| Final Accounts: Article Summary: A final accounts template is a key financial tool used at the end of the financial period to summarize business performance and financial position. This article explains final accounts in a simple and clear way, highlights their main components and importance, and provides a free downloadable final accounts template. |

In a world filled with economic shifts and challenges, businesses arrive at a crucial point at the close of every fiscal year, reviewing their books to assess the results of their efforts, successes, and risks. This is where the preparation of Final Accounts emerges as a pivotal tool, offering strategic leaders and managers a holistic view of their financial health. It’s more than just a report; it’s a document that narrates the story of financial performance, detailing gains, losses, and highlighting opportunities for growth and potential challenges facing the entity.

Final Accounts serve as the culmination of all financial operations conducted over a specific period, aiming to accurately and transparently display the company’s profitability and financial position. Through this process, key financial statements like the Income Statement, Balance Sheet, and Cash Flow Statement are presented, providing an integrated framework for making informed decisions that support sustainable business growth and development.

In a dynamic business environment, relying on accurately prepared Final Accounts becomes an indispensable necessity. They enable organizations to systematically evaluate their financial performance, identify strengths and weaknesses, and confidently forecast the future. Thus, the Final Accounts model acts as the compass guiding companies toward sustained financial success and institutional excellence.

Defining the Role of Final Accounts

Final Accounts (or Final Statements) are a set of financial statements and data that companies and institutions prepare at the end of a financial period. These accounts are designed to provide a clear and comprehensive picture of the entity’s financial performance during that time, accurately determining whether a profit or loss was achieved and assessing the company’s financial position.

Importance of Final Accounts for Businesses

At the end of the financial period, Final Accounts help decision-makers, managers, investors, and creditors accurately understand the entity’s financial status. They enable businesses to:

- Summarize the results of all financial transactions conducted during the year.

- Evaluate financial performance by calculating profits and losses.

- Present the financial position regarding assets, liabilities, and equity in the Balance Sheet, indicating the entity’s ability to meet its obligations and finance future activities.

- Support economic and investment decision-making based on reliable financial information.

