Easy Entries

Easy Entries:

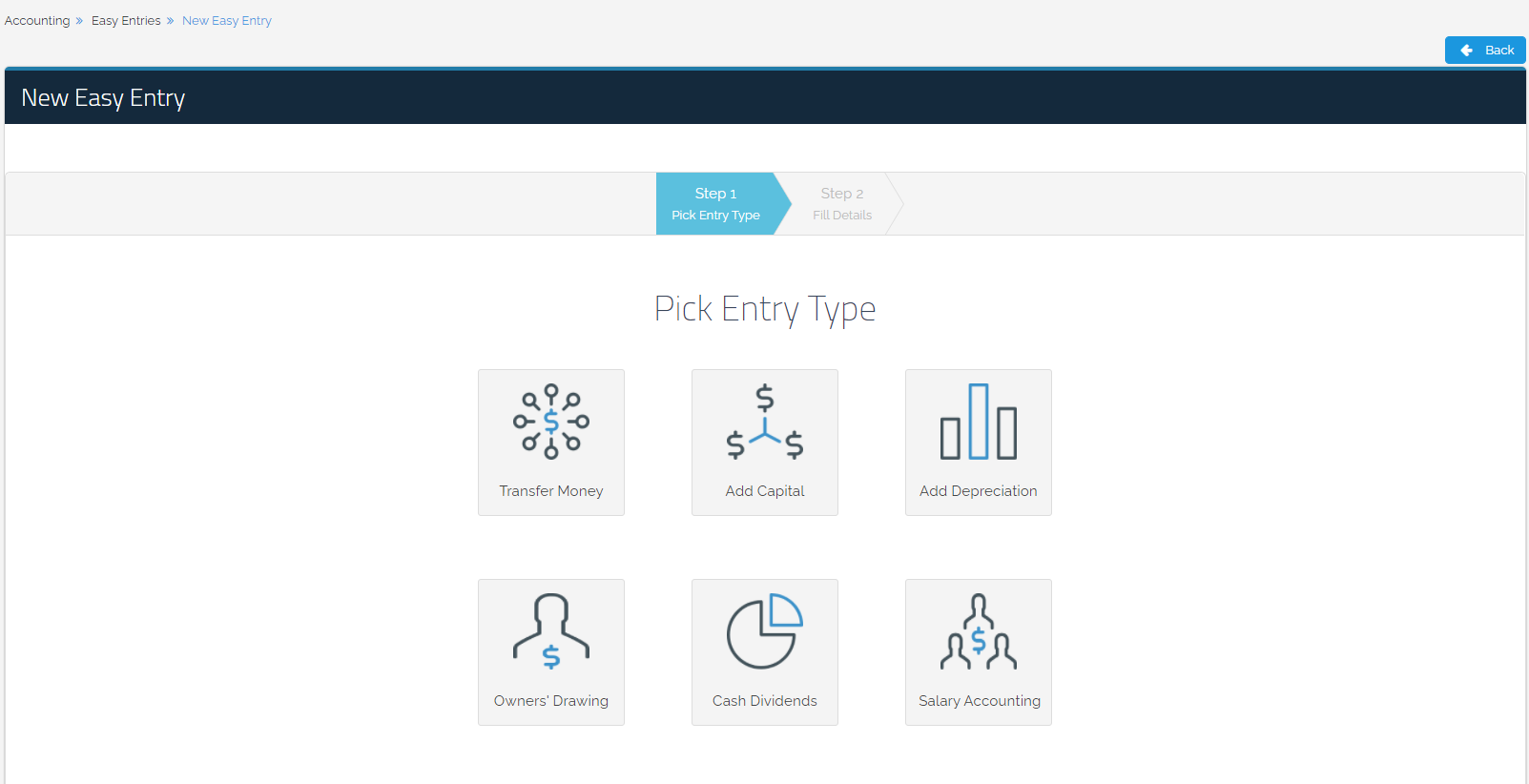

“Easy Entries” save time entering the entry and ensure the integrity of the data entered. It allows you to choose the type of entry and then enter the specific data available for each entry. Account data are shown in a brief and specific manner in line with the type of entry so that users without an accounting background can easily enter these entries. This will result in one or more accounting entries being automatically created in the system to be reflected on the reports page.

