| Expert Summary:

Are you searching for the best cloud accounting software for small businesses in Saudi Arabia? This article outlines essential features, options available, and practical tips for choosing the right system to manage your company’s accounts easily and securely, ensuring ZATCA compliance. |

The financial management of small businesses is no longer simple, especially in the Kingdom of Saudi Arabia (KSA), where new regulations like e-invoicing (Fatoorah) and mandatory VAT compliance require high accuracy and speed. This is where the role of the best cloud accounting software for small businesses emerges as a practical and intelligent solution, helping entrepreneurs take control of their finances easily, anytime, and from anywhere.

Many entrepreneurs ask: Which cloud accounting program is best for my small company? Should I prioritize ease of use? Support for e-invoicing? Or pricing that fits my budget?

In this article, we will review the key features of these programs and highlight the prominent options available in the Saudi market, along with practical tips to help you select the software that suits your business nature and daily needs.

What is Cloud Accounting Software for Small Businesses?

Cloud Accounting Software is an electronic systems that operate over the internet, enabling you to manage all your financial transactions, from recording sales and expenses to preparing reports, without needing to download heavy software onto your device. All you need is an internet connection to access your account from anywhere and at any time, whether on a computer or a mobile device.

The main advantage of these programs is that they store your data on secure cloud servers, meaning you won’t worry about losing or corrupting your files due to technical failures.

Cloud vs. Traditional Accounting: The Key Differences

| Aspect | Traditional Accounting | Cloud Accounting |

| Operation Method | Relies on paper records or Excel sheets and manual data entry. | Operates online using specialized programs, with automatic transaction recording. |

| Data Accessibility | Access is limited to one device or locally stored files. | Data can be accessed from anywhere and at any time using a computer or smartphone. |

| Updates & Modifications | Requires manual updating of every adjustment, potentially causing errors or delays. | Updates are instantaneous, and data is adjusted automatically with minimal intervention. |

| Security & Data Protection | Susceptible to file loss or damage due to technical problems or accidents. | Data is encrypted on secure servers, with automatic backup copies. |

| System Integration | Very limited; often requires manual linking with inventory or billing. | Can be easily integrated with sales, inventory, banking, and e-invoicing systems. |

| Efficiency & Time | Takes longer and requires greater effort from employees. | Reduces wasted time, increases efficiency, and delivers accurate reports quickly. |

In other words, cloud platforms offer small companies greater flexibility and lower cost compared to traditional methods, which is exactly what emerging businesses in the Saudi market require.