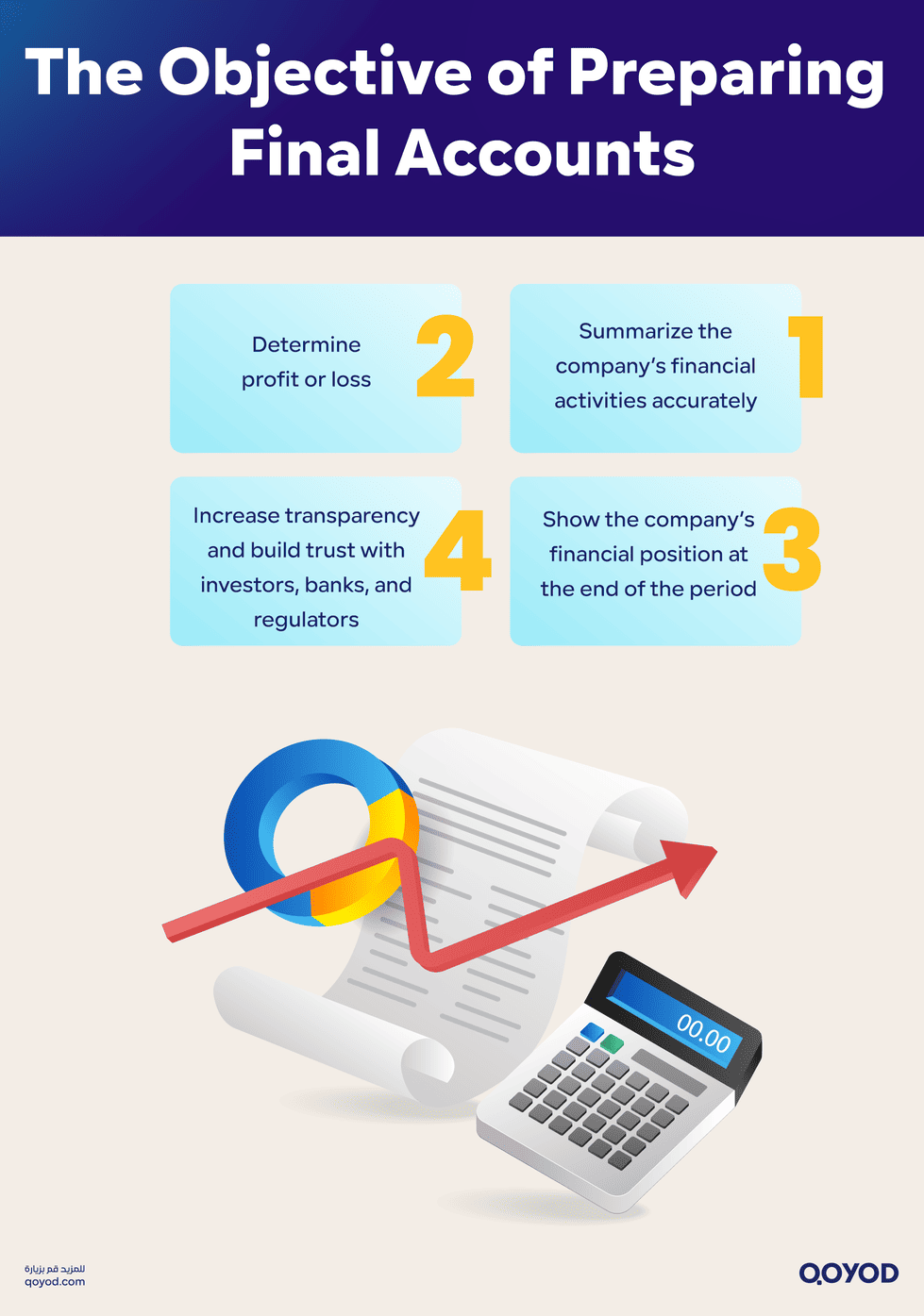

The Objective of Preparing Final Accounts

The primary objective of preparing Final Accounts is to:

- Provide an accurate summary of commercial operations and financial activities over the fiscal period.

- Evaluate the profitability or loss resulting from these operations.

- Present the Financial Position in detail to reflect the entity’s financial health and standing at the period’s end.

- Increase financial transparency, which helps build confidence among the entity and its various stakeholders, such as shareholders, banks, and regulatory bodies.

In this manner, Final Accounts are a central tool in the accounting cycle, transforming raw financial information into organized and reliable data used for decision-making and forecasting the financial future of the entity.

Free Final Account Template:Download Now

Free Final Account Template 2:Download Now

Key Components of Final Accounts

The components of Final Accounts are the foundational pillars upon which the complete financial picture of an entity is built at the end of the fiscal period. These principal elements consist of three components:

1. The Trading Account (For Gross Profit)

This account aims to determine the Gross Profit or loss resulting from sales and purchasing activities during the financial period. This is achieved by recording revenues from sales and deducting the Cost of Goods Sold (COGS), which includes the cost of purchasing goods involved in sales operations, plus any returns or discounts related to sales or purchases. The net result of this account represents the gross profit or loss before calculating other expenses.

2. The Profit and Loss Account (Income Statement)

This account takes the result of the Trading Account as its base. All operating and non-operating expenses, such as salaries, rent, administrative costs, taxes, and other expenses incurred by the entity during the period, are then deducted. After deducting these expenses from the revenues, the Net Profit or Loss appears, which determines the overall success of the business activity for that period.

Learn More: Income statement: what do you know about it?

