Have you ever questioned, as a business owner or CEO in the Kingdom of Saudi Arabia, “Is the money I invested yielding the required return?” This fundamental question lies at the heart of the ROI (Return on Investment) concept. Amidst the rapid economic development and clear accounting regulations in Saudi Arabia, measuring ROI has become a crucial tool for Small and Medium-sized Enterprises (SMEs) aiming for growth and compliance with the Zakat Authority’s requirements. Understanding how to analyze this metric is not a luxury; it is the first line of defense to ensure the survival and profitability of your venture in the Saudi market. In this comprehensive article, we will guide you step-by-step to learn how to calculate, understand, and most importantly, how to boost your ROI using practical solutions tailored specifically for your local business context.

What Is ROI and Why is it the Golden Metric for Saudi Businesses?

What is ROI? Simply put: Did your money come back with profit?

ROI (Return on Investment) is your essential metric for determining whether your investment is a “success” or a “failure.” It answers the question: How much profit did I make for every Saudi Riyal I spent? For businesses in Saudi Arabia, ROI is the most crucial number because the government (like ZATCA) demands high accuracy in your financial reports. Knowing your ROI helps you make the right decision, whether you are based in Riyadh, Jeddah, or Dammam.

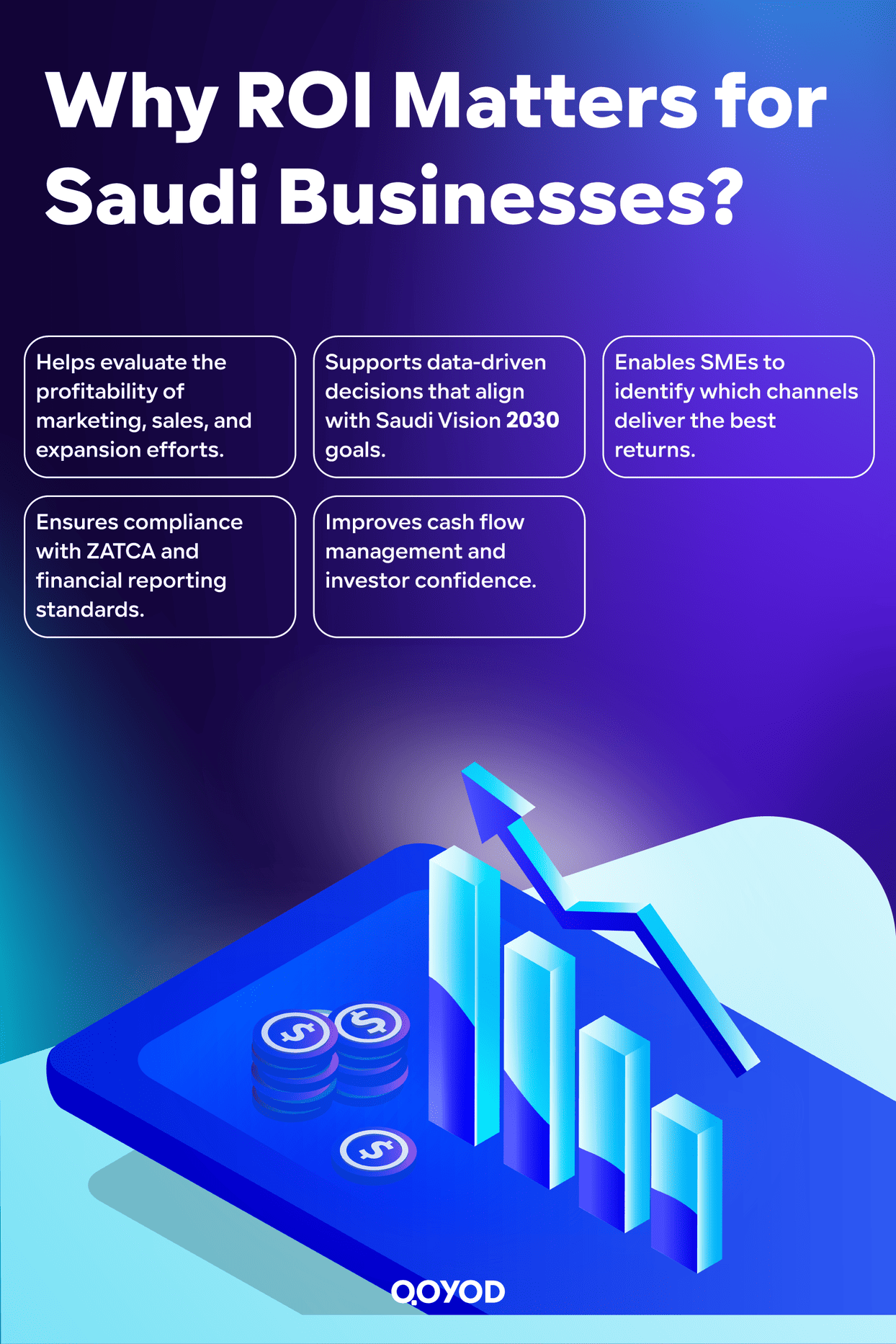

Why is ROI Critical for You as a Saudi Entrepreneur?

- Where Does Your Money Go? It shows you where to inject more funds and where to stop the losses.

- Investor Trust: It is the language of banks and investors. If your project’s ROI is high, you will secure funding easily.

- Compliance: It helps you submit transparent and accurate reports to the Zakat, Tax and Customs Authority.

The ROI Formula Explained

ROI (Return on Investment) measures how much profit your business earns compared to the cost of your investment. It’s a simple yet powerful way to know whether your money is generating real value.

The basic formula is:

ROI = (Net Profit − Investment Cost) ÷ Investment Cost × 100

