| Expert | This guide offers small and medium-sized businesses a fundamental framework for financial accuracy by explaining the five core Main Accounting Account Types (Assets, Liabilities, Equity, Revenue, and Expenses). By mastering these classifications, businesses can ensure reliable financial reporting, optimize cash flow, and maintain global compliance using systems like Qoyod. |

The Essential Guide to Main Accounting Account Types for Business Growth

Every successful business needs a solid financial foundation, and that starts with a robust understanding of the Main Accounting Account Types. Are you a small or medium-sized business (SMB) owner struggling to organize transactions, ensure compliance, or build reliable financial reports? Without proper classification, even the most basic financial processes, like e-invoicing or calculating tax liability, can become complex and prone to error.

This comprehensive guide from Qoyod Accounting Software simplifies the fundamental principles of account classification. We will clearly explain the five primary categories that form the backbone of your financial statements, empowering you to manage your business’s financial data with confidence, transparency, and accuracy. Implement these principles, often automated by a modern cloud accounting system like Qoyod, to drive sustainable growth.

Concept and Importance of Main Accounting Account Types

At the very start of setting up any accounting system, it is essential to categorize all financial transactions into clear classes, ensuring each one is recorded in the appropriate account. Correctly maintaining these accounts is not a luxury; it’s a fundamental accounting and legal necessity for financial integrity.

What are the Main Accounting Account Types?

The main accounts are the high-level categories that form the Chart of Accounts (COA) structure within any entity’s accounting system. When developing a COA, you generally find five principal classifications from which sub-accounts and detailed ledger accounts branch out. This structure enables systematic tracking of every resource, obligation, income stream, and expenditure.

The five primary classifications are: Assets, Liabilities, Equity, Revenues (or Income), and Expenses.

Why is Understanding the Main Accounting Account Types Crucial?

- Accurate Accounting Records: If accounts are not precisely classified or are confused with one another, financial statements become inaccurate, directly hindering effective decision-making.

- Regulatory Compliance: Accounting systems require the preparation of reliable financial statements based on generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). Any classification error can lead to audit issues.

- Fundamental Financial Analysis: By understanding the type of account and its debit/credit nature, management can predict the impact of transactions, manage cash flow, and optimize operational efficiency.

- Transparency and Governance: For established companies, adopting clear classifications assures investors and partners that a controlled system monitors financial performance.

Overview of the Five Main Accounting Account Types

Here is a summary of each of the five core Main Accounting Account Types in an accounting system:

| Account Type | Definition | Nature | Balance Sheet/Income Statement |

| Assets | Economic resources owned by the entity, expected to provide future benefits (e.g., Cash, Equipment, Inventory). | Debit | Balance Sheet |

| Liabilities | Financial obligations the company must pay to external parties (e.g., Accounts Payable, Loans). | Credit | Balance Sheet |

| Equity | The residual value belonging to the owners after deducting liabilities from assets (e.g., Capital, Retained Earnings). | Credit | Balance Sheet |

| Revenues | Gains realized from the entity’s core operating activities (e.g., Sales, Service Fees). | Credit | Income Statement |

| Expenses | Costs incurred by the entity to generate revenue or sustain operations (e.g., Salaries, Rent, Utilities). | Debit | Income Statement |

Account Nature (Debit/Credit) Briefly Explained

To understand how to interact with these accounts in daily financial entries, remember:

- Assets and Expenses have a “Debit” nature — meaning they increase with a debit entry and decrease with a credit entry.

- Liabilities, Equity, and Revenues have a “Credit” nature — meaning they increase with a credit entry and decrease with a debit entry.

Detailed Classification and Transaction Handling

In financial accounting, accounts are pivotal units used to record a company’s financial transactions. They are the registers that express Assets, Liabilities, Equity, Revenues, and Expenses. With a precise understanding of this classification, any business can organize its financial data accurately, achieving transparency and sustainability in financial performance.

1. Asset Accounts

Asset Accounts represent economic resources or rights owned by the entity that are expected to contribute to future benefits. They are a core pillar of financial statements, such as the Balance Sheet.

Asset dimensions are typically divided into:

- Current Assets: Such as cash, accounts receivable (money owed by customers), inventory, and prepaid expenses.

- Fixed or Non-current Assets: Includes land, buildings, machinery, and equipment used by the entity for a long period.

- Intangible Assets: Such as patents, software licenses, and trademarks, which lack physical existence but represent value.

