| Excerpt

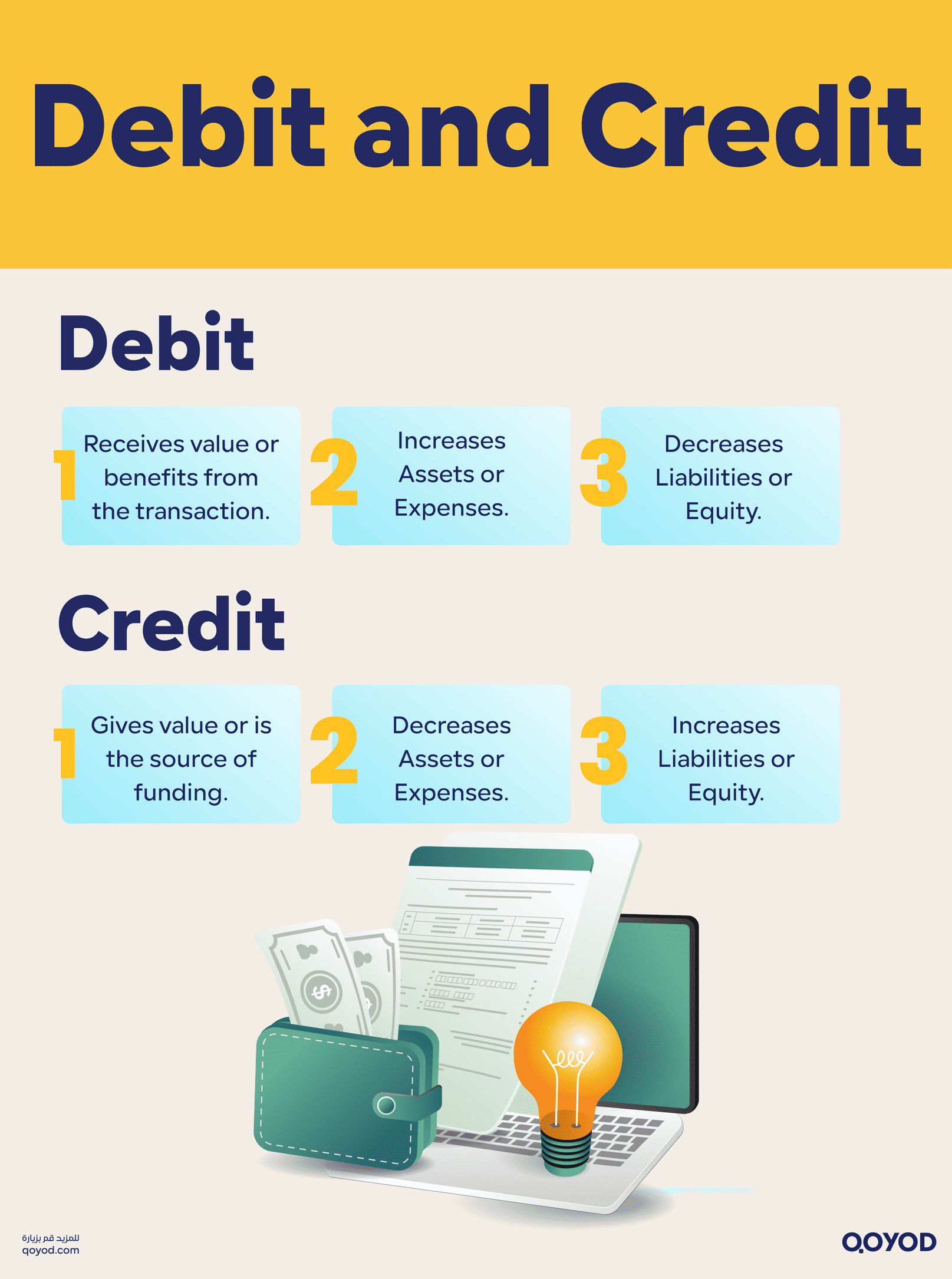

Debit and Credit are the foundation of the double-entry system. Debit is the receiving side (increases Assets and Expenses), while Credit is the giving side (increases Liabilities, Equity, and Revenue). |

Have you ever wondered about the secret behind a company’s financial balance and how accounts are managed accurately, especially for growing small and medium-sized enterprises (SMEs) in Saudi Arabia?

