| Excerpt

Saudi SMBs must comply with a triple tax system,VAT (15%), Zakat (2.5%), and Income Tax (20% for foreign entities) to avoid penalties and ensure legal operation. Leveraging specialized solutions like Qoyod Accounting Software is crucial for automating calculations, generating accurate returns, and maintaining ZATCA compliance in the evolving digital environment. |

In the Kingdom of Saudi Arabia, understanding and complying with tax regulations is a fundamental requirement for small and medium-sized businesses (SMBs) to operate legally and efficiently. Tax Accounting for Small Businesses in Saudi Arabia involves navigating several key types of tax: Income Tax, Value Added Tax (VAT), and Zakat, each with its own calculation mechanisms and submission requirements.

This guide aims to clarify these key tax types, explain how to calculate them, and detail the mandatory compliance for Saudi businesses with the Zakat, Tax and Customs Authority (ZATCA). This robust understanding empowers businesses in key cities like Riyadh, Jeddah, and Dammam to better manage their financial resources, avoid legal penalties, and ensure growth within the Kingdom’s organized and evolving commercial environment, especially with the mandatory e-invoicing system in Saudi Arabia.

Key Types of Taxes on Small Businesses in Saudi Arabia

Small businesses in Saudi Arabia are subject to a clear and defined tax system that includes three main types: Income Tax, Value Added Tax (VAT), and Zakat. The specific rules for each tax depend on the company’s activity and the nationality of its owners.

Income Tax (20%)

- Applicability: Income Tax is imposed at a rate of 20% on the net income of foreign companies or companies owned by non-Saudis or non-GCC citizens.

- Exemption: It does not apply to companies wholly owned by Saudis or citizens of GCC countries, as these entities are subject to Zakat only.

- Special Cases: A progressive tax rate, up to 85%, is applied to companies operating in natural resources like oil and hydrocarbons, depending on the activity and investment size.

- Non-Residents: Non-resident companies conducting business through a permanent establishment within the Kingdom are also subject to tax on their local income.

Value Added Tax (VAT – 15%)

- Definition: VAT is an indirect tax imposed at a rate of 15% on most goods and services sold or purchased within the Kingdom.

- Mechanism: It is paid by the final consumer at the point of purchase. The company is responsible for collecting the tax from its customers (Output VAT) and remitting it to ZATCA periodically.

- Supply Chain: VAT applies at all stages of the supply chain, from production to the sale of the service or commodity, with the possibility of recovering Input VAT paid by the company to its suppliers.

- Settlements: Settlements are made by submitting monthly or quarterly returns to the Zakat, Tax and Customs Authority.

Zakat (2.5%)

- Definition: Zakat is a Sharia-mandated and obligatory religious levy on Saudi and GCC-owned companies. It is calculated at a rate of 2.5% of the company’s capital and commercial activity, based on the Saudi Zakat system.

- Filing: An annual return must be submitted to ZATCA, linked to the company’s net assets and actual annual activity.

- Exclusion: Non-Saudis and companies with foreign partners are excluded from Zakat and are instead subject to Income Tax on the foreign partner’s share.

Note: Small businesses in major hubs like Khobar and Madinah must comply with all three types through tax registration, preparing returns, and accurately documenting all accounting operations to ensure adherence to local laws and regulations.

Registration Rules for Small Businesses in the Saudi Tax System

Registering small businesses in the Saudi tax system and fulfilling the requirements of ZATCA involves several rules and procedures to ensure compliance with local tax regulations.

