Deductions

Deductions

It pertains to deducting sums of money from employee entitlements without referring to manual entries or receipts so that the value and type of deduction are determined, such as policy violation, loan payment, or reimbursements and other repayments. In addition, you can specify the description and date of the deduction which will be directly reflected on the salary statement.

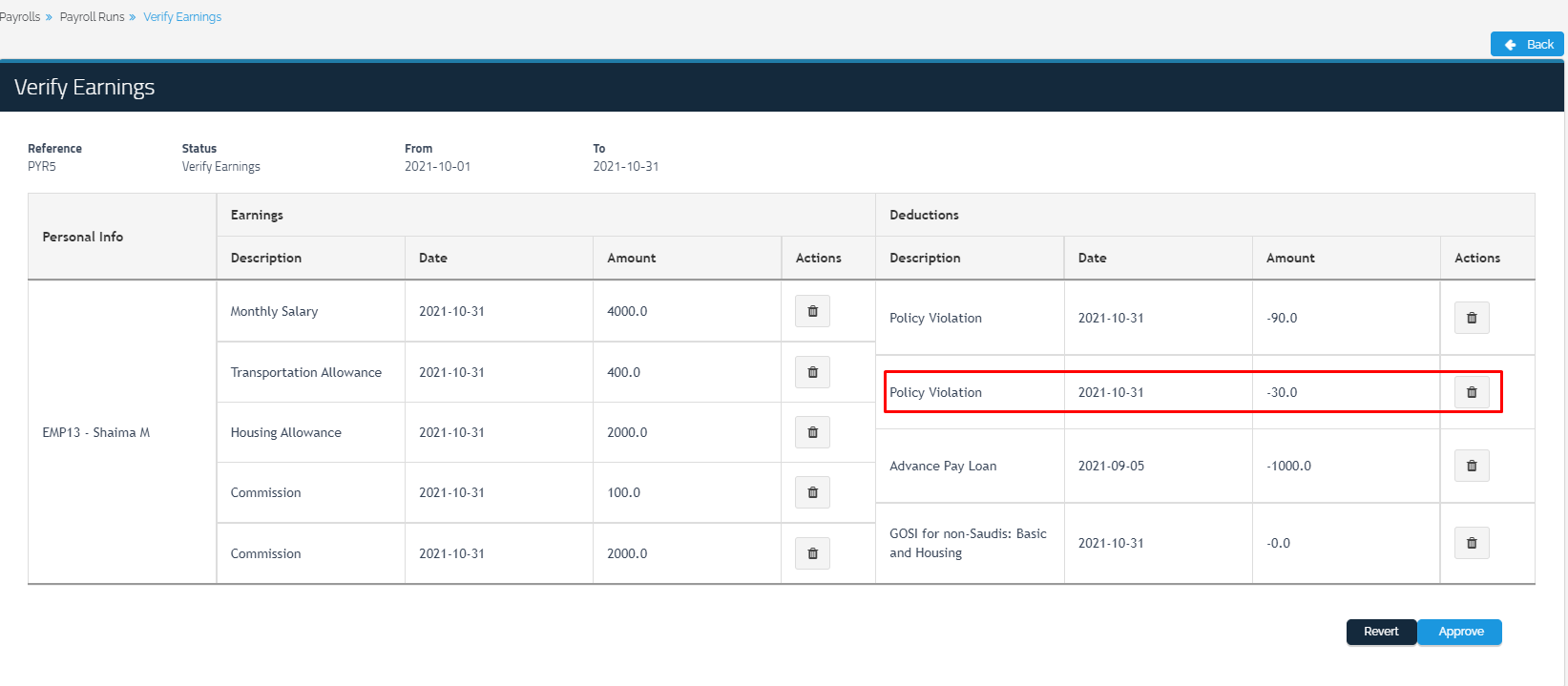

Below is the page where employees’ deductions appear when calculating any defect in the check-in and check-out schedules.

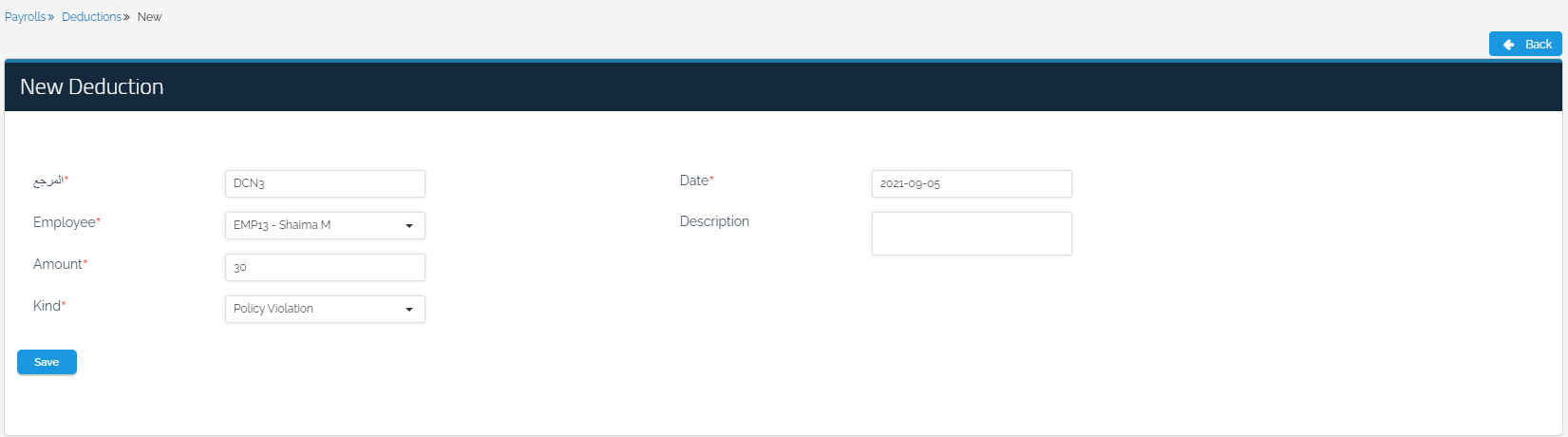

Adding new deductions:

Select “Payrolls” from the main list, then “Deductions”.

Then, select the “Employee”, the “Amount” of the deduction in riyals, the “Kind” of deduction whether it is a policy violation, loan payment, or reimbursements & other repayments, and select the “Date” and type in the description of the deduction in the “Description” field and click on “Save”. Thus, you will be able to know the date, amount, and payment status of deductions obtained by employees. The reference will be the deduction ID number.

You can indicate that the deduction has been paid by the employee through the icon “Payment Received from Employee” next to the employee’s name.

You can, also, indicate that the deduction is paid by employees through the payroll run, where you can adjust the amount by clicking on it if the deduction was made partially in the payroll run.