Financial budgeting is the essential cornerstone of success for small and medium-sized enterprises (SMEs) operating in today’s complex global economy. Without a rigorous, forward-looking financial plan, businesses often struggle with unpredictable cash flow, inefficient resource allocation, and a lack of preparedness for market volatility. Many SME owners worldwide ask: How can we move beyond simple record-keeping to proactive financial management that drives sustainable growth and ensures tax compliance across different jurisdictions?

The solution lies in adopting a disciplined approach to planning and leverage modern technology. This comprehensive guide will dissect the fundamental concepts of financial budgeting, exploring the different budget types (capital, operational, flexible) and outlining a step-by-step process for its successful creation and execution. We will show you how integrating advanced solutions, such as Qoyod Accounting Software, can automate forecasting, enhance accuracy, and transform your budgetary process from a yearly chore into a powerful strategic asset for your global business.

Definition of the Budget

A budget is a detailed financial plan that outlines the sources of funds and how they will be spent over a specific period. A budget can be set for a corporation, a household, a private project, or even an entire nation. It is a plan that demonstrates how money is managed—both earning it and spending it with the goal of focusing on achieving specific objectives and organizing the spending process during that period.

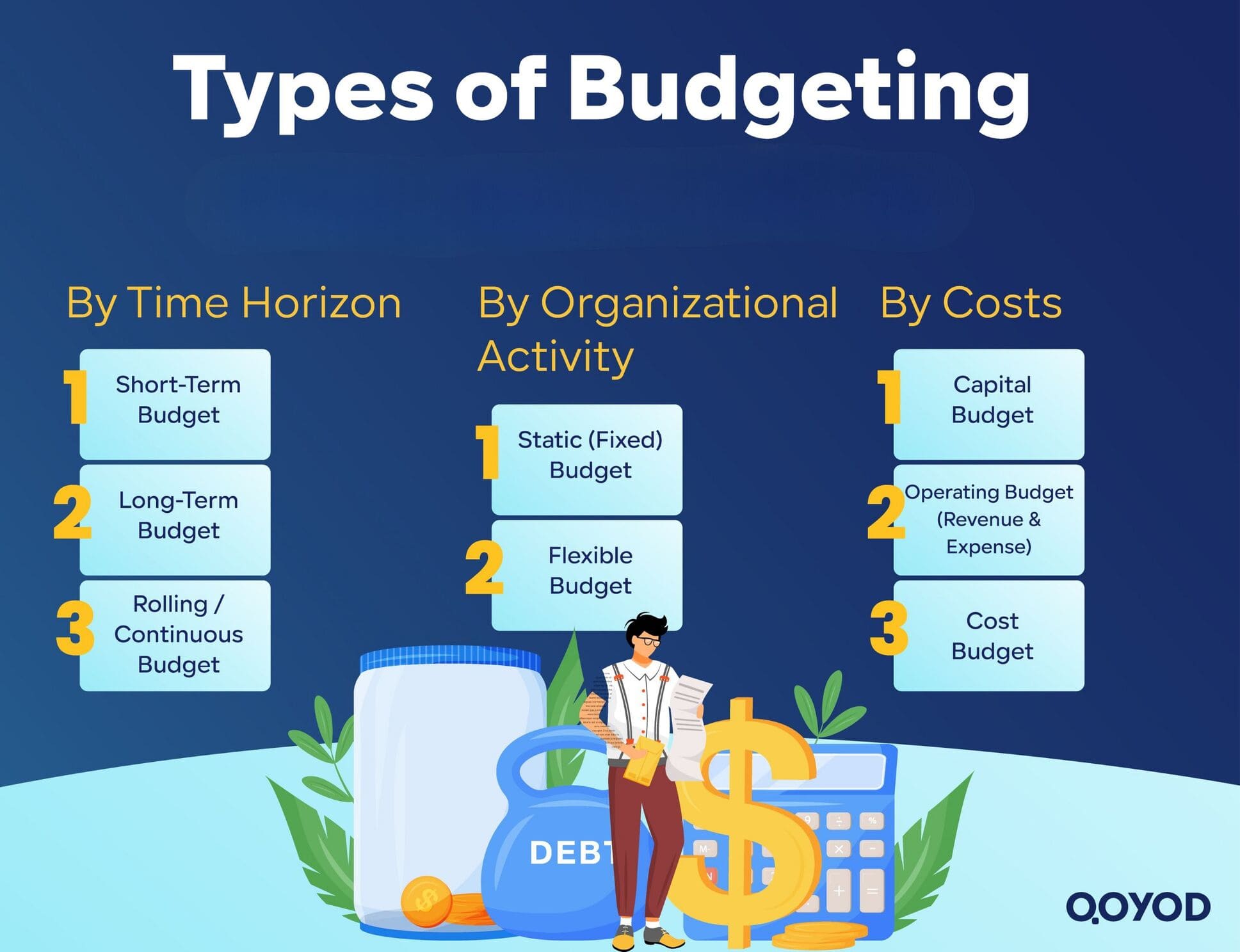

Types of Budgeting

Budgets have several classifications that vary based on the entity for which they are used and other considerations. The most important types include:

Types of Budgeting by Time Horizon

These types are classified according to the timeframe during which financial transactions are planned. The types in this classification are:

- Short-Term Budget: A budget established to manage the income and expenses of an organization for a period not exceeding one year. It is based on specific objectives, and then daily plans are set to help achieve those goals.

- Long-Term Budget: This involves forecasting an organization’s revenues and expenses for a period ranging from 3 to 5 years. It is suitable for major projects, investment operations, and business expansion.

- Rolling/Continuous Budget: These budgets are updated periodically, usually by dividing the year into months or quarters (regular financial periods). This makes them more flexible and positive in decision-making.

Types of Budgeting by Organizational Activity