Debit and Credit are the bedrock of the double-entry accounting system. Debit is the side that receives value (an increase in Assets and Expenses), while Credit is the side that provides value (an increase in Liabilities, Equity, and Revenue). Understanding these concepts ensures accurate financial recording, which is critical for Saudi businesses amid regulatory requirements, such as the mandatory e-invoicing system in Saudi Arabia.

In the world of finance, the difference between Debit and Credit is the essential element governing all financial relations. This concept is not merely theoretical; it is the pillar upon which major financial decisions are based. In the context of the Kingdom’s digital transformation where statistics indicate that over 60% of SMEs still rely on manual or simple accounting systems, exposing them to common accounting errors, mastering the rules of Debit and Credit in Accounting becomes a fundamental necessity.

In this article, we’ll dive deep into this topic to understand the roles of Debit and Credit, their impact on a business’s financial performance, and answer the most crucial question: How do I differentiate between Debit and Credit in accounting? Follow along to become an expert in this accounting essential.

Debit and Credit: Defining the Two Sides

1. What is Debit?

Simply put, Debit is the party that receives value or is the beneficiary of the financial transaction. In accounting, a Debit means there is an increase in Assets (such as Cash, Inventory, or Accounts Receivable) or an increase in Expenses. Conversely, a Debit can also mean a decrease in Liabilities or Equity.

Practical Example: When a company in Riyadh purchases inventory for cash, the “Inventory” account is debited because it increased (it received value from an accounting entry perspective).

Who is the debtor, and what is his role in financial relations? READ MORE

2. What is Credit?

Credit is the party that gives value or represents the source of funding in the transaction. Unlike the Debit, a Credit causes a decrease in Assets and Expenses, and an increase in Liabilities (such as Loans and Accounts Payable) or Equity.

Practical Example: When a company in Jeddah obtains a bank loan, the “Loan” account is credited because it increased, representing a source of funding (a liability) for the company.

These rules are essential for understanding the difference between Debit and Credit and applying the double-entry principle.

The Core Difference Between Debit and Credit

The fundamental difference between Debit and Credit lies in the nature of their effect on account balances. Debit records an increase in Assets and Expenses and a decrease in Liabilities. In contrast, Credit records an increase in Liabilities, Revenue, and Equity and a decrease in Assets.

To understand the distinction, review the following table:

| Aspect of Difference | Debit | Credit |

| Accounting Definition | The party that receives the value or is the beneficiary of the entry. | The party that gives the value or is the source of funding. |

| Effect on Assets & Expenses | Increases Assets and Expenses. | Decreases Assets and Expenses. |

| Effect on Liabilities, Equity, & Revenue | Decreases Liabilities, Equity, and Revenue. | Increases Liabilities, Equity, and Revenue. |

| Normal Account Balance | The natural balance for accounts with a Debitor nature (Assets, Expenses). | The natural balance for accounts with a Creditor nature (Liabilities, Revenue, Equity). |

| Double-Entry Application | Recorded on the left side of the journal entry or Ledger (T-Account). | Recorded on the right side of the journal entry or Ledger (T-Account). |

To master the rules of Debit and Credit in Financial Accounting, remember that the double-entry system mandates that the entry must balance: Total Debits must equal Total Credits. This is the basis for accurately determining how to differentiate between Debit and Credit in accounting when recording any financial transaction. For instance, Expenses are naturally Debit; thus, if Expenses increase, they are Debited, and if they decrease, they are Credited. The opposite is true for Liabilities, such as Accounts Payable.

Read Also: How to create Credit and Debit Notes and cancel an e-invoice in Qoyod.

How Debit and Credit Impact Different Accounts

In accounting, a fundamental rule governs how every transaction is recorded: the relationship between Debit and Credit. To understand this impact more clearly, let’s look at the following table:

| Account Type | Increases (Normal Balance) | Decreases |

| Equity | Credit | Debit |

| Assets | Debit | Credit |

| Liabilities | Credit | Debit |

| Expenses | Debit | Credit |

| Revenue | Credit | Debit |

This table shows how different accounts are affected by increases or decreases. For example, when Assets increase, such as buying new equipment, the entity has spent money, and the Asset account becomes Debited. When Assets decrease, like selling part of that equipment, the entity receives cash, and the Asset account becomes Credited by the value collected. This balance between increase and decrease reflects the flow of funds and its impact on the different accounts.

