Expert SummaryReady to launch a thriving accounting career? This guide offers essential tips for new accountants on mastering core principles, professional ethics, and leveraging powerful cloud tools like Qoyod to automate compliance and drive business success globally. |

Are you striving to become an outstanding accountant in a job market that demands extreme accuracy and continuous innovation? Discover crucial tips for new accountants that will transform your start into a path of sustained success. This article covers everything from understanding fundamentals like the accounting cycle and the balance sheet to mastering tools like Excel for data analysis and utilizing cloud software like Qoyod Accounting Software for generating instant reports and efficiently managing e-invoicing.

The modern business world, particularly for small and medium-sized businesses (SMBs), requires accounting to be agile, accurate, and compliant. The challenges of global tax compliance, digital transformation, and the shift towards e-invoicing necessitate a strong foundation combined with cutting-edge technological proficiency. This guide is your resource for meeting these challenges head-on with actionable advice.

Golden Advice for Success in the Fast-Paced Accounting World

Tips for New Accountants

Before diving into the specifics of technology, a successful accounting career rests on a solid foundation of professional skills and ethics. These core tips for new accountants are essential for sustained growth.

1. Define Your Career Path: Accounting vs. Financial Auditing

Before entering the job market, you must decide your primary area of focus. Do you prefer working as an Internal Accountant within a company, or would you prefer the field of Financial Auditing as an External Accountant? This decision will help you focus your development efforts on the appropriate skills, such as mastering IFRS compliance for external roles or advanced financial analysis for internal positions.

2. Acquire Knowledge and Core Skills

Every beginner accountant needs to seize every opportunity to learn more about accounting and develop their skills. Always stay informed about the latest developments in the accounting field and financial technology applications (FinTech). Continuous learning is key to staying relevant.

3. Master Microsoft Excel

Excel is an indispensable tool in financial accounting. You must learn how to use it professionally for tasks like complex calculations, financial modeling, and data manipulation. You can start by attending online training courses or utilizing educational resources on platforms like YouTube.

4. Communication and Collaboration

What does an accountant do from the first day? They connect and collaborate! Maintain constant communication with colleagues and cooperate with them to solve accounting problems, benefiting from their experiences and advice. Effective communication builds strong working relationships.

5. Discipline and Accuracy

As an accountant, you must be disciplined and organized. Create a systematic approach to managing your tasks, and establish daily, weekly, and monthly work plans to ensure timely completion of tasks.

6. Understand Laws and Regulations

Ensure a thorough understanding of all accounting laws and regulations that apply to your work. Maintain constant awareness of changes in these laws to guarantee tax compliance and regulatory adherence. Reference materials published by international bodies like the OECD can be invaluable.

7. Embrace Technology

Utilize financial technology and modern accounting software to simplify and accelerate accounting processes. You should be aware of the latest tools and techniques in the field. This is crucial for automation and efficiency.

8. Strive for Error Avoidance

If you want the best tips for new accountants, avoiding errors is paramount. Maintain a high level of accuracy and avoid mistakes in your work. Regularly review figures and data to ensure their correctness and integrity.

9. Professional Development

Continuously develop yourself professionally by attending the best courses, training, and workshops for accounting graduates. Acquiring recognized professional accounting certifications can significantly enhance your career opportunities and keep you ahead of market demands.

10. Commitment to Professional Ethics

New accountants must adhere to high professional ethics and standards. Be reliable and honest in your practice, and respect the confidentiality of financial information for clients and stakeholders. This builds trust and ensures repeat business.

11. Develop Your English Language Skills

Developing English is a crucial step. It is the fundamental language for international accounting terms and communication. Enroll in language courses or use online resources to improve your ability to communicate effectively in English.

12. Read Financial Accounting Texts

If you are wondering how to start learning accounting, begin by reading financial accounting books. Start with introductory texts, then move on to more specialized and in-depth resources in the field.

13. Build Self-Confidence

New accountants must build confidence in themselves and their professional abilities. Be confident in your capacity to provide financial services professionally and accurately.