These budgets are set based on the organization’s level of production and marketing activity. The types are:

- Static (Fixed) Budget: This is a fixed type of budget, meaning it is set assuming the organization’s activity level remains unchanged throughout the period it covers. This budget is not subject to change even if the organization’s activity level changes.

- Flexible Budget: Set based on the organization’s activity level, but it changes as the level of activity changes. This makes it superior in terms of monitoring the organization’s actual performance and providing financial requirements based on that performance.

Types of Budgeting by Costs

These budgets are allocated and organized according to the organization’s spending channels, how it benefits from profits, and the resources and assets it owns. The types of budgeting in this classification include:

- Capital Budget: Set to forecast the costs associated with large strategic projects. It helps ensure that the organization can maintain expected revenues to fund these projects until completion.

- Operating Budget: Comes in two forms: a revenue budget, which forecasts the income the organization expects to achieve through its operations, and an expense budget, which details the costs the organization plans to cover.

- Cost Budget: A financial plan to anticipate the material costs the organization will incur over a specific period, aiming to optimize the utilization of financial resources.

Learn More About : Financial Analysis in Saudi Arabia: Qoyod’s Free Template

Objectives and Importance of Financial Budgeting

Financial budgeting is prepared and planned in detail across various types of organizations and nations. This highlights several key objectives:

- Sound Financial Planning: Orderly financial transactions and preventing the waste of funds are among the strongest means to help an organization achieve its goals, which is the general aim of budget plans.

- Monitoring Expenditure: Tracking spending within the organization, identifying cost categories, and streamlining spending channels.

- Preventing Losses: Mitigating financial losses in companies due to unstudied costs by setting a financial plan that helps maintain a balance between spending and revenues.

- Informed Decision-Making: Budgets aid in making financial decisions that are most consistent with the organization’s resources and contribute to achieving goals without leading to asset depletion or corporate insolvency.

- Focus on Core Objectives: Concentrating on the organization’s principal objectives and drawing up expansion plans responsibly.

