| Excerpt:

The rapid pace of digital transformation and strict adherence to regulations from the Zakat, Tax and Customs Authority (ZATCA), particularly the e-invoicing system, mean that relying on traditional, manual accounting systems is no longer a viable option for businesses in the Kingdom. Factories, whether operating in Riyadh, Jeddah, or Dammam, require a comprehensive accounting system that does more than just record daily journal entries. |

The rapid pace of digital transformation and strict adherence to regulations from the Zakat, Tax and Customs Authority (ZATCA), particularly the e-invoicing system, mean that relying on traditional, manual accounting systems is no longer a viable option for businesses in the Kingdom. Factories, whether operating in Riyadh, Jeddah, or Dammam, require a comprehensive accounting system that does more than just record daily journal entries. They need a strategic partner capable of managing the complexities of manufacturing and accurately calculating production costs with high precision.

The biggest challenge lies in the unique nature of the Saudi industrial sector, which demands accurate tracking of raw materials, work-in-progress (WIP), and fixed assets. The process of selecting the best accounting software for factories is the key to ensuring compliance with the e-invoicing system in Saudi Arabia, optimizing supply chain efficiency, and achieving a competitive advantage in the local market. Continue reading this comprehensive guide to learn how to choose the system that meets your factory’s ambitions and supports its growth.

Why Do Saudi Factories Need Specialized Accounting Software?

The nature of operations in factories differs fundamentally from that of commercial or service-based companies, which imposes unique accounting requirements. A factory deals with the conversion of raw material into a final product, a process that generates significant accounting complexities requiring specialized software, not just a traditional accounting program.

For instance, a factory in the industrial zone of Jeddah or Khobar needs precise tracking of the Cost of Goods Manufactured (COGM) per produced unit, which includes direct materials, direct labor, and manufacturing overhead costs.

Accounting Challenges Specific to the Saudi Industrial Sector

- Production Cost Calculation: One of the toughest tasks is accurately determining the true cost of the product. The best accounting software for factories must offer advanced tools to calculate job order costs or process costs.

- Multi-Stage Inventory Management: Inventory is not limited to finished goods; it also includes raw materials, work-in-progress, and packaging materials. Specialized software ensures the proper valuation of these assets.

- Depreciation and Fixed Asset Management: Factories own massive machinery and equipment. The accounting system must manage the calculation of depreciation using different methods and facilitate the industrial asset inventory and status tracking.

Compliance with the Zakat, Tax and Customs Authority (ZATCA) Requirements

Compliance is the cornerstone of any commercial activity in the Kingdom. Following the implementation of the “Fatoorah” e-invoicing system by ZATCA, it has become essential that a factory’s accounting software is fully compliant with Phase Two requirements (integration and connectivity). This ensures that all invoices issued by the factory, whether tax or simplified, are processed and stored electronically in a format that meets Saudi specifications. A good program will help you avoid penalties and simplify your regular tax declaration submissions.