This percentage tells you how efficiently your resources are being used.

- A positive ROI means your investment is profitable.

- A negative ROI means you’re losing money and need to reassess your strategy.

For example, if a Jeddah-based e-commerce store spends SAR 15,000 on influencer marketing and earns SAR 28,000 in return, the ROI would be:

(28,000 − 15,000) ÷ 15,000 × 100 = 86.7%

That means the business gained SAR 0.87 profit for every riyal invested, showing strong campaign performance.

Why ROI Matters for Saudi Businesses

In a dynamic and competitive market like the Kingdom of Saudi Arabia, relying solely on high sales numbers isn’t enough. Many businesses, especially startups and established Small and Medium Enterprises (SMEs), can be cash-rich yet unprofitable. The ROI metric cuts through the noise of gross revenue and shows the actual value being generated. This is critical for survival and growth under Saudi Vision 2030, which emphasizes efficiency and economic diversification. For any business operating in cities from Riyadh to Jeddah, understanding your ROI is the difference between sustainable scaling and eventual collapse.

Real-World ROI Example from a Saudi Business

To truly grasp the power of ROI, we need to step away from textbooks and look at a real Saudi business. ROI is like a scoreboard for your investments. It helps you quickly compare different paths for your money, proving that sometimes, the smaller investment actually wins big. This is vital for local businesses trying to navigate the fast-moving markets, especially online retail across the Kingdom.

Case Study: Riyadh-Based E-Commerce Store

Let’s look at “TechFlow,” a company in Riyadh that sells smart devices online. They had 2 options for growth in 2024:

| Investment Option | Money Spent (Cost of Investment) | Net Profit Earned (Over 1 Year) |

| Option A: Setting up a small physical shop (Jeddah) | 250,000 SAR (Rent, Staff, Setup) | 350,000 SAR |

| Option B: Running online ads (Targeting Riyadh/Dammam) | 100,000 SAR (Ads, Videos) | 280,000 SAR |

Calculating the ROI (The Score):

- ROI for Option A – Physical Shop:

The total revenue was SAR 350,000, and the investment cost was SAR 250,000.