The Critical Importance of Budgeting

Several reasons make budget planning profoundly important:

-

Managing Resources in the Entity

Budgets help monitor all sources of income,all resources that contribute to the organization’s profit. With a budget in place, these resources are managed in the best possible way and protected from waste.

-

Making Better Decisions

When an organization considers entering a new investment project, the budget acts as a lens, allowing it to see the necessary expenses, resources, and potential goals it can achieve from that project and others. This makes its decision-making clearer and more responsible.

-

Monitoring Financial Transactions and Company Performance

This is achieved by identifying the costs of production operations alongside the negative issues the organization faces, whether in production, marketing, or otherwise. This helps in formulating better plans to overcome obstacles and improve the company’s productivity and sales.

-

Maintaining Transparency

The organization’s specific goals are outlined in its overall budget, which helps focus on them and defines the role of each employee and their contribution to achieving those goals, preventing the element of surprise in internal events or unexpected spending sources.

Key Elements of the Financial Budget

The components and elements of the accounting budget represent the fundamental axes that a company relies on to set objectives, plan expenses and revenues, and evaluate financial performance. These elements vary according to the nature of the activity and the company, but there are main elements common to most budgets.

- Projected Revenues

- Sales of Products or Services: Expected sales, which can be divided into domestic and international sales revenues.

- Investment Income: Returns from investments like stocks, bonds, or real estate assets.

- Other Income: Includes any other non-recurring income such as rent, sale of old assets, etc.

- Cost of Sales

- Raw Material Costs: Direct costs of primary materials needed for production, including purchase and transportation costs.

- Direct Labor Costs: Wages of labor directly involved in the production process.

- Other Variable Costs: Such as packaging and transportation costs for finished products, which change with the volume of production.

- Operating Expenses

- Salaries and Wages: Includes the wages of staff and administrators not directly working in production, along with taxes and allowances.

- Rent and Utilities: Expenses related to building rent and utilities like electricity, water, and internet.

- Administrative and Marketing Expenses: Includes expenses for marketing, advertising, legal fees, and other administrative costs.

- Maintenance of Equipment and Assets: Costs for maintaining assets and equipment to keep them operating efficiently.

- Fixed and Variable Costs

- Fixed Costs: Costs that remain constant regardless of the volume of production or sales, such as rent, basic management salaries, and insurance.

- Variable Costs: Costs that change with an increase or decrease in production volume, such as raw materials and shipping costs.

- Capital Expenditures

- Purchase of Fixed Assets: Expenses associated with buying new equipment, building new facilities, or expanding production operations.

- Maintenance and Development of Assets: Necessary expenses to update or improve the equipment and technology used.

- Infrastructure Investments: Such as investing in technology systems and infrastructure that support long-term company operations.

- Available Cash

- Cash Inflows: All sources of cash such as cash sales or investment income.

- Cash Outflows: Everything paid out, such as debt repayment, operating costs, and asset purchases.

- Remaining Cash: The cash surplus or deficit remaining after deducting outflows from inflows, which helps determine the company’s need for additional financing sources.

- Liabilities

- Creditors/Accounts Payable: Companies or individuals to whom the company owes money, such as suppliers.

- Loans and Financing: The company’s financial obligations towards bank loans or other funding.

- Accrued Expenses: Expenses incurred but not yet paid, such as taxes and deferred wages.

- Raw Materials: Materials the company needs for the production process.

- Finished Goods: Products that have been completed and are ready for sale.

- Work-in-Progress: Items that are in the production stage but not yet complete.

- Expected Profits and Losses

- Net Profit: The difference between projected revenues and total costs, representing the expected net profit for the company.

- Expected Losses: The financial estimate of potential losses that occur if projected expenses exceed revenues.

- Contingency and Reserve Funds

- Cash Reserve: A reserve of funds held by the company for emergencies or difficult times.