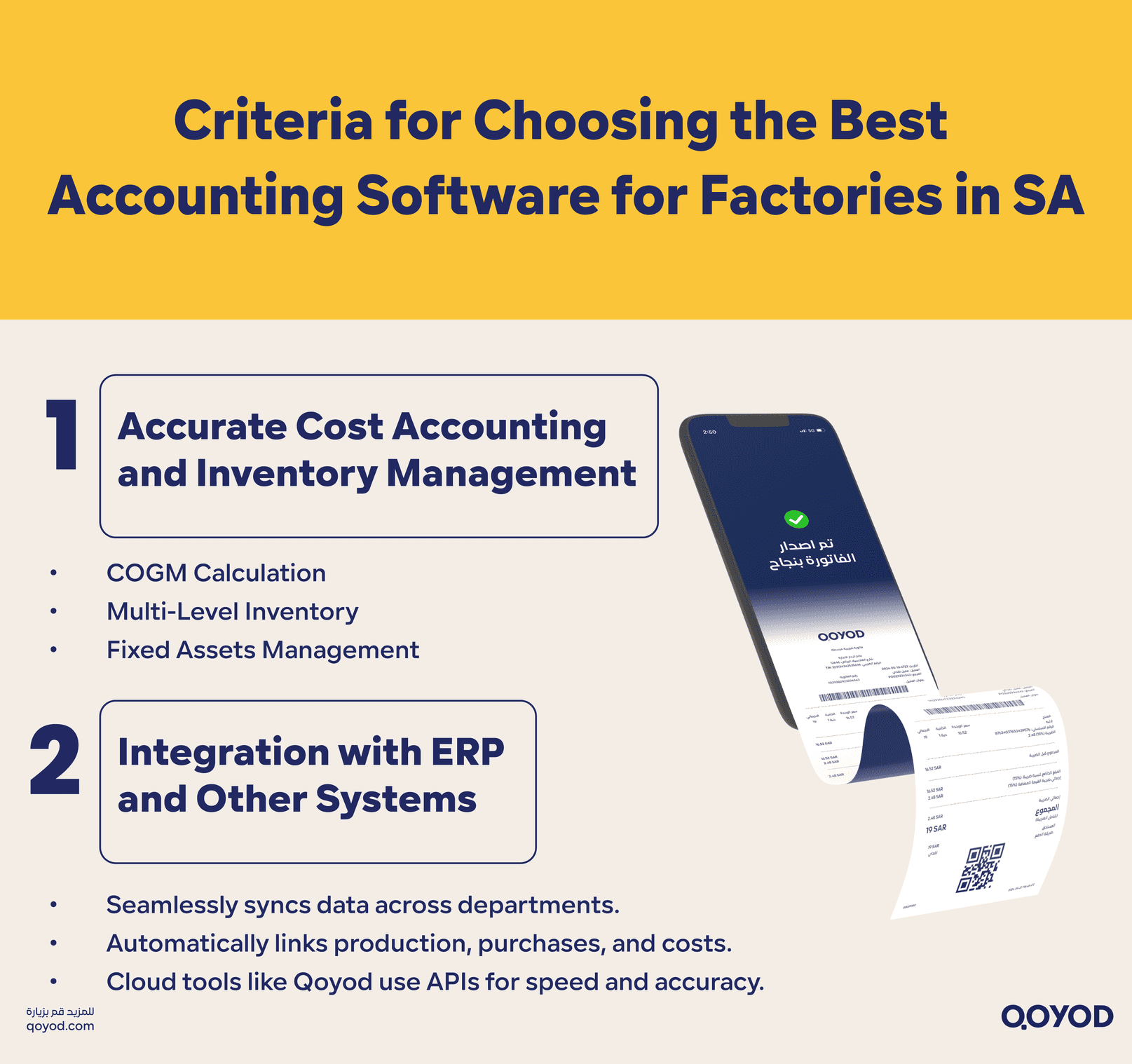

Criteria for Choosing the Best Accounting Software for Factories in the Saudi Market

When you begin the search for the best accounting software for factories, relying on a mere billing software is insufficient. To find a system that truly integrates with your industrial operations in Riyadh, Jeddah, or Dammam, you must evaluate programs based on stringent criteria that ensure efficiency and compliance.

The two most important criteria to focus on are how the program handles cost and inventory complexities and its ability to integrate with the factory’s broader systems.

Accurate Cost Accounting and Inventory Management (Industrial Asset Inventory)

This is the core function that distinguishes a factory accounting software from others. The system must provide the capability to:

- Calculate Cost of Goods Manufactured (COGM): The program must allow you to track and allocate all cost elements (raw materials, direct labor, and manufacturing overhead) to final products and production orders. Without accurate cost accounting, you won’t be able to determine the true profit margin of your products in the Saudi market.