1- Adding a new “Easy Entry”:

From the drop-down list of “Accounting”, click on the (+) sign in front of “Easy Entries”, then select the specified entry.

* An image of dropdown menu Accounting – New easy entry.

2- Determine the type of easy entry from the available list, which contains the following:

- Transfer Money:

Transferring money from one bank account to another or liquidating money by transferring it from the bank account to cash.

- Add Capital:

Capital is the essential step in starting any business and it stands for all the funds, equipment, and materials needed to establish a business.

- Add Depreciation:

Depreciation is the gradual decrease in its historical value of the fixed asset due to the fixed asset’s use or its obsolescence.

- Owner’s Drawing:

It is the money that the owner withdraws from a cash or the bank for his personal use.

- Cash Dividends:

It is the distribution of profits to partners or shareholders at the end of each quarter or year, based on the share or contribution of each party in the company’s capital.

- Salary Accounting:

To enter the salary entry for each employee separately or record the salaries of all employees.

* An image of one of the easy entry types that can be added

3- Fill in the details for each type:

- Transfer Money Entry:

Determine the account from which the funds are reduced.

Determine which account has increased funds. Funds can also be moved to other additional accounts through creating “New Account” previously in the “Chart of Accounts”.

Enter the “Amount”.

Select the “Date”.

Type in the “Description”.

Attach the “Attachments”, if any.