Debit and Credit Accounts: The Five Account Rules

Debit and Credit accounts represent an essential part of any entity’s financial system. The nature of each account is determined based on its fundamental rule. You can understand these rules by classifying the five main accounts in accounting:

- Nature: Debit

- Application: Resources owned by the entity (Cash, Inventory, Land).

- Entry Rule: Increase with a Debit. Decrease with a Credit.

- Example: When buying land, the “Land” account is debited (increased). When selling a piece of furniture, the “Furniture” account is credited (decreased).

- Nature: Debit

- Application: Costs incurred to generate revenue (Salaries, Rent).

- Entry Rule: Increase with a Debit. Decrease with a Credit.

Liabilities

- Nature: Credit

- Application: Financial obligations to external parties (Loans, Accounts Payable).

- Entry Rule: Increase with a Credit. Decrease with a Debit.

- Example: When taking out a loan, the “Loan” account is credited (liability increased).

Revenue

- Nature: Credit

- Application: Funds earned from sales or services.

- Entry Rule: Increase with a Credit. Decrease with a Debit.

Equity

- Nature: Credit

- Application: Owners’ claims on the business (Capital, Retained Earnings).

- Entry Rule: Increase with a Credit. Decrease with a Debit.

The Double-Entry Principle: Balancing Accounts

To better understand how Debit and Credit accounts work, we must focus on the principle that governs them: the Double-Entry Principle. This principle, formalized by Luca Pacioli, rests on a basic rule that guarantees the company’s financial equilibrium:

Assets = Liabilities + Equity

Steps for Recording the Double Entry (Practical Example)

In the double-entry system, every financial transaction must have two parties, and the Debit value must equal the Credit value. Here is an illustrative example of a service transaction in two phases:

| Phase | Debited (Value Received) | Credited (Value Given/Source) | Result/Effect |

| 1. Service Provided on Account | Accounts Receivable (Asset uparrow) Debited | Revenue (Revenue uparrow) Credited | Increase in Asset (Debit) equals Increase in Revenue (Credit). Entry is balanced. |

| 2. Cash Collected Later | Cash (Asset uparrow) Debited | Accounts Receivable (Asset downarrow) Credited | Increase in one Asset (Cash) is offset by a decrease in another Asset (A/R). Entry is balanced. |

This process is known as account balancing. The terms Debit and Credit indicate the nature of the change in the balance:

- Debit (in the Ledger): Recorded on the left side of the T-Account.

- Credit (in the Ledger): Recorded on the right side of the T-Account.

| Transaction | Debit | Credit |

| Issue an invoice. | SAR 700 (Accounts Receivable) | SAR 700 (Revenue) |

| Receive payment. | SAR 700 (Cash Balance) | SAR 700 (Accounts Receivable) |

This way, every transaction is accurately tracked to ensure account balance in the accounting system.

Diverse Examples of Debit and Credit for Saudi SMEs

To practically apply the difference between Debit and Credit, here are practical examples illustrating how financial transactions are recorded according to the double-entry system:

| Transaction Description | Debit Account | Credit Account | Effect/Reason |

| Example 1: Sold product for SAR 8,000 cash in Dammam. | Cash (SAR 8,000) (Asset uparrow) | Revenue (SAR 8,000) (Revenue uparrow) | Cash (Asset) increased (Debit); Revenue increased (Credit). |

| Example 2: Purchased new equipment for SAR 150,000 on credit in Khobar. | Fixed Assets (Equipment) (SAR 150,000) (Asset uparrow) | Liabilities (Accounts Payable) (SAR 150,000) (Liability uparrow) | Equipment (Asset) increased (Debit); Liability increased (Credit). |

| Example 3: Sold goods on account for SAR 12,000 in Madinah. | Accounts Receivable (SAR 12,000) (Asset uparrow) | Revenue (SAR 12,000) (Revenue uparrow) | Accounts Receivable (Asset) increased (Debit); Revenue increased (Credit). |

Automating Debit and Credit Management with Qoyod Accounting Software

The recording of Debit and Credit accounts occurs through the double-entry system, where transactions are first documented in the General Journal and then posted to the General Ledger. Accurate recording of these accounts is fundamental to ensuring the precision of financial statements.