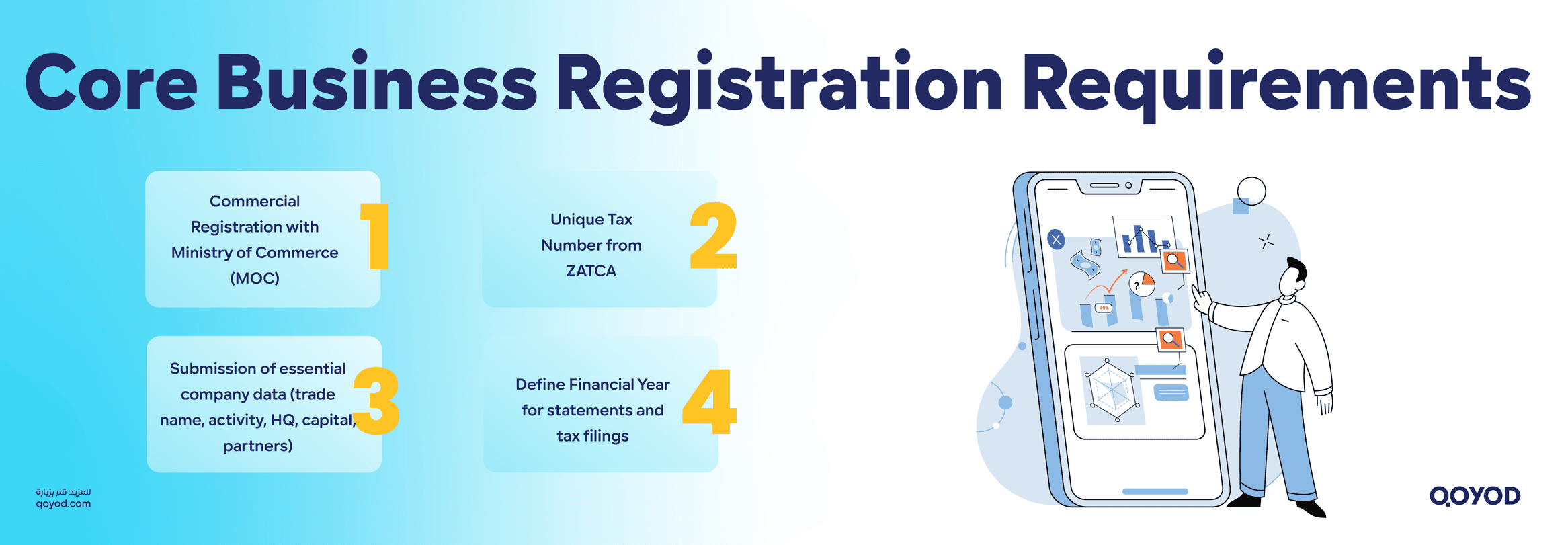

Core Business Registration Requirements

- Commercial Registration: Upon establishment, the company must be registered with the Ministry of Commerce (MOC) according to the Saudi Companies Law, defining its legal form (e.g., Limited Liability Company, Joint Stock Company).

- Unique Tax Number: ZATCA grants a unique identifier to each establishment upon registration, which is essential for utilizing the Authority’s services and submitting electronic tax returns.

- Data Submission: Companies must register all essential data, such as trade name, economic activity, company headquarters (e.g., Riyadh or Jeddah office), capital, and partner details.

- Financial Year: The company must define the financial year used for preparing financial statements and tax filings, as specified in the Articles of Association.

ZATCA Registration Requirements (VAT)

- Mandatory Registration: Businesses whose annual taxable supplies reach or exceed SAR 375,000 are mandatorily required to register for VAT.

- Voluntary Registration: Companies with annual revenues between SAR 187,500 and SAR 375,000 can opt for voluntary VAT registration.

- Online Application: The registration application must be submitted electronically via the ZATCA portal, using the unique tax number and Commercial Registration number, including accurate data such as anticipated annual revenues, purchases, and main expenses.

- Compliance Personnel: Companies must appoint a designated person to handle tax matters with ZATCA and maintain accurate invoicing and records to facilitate audits.

- Filing Deadlines: Tax returns must be filed on time (monthly or quarterly, depending on the company size). All financial and accounting transactions must be accurately recorded within a certified accounting system.

Essential Tips for Small Businesses

- Early Registration: Registering early is advised to avoid late penalties, which can be up to SAR 10,000 or more, depending on the violation.

- Accounting Software: Using specialized accounting software and digitizing records (e.g., in a city like Dammam) helps ensure data accuracy and good tax compliance.

- Expert Consultation: Employing or consulting Saudi tax and VAT specialists helps in fully understanding tax obligations and rights.