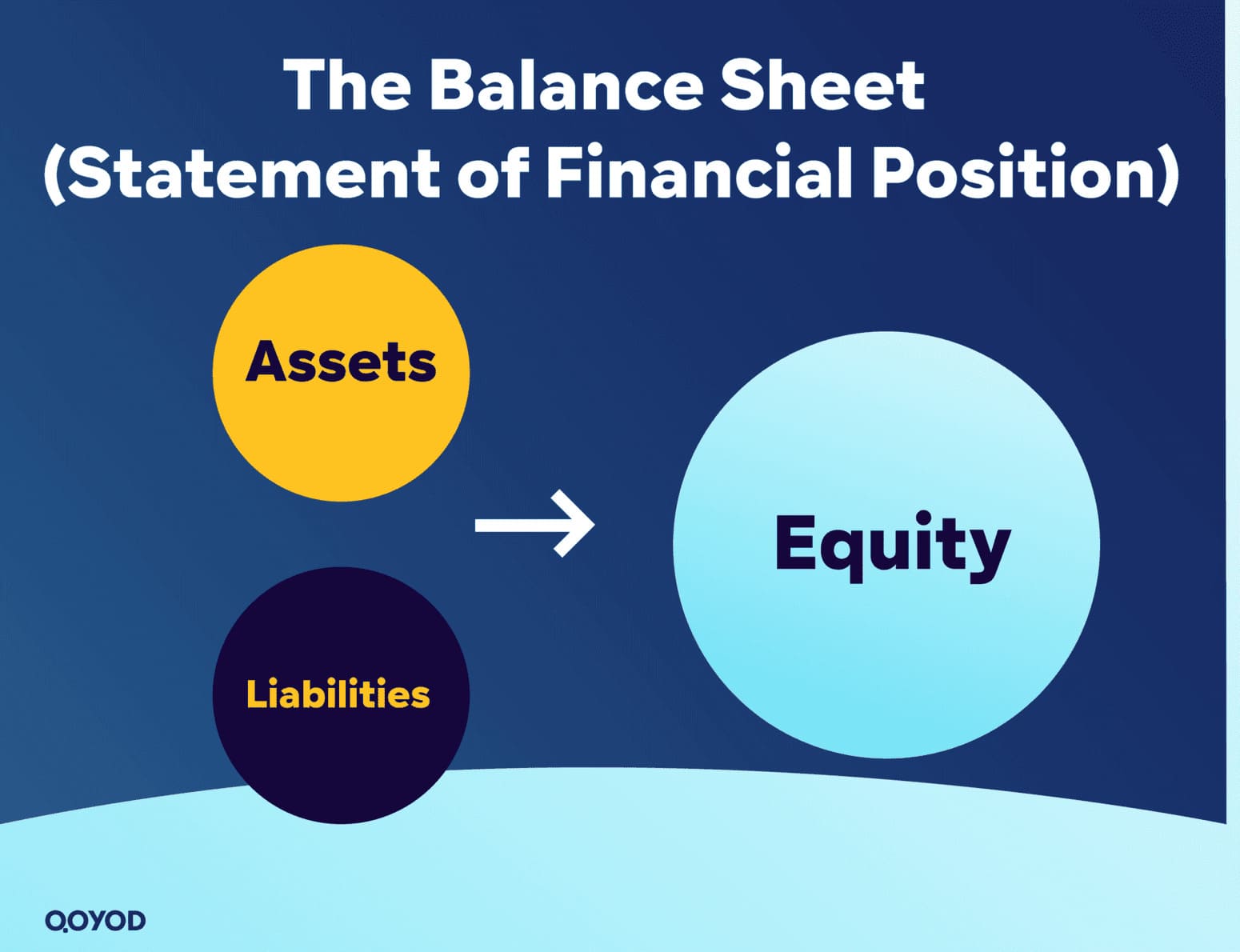

3. The Balance Sheet (Statement of Financial Position)

This statement reflects the entity’s financial position at the end of the financial period. It presents the Assets owned by the company, such as cash, accounts receivable, inventory, and property and equipment. On the other side, it displays Liabilities, which represent the entity’s obligations and debts owed to others, such as accounts payable and loans. Additionally, it shows Equity, which represents funds invested by the owners and retained earnings not yet distributed to shareholders. The Balance Sheet comprehensively clarifies the entity’s financial standing and its ability to meet its obligations and maintain financial stability.

These elements integrate to provide a complete and accurate vision of the entity’s financial performance and position, helping decision-makers evaluate the current situation and establish appropriate plans for growth and development.

How to Prepare Final Accounts

The preparation of Final Accounts is a crucial stage in the accounting cycle, reflecting an entity’s financial results over a specific period.

Detailed Steps in the Preparation Process

- Recording Daily Entries: All financial transactions are accurately logged in the General Journal according to generally accepted accounting principles (GAAP/IFRS).

- Posting to the Ledger: These entries are then transferred (posted) to the General Ledger, which shows the details of each individual account—revenues, expenses, assets, and liabilities.

- Preparing the Trial Balance: This step verifies that the total debit balances equal the total credit balances for all accounts, correcting any errors that may surface.

- Preparing Trading and P&L Accounts: After data verification, the Trading Account is prepared to determine the Gross Profit/Loss, followed by the Profit and Loss Account, where operating and non-operating expenses are deducted from revenues to arrive at the Net Profit/Loss.

- Preparing the Balance Sheet: In the final stage, the Balance Sheet is prepared, reflecting the entity’s financial position: Assets (what the company owns), Liabilities (its obligations), and Equity (the owners’ stake).

- Closing Entries: Temporary accounts, such as the Trading and Profit and Loss Accounts (Revenues and Expenses), are closed, and the net profit or loss is transferred to the Capital or Retained Earnings account.

All these steps are conducted in accordance with internationally accepted accounting principles, ensuring compliance with local standards and financial regulations to guarantee the accuracy and reliability of the Final Accounts used for the entity’s financial and strategic decision-making.