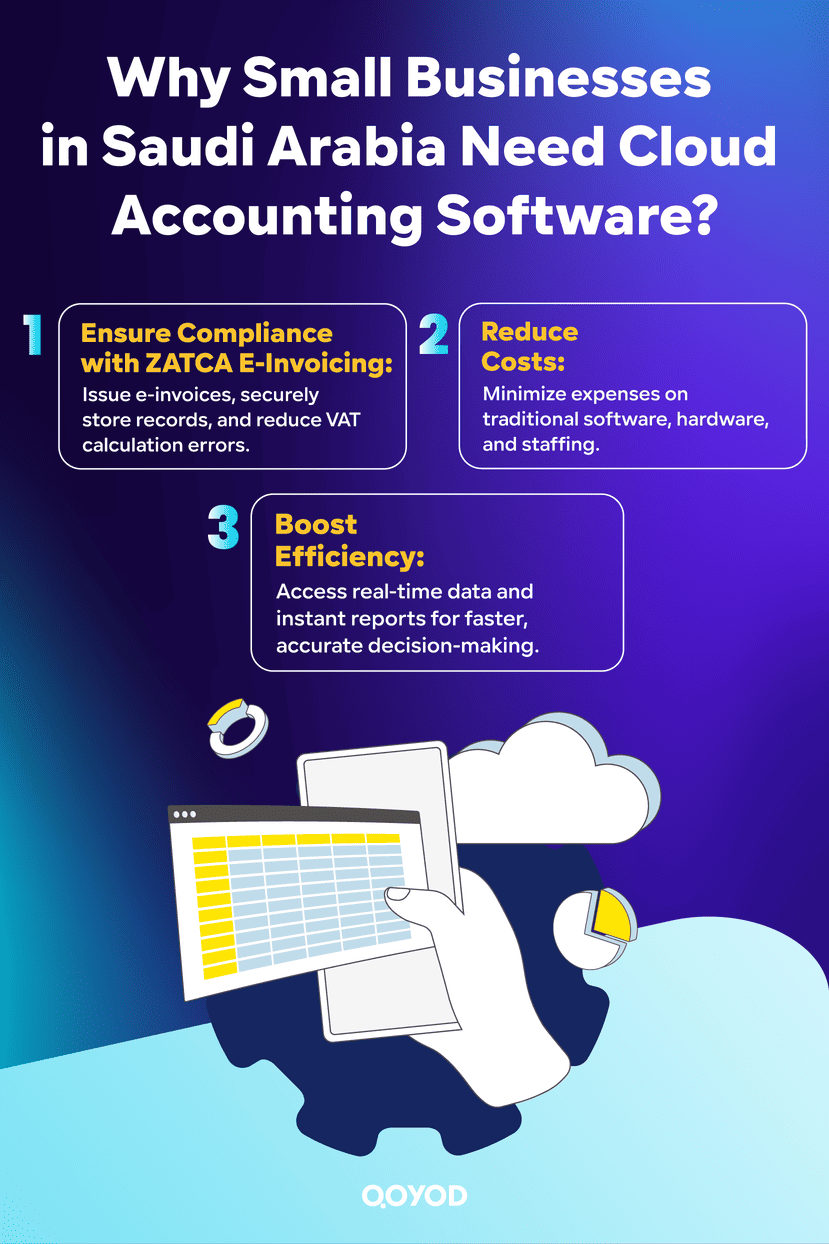

Why Small Businesses in Saudi Arabia Need Cloud Accounting Software

Compliance with E-Invoicing (Fatoorah) and ZATCA Requirements

Since the Zakat, Tax and Customs Authority (ZATCA) in Saudi Arabia launched the E-invoicing initiative (Fatoorah), it has become mandatory for small and medium-sized enterprises (SMEs) to adhere to the new standards for issuing and storing invoices.

Cloud Accounting Software simplifies this process by:

- Issuing electronic invoices that comply with ZATCA requirements.

- Storing records systematically and securely for easy retrieval during audits.

- Reducing human errors in calculating Value Added Tax (VAT) and submitting tax declarations.

This compliance ensures that small businesses are fully aligned with local regulations, helping them avoid fines or legal issues.

Reducing Costs and Boosting Efficiency

Small businesses typically operate with constrained budgets, and relying on manual accounting or hiring a full-time accountant can be expensive. By utilizing a cloud accounting system:

- Expenses associated with traditional software (buying licenses, updates, powerful hardware) are minimized.

- Access to data is easily available to the owner or their team without the need for high technical expertise.

- Instant reports are provided to aid in making faster and more precise financial decisions.

Key Features of the Best Cloud Accounting Software for Small Businesses

Ease of Use and Accessibility from Anywhere

One of the most notable advantages of the best cloud accounting software for small businesses is that it does not require extensive accounting expertise. The interface is usually simple and direct, allowing the business owner or employee to accomplish tasks easily.

Since these programs operate online, you can track your company’s accounts at any time and from anywhere, whether in the office, at home, or while travelling, using a computer or smartphone.

Security and Data Protection

Worrying about data loss or breaches is a key concern for small businesses. Modern cloud accounting software offers high levels of security, such as:

- Data encryption to protect against unauthorized access.

- Daily or automatic backups to prevent file loss.

- Defined access permissions for each user within the company.

This way, companies ensure their financial data is preserved securely and reliably.