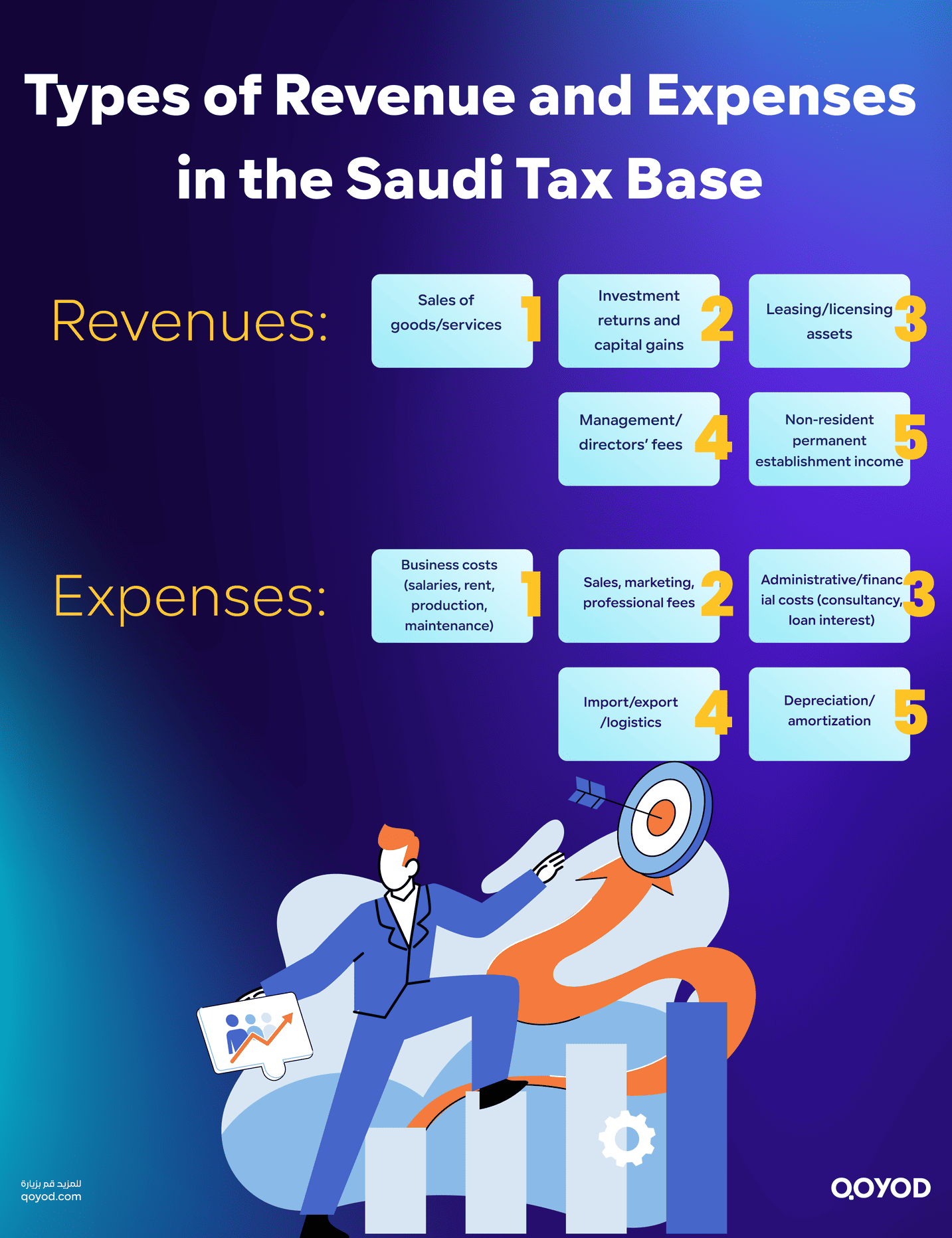

Types of Revenue and Expenses in the Saudi Tax Base

The Tax Base is the foundation upon which taxes are calculated. It includes the total taxable revenues after deducting legally allowable expenses. In Saudi Arabia, tax regulations and the Executive Regulations define the following:

Revenues (Taxable Income)

- Revenues generated from various economic activities, such as sales and supplies of goods and services within the Kingdom.