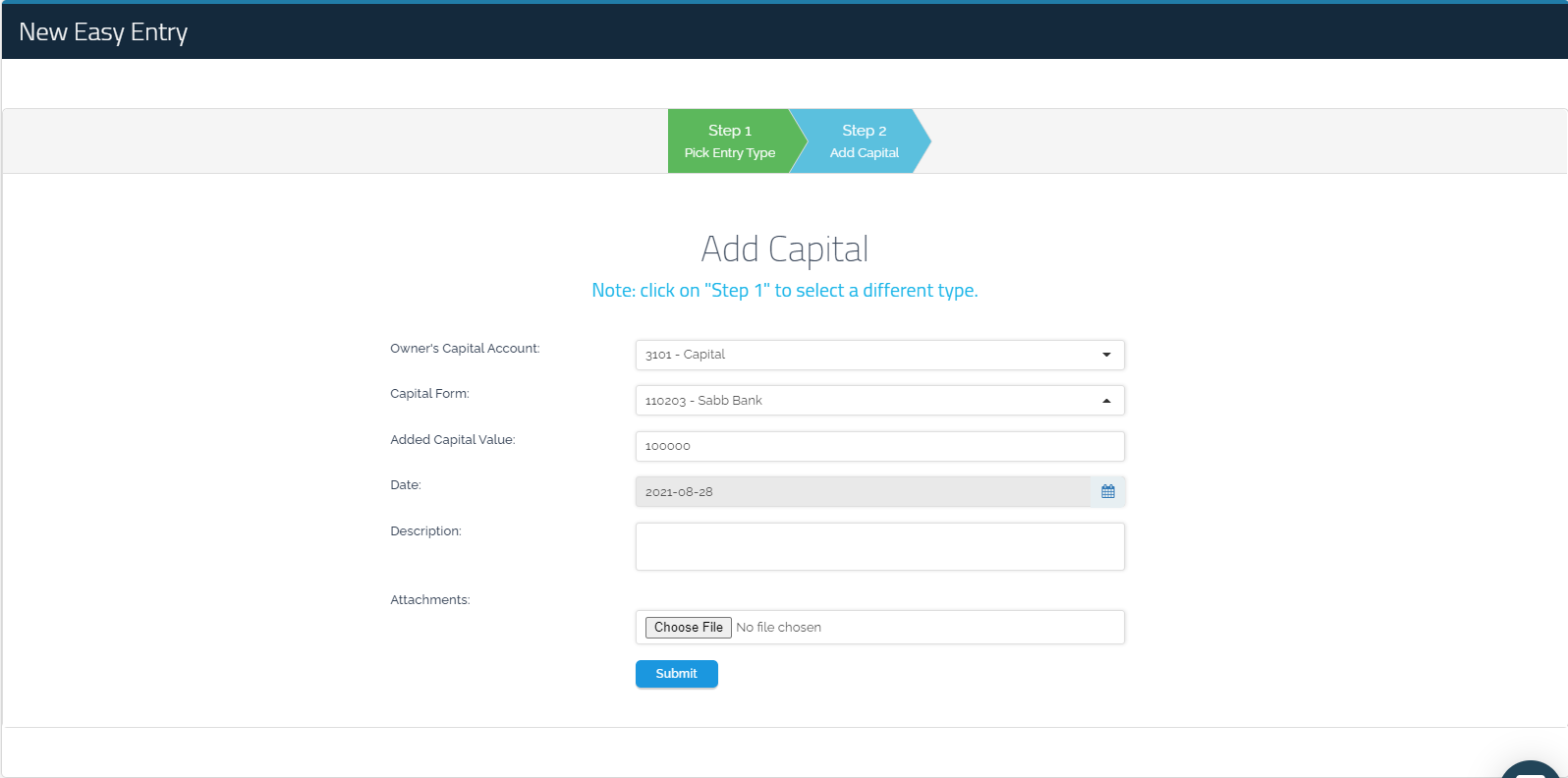

- Add Capital:

Determine the “Owner’s Capital Account” and the “Capital From” account which has risen.

Determine the “Added Capital Value”, such as cash or fixed assets.

Enter the value of the added capital.

Select the “Date”.

Type in the “Description”.

Attach the “Attachments”, if any.

