| (Excerpt):

Discover why Year Over Year (YOY) is the gold standard metric for assessing sustainable performance in the Saudi Arabian market. Learn how to apply it, avoiding common seasonal mistakes (like Ramadan’s effect), using local examples from Jeddah and Riyadh. |

To any business owner interested in understanding the value of their company, year over year (YOY), is probably the most important measure. Particularly for business owners and managers dealing with the Saudi Arabia market, understanding YOY is no longer a best practice, it is a necessity. Are your sales growing for real, or are you just riding a lucky moment? The latter question becomes critical in times of changes of regulations such as the ZATCA (Zakat, Tax and Customs Authority) E-Invoicing (FATOORAH) system or in the midst of fierce competition, economically speaking, in cities like Jeddah and Riyadh.

This guide intends to explain, with real examples that SMBs (Small Medium Businesses) in Saudi Arabia can relate to, what Year Over Year growth means, how to calculate it, and provide practical examples. After reading this, you will help your business continue growing by understanding the YOY growth in value and making informed business decisions.

What Does Year Over Year (YOY) Mean?

The Definition and Origin of YOY

Year Over Year (YOY) is a fundamental financial technique used to compare a specific metric for one period with the exact same period from the previous year. This comparison, typically expressed as a percentage, helps gauge the change and growth rate of a business.

The core purpose of the Year Over Year comparison is to neutralize the impact of seasonality. For example, comparing sales in December (a high shopping month) with sales in August (a low shopping month) would be misleading. By comparing December 2025 sales to December 2024 sales, the analyst ensures that seasonal peaks and troughs are factored out, allowing for a clear, apples-to-apples evaluation of sustainable growth. The concept originated in financial reporting to help investors and stakeholders assess consistency and predictability in revenue streams.