- Investment returns and capital gains, including profits from selling assets or shares owned by the company.

- Amounts earned from exploiting non-movable and movable properties, such as leasing or licensing intellectual property within Saudi Arabia.

- Funds obtained from providing management or guidance services or directors’ fees received by the company.

- Income from the permanent establishment of non-resident companies operating in the Saudi market, whether from selling goods or providing services.

Expenses (Deductible from Income)

- Ordinary and necessary expenses for generating income, such as salaries, rents, production costs, and maintenance, provided they are supported by proper documentation and related to the company’s activity.

- Expenses related to sales, marketing, distribution costs, and professional service fees.

- Certain administrative and financial expenses, such as consultancy fees or interest paid on loans related to the economic activity.

- Import, export, and logistical costs related to commercial activity.

- Depreciation and amortization costs on fixed assets used in the economic activity.

- Exclusions: Expenses not linked to generating income, entertainment expenses, fines, bribes, and paid taxes are generally not allowable as deductions.

Summary: The Tax Base is calculated by subtracting allowable expenses from the total taxable revenues. This figure is then used to calculate the imposed tax according to the specific rates defined in the system. ZATCA carefully audits all revenues and expenses to ensure the accuracy of tax calculations and strict adherence to laws.

Calculating 15% VAT on Sales and Purchases: A Practical Guide

Value Added Tax (VAT) is an indirect tax imposed at 15% on most goods and services in the Kingdom of Saudi Arabia. Companies collect the tax (Output VAT) and remit it to ZATCA.

1. Calculating VAT on Sales (Output VAT)

If the Price is Excluding VAT:

- Convert the VAT percentage (15%) to a decimal: 0.15.

- Multiply the price of the good or service by 0.15 to get the VAT amount.

- Add the VAT amount to the basic price to get the total price.

| Example: Item Price: SAR 1,000 | Calculation | Result |

| VAT Amount | 1,000* 0.15 | SAR 150 |

| Total Price | 1,000 + 150 | SAR 1,150 |

If the Price is Including VAT:

- To extract the VAT from the total price:

- Basic Price = Total Price ÷ 1.15

- VAT Amount = Total Price − Basic Price

calculate VAT by Qoyod TRY NOW

| Example: Total Price: SAR 1,150 | Calculation | Result |

| Basic Price | 1,150 \ 1.15 | SAR 1,000 |

| VAT Amount | 1,150 – 1,000 | SAR 150 |

2. Calculating VAT on Purchases (Input VAT)

- Businesses can recover Input VAT (the tax paid on purchases and services) paid to their suppliers.

- Net VAT Due is calculated by subtracting Input VAT from Output VAT. This net amount is what the company must pay to ZATCA.

3. Organizing Periodic VAT Settlements

Companies submit periodic tax returns (monthly or quarterly based on turnover) that include:

- Total value of taxable sales and Output VAT.

- Total value of taxable purchases and Input VAT.

- Calculation of the Net Tax Due or Refundable (the difference between Output VAT and Input VAT).

Important: Using automated and accurate accounting systems is critical for proper reporting and ensuring timely submission without errors, especially for businesses in areas like Khobar.

Best Tools: Qoyod Accounting Software for Tax Compliance

Qoyod Accounting Software is one of the modern tools specialized in supporting small and medium-sized businesses in the Kingdom of Saudi Arabia. It is designed to simplify and enhance accounting and tax operations in compliance with ZATCA requirements, including the mandatory e-invoicing system in Saudi Arabia.

Advantages of Qoyod Software in Tax Accounting

- Accurate Accounting Registration: Qoyod allows for precise and organized recording of all financial movements. It automatically posts accounting entries for sales, purchases, and tax expenses, reducing manual errors in tax calculation.

- Automated VAT Calculation: The software automatically calculates VAT based on registered transactions, determining the tax on both purchases and sales, which helps in accurately identifying Input and Output VAT.