Integration with Other Systems (Sales, Inventory, Banking)

Another important feature is that cloud software does not work in isolation from the company’s other systems. It can be linked with:

- Sales and e-invoicing systems.

- Inventory management systems to track products and materials.

- Bank accounts to monitor financial movements instantly.

This integration makes accounting operations smoother and provides accurate reports that help management make faster and better decisions.

Accelerate your performance with integrations.

Why Qoyod Accounting Software is the Preferred Choice for Small Businesses in KSA

Qoyod Accounting Software is widely regarded as the most suitable choice for small businesses in Saudi Arabia due to its local focus and comprehensive features.

1. Arabic Language Support and Local Systems Compliance

Qoyod offers a complete interface in Arabic, making it easier for small and medium-sized companies to manage accounts without needing a professional accountant fluent in English. The system is specifically designed to comply with local regulations in the KSA, making the management of invoices, expenses, and overall accounting smoother and safer.

2. Full Compliance with Zakat and Tax Authority Requirements (ZATCA)

Qoyod guarantees full compliance with ZATCA requirements, including e-invoicing and VAT.

- Issue ZATCA-compliant electronic invoices.

- Provide accurate reports for tax management.

- Reduce human errors and the risks of fines.

3. Flexible and Affordable Plans for Startups

Qoyod provides multiple pricing plans suitable for small and emerging businesses, allowing you to choose the appropriate package based on your activity volume and the number of users, thereby reducing costs while ensuring access to all necessary features.