Transitioning to Automation and Technical Support

To improve the accuracy and efficiency of this process especially with the mandatory e-invoicing requirements in the Kingdom many accountants and business owners are turning to:

- Using Accounting Software (like Qoyod): These programs offer an effective way to track Debit and Credit automatically. They automatically create and post double entries, reducing common accounting errors and ensuring continuous entry balance.

- Financial Credibility and Compliance: Using certified and trusted accounting software, such as Qoyod, ensures your financial records are reliable and auditable, boosting your credibility with official and tax authorities like ZATCA (Zakat, Tax, and Customs Authority).

Always Remember: The accounting system is a balanced network, and any small error in identifying the Debit or Credit leads to severe financial consequences that impact the financial statements.

LEARN MORE : A comprehensive guide to the accounting cycle

How Does Qoyod Help You Manage Debit and Credit Accounts?

After grasping the difference between Debit and Credit and the basic rules, the importance of accurate application emerges. Qoyod Accounting Software stands out as an integrated accounting solution that eliminates the need for error-prone manual recording.

- Automatic Recording: Qoyod automatically records double entries for every transaction (invoice, cash expense, purchase), ensuring the correct identification of Debit and Credit and a balanced entry every time.

- E-Invoicing Compliance: The system ensures financial reports comply with the Zakat, Tax, and Customs Authority, ensuring your accounts are free from errors that could arise from a misunderstanding of Debit and Credit rules.

- Receivable/Payable Tracking: Qoyod provides detailed reports on Accounts Receivable and Payable, helping you efficiently track your entitlements from customers and obligations to suppliers. This is vital for accounting solutions for Riyadh businesses and across the Kingdom.

Conclusion

In the world of finance, where accounts intersect and numbers intertwine, Debit and Credit stand as the two sides of a sensitive balance. We have delved into the depths of this concept and realized that understanding the difference between Debit and Credit and knowing the rules for balancing these accounts is not just theoretical knowledge it is the key to controlling your entity’s financial future.

Understanding Debit and Credit rules ensures companies comply with the accounting equation and the double-entry principle, which is essential for accurate financial statements and adherence to Saudi e-invoicing system requirements.

However, achieving this balance and accuracy manually can be a challenge. This is where technological solutions shine, offering the Best accounting software in Saudi Arabia.

How Qoyod Completes Your Debit and Credit Journey:

- Error-Free Recording: Qoyod Accounting Software automatically records double entries, ensuring your accounts are free from errors in identifying Debit and Credit.

- Easy Compliance: The system provides e-invoicing and POS systems, making compliance with government regulations simple and accessible.

Dear reader, now that you know what is Debit and Credit: transform this financial art into a tool to achieve your goals.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for Saudi companies.

Join our inspiring community! Subscribe to our page on LinkedIn and X (formerly Twitter) to be the first to see the latest articles and updates in the world of accounting and e-invoicing, and don’t miss the opportunity for learning and development.

Frequently Asked Questions (FAQ) about Debit and Credit

What is the fundamental difference between Debit and Credit?

Answer: Debit is the side that receives or benefits from the value (increases Assets and Expenses). Credit is the side that gives or funds the value (increases Liabilities, Equity, and Revenue).

How do I determine if an account is Debit or Credit?

The account's nature is determined by its rule: Assets and Expenses are naturally Debit (increase with a Debit). Liabilities, Revenue, and Equity are naturally Credit (increase with a Credit).

What are examples of Debit accounts in a company?

Answer: Primarily include Assets (Cash, Bank, Accounts Receivable, Inventory, Equipment) and Expenses (Salaries, Rent, Utility Bills).

Why are Assets debited when they increase?

In the double-entry accounting system established by Luca Pacioli in the 14th century, Assets are debited when they increase because the debit represents the "receiving" side of a transaction. When a company acquires an asset (like purchasing equipment or receiving cash), it "receives" value, which is recorded on the debit (left) side of the account. This fundamental principle ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced.

Can a transaction have multiple debits and credits?

