Accounting Entries form a fundamental part of the accounting system and are the bedrock for documenting all financial transactions in line with the standards set by the Organization for Chartered and Professional Accountants (SOCPA) and the Zakat, Tax and Customs Authority (ZATCA). These entries establish the rules for a company’s financial reporting. For small and medium-sized enterprises (SMEs), mastering these entries can sometimes feel like a hurdle, potentially limiting focus on growth and innovation. In the Kingdom, accurately documenting financial operations through entries is a core requirement for tax and regulatory compliance, especially with the mandatory e-invoicing system now fully active, making review and auditing processes simpler under ZATCA’s requirements. This article provides a comprehensive guide to understanding these essential financial tools.

What Are Accounting Entries in Business?

Accounting Entries are the primary tools used to document financial operations within companies. They are critical for accurately recording transactions to ensure compliance with local legal requirements.

By accurately documenting and recording financial operations, accountants and managers can effectively utilize accounting data to evaluate the entity’s performance, analyze profits and losses, identify financial strengths and weaknesses, and make informed, sound decisions based on reliable accounting information.

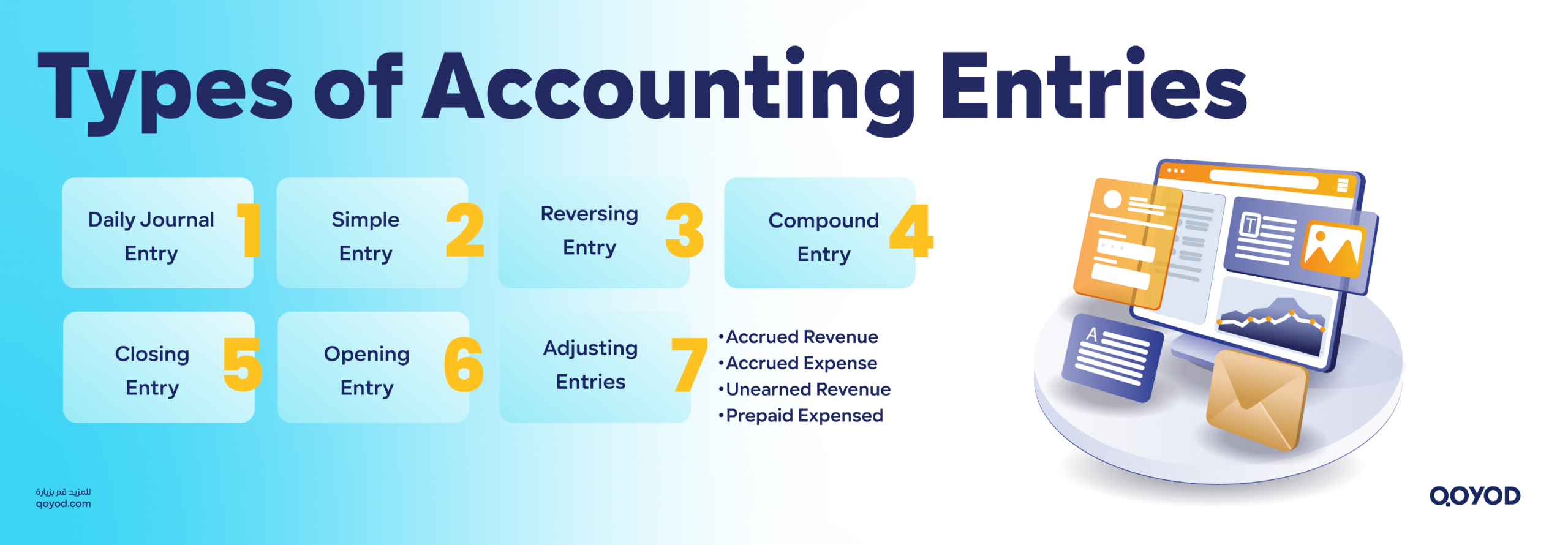

Types of Accounting Entries

Accounting entries are used to record financial events in a company’s accounting ledgers, aiming to ensure the integrity and balance of financial information. The main types of these entries include:

Daily Journal Entry

The Daily Journal Entry is the cornerstone for recording the daily transactions of establishments. It is structured according to the financial statement requirements adopted under the International Financial Reporting Standards (IFRS) endorsed in the Kingdom.

| Debit | Credit | Description |

| 3,000 | From A/C / (Bank) | |

| 3,000 | To A/C / (Capital) |

Simple Entry

A simple entry records financial transactions that affect only one account on the debit side and one account on the credit side in the journal. For example, when recording cash sales revenue, a simple entry is used to increase the cash account and record the revenue.