Net gain = 350,000 − 250,000 = SAR 100,000.

ROI = (100,000 ÷ 250,000) × 100 = 40%.

This means that every riyal spent generated 40 halalas in profit.

- ROI for Option B – Online Ads:

The total revenue was SAR 280,000, while the investment cost was SAR 100,000.

Net gain = 280,000 − 100,000 = SAR 180,000.

ROI = (180,000 ÷ 100,000) × 100 = 180%.

This means that every riyal spent generated 1.80 SAR in profit, showing a much higher return than the physical shop option.

The Decision: Even though the physical shop generated higher total revenue, the online ads were clearly the smarter investment. The online campaign achieved an ROI of 180%, compared to only 40% for the physical shop. This means the online ads delivered far better returns for every riyal spent.

LEARN MORE: 10 Cloud accounting programs benefits

Key Lessons from Local Market Performance

What should Saudi entrepreneurs learn from this?

- Focus on Efficiency: A smaller budget (like for digital ads) can bring a much better return than a massive budget (like a physical shop).

- Speed is Power: Digital campaigns start giving you high ROI faster. This quick return means you can take that profit and reinvest it immediately, boosting your growth speed.

- Easy Expansion: It’s much simpler and cheaper to expand a successful online ad campaign across the Kingdom (to Al Khobar or Madinah) than to build new physical shops in every city.

- Data Wins: ROI helps you avoid decisions based on gut feeling and stick to facts, which is crucial in the competitive Saudi economy.