- Emergency Backup Plans: Identifying alternatives for costs and financing in case of sudden changes or a drop in revenues.

- Return on Investment (ROI)

- Returns Analysis: Measuring the expected return from different investments included in the budget.

- Analytical Indicators for Return: Analyzing the expected financial return from projects or assets the company acquires, which helps in determining the most viable investments.

These elements provide a comprehensive picture of the company’s financial status through the budget, giving management an analytical view to direct resources and make strategic financial decisions that support business sustainability and development.

Stages of General Budget Preparation

A budget is a financial organizational plan for any entity or institution,including nations but the General Budget (usually national/governmental) concerns governments and focuses on planning a nation’s revenues and expenditures. It is a legal document tied to the timeline of the state’s objectives and goes through four stages:

1- Preparation

This is the initial stage of drafting the budget, carried out by the Executive Authorities. It is formulated with reference to what the state achieved during the past year. Based on this, the percentages of increase and decrease in revenues are determined, and the general budget is drafted based on the actual revenues achieved by the state.

2- Adoption (Approval)

This is the second stage, specific to the Legislative Authority of the state. The general budget plan is received before the start of the fiscal year, reviewed, and sent to the parliamentary councils, which can reduce some expenditures but do not have the authority to add any new spending channels.

3- Execution (Implementation)

The budget is published in official sources and applied as stipulated across all relevant ministries and government bodies.

4- Evaluation

The Legislative Authority monitors the budget’s performance, the revenues obtained, the projects and investments the state has initiated, and measures the budget’s success and its coverage of necessary and essential expenses, ensuring its implementation is as required.

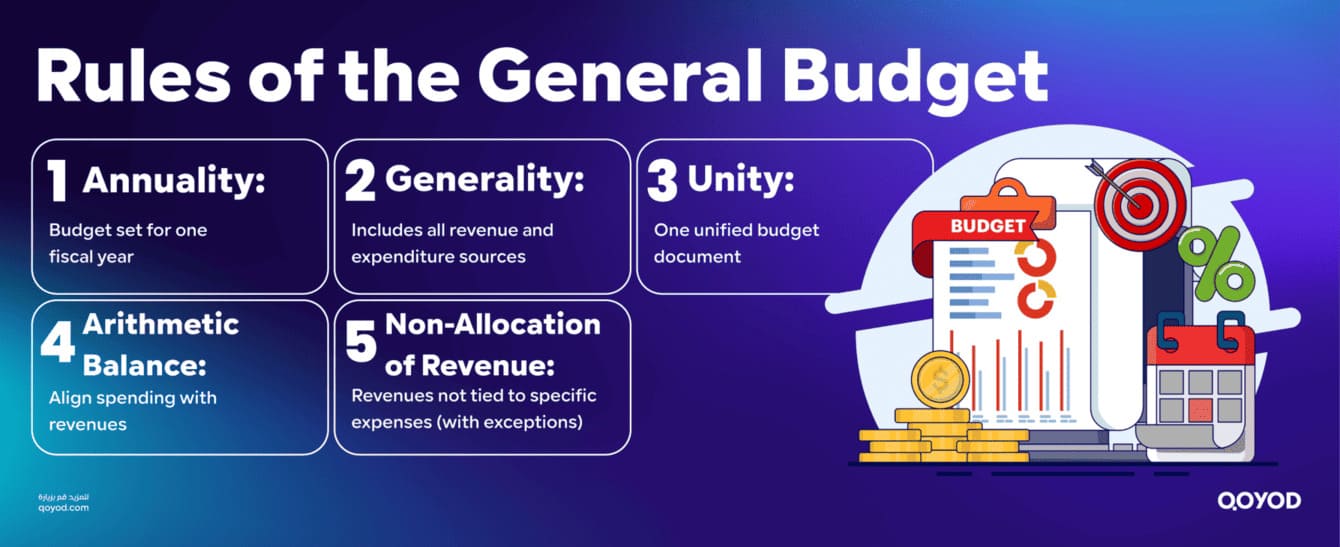

Rules of the General Budget

When formulating the general budget, several organizational rules must be adhered to:

- Annuality (Yearly Basis): This rule obliges the state to set a financial plan for one fiscal year, which is then renewed after its end, updated to conform with current needs and requirements.