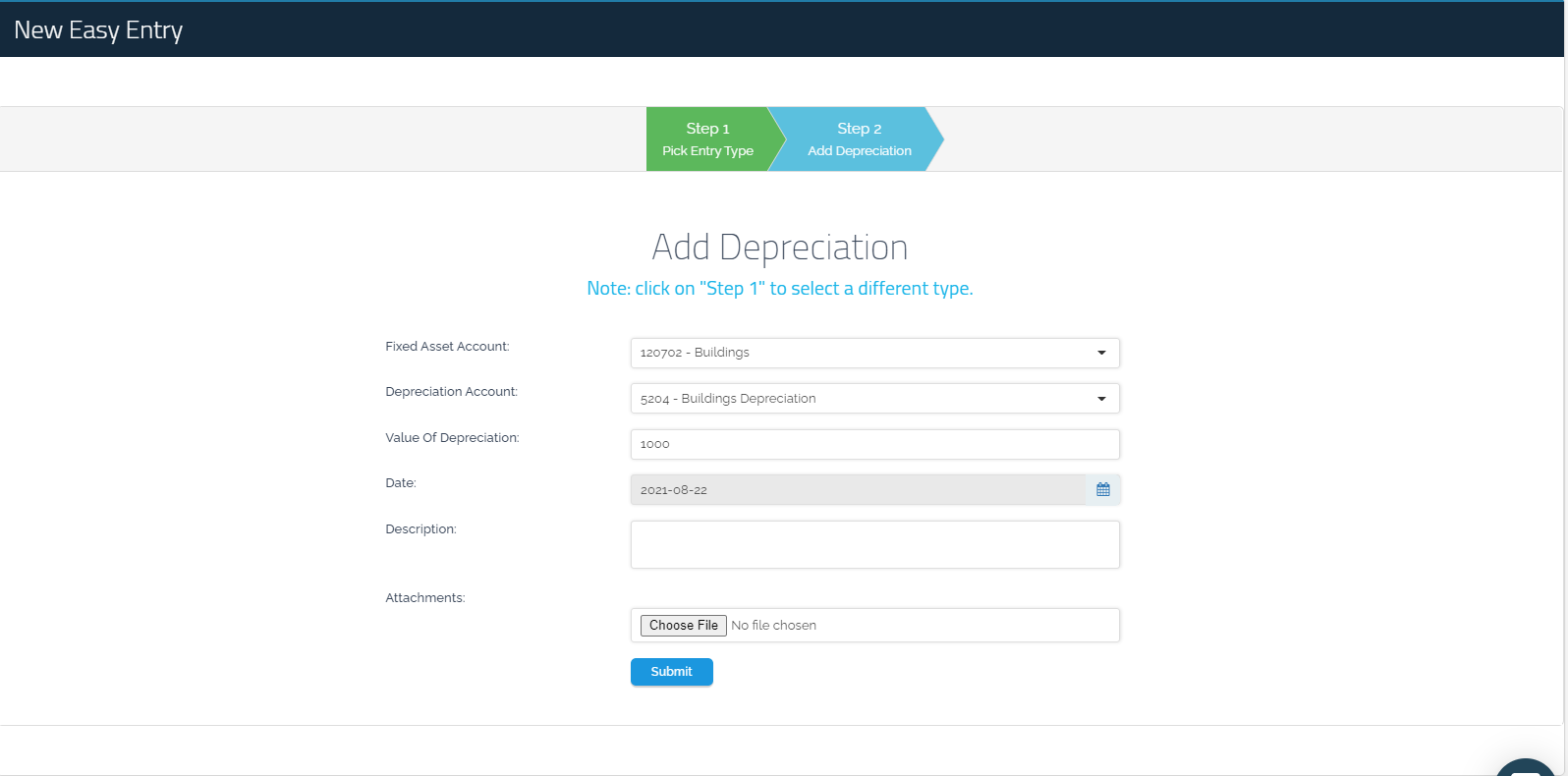

- Add Depreciation:

Determine the depreciated “Fixed Asset Account”.

Determine the depreciation account on which the depreciated fixed asset is charged. This requires adding “Depreciation Account” in advance in the “Chart of Accounts”.

Enter the “Value Of Depreciation”.

Select the “Date”.

Type in the “Description”.

Attach the “Attachments”, if any.

- Owner’s Drawing:

Determine the “Asset” from which the owner has withdrawn.

Determine the “Owner Current” account to which the money was transferred. This requires adding “Owner Current” account in advance in the “Chart of Accounts”.

Enter the withdraw “Amount”.

Select the “Date”.

Type in the “Description”.

Attach the “Attachments”, if any.