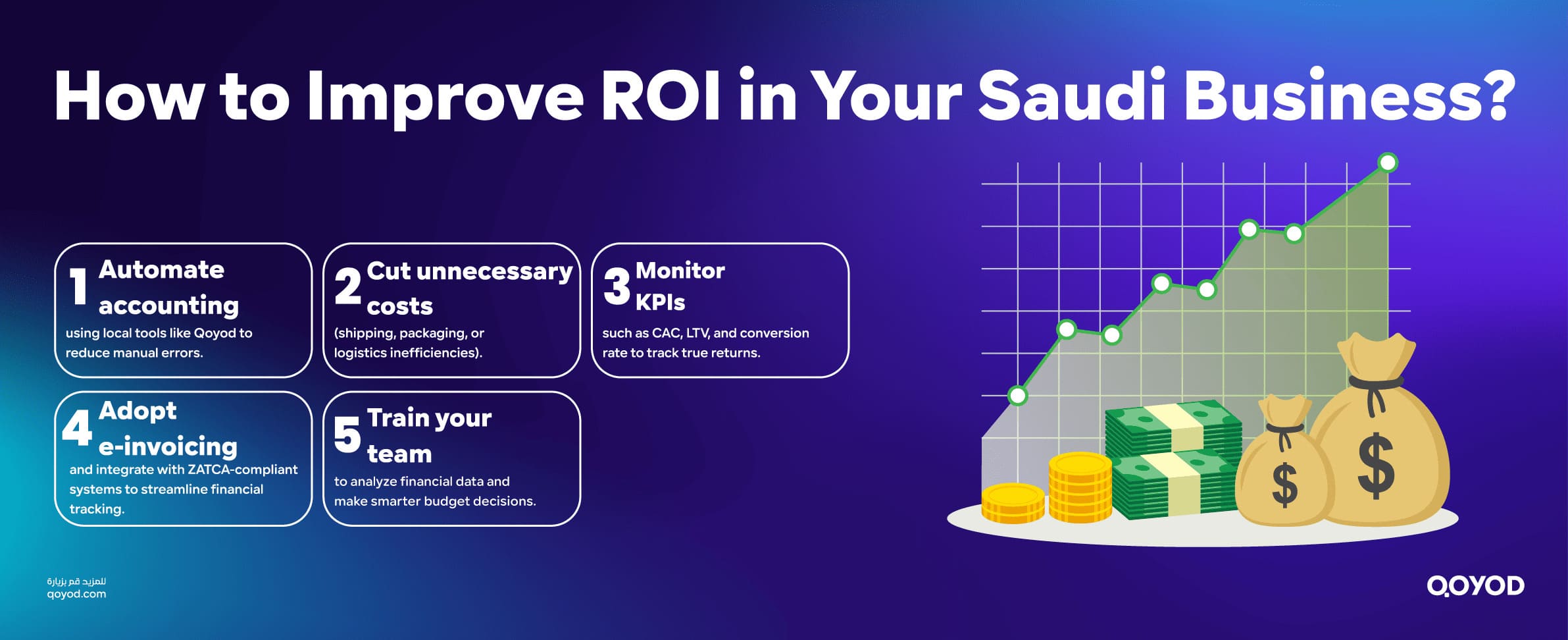

How to Improve ROI in Your Saudi Business

Boosting ROI means earning more profit from every riyal you spend. For Saudi companies, especially SMEs, improving ROI starts with cutting costs, embracing technology, and tracking performance efficiently.

Reduce Unnecessary Costs

Lowering expenses directly increases ROI.

- Negotiate Locally: Get better supplier deals in Riyadh or Jeddah.

- Optimize Logistics: Choose faster, cheaper shipping partners in Dammam or Khobar.

- Stay ZATCA-Compliant: Avoid penalties and maximize tax efficiency with accurate accounting.

Invest in Digital Transformation

Automation improves accuracy and saves time.

- Use CRM Tools: Automate client follow-ups to close more deals.

- Adopt E-Invoicing: Ensure compliance and faster revenue reporting.

- Manage Inventory Smartly: Prevent overstocking or shortages that hurt ROI.

Track ROI Using Cloud Tools Like Qoyod

Cloud accounting helps monitor performance anytime, anywhere.

- Real-Time Reports: Instantly see profit and cost data.

- Project-Based Tracking: Compare ROI across campaigns or branches.

- Remote Access: Manage finances from Riyadh, Jeddah, or Madinah with ease.

Smart solutions trusted by over 15K businesses.

Common Mistakes When Calculating ROI

Even though ROI (Return on Investment) looks simple, many Saudi businesses calculate it incorrectly. A small mistake can lead to bad financial decisions, such as continuing a project that loses money or stopping one that actually works. Avoiding these common errors helps you make smarter, more accurate business choices.

Ignoring Hidden Costs

Many companies only count the main cost of an investment and forget about the smaller, hidden ones. These extra costs can make your real ROI lower than it seems.

What to include: setup fees, employee training, equipment maintenance, higher electricity bills, or even customs fees.

Example: A factory in Jubail buying new machinery should include import fees, permits, and installation costs. Ignoring these makes the ROI look better than it really is — and that can be dangerous for planning.

Misjudging the Time Frame

ROI changes over time. If you measure it too early or compare different types of projects, your results will be misleading.

Example: A small coffee shop in Jeddah that launches a delivery service might see low ROI in the first month. But after six months, when customers learn about the service, ROI could rise sharply.

Real Estate Case: A property in Riyadh may take years to show its true ROI. Measuring it after just one year will not show the real long-term value. Always choose the right time frame before calculating ROI.

ROI and Saudi Regulations You Should Know

Saudi Arabia has clear financial rules that directly affect ROI calculations. Understanding them helps ensure your numbers are accurate and compliant.

The Role of ZATCA and Tax Compliance

The Zakat, Tax and Customs Authority (ZATCA) manages financial reporting and compliance. Accurate records are not optional , they’re required by law.

- Zakat and VAT: These should not be included as costs in your ROI formula. ROI should reflect how profitable your business is before taxes.

- Keep Good Records: When you claim that an investment increased profits, you must have invoices and reports to prove it if ZATCA audits your company.

Impact of E-Invoicing on ROI Accuracy

The Saudi E-Invoicing (Fatoorah) System makes financial tracking faster and more reliable.