- Generality (Comprehensiveness): The budget must cover all sources of income and aspects of spending for the state.

- Unity: Presenting one single budget document that includes all the state’s revenues and costs.

- Arithmetic Balance: A rule stating that spending must be organized to be balanced with revenues to prevent deficits or surpluses.

- Non-Allocation of Revenue: State revenues should not be designated for specific spending channels; all revenues are allocated to cover all requirements.

Note: All these rules have exceptions in special cases.

How to Prepare a Financial Budget?

Preparing a budget requires going through several organized steps to ensure its feasibility and reliance on facts. These steps are:

-

Historical Data

This means reviewing the budgets of at least the two preceding years or two budgets if they are long-term budgets to make forecasts based on the experience during those years and to identify spending patterns and income sources.

-

Setting Forecasts

Based on what was extracted from the previous budgets, new forecasts are set, linked to the objectives required to be achieved by the new budget.

-

Identifying Factors Influencing the Budget

A clear strategic vision of the market and the organization’s operating mechanism must be available to identify internal and external factors that might affect the budget’s implementation. Plans should be made to overcome any potential negative effects, and the opinions of investors and business owners should be taken into account, which often highlight future opportunities the organization can benefit from.

-

Financial Allocation

This involves determining the amount that will be spent on each activity within the organization. The financial needs of these activities must be studied, and figures should not be set without thorough analysis.

-

Review and Analysis

This stage involves ensuring that the figures on which the forecasts are based are correct and linked to the required objectives.

-

Implementing the Budget Plan

Distributing the budget plan to all departments, ensuring its correct execution, and monitoring the results.

Example of Budget Preparation

In Al-Rashidi Company for Paper Product Trade, the management requires a budget plan for the fiscal year 1446 (example year). When the management accountant was assigned the task, they did the following:

- Identified all company income sources from sales, contributions, partnerships, etc., which amounted to a regular income of 1,500,000 Riyals (example currency) plus 150,000 Riyals of irregular income during the year 1445.

- Recorded all company expenditures and costs, including salaries, operating costs, production costs, etc., which amounted to approximately 1,250,000 Riyals plus 50,000 Riyals of irregular expenses in 1445.

- The budget for the year 1446 was set as follows (using general percentages and a globally-relevant example):

| Income Statement | Income in 1445 (Actual) | Income in 1446 (Estimated) | Percentage Change |

| Total Revenues | 1,650,000 | 1,750,000 | ≈ 6.06% |

| Total Expenses | 1,300,000 | 1,000,000 | ≈ -23.08% |

| Gross Profit | 350,000 | 750,000 | ≈ 114.29% |

The accountant planned to improve the net profit value by setting the following objectives:

- Using lower-cost marketing plans, such as digital marketing.

- Studying competitors and developing products in line with customer needs.

- Expanding market reach and enhancing e-commerce.

- Strengthening partnerships between the organization and other benefiting entities to improve its investment appeal.

Mistakes to Avoid When Preparing a Budget

When setting a budget to monitor financial performance and spending, several mistakes that can cause budget failure and, consequently, waste organizational resources must be avoided:

- Failing to set a clear, realistic plan linked to figures and facts.

- Neglecting to monitor the implementation of the financial plan or failing to adjust it in line with changes in the company.

- Avoiding the allocation of a sum within the budget to cover unexpected expenses, such as emergency situations.

- Relying on loans instead of the available liquidity within the company.

- Ignoring the use of correct budget preparation methodologies.

- Failing to detail the revenues and expenditures incurred by the organization.