How to Calculate Year Over Year Step by Step

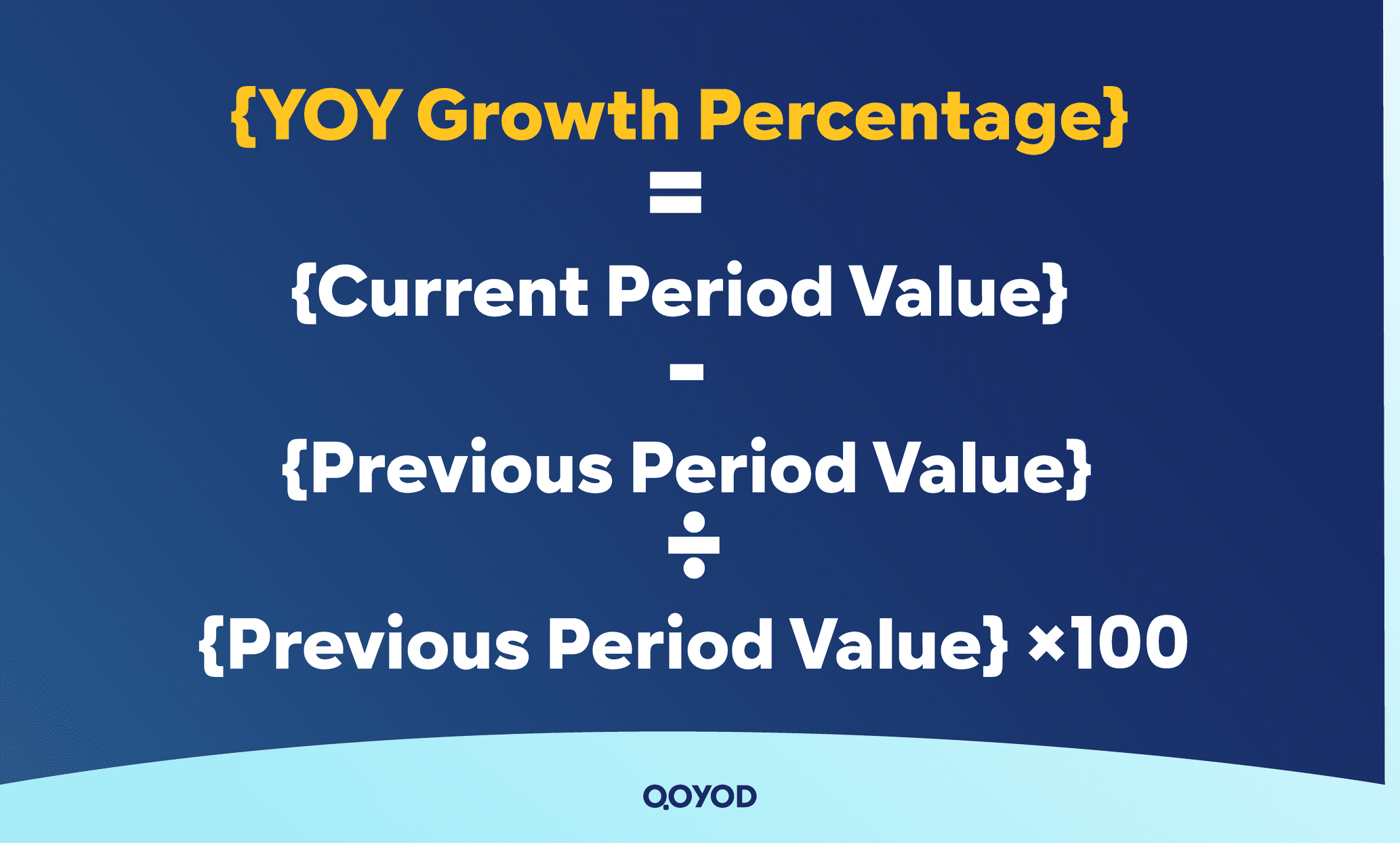

Calculating Year Over Year (YOY) growth is simple. You can use it for any metric: revenue, expenses, profit, or even how many new customers you gained.

{YOY Growth Percentage} = {Current Period Value} -{Previous Period Value} ÷ {Previous Period Value} ×100

Here is the breakdown of the calculation process:

- Identify the Metric You Need: Pick the specific key performance indicator you want to assess (for example, total sales, net income, or website traffic).

- Find the Current Value: Determine the value of that metric in the most recent period, for example, in Q3 2025.

- Find the Value from the Previous Year: Determine that same metric for the same period of the previous year, for example, Q3 2024.

- Execute the Formula: Insert the two values into the YOY formula to calculate the percentage change.

Why Year Over Year Analysis Matters for Saudi Businesses?

For companies situated within the Saudi business ecosystem, which includes the rapid economic changes under Vision 2030, customized regulations, and certain distinct seasonal differences, Year Over Year analysis becomes vital. It is the analysis that brings much-needed clarity to assess if we are making strides within local competitors and regional competition.

Its Role in Saudi Accounting Systems and SME Growth

In the growing SME sector, Saudi legislation and accounting regulations reinforce the use of standard accounting practices and consistency in a firm’s Year Over Year analysis. It is in these two areas that the analysis offers the greatest value.

- Financial Reporting: Saudi law expects certain levels of transparency. Year Over Year analysis and the presentation of a firm’s financial statements to regulators and the Ministry of Commerce, for example, prove he firm’s growth is consistent and passive which advances and demonstrates strategic growth.

- SME Investment: For small and medium businesses in Al-Khobar or Madinah, proving a healthy YOY trend is often the key to unlocking financing. Banks and venture capitalists rely on these figures to determine if the business is worth investing in, as YOY growth is a direct indicator of market acceptance and operational efficiency.

How YOY Helps Assess the Impact of E-Invoicing and VAT Regulations in Saudi Arabia (Riyadh, Jeddah, Dammam)

Major regulatory shifts, such as the introduction of the E-Invoicing (FATOORAH) system by ZATCA, require significant operational investment. YOY analysis allows Saudi businesses to quantify the financial impact of these changes.

For example, a wholesaler based in Dammam can use YOY to compare administrative costs:

- Before E-Invoicing: Administrative salaries and compliance fees in H1 2023.

- After E-Invoicing: Automated processing costs and training expenses in H1 2024.