- Multi-Level Inventory Management: Factories deal with three main types of inventory (raw materials, work-in-progress, and finished goods). The software should support a flexible system for managing transfers between these levels and valuing them using multiple methods (e.g., weighted average or FIFO).

- Fixed Asset Inventory: The program must have an integrated module for managing industrial assets (machinery and equipment), automatically calculating their depreciation, and tracking their maintenance, which simplifies the preparation of financial statements according to Saudi standards.

Integration with Enterprise Resource Planning (ERP) Systems

In the age of digitization, accounting software cannot operate in isolation from other departments. The best accounting software for factories must be easily integrable with ERP or Customer Relationship Management (CRM) systems. This integration ensures seamless data flow between:

- Production Module: To directly link work orders to their accounting costs.

- Purchasing Module: To ensure that raw material invoices are automatically recorded and charged to the appropriate inventory or cost center.

Modern cloud systems, such as Qoyod Accounting Software, offer high flexibility in integration via Application Programming Interfaces (APIs), making your factory management in the industrial zone more efficient and eliminating the risk of errors resulting from manual data entry.

Qoyod Accounting Software: The Ideal Solution for Your Factory Management

When searching for the best accounting software for factories in Saudi Arabia, Qoyod stands out as a leading cloud-based solution specifically designed to meet the needs of the local market. Qoyod is an integrated system that combines the power of cost accounting with the flexibility of cloud systems.

Qoyod is more than just an invoicing tool; it’s a system that manages multi-stage inventory, records fixed assets, and provides detailed cost center reports, making it ideal for industrial establishments in the Kingdom, from small and medium-sized enterprises (SMEs) to larger companies.

