damaged or products are obtained at no cost, the stock quantity can be adjusted on the Qoyod website by following the following steps:

- From the drop-down menu, choose Products and Costs.

- From the “Products” menu, choose “Stock Take” to enter the stock modification page.

- Select the main site or one of the added subsites.

- Enter the item’s name and the current and actual (desired) quantity.

- You can perform “Stock Take” for more than one product at the same time.

- Click “Save” to apply the inventory count process.

note

Increase stock: In the event of obtaining products at no cost (as a gift from the supplier), the quantity of these products in stock increases.

Decrease in stock: In the event of damage to the goods, the damaged amount of stock is reduced.

Impact on revenues and expenses: Remember that an increase in stock without a cost is revenue, while a decrease in stock due to spoilage is an expense.

stock-take model

If you want to download a template for a daily stocktake, click here.

Conclusion

Stock-taking and monitoring are among the most important things companies care about.

The stock-taking process is one of the arduous tasks that takes a lot of time and effort, and the more branches the company has, the greater the stock-taking effort.

Thus, we reach the end of this article, which introduces the stock-taking process and explains how to implement it.

Do you want to make the stock-taking process easier? Try Qoyod now for free for 14 days, so you can do it the easiest way.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!