Accounting Treatment: When recording a transaction affecting an Asset, it is typically recorded as a “Debit” if the asset increases, and a “Credit” if it decreases.

2. Liability Accounts

Liabilities represent the entity’s obligations to third parties—amounts due or payable in the future.

They are usually divided into:

- Current Liabilities: Such as accounts payable (money owed to suppliers), short-term loans, and accrued expenses.

- Long-term Liabilities: Such as bank loans extending over long periods, bonds, and long-term financial lease obligations.

Accounting Treatment: When incurring a loan or making a purchase on credit, the liability is recorded as a “Credit” because this signifies an increase in the company’s debt.

3. Equity Accounts

Equity represents the net value returned to the owners of the entity after subtracting liabilities from assets.

It includes components like:

- Capital invested by the owners.

- Retained Earnings.

- Common or preferred stocks (in the case of joint-stock companies).

Accounting Treatment: Equity increases upon achieving profits or additional owner investment and decreases when distributing profits or incurring losses.

4. Revenue Accounts (Income)

Revenues represent the funds an entity generates from its operating activities, personal income, or services provided.

Types of revenues include:

- Sales Revenue.

- Service Revenue.

- Rental Income or investment returns.

Accounting Treatment: When revenue is realized, the account is typically recorded as a Credit because credit represents its increase.

5. Expense Accounts

Expenses are the costs incurred by the entity to generate revenues or sustain its operations.

They include expenses such as salaries, rent, utilities, production costs, and marketing.

Accounting Treatment: Expenses increase with a debit and decrease with credits or at the time of closing (end of the accounting period).

Advanced Classification: Real, Personal, and Nominal Accounts

In addition to the common five-way classification of Main Accounting Account Types, some accounting schools use an older or supplementary three-way division:

- Personal Accounts: Relate to individuals or legal entities (e.g., customers, suppliers, owners).

- Real Accounts: Relate to assets or properties (e.g., cash, buildings, equipment).

- Nominal Accounts: Include revenues, expenses, profits, or losses, and are closed at the end of the accounting year.

This classification aids in easily understanding the debit/credit rule, according to the “Golden Rules” of accounting:

| Account Type | Debit Rule | Credit Rule |

| Personal | The receiver (debtor) | The giver (creditor) |

| Real | What comes in (asset increase) | What goes out (asset decrease) |

| Nominal | All expenses and losses | All revenues and gains |

The Link Between Main Accounting Account Types and the Accounting Equation

It is critical to recognize that every financial transaction falls under one of the Main Accounting Account Types and is recorded using the Double-Entry Bookkeeping System. This system mandates that the sum of all debits must equal the sum of all credits in every journal entry, ensuring the fundamental Accounting Equation always balances:

Assets=Liabilities+Equity

When including revenues and expenses (which impact equity):

Assets+Expenses=Liabilities+Equity+Revenues

A deep understanding of this relationship enables management to analyze the financial situation and make decisions based on accurate data.

Practical Application and Modern Solutions

In today’s digital economy, precise organization and classification of accounts are mandatory. Businesses need clear classifications to simplify the preparation of financial statements, enhance the ability of external auditors to examine data, and help management make strategic decisions.

Qoyod’s Operational Recommendation

Based on our expertise at Qoyod Accounting Software, we recommend two key solutions for all businesses:

- Design a Robust Chart of Accounts: Start by creating a well-structured Chart of Accounts that includes the main and sub-accounts, covering every expected operation of your business.

- Use Numerical Coding: Adopt a numerical coding system (a number for each account) to facilitate recording, searching, internal control, and external auditing.

Bookkeeping Services in Qoyod

Bookkeeping is the backbone of any entity aiming for financial sustainability and decisions based on accurate, reliable data. Qoyod offers professional bookkeeping services through certified partners, designed to help business owners manage their financial and accounting requirements effectively.

Definition and Importance of Bookkeeping:

Bookkeeping is the systematic, periodic process of recording and organizing all the entity’s financial transactions according to accepted accounting standards.

The objectives of this process are:

- Accurately document Revenues, Expenses, Assets, and Liabilities.

- Ensure the preparation of reliable financial reports for correct managerial and financial decision-making.

- Achieve compliance with tax regulations and financial legislation globally.

- Enable companies to monitor financial performance, improve cash flows, and mitigate accounting and tax risks.