By comparing these figures Year Over Year, management can determine if the long-term investment in compliance ultimately led to cost savings or operational efficiencies. Similarly, YOY helps track the stability of revenue post-VAT increases, ensuring the business successfully absorbed the tax changes without losing market share. (For more on compliance, see the ZATCA E-Invoicing Portal.)

How to Apply Year Over Year Analysis in Your Saudi Company

Example 1 — Retail Shop in Jeddah: Comparing Muharram 2024 vs. Muharram 2023 Sales

Seasonal tourist traffic and fierce competition are two challenges for a retail clothes store in Jeddah. In late 2023, they started a new marketing effort, and they want to see if it worked. To counteract the precise Gregorian date shift, they compare it to the Islamic calendar month of Muharram.

| Metric | Muharram 1446 (Current Year) | Muharram 1445 (Previous Year) |

| Gross Sales (SAR) | SAR 125,000 | SAR 105,000 |

{YOY Growth} = {125,000 – 105,000} ÷ {105,000} x100 ≈19.05%

A 19.05% YOY increase in sales during the quiet month of Muharram strongly suggests the new marketing strategy is effective, allowing the shop owner to confidently scale the campaign.

Example 2 — Tech Startup in Riyadh: Tracking Annual Customer Growth and Revenue

A FinTech startup operating in Riyadh‘s King Abdullah Financial District (KAFD) needs to demonstrate rapid expansion to attract its Series B funding. They must track two crucial YOY metrics:

| Metric | Q3 2025 (Current) | Q3 2024 (Previous) | YOY Growth |

| Monthly Recurring Revenue (MRR) | SAR 80,000 | SAR 55,000 | 45.45% |

| Total Active Users | 1,200 | 750 | 60.00% |

These outstanding year-over-year percentages demonstrate aggressive, effective scaling. For investors, the YOY comparison offers a useful insight: the higher growth rate of active users (60%) compared to MRR (45.45%) may suggest successful user acquisition but the need to optimize monetization tactics.

Learn More: Qoyod offers the most affordable e-invoice program costs

Tips to Get Accurate YOY Insights for the Saudi Market

Avoiding Common Mistakes (Seasonality, Expansion, Acquisitions)

- Shifting Seasons (Ramadan/Hajj): The most common mistake in Saudi analysis is ignoring the calendar shift of religious holidays. Always use the same number of working days or a rolling 12-month comparison to adjust for the impact of Ramadan or Hajj on retail and travel-related businesses.

- Expansion/Acquisitions: If your company opened a new branch in Taif or acquired a competitor, the resulting revenue surge will artificially inflate the YOY growth. Always perform a YOY calculation for the core business separately from the acquired entity to see true organic growth.

- Inconsistent Metrics: Ensure you are comparing the same accounting figures. Comparing Gross Profit this year to Operating Profit last year is meaningless.

Using Accounting Software Like Qoyod to Simplify YOY Tracking

It takes a lot of time and is prone to error to calculate YOY across several metrics by hand. This procedure is made simpler by contemporary, cloud-based accounting solutions created for the Saudi market:

- Automatic Reporting: With built-in comparison data from the prior year, Qoyod Accounting Software automatically combines all transactions, including bank reconciliation and e-invoices, and produces instant financial reports (profit and loss, balance sheet).

- Compliance Certainty: The YOY results are trustworthy for official reporting since using a solution like Qoyod guarantees that all data complies with local ZATCA and Saudi accounting requirements. Visit the Qoyod Blog to learn more about the significance of local compliance.

Mastered Financial Management at Your Fingertips with Qoyod Software.

Limitations of Year Over Year Analysis

What YOY Doesn’t Show (Changes in Structure or Regulation)

YOY analysis is a historical tool, notwithstanding its strength. Though not usually the reason, it tells you what happened.

- Structural Changes:A disruptive new rival entering the market or a significant government tender that alters the competitive environment are examples of structural changes that YOY won’t instantly reflect. A positive year-over-year trend could conceal underlying market saturation.