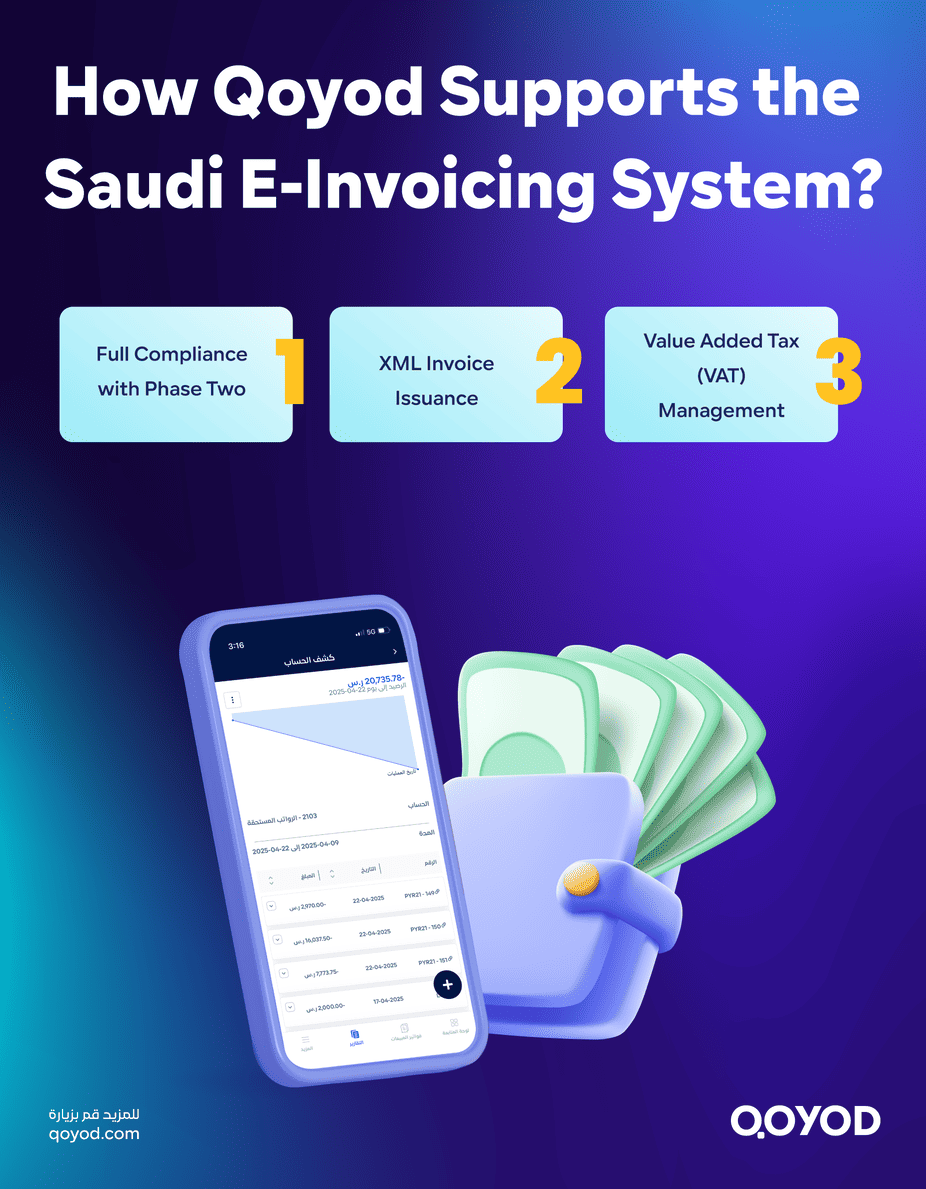

How Qoyod Supports the Saudi E-Invoicing System (Tax Invoice)

Qoyod Accounting Software is fully compliant with ZATCA’s requirements. The most important advantages it offers in this context are:

- Full Compliance with Phase Two: The software is ready for automatic connection with the Authority’s systems as soon as the second phase of e-invoicing is activated.

- XML Invoice Issuance: Qoyod ensures invoices are issued in the legally required electronic format.

- Value Added Tax (VAT) Management: It facilitates the calculation and recording of VAT on sales and purchases, simplifying the process of preparing and submitting periodic tax declarations to the Zakat and Tax Authority.

