| Excerpt:

Financial analysis is the essential compass for Saudi SMEs, transforming raw financial data into a clear roadmap for profit growth, compliance with ZATCA regulations, and sustainable success in the Kingdom’s competitive market. |

Imagine having a private financial dashboard for your Saudi business, filled with figures that reveal its true performance, enabling you to understand your reality in the fast-evolving Saudi market. Every company has its own “dashboard” of numbers and financial data. These figures, in isolation, can seem dry and confusing. This is where financial analysis comes in.

Financial analysis is simply the art of reading and interpreting the language of financial numbers. It is the process of examining a company’s financial statements (like income statements and balance sheets) to understand its past performance, current position, and predict its future. It allows us to look beyond raw numbers and see the bigger picture: Is the company financially healthy? Is it growing? Is it utilizing its resources efficiently? In this article, we will explore what financial analysis truly means and why it is an indispensable tool for business owners in locations like Riyadh, Jeddah, and Dammam.

What is Financial Analysis? Decoding Numbers for Deeper Understanding

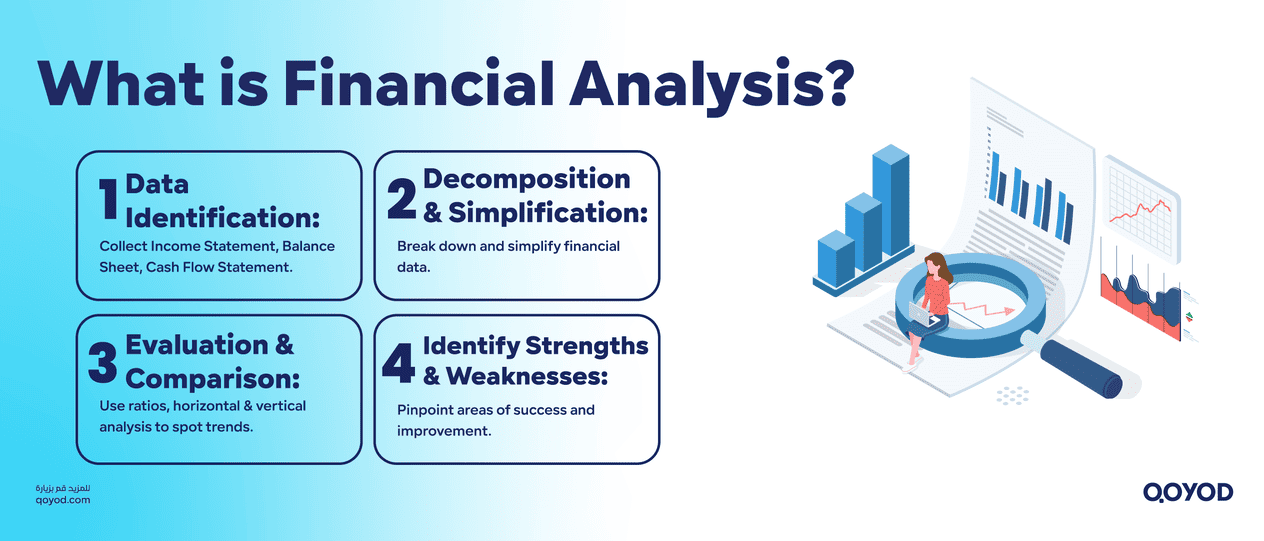

Financial analysis is a systematic process involving the use of various techniques and tools to examine an organization’s financial data. The goal is not just to know the numbers, but to understand what lies behind them. It includes:

- Data Identification: Collecting core financial statements, such as the Income Statement (showing revenues, expenses, and profits for a period), the Statement of Financial Position (Balance Sheet showing assets, liabilities, and equity at a specific point), and the Statement of Cash Flows (detailing cash movement).

- Decomposition and Simplification: Breaking down these statements into their basic components and simplifying them.

- Evaluation and Comparison: Using financial ratios and other metrics to compare the company’s performance over time (Horizontal Analysis) or benchmark it against competitors in the same industry (Vertical Analysis). This helps in identifying trends and patterns.

- Identifying Strengths and Weaknesses: Through this examination, the financial analyst can pinpoint areas where the company excels and areas that require improvement.

In short, financial analysis is not just a report; it is a research and fact-finding process that supports crucial decision-making.

Download your Free Simplified Financial Analysis Template from Qoyod to jumpstart your business insights today.

The Importance of Financial Analysis:

Financial analysis is an essential tool for a wide range of stakeholders, each using it to achieve their specific goals in the Saudi business ecosystem.