Learn More: How to calculate purchases and sales through Qoyod

| Debit | Credit | Description |

| 12,000 | From A/C / (Employee Wages Expense) | |

| 12,000 | To A/C / (Bank) |

Reversing Entry

The reversing entry is used to correct accounting errors discovered after closing the accounts. The reversing entry is recorded for an amount that precisely reflects the error’s impact, ensuring the balance of financial information.

Compound Entry

A compound entry is used to record financial transactions that affect two or more accounts in the journal. For instance, when a company purchases raw materials on credit, a compound entry is used to increase the Raw Materials account and increase the Creditors account.

- Compound Entry – Multiple Debits:

| Debit | Credit | Description |

| 65,000 | From Mentioned Accounts: | |

| 10,000 | A/C / (Bank) | |

| 55,000 | A/C / (Cash) | |

| 65,000 | To A/C / (Debtors / Customer X) |

- Compound Entry – Multiple Credits:

| Debit | Credit | Description |

| 4,700 | From A/C / (Assets – Furniture) | |

| 4,700 | To Mentioned Accounts: | |

| 4,000 | A/C / (Cash) | |

| 700 | A/C / (Bank) |

- Compound Entry – Multiple Debits and Credits:

| Debit | Credit | Description |

| 3,000 | From Mentioned Accounts: | |

| 2,000 | A/C / (Internet Expense) | |

| 1,000 | A/C / (Gas Expense) | |

| 3,000 | To Mentioned Accounts: | |

| 2,250 | A/C / (Bank) | |

| 750 | A/C / (Cash) |

Closing Entry

The closing entry is used at the end of the accounting period to close temporary accounts and transfer balances to the closing account.

- Closing Expenses:

| Debit | Credit | Description |

| XXX | From A/C / (Profit and Loss) | |

| XXX | To A/C / (Expense) | |

| (CLOSING EXPENSE) |

- Closing Revenues:

| Debit | Credit | Description |

| XXX | From A/C / (Revenue) | |

| XXX | To A/C / (Profit and Loss) | |

| (CLOSING REVENUE) |

Learn More About: What are closure entries in accounting?

Opening Entry

The opening entry is used at the beginning of the accounting period to record the initial balances of the financial accounts, establishing the starting balance for the accounting duration.

| Debit | Credit | Description |

| XXX | From A/C / (Assets) | |

| XXX | To A/C / (Capital) |

Adjusting Entries

Adjusting entries are used to modify financial balances and achieve accuracy at the end of the accounting period. Examples include:

Accrued Revenue Adjustment

This is a vital accounting process aimed at recording revenue a company is entitled to after providing services or products, but for which cash has not yet been received.

Example: A consulting firm in the region provided services worth SR 35,000 but hasn’t received the cash by the end of the accounting year.

| Debit | Credit | Description |

| 35,000 | From A/C / (Accrued Environmental Consulting Revenue) | |

| 35,000 | To A/C / (Consulting Revenues) |

Accrued Expense Adjustment

This refers to expenses belonging to a specific accounting period that haven’t been recorded or paid yet. This adjustment ensures the accuracy of accounting records.

Example: Employee wages totaling SR 250,000 were incurred but only SR 210,000 was recorded in the trial balance. An accrued expense of SR 40,000 is required.

| Debit | Credit | Description |

| 40,000 | From A/C / (Wages) | |

| 40,000 | To A/C / (Accrued Wages) |

Unearned Revenue Adjustment

This involves revenue received in advance before the corresponding service or product is delivered. The part belonging to the current fiscal year is recognized, while the remainder is classified as a current liability.

Example: XYZ Company leased its administrative headquarters to ABC Company for three years for SR 300,000, receiving the full amount in advance. The adjustment recognizes one year’s revenue (SR 100,000)

| Debit | Credit | Description |

| 100,000 | From A/C / (Unearned Rental Revenue) | |

| 100,000 | To A/C / (Rental Revenues) |

Prepaid Expense Adjustment

This concerns payments made in advance for expenses that will benefit future periods.

Example: A company paid SR 200,000 upfront for two years’ rent. The adjustment recognizes one year’s expense (SR 100,000).

| Debit | Credit | Description |

| 100,000 | From A/C / (Rent Expense) | |

| 100,000 | To A/C / (Prepaid Rent) |

How to Write an Entry in the Daily Journal

When writing an entry in the daily journal, several key points must be taken into consideration:

- Debit and Credit: The accounting entry has two sides: Debit and Credit. The amounts must always be equal.

- Description: The reason and nature of the accounting entry must be clarified.

- Cost Center: Cost centers are assigned according to the local organizational structure to identify departments and projects. This is crucial for generating detailed financial reports that meet the requirements of government and regulatory bodies.

- Entry Number: A sequential number is assigned to each accounting entry to track transactions easily.

- Ledger Page Number: The page number in the General Ledger where the entry will be posted must be specified.