- Automated Tax Return Generation: Qoyod offers the feature to prepare and generate tax returns automatically. It aggregates tax-related financial data directly from daily entries, assisting the user in submitting them through the ZATCA electronic system.

- Compliance with ZATCA Requirements: The program is compliant with ZATCA standards and provides regular updates to ensure that tax reports and calculation methods adhere to the latest Saudi regulations.

- Ease of Use & Comprehensive Reports: It features an intuitive user interface, enabling accountants and business owners (e.g., in Madinah) to access detailed reports on taxes, invoices, and financial movements, facilitating financial management.

Conclusion: Qoyod Accounting Software is an integrated solution that makes it easier for small businesses in Saudi Arabia to calculate and organize taxes accurately. It simplifies the process of submitting tax returns automatically while adhering to local laws.

Common Errors in Tax Accounting for Small Businesses

Avoiding common errors is key to successful tax compliance and using the Best accounting software in Saudi Arabia is a major step.

| Common Error | Explanation and Impact | Tips for Avoidance |

| Not Updating VAT Rate | Using an outdated tax rate leads to incorrect calculation and financial penalties. | Always ensure your accounting or invoicing software (like Qoyod) uses the current 15% rate. |

| Lack of Detail on Invoice | Weak transparency and difficulty in auditing by ZATCA, potentially leading to invoice rejection. | Use e-invoices that clearly show the tax amount and whether the price is inclusive or exclusive of VAT. |

| Late Filing of Tax Returns | Financial penalties up to 25% of the due tax, incurring additional costs for the company. | Schedule filing dates and activate automated reminders for timely compliance. |

| Incorrect VAT Calculation for Inclusive Prices | Leads to an under- or over-calculated tax, potentially resulting in rejection of the return or invoice. | Use tax calculators or software that support the automated calculation of both inclusive and exclusive VAT. |

| Not Recording Input VAT on Imports | Loss of the right to recover or deduct the paid tax, affecting cash flow. | Record all invoices and regularly review Input VAT deduction using accounting programs. |

| Reliance on Manual Calculation | Increases the error rate and likelihood of non-compliance due to tax complexities. | Use ZATCA-compliant accounting systems like Qoyod Accounting Software. |

FAQ on Small Business Tax in Saudi Arabia

What are the tax types required for small businesses in Saudi Arabia?

Small businesses in Saudi Arabia are mainly subject to three types: Income Tax (20% for foreign/non-Saudi shares), Value Added Tax (VAT) (15% on goods and services), and Zakat (2.5% for Saudi and GCC companies).

When is a small business required to register for VAT?

Any taxable person whose annual value of taxable supplies exceeds SAR 375,000 is mandatory to register with ZATCA for VAT purposes. Businesses with annual supplies between SAR 187,500 and SAR 375,000 are eligible for voluntary registration.

Are small businesses required to submit tax returns electronically?

Yes, all companies must submit their tax returns electronically via the ZATCA portal by the specified deadlines. Returns are usually quarterly for small and medium-sized businesses.

Do all small businesses pay Income Tax?

No, Saudi or GCC-owned companies pay Zakat only. Companies with foreign shares are subject to Income Tax at 20% only on the foreign share, while the Saudi share pays Zakat.

What are the penalties for non-registration or late filing?

ZATCA imposes financial penalties for late registration, late submission of returns, or late payment of the due tax. The fine amount varies depending on the violation type and severity.

AT SUM UP

In conclusion, mastering Tax Accounting for Small Businesses in Saudi Arabia is an essential step towards successful financial and legal compliance. Understanding the different tax types Income Tax, VAT, and Zakat and adhering strictly to the registration rules and tax requirements help businesses avoid legal risks and financial penalties.

Furthermore, relying on modern accounting software plays a significant role in facilitating accurate tax calculation and automated submission of returns, which enhances the efficiency of financial operations and improves transparency and reliability. Awareness of common mistakes and implementing prevention tips ensures business stability and continuity in a competitive and evolving economic environment.

Therefore, knowledge of the tax systems and commitment to compliance, combined with the use of advanced digital solutions, form a crucial pillar for any small company aspiring to growth and success in the Saudi market.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for Saudi companies.