1. For Investors and Financial Decision-Makers

For investors, financial analysis is the key to sound investment decisions. Should you invest in this company? Is it profitable? Does it have growth potential? Financial analysis answers these questions by assessing:

- Profitability: Is the company generating good profits? How do these profits change over time?

- Liquidity: Does the company have enough cash and liquid assets to cover its short-term liabilities? This is crucial for ensuring its ability to pay daily bills.

- Solvency: Is the company capable of paying its long-term debts? This indicates its long-term financial stability.

- Operational Efficiency: Is the company effectively utilizing its assets and resources to generate revenue?

Through analysis, investors can predict the likelihood of a company’s growth and success, thus estimating the potential return on their investments.

Qoyod Accounting Software offers the best accounting software in Saudi Arabia for accurate data collection, which is the foundation of robust financial analysis.

To understand the full financial health of your business,review our detailed financial statement reports

2. For Internal Management: The Compass for the Steering Wheel

For company management, financial analysis acts as a compass guiding the course in the sea of business. It helps managers in Saudi Arabia’s competitive market to:

- Evaluate Performance: Understand the company’s actual performance compared to set goals or competitors.

- Identify Problems and Opportunities: Reveal weaknesses such as unnecessary high costs, low-profit margins, or poor inventory management. It also uncovers opportunities for efficiency improvement or revenue growth.

- Make Strategic Decisions: Based on the results, management can make informed decisions about expansion, investment in new projects, cost reduction, pricing strategies, or operational restructuring.

- Planning and Budgeting: Financial analysis provides valuable historical data that assists in setting more realistic and accurate future financial plans and budgets. This is vital for businesses in bustling centers like Khobar and Madinah.

How to prepare an estimated budget with practical examples?

3. For Lenders and Banks: A Guarantee of Trust

Before granting a loan to a company, lenders (like banks) conduct meticulous financial analysis. Why? Because they need assurance that the company has the capacity to repay the loan and interest on time. They focus on:

- Company’s Cash Flow Generation Ability: Does the company generate enough cash from its operations to cover loan payments?

- Debt Ratios: What is the size of the company’s debt compared to its assets or equity? The higher these ratios, the greater the risk.

- Collateral: In addition to financial analysis, they look at the guarantees the company can provide.

Financial analysis minimizes risk for lenders and helps them make an informed decision about granting credit.

4. For Government and Regulatory Bodies: Compliance and Fairness

Saudi government bodies, such as the Zakat, Tax and Customs Authority (ZATCA), rely on financial analysis to ensure compliance with tax regulations and promote transparency in the Saudi market:

- Tax Compliance (Zakat and VAT): Ensuring that companies pay their Zakat and taxes correctly and in accordance with the laws, especially with the mandatory e-invoicing system in Saudi Arabia.

- Market Regulation: Monitoring the financial performance of companies in specific sectors to ensure transparency, fairness, and investor protection.

- Statistical Data Collection: Using aggregated financial data to assess the health of the macro-economy.

Conclusion: Financial Analysis – More Than Just Numbers, It’s A Vision

Financial analysis in Saudi Arabia is the key to understanding financial performance in a rapidly evolving economic environment, and an integral part of the strategies for companies and investors seeking sustained success in the local market. It’s the ability to understand the past, evaluate the present, and plan confidently for the future. In a world characterized by constant change and intense competition, financial analysis is no longer a luxury but an absolute necessity for everyone striving for success and sustainability. Are you ready to read the language of numbers and uncover the stories they tell?

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for Saudi companies.

Frequently Asked Questions (FAQ) about Financial Analysis for Saudi SMEs

What is Financial Analysis?

It's the process of examining a company's financial statements to understand performance, predict the future, and support investment or operational decisions.

Why is it important in Saudi companies?

It helps measure profitability, efficiency, liquidity, and solvency, revealing strengths and weaknesses to improve decisions in the local market.

What are the most important tools?

Income Statements, Balance Sheets, Cash Flow Statements, and financial ratios like liquidity, profitability, and debt ratios.

Who benefits from it?

Investors, management, banks, regulatory bodies (ZATCA), and suppliers all rely on financial analysis for their decisions.

Is there software to simplify it?

Yes, accounting software like Qoyod provides automated reports, or you can use readymade templates like Qoyod's simplified financial analysis template.

What is the benefit for government bodies?

It supports tax compliance, market monitoring, and ensures the transparency and fairness of the investment environment in the Kingdom.