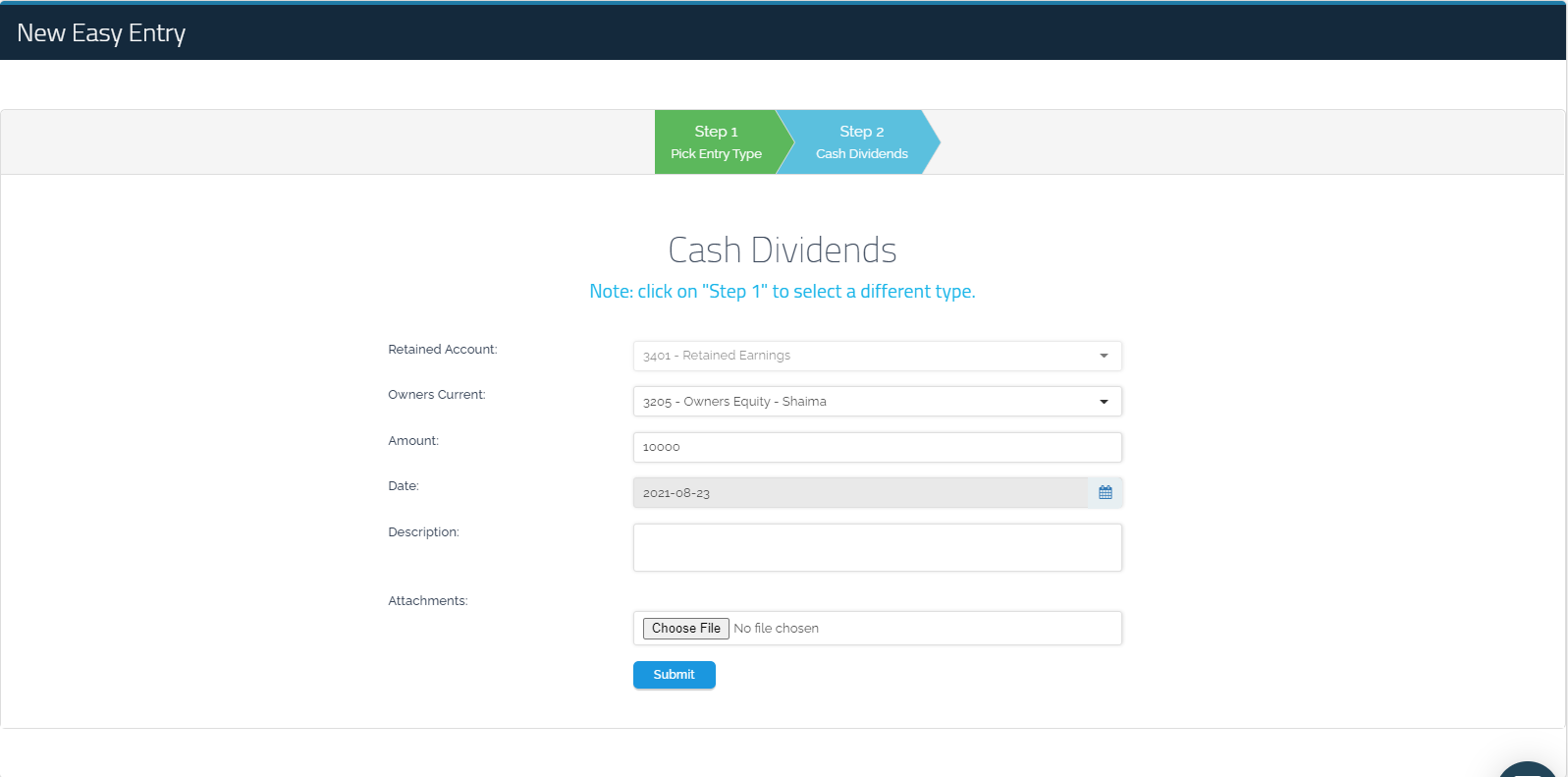

- Cash Dividends:

Determine the “Retained Account” from which profits are distributed, for example, working profits.

Select the “Owners Current” account to which the profits will be distributed. Profits can, also, be distributed to additional accounts other than the capital account and the owners’ equity account through adding a new account previously in the “Chart of Accounts”.

Enter the “Amount” of the profits to be distributed

Select the “Date”.

Type in the “Description”.

Attach the “Attachments”, if any.

- Salary Accounting:

On the “Salary Accounting” entry page, you can add two different entries according to the purpose of each entry.

1- Salary Expenses Already Recorded: It means that an accrual entry was previously created and another entry was created to prove the payment of salaries on the third day of the month, for example.

2- Did Not Pay Salaries: It means creating a record for salaries when they are due to be paid at the end of the month.

When you deselect any of the previous options, you will be able to create both records at once, with the payment due and on the same date.

Creating an entitlement entry:

Select “Did Not Pay Salaries” and determine the “Paid Amount” which is salaries.

Determine the value of the salaries paid for each employee separately or the total salaries of the employees.

Select the due “Date” in addition to a “Description” of the entry, which is the entitlements of the May salaries and any attachments related to the entry, such as the Paycheck, for example.

When it’s time to pay the salaries:

Create a new “Easy Entry” and select “Salary Expenses Already Recorded” which is “the accrual entry that was previously created”. After that, determine the type of “The Account That Salaries Will Be Recorded In”, whether cash or bank.

Specify the “Date” of payment and the “Description”, for example, May salaries being paid. The attachments might be a summary of salary transfers.

Complete the remainder of the data for the Salary Accounting:

Select the “Date”.

Type in the “Description”.

Attach the “Attachments”, if any.