14. Systematic Document Organization

It is vital for new accountants to be organized in arranging financial documents. Establish a methodical system for document organization, which will facilitate quick access to information when needed, enhancing overall efficiency.

15. Correct Accounting Guidance

New accountants must learn how to guide companies and individuals regarding accounting laws and regulations. They should be able to provide sound and professional financial advice to their clients.

16. Regular Figure Comparison

This is one of the most important tips for new accountants. You must be cautious and precise in regularly comparing financial figures and data. Verify the accuracy of the numbers and ensure they match other financial statements to guarantee there are no errors in the final reports.

How Beginner Accountants Benefit from Cloud Accounting Software

Cloud-based accounting software has become an essential tool for modern accountants, allowing access to financial data from anywhere at any time. This makes the account management process much easier and more effective, especially for SMBs looking for automation and compliance.

Among the leading solutions is Qoyod Accounting Software, a top choice in its field. New accountants should learn how to use Qoyod effectively and not overlook the following steps:

Leveraging Qoyod for Success

1. Enroll in Training Courses

Every beginner accountant should seek out training courses or online educational resources to increase knowledge and develop skills in using this powerful software.

2. Maximize Software Features

New accountants must take advantage of cloud software features, such as automatic updates, secure data storage, and compliance features like integrated e-invoicing functionality. Use the software to generate financial reports faster and more accurately.

3. Maintain Security and Privacy

Accountants must be vigilant regarding data security and privacy when using the software, utilizing strong passwords and multi-factor authentication.