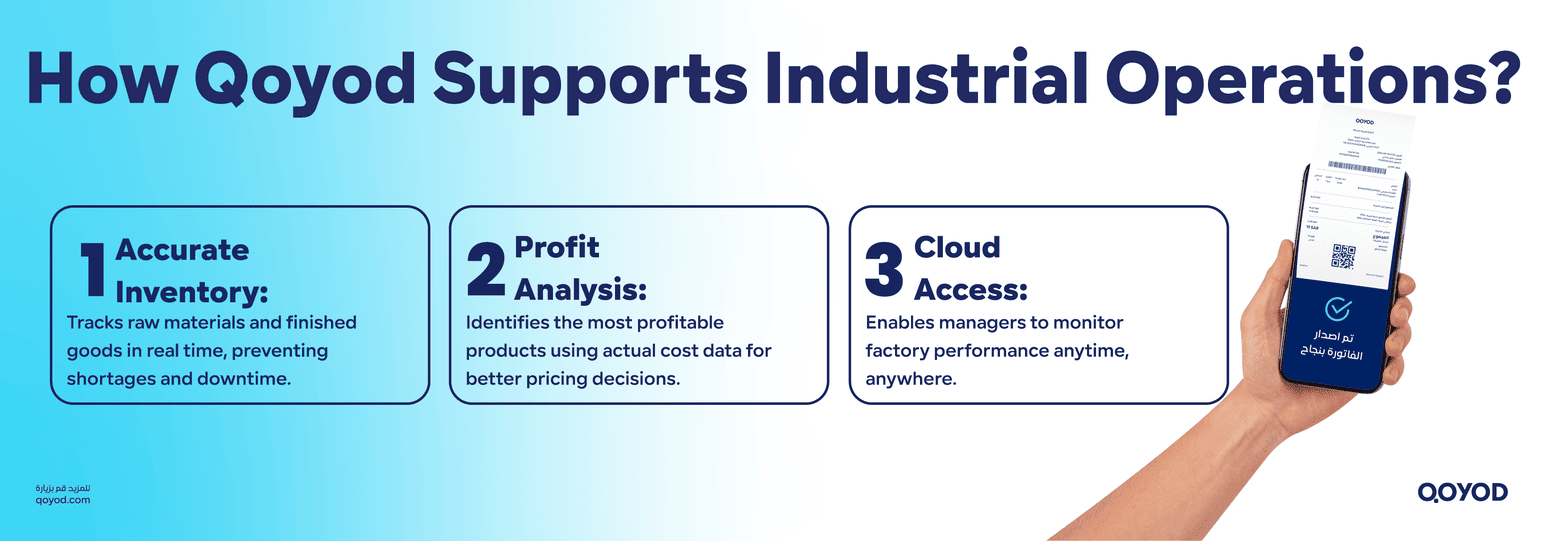

How Qoyod Supports Industrial Operations and Inventory Management in Your Factory

Industrial companies in major cities rely on Qoyod Accounting Software for several vital functions:

- Inventory Accuracy: The system provides instant knowledge of available quantities of raw materials and final products, helping to avoid material shortages and production line disruption, a common issue for small and medium-sized businesses.

- Profitability Analysis: Qoyod helps accurately identify the most profitable products, based on the actual cost of inputs (raw materials and operations). These reports assist management in making strategic pricing decisions in the Saudi market.

- Ease of Access: Being a cloud-based system, management can track the factory’s performance from anywhere (whether from the office in Riyadh or the factory site), which is vital for management needing constantly updated data.

Success Story

Managing cost accounting and tax compliance are among the biggest challenges in the factory sector, especially in feed and fattening.

One of the partners in the “Tasmeen” institution recounts their experience with Qoyod Accounting Software, which helped them achieve a qualitative leap by:

- Cloud Migration: Relying on a cloud-based program accessible from anywhere was one of the essential determinants for choosing the software.

- Rapid Adaptation to Government Developments: The program is always one step ahead, especially in handling tax updates. When VAT was imposed, they did not struggle with updating or modifications (unlike non-cloud programs).

- Readiness for E-invoicing: The institution has been issuing invoices completely electronically since 2018, making it ready and compliant with the requirements of the Saudi e-invoicing (Fatoora) before its launch.

Comparison: Cloud vs. Traditional Accounting Software for Factories

Amidst the shift toward cloud solutions, manufacturers find themselves facing two options: traditional systems (locally installed) or cloud-based systems. To choose the best accounting software for factories, a comparison based on the operating environment in the Kingdom is necessary:

| Feature | Cloud Systems (e.g., Qoyod) | Traditional Systems (On-Premise) |

| Initial Costs | Low (monthly/annual subscription) | Very high (license purchase + servers) |

| Updates & Compliance | Automatic (e-invoicing updates are free) | Manual and require expensive maintenance fees |

| Security & Backup | Very high (provider is responsible) | Depends on the factory’s technical capability (data loss risks) |

| Access & Remote Work | Easy from anywhere (suits mobile work) | Requires complex and costly VPN network |

Security and Flexibility: The Importance of Cloud Solutions for Factories in Industrial Cities

Cloud systems are the superior choice for the best accounting software for factories in Riyadh, Jeddah, and other cities. Factories require:

- Scalability: The ability to add new users or branches quickly and easily as the factory grows.

- Reduced Operational Cost: No need to hire a large technical team to manage servers and infrastructure.

- Speed of Implementation: Use of the program can begin within days, unlike traditional systems that may take months to implement.

Qoyod at Riyadh International Industry Week 2025: Innovative Technical Solutions to Support the Growth of Industrial Companies.