- Date: The date of the financial transaction must be recorded.

| Debit | Credit | Description |

| XXX | From A/C / (Assets) | |

| XXX | To Mentioned Accounts: | |

| XXX | A/C / (Bank) | |

| XXX | A/C / (Cash) |

Effortless Entry Creation with Qoyod System

Modern accounting software, like Qoyod, simplifies the creation of these entries. By simply recording an invoice, payment, or expense, the system automatically generates the complex Accounting Entries in the background, making compliance easier for SMEs.

The Importance of Accounting Entries for Saudi Businesses

Accounting Entries play a vital role in ensuring the integrity and accuracy of financial data, providing a reliable foundation for managerial and investment decisions in the local market.

- Accurate Documentation and Recording of Financial Operations: Entries act as the official record for every financial transaction, ensuring a complete record for easy tracking.

- Preparation of Financial Statements and Reports: Financial statements rely on data recorded in the entries. Entries are the basis for preparing reports subject to auditing by entities like the Capital Market Authority (CMA), enhancing transparency and credibility in companies.

- Financial Control and Auditing: Entries support the internal control system, a requirement under the Financial Control Law issued by the Ministry of Finance. They facilitate external auditing, allowing auditors to verify the correctness of records against accounting standards.

- Informed Management Decisions: Entries provide detailed information on financial performance. Management can use this data to analyze performance, identify strengths and weaknesses, and make better decisions regarding operational activities, investments, and financing in the Kingdom.

- Compliance with Accounting Standards and Laws: They ensure organizations adhere to accounting standards adopted by SOCPA and local tax and legal regulations, particularly the mandatory e-invoicing system. Compliance reduces legal and financial risks, avoiding potential fines and penalties.

- Tracking Assets and Liabilities: Entries track and record all company assets and liabilities, providing the net worth of the company for appropriate financial decisions.

Legal Significance of Accounting Entries

Accounting Entries are crucial not just for internal finance but also for the legal and compliance framework.

- Documenting Rights and Obligations: Entries act as legal evidence, documenting the company’s rights and obligations. Local commercial and civil laws mandate maintaining accurate records, used to prove the validity of commercial transactions and define rights and liabilities in legal disputes.

- Accurate Tax Calculation: Taxes, including Zakat and VAT, are a key part of the relationship between businesses and the state. Accounting Entries are essential for determining the correct tax liability, ensuring adherence to ZATCA’s regulations, and avoiding legal accountability.

- Impact of Tax Laws and Regulations: Constant changes in tax laws, such as updates to VAT, directly affect how entries are prepared. Companies must adapt their systems to align with these new laws, often requiring specific documentation to support the entries for tax auditing.

- Compliance and Risk Protection: Compliance with tax and regulatory laws is vital for protecting the company from substantial financial penalties or criminal liability. Accurate and organized records minimize legal and tax risks, enhancing the company’s reputation.

Accounting Standards and Their Influence on Entries

Accounting standards are rules and principles that dictate how financial transactions are recorded and reports are prepared.

The Role of Accounting Standards

- Standardization: Ensures uniformity in recording and presenting transactions, making financial data comparable between different companies, whether locally or internationally..

- Transparency and Reliability: Boosts the confidence of investors and creditors in the company’s financial data.

- Compliance: Helps companies comply with local and international regulations, minimizing risks.

Types of Accounting Standards

Companies predominantly comply with the International Financial Reporting Standards (IFRS), adopted in the Kingdom, in addition to updates issued by SOCPA.

- IFRS (International Financial Reporting Standards): Issued by the International Accounting Standards Board (IASB), used in over 140 countries.

- GAAP (Generally Accepted Accounting Principles): Primarily used in the US.

Core Accounting Principles Impacting Entries

Accrual Basis: Revenue and expenses are recorded when earned or incurred.

Historical Cost: Assets are recorded at their original cost.

Going Concern: Assumes the company will continue to operate.

Matching Principle: Expenses are matched with the revenue they generated.

Consistency: Accounting policies are applied uniformly.

Full Disclosure: All material financial information is disclosed.

Materiality: Focus on information that could influence users’ decisions.

The Importance of Internal and External Auditing

In the business landscape, internal and external auditing are twin pillars ensuring the integrity of financial data, particularly the Accounting Entries.

Internal Auditing: The Company’s Vigilant Eye

Internal auditing is an in-house function that evaluates financial and administrative operations, assessing internal control systems to prevent errors and fraud.

- Focus: Checking control systems, verifying financial records, and ensuring operations align with established policies.

- Goal: Risk assessment and providing reports to senior management.

External Auditing: An Independent Integrity Seal

External auditors, who are completely independent, examine the financial statements to provide an unbiased opinion on their accuracy and reliability.