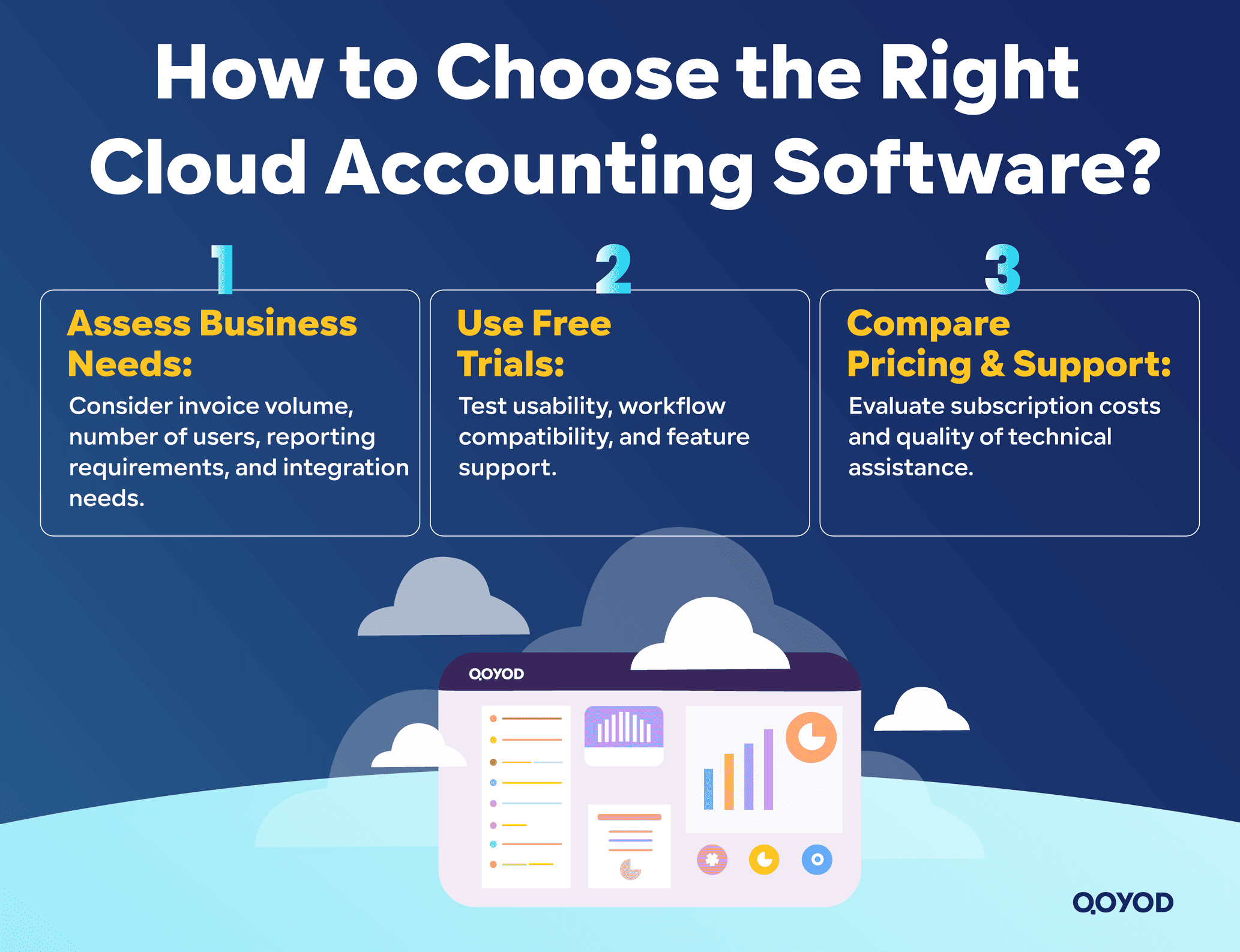

How to Choose the Right Cloud Accounting Software for Your Small Business

Assessing Business Needs

Before choosing any software, the business owner must define their activity’s requirements:

- Monthly invoice volume.

- Number of users.

- Need for detailed or basic reports.

- Integration requirements with inventory, sales, or banking.

Utilizing Free Trials

Most cloud accounting software provides free trial versions. These trials allow you to:

- Test the ease of use.

- Determine the system’s suitability for your daily workflow.

- Ensure support for all the features your company needs.

Comparing Pricing and Technical Support

When selecting the program, it is important to compare:

- The monthly or annual pricing for each package.

- Customer Support: Is it available in Arabic? Is it quick to respond?

- Integration capabilities with other systems or future applications.

Frequently Asked Questions (FAQ) About Cloud Accounting in KSA

What is the best cloud accounting software for small businesses in Saudi Arabia?

For easier financial management and compliance, Qoyod Accounting Software is a reliable and practical choice as it supports Arabic and complies with local regulations without complexity.

Where can I find cloud accounting service that offers technical support in Arabic?

The best way to avoid communication difficulties is to use a program with Arabic support. Qoyod offers clear and fast technical support.

Which cloud accounting options support ZATCA E-invoicing in KSA?

If you need to issue invoices compliant with the Saudi Zakat and Tax Authority, selecting Qoyod is appropriate as it is directly configured for this purpose.

Do cloud accounting programs offer automatic backups of accounting data?

To protect your company’s data, it’s best to choose a program that offers automatic backups. Qoyod provides this feature to ensure financial data is securely saved.

Which cloud services provide financial reports ready for the Zakat Authority?

To simplify submitting financial reports, choosing a program like Qoyod provides ready reports that comply with ZATCA requirements, helping you manage accounts easily.

Are there cloud accounting programs that support salaries and employee management?

If you have employees, Qoyod allows for organized and clear management of salaries and entitlements without the need for additional tools.

Which cloud accounting programs offer a free trial period?

To test the software before subscribing, you can rely on Qoyod, which offers a trial version enabling you to view all features before making the final decision.

In Conclusion

Choosing the best cloud accounting software can completely change how your small business in Saudi Arabia is managed,from saving time and cost to ensuring accuracy and adherence to local laws. Cloud systems offer easy data access, high security, and accurate financial reports that help you make better decisions for your company’s growth.

If you are looking for a comprehensive, user-friendly solution that is perfectly suited for small businesses in the KSA, we recommend trying Qoyod Accounting Software to benefit from all its integrated features and dedicated support.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.