Yes, absolutely! The double-entry system only requires that the total debits equal the total credits in each transaction. Complex transactions often involve multiple accounts. For example, if a Saudi company purchases equipment for SAR 100,000 by paying SAR 40,000 in cash and taking a SAR 60,000 loan, the entry would be: Debit Equipment SAR 100,000 (asset increase), Credit Cash SAR 40,000 (asset decrease), and Credit Loan Payable SAR 60,000 (liability increase). The total debits (SAR 100,000) equal the total credits (SAR 100,000).

What happens if debits don't equal credits?

When debits don't equal credits, this indicates an error in the accounting records. This imbalance means the financial statements will be incorrect and the accounting equation (Assets = Liabilities + Equity) won't balance. Common causes include: typing errors, missing entries, posting to wrong accounts, or mathematical mistakes. Modern accounting software like Qoyod prevents these errors by automatically balancing entries and alerting users to discrepancies.

How does the Saudi e-invoicing system relate to Debit and Credit?

The Saudi e-invoicing system (FATOORA) mandated by ZATCA requires accurate recording of all sales and purchase transactions. Each e-invoice must be properly recorded using debit and credit entries: sales invoices credit Revenue accounts and debit Accounts Receivable or Cash; purchase invoices debit Expense or Asset accounts and credit Accounts Payable or Cash. Compliance with ZATCA regulations requires Saudi businesses to maintain accurate double-entry accounting records, making proper understanding of debit and credit essential for legal compliance.

How does VAT (Value Added Tax) recording work with Debit and Credit in Saudi Arabia?

In Saudi Arabia, VAT (15%) must be properly recorded in all transactions. When making a sale: debit Accounts Receivable/Cash for the total amount, credit Revenue for the base amount, and credit VAT Payable for 15% of the base. When making a purchase: debit Expense/Asset for the base amount, debit VAT Receivable for 15%, and credit Cash/Accounts Payable for the total. Proper VAT accounting is essential for ZATCA compliance and accurate tax reporting.

When does a customer become a Debtor to the company?

A customer becomes a Debtor when they buy goods or a service on account (on credit). In this case, the outstanding amount is recorded in the Accounts Receivable account, which is an asset for the company.

Why do bank statements show credits when money is deposited?

This commonly confuses people because from the bank's perspective, your account is their liability. When you deposit money, the bank owes you that amount, so they credit their liability account (your account). From your company's perspective, however, this same transaction is a debit to your Cash or Bank account (an asset increase). The key is understanding that debit and credit depend on whose perspective you're viewing the transaction from.

What is the T-account and how does it relate to Debit and Credit?

A T-account is a visual representation of an account that looks like the letter "T". The left side of the T represents debits, and the right side represents credits. This visualization helps accountants and business owners track increases and decreases in accounts. For Assets and Expenses, increases go on the left (debit) side; for Liabilities, Equity, and Revenue, increases go on the right (credit) side. T-accounts are fundamental teaching and analysis tools in accounting.

Do all countries use the same Debit and Credit system?

Yes, the double-entry system with debit and credit is a universal accounting standard used worldwide, including in Saudi Arabia. Saudi businesses follow International Financial Reporting Standards (IFRS) as adopted by the Saudi Organization for Chartered and Professional Accountants (SOCPA). This ensures consistency in financial reporting across international borders, making it easier for Saudi companies to attract foreign investment and conduct international business.

How do returns and allowances affect Debit and Credit entries?

Returns and allowances reverse the original transaction. For sales returns: if you originally credited Revenue and debited Cash/Accounts Receivable, the return would debit Sales Returns (contra-revenue account) and credit Cash or Accounts Receivable. For purchase returns: the original entry debited Inventory/Purchases and credited Cash/Accounts Payable; the return reverses this by crediting Inventory/Purchases and debiting Cash or Accounts Payable. These entries ensure accurate financial records.

What are contra accounts in relation to Debit and Credit?

Contra accounts have balances opposite to their associated account type. For example, Accumulated Depreciation is a contra-asset account with a credit balance (opposite of normal asset accounts). Sales Returns and Allowances is a contra-revenue account with a debit balance (opposite of Revenue). These accounts are crucial for Saudi businesses to comply with IFRS standards and accurately report net values in financial statements.

How does Qoyod help me determine Debit and Credit?

Accounting software like Qoyod automatically identifies Debit and Credit and records the double entries for every financial transaction (such as invoices and expenses), ensuring accuracy and balance without manual intervention.