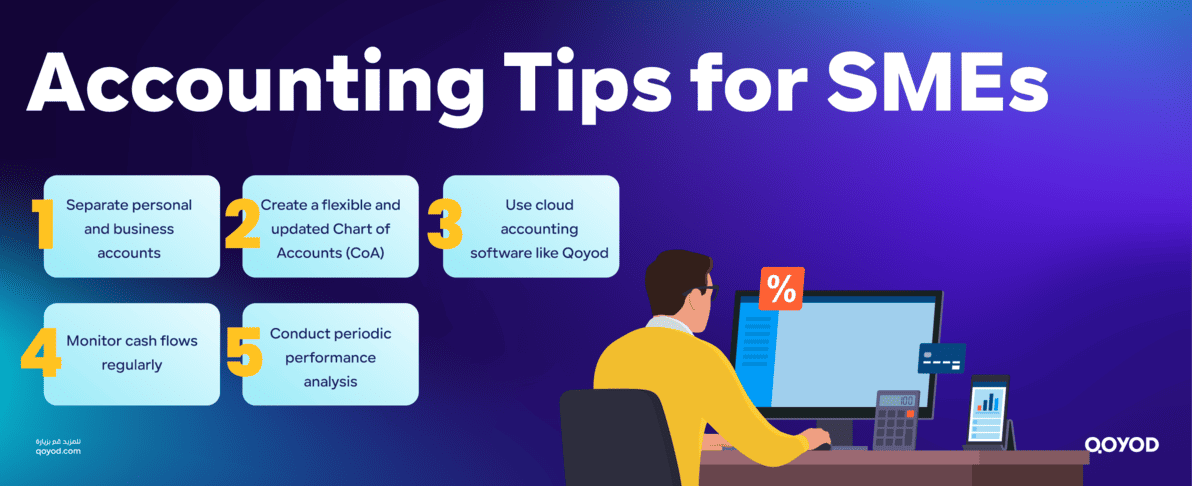

Essential Accounting Tips for Small and Medium Businesses

- Separate Personal and Business Accounts: One of the most common errors in small businesses is mixing the owner’s personal accounts with company accounts, which causes confusion during tax and reporting preparation.

- Create a Flexible and Updated COA: Ensure you regularly update your account structure to align with business expansion or changes in local and international regulations.

- Utilize Cloud Accounting Software: Cloud accounting systems like Qoyod provide instant and secure access from anywhere, supporting digital transformation and efficiency.

- Monitor Cash Flows Regularly: Ensure you review revenues and expenses monthly to avoid sudden financial deficits and optimize liquidity management.

- Adopt Periodic Performance Analysis: Review your financial data at least quarterly to evaluate profitability and identify operational strengths and weaknesses.

Frequently Asked Questions (FAQ) about Main Accounting Account Types

What are the key Main Accounting Account Types that should be in any financial system?

The accounting system must include five fundamental groups of Main Accounting Account Types: Assets, Liabilities, Equity, Revenues, and Expenses. These cover all company operations, whether commercial, service, or industrial.

How are financial transactions recorded in modern accounting?

Transactions are recorded using the Double-Entry Bookkeeping System, where every debit amount in one account is matched by an equal credit amount in another account, ensuring the accounting equation remains balanced in the financial statements.

Do the account types differ between small and large companies?

No, the basic classification is the same, but the difference lies in the detail and sub-divisions. Larger companies typically have more sub-accounts within each type (e.g., fixed assets sub-divided into vehicles, buildings, machinery, etc.).

What is the difference between Real, Nominal, and Personal Accounts?

- Real: Represents tangible or intangible assets (e.g., buildings, cash, trademarks).

- Nominal: Represents expenses and revenues.

- Personal: Relates to individuals or institutions (e.g., customers and suppliers). This classification is used to facilitate understanding and analysis within the double-entry system.

In Conclusion

Understanding the Main Accounting Account Types is not just an academic requirement; it is the foundation of success for any company seeking to organize its resources and manage its growth with confidence. In a rapidly evolving global market, financial accuracy is synonymous with trust and sustainability.

By adopting Qoyod Accounting Software, you can build a strong financial structure that aligns with modern accounting standards and keeps your data ready for oversight, auditing, and decision-making. “Accounting is not just numbers; it is the language that expresses your company’s future. Ensure your language is clear and organized.”

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.

- To learn more about accounting and financial management, visit the Qoyod blog: https://www.qoyod.com