- Focus: Reviewing financial records against accounting standards (IFRS) and local laws.

- Goal: Issuing an audit report that certifies the integrity of the financial statements to the public, investors, and regulatory bodies like ZATCA.

The synergy between internal and external auditing maximizes effectiveness and enhances public trust.

Professional Ethics in Accounting Entries

Professional ethics are the moral compass for accountants, ensuring that the numbers in the Accounting Entries reflect a true and fair view.

- Integrity: Being honest and straightforward in every step, recording every transaction as it happened without manipulation or fabrication. This is the basis of trust.

- Objectivity: Viewing matters from a neutral angle, making decisions based on facts and evidence, not personal opinions or external pressures.

- Confidentiality: Safeguarding sensitive and secret information.

- Avoiding Conflicts of Interest and Pressure: Accountants must be strong enough to resist pressures to alter figures, sticking to professional principles.

- Documentation and Disclosure: Documenting every transaction and decision. Accountants have an ethical responsibility to report any illegal or unethical activity.

Conclusion: Transforming Challenges into Opportunity with Qoyod

Accounting Entries are an essential part of the accounting process and may sometimes present a challenge to small/medium-sized businesses focused on growth. However, these regulations should not be viewed as an obstacle to innovation; rather, they present an opportunity to enhance financial performance and excel.

By embracing advanced, intelligent accounting systems that leverage data analysis, like Qoyod Accounting Software, companies can move beyond traditional constraints. Qoyod empowers businesses to achieve accurate, transparent, and timely financial reporting, ensuring adherence to correct accounting standards and compliance with all ZATCA requirements, including the mandatory e-invoicing system.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for companies in the region.

Join our inspiring community! Follow us on LinkedIn and X (Twitter) to be the first to see the latest articles and updates. A perfect opportunity for learning and development in the world of accounting and finance. Don’t miss out, join today!

FAQ: Essential Questions about Accounting Entries

What are Accounting Entries?

Accounting Entries are the fundamental method used to document and record all financial transactions that occur within a company. Their primary purpose is to ensure commitment to the standards set by the Organization for Chartered and Professional Accountants (SOCPA) and facilitate subsequent auditing. They include Debit and Credit accounts and a brief Description, playing a key role in preserving financial rights and analyzing the company's performance.

What are the main types of Accounting Entries?

The most common types of Accounting Entries essential for businesses include: the Daily Journal Entry, the Simple Entry, the Compound Entry, the Reversing Entry (used for error correction), the Closing Entry (for year-end procedures), the Opening Entry (for period start), and the Adjusting Entry (used to finalize revenues and expenses at the end of the accounting period according to local standards).

What is the difference between a Simple Entry and a Compound Entry?

A Simple Entry records only one account in the Debit side and one account in the Credit side. In contrast, a Compound Entry involves more than one account on either the Debit side, the Credit side, or both. This is typical for complex transactions, such as multiple payments or a purchase involving partial credit.

How should Accounting Entries be written correctly?

To write a correct accounting entry, you must accurately identify the Debit account and the Credit account, provide a concise Description of the transaction, and properly document the Date, Entry Number, and Ledger Page. It is also vital to assign a Cost Center according to the company's structure to ensure easy review and compliance with regulatory systems.

Why are Accounting Entries important for financial management?

The organized and accurate recording of Accounting Entries provides a reliable foundation for preparing financial reports, evaluating profits and losses, identifying financial strengths and weaknesses, and making informed decisions regarding investment or cost reduction. Furthermore, it significantly facilitates tax assessment and auditing, especially with ZATCA's requirements and the e-invoicing system.

How do Accounting Entries relate to local laws?

Accounting Entries serve as legal evidence to substantiate transactions before official authorities or in legal disputes. They are essential for accurately calculating tax liabilities and ensuring the company's full compliance with regulations like the Zakat, Tax and Customs Authority (ZATCA) system, thereby avoiding legal penalties.

What are the most important accounting standards that affect the writing of entries?

Companies adhere to the International Financial Reporting Standards (IFRS), supplemented by updates from SOCPA. These standards require that operations be recorded accurately and transparently, particularly adhering to the principles of the Accrual Basis, Consistency, and Full Disclosure.

What is the difference between internal and external auditing of entries?

Internal Auditing is an internal function that monitors the integrity of the entries and continuously assesses operations from within the company. External Auditing, however, is an independent examination by an external party to confirm the fairness, accuracy, and compliance of the financial records with local regulations and standards.

How does professional ethics play a role in Accounting Entries?

Professional ethics mandate that the accountant maintains Integrity, Objectivity, and Confidentiality when recording Accounting Entries. This requires accurate documentation of all details without manipulation, preserving the trust of the company and regulatory bodies, and ensuring the validity of financial decisions.