Budget (Budget) vs. Balance Sheet (Mizaniya)

Although the Balance Sheet and the Budget are financial plans that contribute to efficient money management, they do not mean the same thing. The following table highlights the key differences:

| Point of Comparison | Balance Sheet | Budget |

| Responsibility | Falls under the responsibility of the Financial Accountant. | Falls under the responsibility of the Management Accountant. |

| Nature of the Plan | A financial plan based on actual figures derived from historical statistics. | A forecasting financial plan based on predictions that have not yet occurred. |

| Timing of Planning | Prepared at the end of the fiscal year. | Prepared at the beginning of the fiscal year. |

| Components | Assets, Liabilities, Equity (Net Assets). | Expected Revenues, Expected Expenses, Expected Net Profit. |

| Importance | Measuring historical financial performance. | Organizing future financial performance. |

| Goal | Clarifying the economic position and achieving financial transparency. | Forecasting the volume of future revenues. |

Challenges in Estimating the Budget

Several factors can negatively affect the budget during its preparation, including:

- Estimates based on unstable factors or an unexpected event that makes the budget volatile.

- Lack of information due to restrictions.

- Conflict of interests, with each department seeking more financial resources, even at the expense of others.

- Shortage of staff and insufficient expertise.

FAQ: Financial Budgeting for Global Businesses

A budget is a provisional financial plan for a specific period that outlines expected revenue sources and planned expenditures, aiming to organize resources and achieve the goals of an organization or state with higher efficiency. It helps control expenses, avoid waste, and direct funds to priority activities, ensuring business sustainability and the ability to finance future expansion. The Budget is a predictive document prepared at the start of the financial period to estimate future revenues and expenditures for planning and control purposes. The Balance Sheet is a financial statement prepared at the end of the period to show the actual financial position of assets, liabilities, and equity, used to measure historical performance and show economic status with transparency. There is the Short-Term Budget (one year or less), focusing on daily operations and immediate goals, and the Long-Term Budget (three to five years), used for investment and expansion decisions. There is also the Rolling/Continuous Budget, which is regularly updated by adding a new period as a preceding one ends, providing flexibility to adapt to changes. There is the Static Budget, which is built on a fixed activity level and does not change even if production or sales volume changes, making it simpler but less accurate in volatile environments. In contrast, the Flexible Budget is prepared for different activity levels, allowing estimates to change automatically with the volume of work, providing a more accurate reading of actual performance. They include the Capital Budget, concerned with strategic projects and the purchase of fixed assets, and the Operating Budget, covering operating revenues and current expenses. Additionally, there is the Cost Budget, which focuses on estimating direct and indirect costs to improve the efficiency of resource use and reduce unit cost. The budget aims to achieve organized financial planning that prevents resource waste and links spending to priorities and strategic goals. It also seeks to control spending, reduce losses from uninformed decisions, support financial decision-making, and focus management on core objectives and expansion plans in a responsible and disciplined manner. The budget aggregates all available income and funding sources and links them to various uses, enabling management to allocate resources to the most profitable and impactful activities. This approach reduces unnecessary expenses, improves the entity's ability to utilize its assets, directs liquidity towards high-return projects, and maintains stable cash flow.What is a Financial Budget?

What is the difference between a Budget and a Balance Sheet?

What are the types of Budgets by Time Horizon?

What are the types of Budgets by Organizational Activity?

What are the types of Budgets by Costs?

What are the most important goals of Budget Preparation?

Why is the Budget an important tool for Resource Management in an Entity?

Budget Preparation Software

Qoyod Accounting Software is one of the most important programs for preparing budgets of various types. It’s a smart program that enables you to conduct realistic predictive planning based on figures achieved in previous years. Therefore, it helps manage revenues and expenses efficiently and contributes to setting automated and auditable budgets. It also provides sufficient accounting operations to make financial planning easier and simpler.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.