Practical Tips for Selecting and Implementing Accounting Software in Your Saudi Factory

The process of choosing and implementing accounting software for factories must be systematic to ensure the project’s success. Here are the most important tips aimed at Saudi companies:

- Define Production Requirements First: Before searching for the best accounting software for factories, document your production cycles: How do you calculate labor costs? How do you allocate electricity costs? This determines the nature of the program you need (whether you need a full ERP system or an accounting program with strong manufacturing features).

- Verify Local Compliance: Ensure the program fully supports the Arabic language, supports the Saudi accounting system, and complies with the e-invoicing and tax regulations issued by ZATCA.

- Training and Technical Support: Choose a program that offers technical support in Arabic and is available during business hours in the Kingdom, preferably one with experience dealing with Saudi SMEs.

- Testing and Trial: Do not commit to a long-term contract before practically trying the system on a part of your factory’s operations. Many programs like Qoyod offer a free trial period.

- External Integration: Ensure the program can easily export and import data from other systems you may use (such as quality management software or HR software).

In Conclusion of This Guide

It is clear that choosing the best accounting software for factories is not just an operational decision; it is an investment in the future of your factory in the Kingdom. We have discussed the importance of a specialized system for managing the complexities of costs and inventory, and the necessity of full compliance with the Saudi e-invoicing requirements (Fatoora) to ensure legal compliance.

Digital transformation necessitates that factories adopt flexible and secure cloud solutions that allow for accurate decisions based on real-time accounting data. If you are looking for a system that combines the power of industrial operations management with ease of use designed for the Saudi market, locally compliant solutions are your best choice.

Don’t let the complexities of industrial accounting hinder your factory’s growth.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for Saudi companies.

Frequently Asked Questions (FAQ) about Accounting Software for Factories

Does accounting software for factories support the Value Added Tax (VAT) system?

Yes, the accounting software for factories must support all Value Added Tax (VAT) systems in force in the Kingdom of Saudi Arabia, including the correct registration of tax on sales and purchases, and the issuance of reports required to prepare periodic tax declarations for the Zakat, Tax and Customs Authority.

What is the importance of inventory management in factory accounting software?

Inventory management is crucial for factories because they do not deal with a single product. The program must allow you to track inventory at all stages (raw materials, work-in-progress, finished products), and value it based on approved accounting methods (such as FIFO or LIFO), which directly affects the determination of the Cost of Goods Sold (COGS) and the factory’s profitability.

Does the accounting software need to be certified by the Zakat, Tax and Customs Authority?

Yes, in the context of e-invoicing, the software must be compliant with the requirements of the Authority (ZATCA) for the implementation stages of “Fatoora”. This means the system is capable of issuing invoices in the legally required electronic format (XML) and connecting with the Authority’s systems in Phase Two to ensure full compliance.

What is the importance of Cost Center reports for factories in Saudi Arabia?

Cost Center reports are vital for factories, especially in the competitive Saudi environment. These reports allow manufacturers in Riyadh or Jeddah to track expenses and revenues associated with specific departments (such as a particular production line, workshop, or even a manufacturing order). This helps management identify the most efficient departments and those that need improvement to reduce waste and increase profitability. Good accounting software for factories must effectively support this feature.

Are cloud-based accounting systems safe for storing sensitive factory data?

Yes, in most cases, reliable cloud systems (such as Qoyod) are safer than traditional, locally installed systems. Cloud software providers offer advanced protection layers, data encryption, and regular backups—procedures that may not be available with the same efficiency in SMEs. This ensures the protection of the factory’s sensitive financial data, especially in industrial cities that may be targets of cyber threats.

References and Resources:

- Zakat, Tax and Customs Authority (ZATCA): E-invoicing and Tax Requirements

- Saudi Ministry of Industry and Mineral Resources: A Trusted Reference for Statistics and Reports related to the Industrial Sector

- Small and Medium Enterprises General Authority (Monsha’at): Support directed to the SME sector

- Saudi Organization for Certified Public Accountants (SOCPA): Applied Accounting Standards in the Kingdom