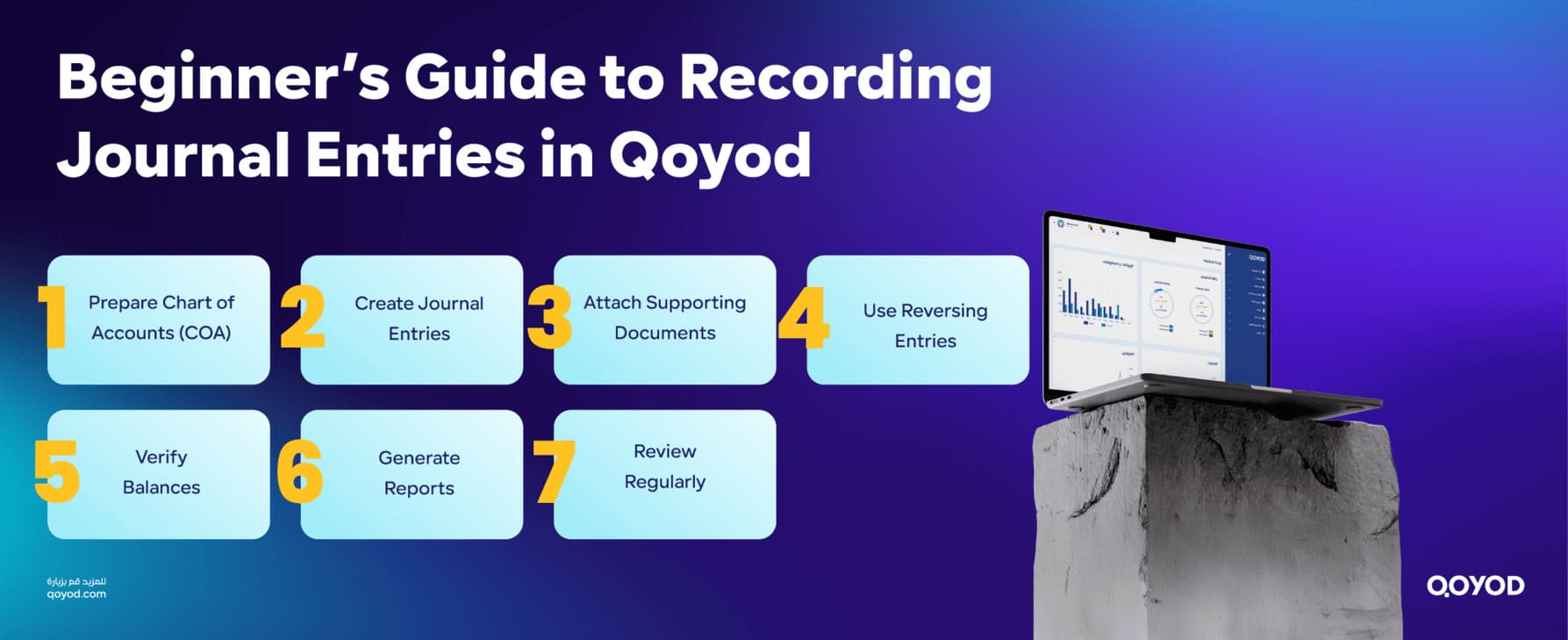

4. Prepare the Chart of Accounts (COA)

You must prepare a list of all your company’s financial accounts. This includes asset accounts, liabilities, equity, as well as revenue and expense accounts.

Read More: Chart of accounts: what is it and how do I set it up?

5. Record Accounting Entries (Journal Vouchers)

After preparing the COA, you can begin creating accounting entries. You must identify the debit and credit accounts involved in each financial transaction and determine the amount to be recorded in each. Qoyod Accounting Software helps verify the balance of journal entries, ensuring data accuracy.

6. Generate Financial Reports

After recording the entries, you can use Qoyod to generate the required financial reports. These reports can include the Income Statement, the Balance Sheet, and other reports that help monitor your company’s financial performance.

7. Verification and Review

It is crucial to periodically verify and review the accounting entries and financial reports created using the software. This ensures data accuracy and that the reports precisely reflect the company’s financial operations.

FAQ: Essential Questions for New Accountants

What is the importance of Tips for New Accountants?

They provide the foundations for success, such as accuracy and organization, helping to overcome initial challenges and build strong professional confidence in the precise world of accounting.

How does a new accountant define their primary work field?

They decide whether they prefer Internal Accounting within a company or External Auditing, to focus on developing the appropriate skills like compliance or internal analysis.

Why is Excel considered an essential tool?

Excel is used for data analysis, report preparation, and complex calculations. Mastery can be achieved quickly through focused online courses or YouTube tutorials.

How does effective communication enhance a beginner's success?

It builds relationships with colleagues for sharing knowledge, solving common problems, and learning from their experiences right from the first day.

What is the role of discipline and accuracy?

It ensures tasks are completed on time by setting daily and weekly plans, combined with regular figure review to prevent costly errors.

How does a new accountant stay updated on laws?

They follow changes in regulations and international standards like IFRS to ensure compliance and accuracy in financial recording and reporting.

What is the benefit of cloud software like Qoyod?

It accelerates the recording process, report generation, and remote access, offering essential security features and automatic updates for beginners.

Why is a commitment to professional ethics stressed?

It builds trust with clients through honesty, confidentiality, and integrity, ensuring repeat business and long-term professional excellence.

How does a new accountant develop English skills?

By participating in online courses or using apps, as English is the fundamental language for international accounting terms and global communication.

What are the steps to benefit from Qoyod?

Enroll in training, set up the Chart of Accounts (COA), create journal entries, generate reports, and conduct periodic review for efficiency and accuracy.

Conclusion: Achieving Sustainable Success

Success in the accounting field requires significant effort and dedication. It is not solely about numbers and financial reports but also demands soft skills, strong ethics, and the ability to embrace technological change. By following these tips for new accountants, you are building a bright professional future. When you are able to adopt these tips and turn them into daily habits, you will have the opportunity to develop and grow in this field, become an influential force, and achieve sustainable success.

No matter your professional goals, you will find that Qoyod helps you build a bright future and achieve sustainable success efficiently. The software offers integrated features, including e-invoicing systems, POS systems, inventory management, and CRM.

Starting today, remember that you have the power to achieve accounting success and reach the highest levels in this profession,especially when you utilize accounting software that saves you time and effort.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses. Start your 14-day free trial today!