- Real-Time Data: Every sale is recorded instantly, giving you accurate and up-to-date numbers for ROI calculation.

- Less Risk: Using a ZATCA-approved e-invoicing system helps you avoid penalties which are unexpected costs that lower your ROI.

- Consistency: Whether your company operates in Al Khobar, Riyadh, or Tabuk, e-invoicing ensures all data is consistent across branches.

Ready for the 2nd phase of E-invoicing?Use Qoyod to generate and send invoices.

Tools and Software to Measure ROI Effectively

Manual tracking of ROI using spreadsheets is slow, prone to errors, and simply outdated for the modern Saudi market. The best strategy for high-growth businesses is leveraging specialized software. These tools integrate your revenue and cost data automatically, giving you the real-time visibility needed to make fast, profitable decisions.

How Qoyod Simplifies ROI Tracking for Saudi Companies

Using an accounting system tailored for the Saudi environment is a powerful way to boost your financial clarity. Qoyod Accounting Software is designed to address local needs while simplifying complex calculations:

- Accurate Cost Segregation: Qoyod lets you easily categorize and track expenses for specific projects or branches (e.g., separating the cost of a marketing campaign in Riyadh from operational expenses in Jeddah). This means your Cost of Investment is always precise.

- Real-Time Profitability: Because all sales and expenses are logged instantly, you get an immediate “Net Profit” figure. Qoyod allows you to see the ROI of any segment without waiting for month-end reconciliation.

- Compliance Certainty: By automating compliance with ZATCA rules, Qoyod prevents penalties (a hidden cost) and ensures that your reported profits are legally sound.

Integrations with POS, E-Invoicing, and Sales Data

The true power of modern software lies in integration. A standalone system is not enough; it needs to talk to all your sales channels.

- Seamless E-Invoicing: Qoyod is built to fully comply with the Saudi E-invoicing System. This means every sale is tracked correctly, guaranteeing your revenue data (the ‘Profit Generated’ part of the ROI formula) is 100\% accurate and instantly updated.

- POS Integration: Linking your Point-of-Sale (POS) system (used in your stores in Dammam or Al Khobar) directly to Qoyod ensures that retail sales data flows immediately into your accounting records. This real-time sales insight is vital for quickly calculating the ROI of your physical locations.

- Consolidated Reporting: By pulling data from all sources (online stores, physical shops, expense accounts), Qoyod provides a single, consolidated dashboard. This makes comparing the ROI of your entire business portfolio easy.

Frequently Asked Questions (FAQ)

What is a "Good ROI" in the Saudi Market?

It depends on the risk. Low-risk investments (like government funds) might yield 5-8% ROI. High-growth tech or startup ventures in Riyadh need ROI of 30% or more to justify the higher risk. A good rule of thumb is that your ROI must be significantly higher than the cost you pay to borrow money.

Does VAT/Zakat Affect ROI Calculation in Saudi Arabia?

No, not directly. VAT and Zakat are regulatory obligations calculated post-profit. ROI focuses on operational profitability the efficiency of the investment itself before these taxes are deducted. Your accounting must keep these regulatory elements separate from operational costs.

What is the biggest mistake Saudi SMEs make with ROI?

The biggest mistake is ignoring hidden costs. They calculate ROI based only on the initial purchase price, forgetting about setup fees, ongoing maintenance, training costs, and potential ZATCA penalties.

Conclusion

Mastering ROI is not just about doing math; it’s about building a financially smart, compliant, and growth-focused business in Saudi Arabia. The ROI metric provides the necessary clarity to move past assumptions and base every decision from opening a new branch in Madinah to investing in digital marketing on verifiable profitability. By avoiding common calculation mistakes and leveraging modern tools like Qoyod Accounting Software, you ensure your business is on the fastest track to success.

Ready to see your real ROI and simplify your financial management?

Try Qoyod Accounting Software now and make your work easier and more accurate with solutions designed for Saudi businesses.