- One-Time Events: An excessively high positive year-over-year (YOY) can result from a significant one-time contract or a sizable, one-time insurance payout. In the absence of outside context, this could lead managers to establish unreasonably high goals for the upcoming year.

Alternative Metrics: Month-Over-Month (MoM) and Year-to-Date (YTD)

For a complete picture, YOY should be supplemented with other metrics:

- Month-Over-Month (MoM): Excellent for tracking the immediate impact of a new strategy, such as a flash sale or a social media campaign. MoM is fast but highly susceptible to seasonality.

- Year-to-Date (YTD): Compares performance from the start of the fiscal year to the current date. It is useful for tracking progress against the annual budget but is not a good indicator of growth because the comparison period is always different.

Conclusion

In the cutthroat Saudi market, mastering Year Over Year (YOY) analysis is essential to attaining steady and lucrative growth. It provides the clarity needed to distinguish between seasonal noise, gauge the actual impact of strategic initiatives, and adhere to ZATCA and Ministry of Commerce rules.Saudi SMEs may move past conjecture and make data-driven, well-informed decisions that advance them by using the YOY formula to both financial and operational KPIs and keeping in mind regional considerations like the changing nature of Ramadan and Hajj.

Don’t allow disorganized data and human mistake to impede your business insights.

Try Qoyod Accounting Software today and make your business operations in Saudi Arabia simpler, smarter, and fully compliant.

Frequently Asked Questions (FAQ)

What is the difference between Year-Over-Year (YoY), Month-Over-Month (MoM), and Quarter-Over-Quarter (QoQ) analysis?

Year-over-year (YoY) analysis compares a company's performance during a specific period to the same period in the previous year to remove seasonal effects and reveal real growth trends. Month-over-month (MoM) focuses on short-term changes. Quarter-over-quarter (QoQ) compares the four quarters of the year to track medium-term trends.

Why are annual analyses important for entrepreneurs and small businesses in Saudi Arabia?

Because they provide a true picture of business growth, free from seasonal influences. They help gauge managerial efficiency and support wise decisions regarding purchasing or budgeting.

How can I properly apply annual analysis in my company?

You need to standardize account classifications, use the same revenue recognition basis (accrual/cash), and clearly select key performance indicators (KPIs). Then, compare them accurately between the two periods.

How can cloud accounting software like “Qoyod” simplify annual analysis?

Such software can automatically generate annual comparison reports, unify your data, ensure compliance with the Zakat, Tax, and Customs Authority (ZATCA) regulations, and provide high security and ease of retrieval and analysis.

Are there specific standards to follow in Saudi Arabia for annual analysis?

Yes, you must comply with Saudi accounting standards and the requirements of the Zakat, Tax, and Customs Authority, particularly with the implementation of the e-invoicing system. The annual data must be accurate and officially certified.

How do I interpret negative annual analysis results (performance decline year-over-year)?

You should review the reasons for the decline. This could be due to unjustified increases in expenses, decreased demand because of weak marketing, or seasonal issues. It is advisable to review your business plan and actions taken during the previous year.

Is annual analysis enough to make company expansion or scaling decisions?

Yes, consistently positive results over several years are a primary driver for strategic decisions like expansion or opening new branches. Unstable results require further study and caution before expanding.

What are the most common errors leading to inaccurate annual analysis?

Entering incomplete or inconsistent data, changing account categories without standardizing across years, or using different revenue recognition bases—all these lead to inaccurate results and a misleading view of performance.

Does annual analysis help with Saudi tax and zakat compliance?

Yes, annual analysis is the basis for accuracy in annual filings and facilitates tax processes, providing clear data for auditors and official authorities.

(Source Links)

- General Authority for Statistics in Saudi Arabia (GASTAT)

- Investopedia: https://www.investopedia.com/terms/y/year-over-year.asp

- Wall Street Prep: https://www.wallstreetprep.com/knowledge/year-over-year-yoy/

- Corporate Finance Institute (CFI): https://corporatefinanceinstitute.com/resources/accounting/year-over-year-yoy-analysis/