Free Final Account Template:Download Now

The Role of Final Accounts in Financial Analysis

Final Accounts are among the most important tools in financial analysis, playing a vital role in presenting a clear and comprehensive picture of any entity’s financial performance over a specific period.

-

Enhancing Efficiency and Profitability

These accounts assist in detailed analysis of revenues and expenses, enabling the identification of strengths and weaknesses in operational processes. By understanding sources of revenue and areas of expenditure, management can focus on the most profitable segments and reduce unnecessary costs, thereby enhancing business efficiency and profitability.

-

Evaluating Performance and Growth

Final Accounts contribute to assessing the entity’s financial performance by revealing the net profit or loss, allowing for a precise understanding of the company’s ability to achieve its financial goals. This evaluation empowers decision-makers to take corrective or reinforcing actions based on actual performance data.

Furthermore, Final Accounts provide a crucial tool for comparing financial performance across different time periods, aiding in tracking the entity’s progress and growth over time. They are also used to compare performance with other companies in the same sector, contributing to the assessment of the entity’s market standing and competitiveness.

Consequently, Final Accounts are the fundamental pillar upon which accurate financial analyses are built. Without them, it would be difficult for managers and investors to make informed strategic decisions that ensure business sustainability and future growth.

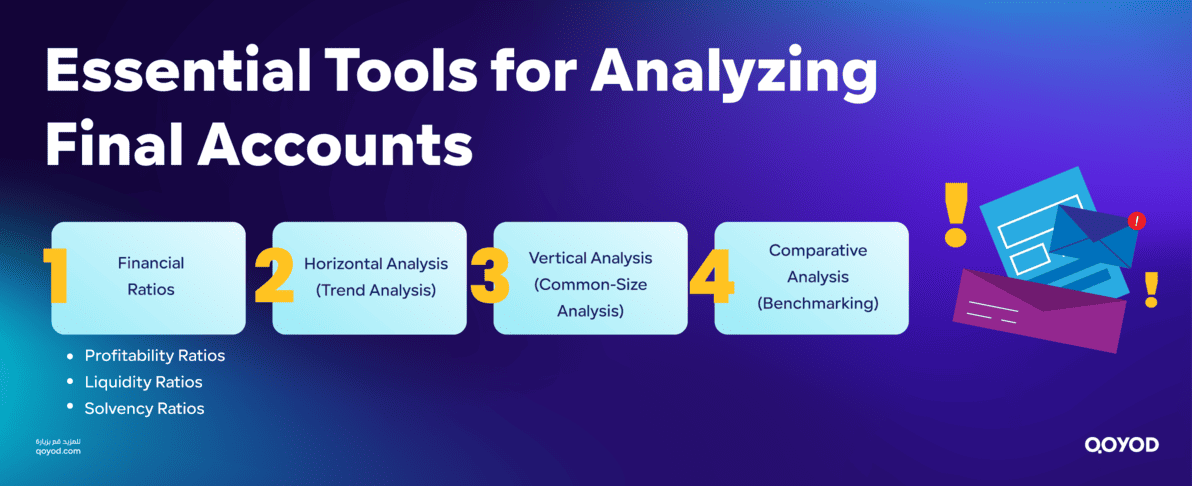

Essential Tools for Analyzing Final Accounts

Analyzing Final Accounts relies on a set of financial tools that help convert financial figures into easily understandable metrics, providing management and investors with a deeper comprehension of the entity’s financial status. The most important of these tools include:

1. Financial Ratios

Financial Ratios are specialized numerical tools calculated from Final Accounts data to provide clear indicators about specific aspects of an entity’s financial performance. Key types include:

- Profitability Ratios:

- Gross Profit Margin: Compares gross profit (Sales minus COGS) to net sales, helping assess operational efficiency and cost control.

- Net Profit Margin: Measures the percentage of net profit from total sales, giving a complete picture of profitability after all expenses.

- Return on Assets (ROA): Indicates how effectively the company utilizes its assets to generate profit.

- Liquidity Ratios:

- Current Ratio: Calculated by dividing current assets by current liabilities, indicating the company’s ability to cover its short-term obligations using available resources.

- Quick Ratio (Acid-Test): Similar to the Current Ratio but excludes inventory, offering a more conservative view of the ability to meet urgent liabilities with near-cash resources.

- Solvency Ratios:

- Debt to Equity Ratio: Measures the company’s reliance on debt financing compared to equity, with a higher ratio indicating increased financial risk.

- Interest Coverage Ratio: Measures the ability to cover interest expenses from operating profits, impacting relationships with lenders and banks.

2. Horizontal Analysis (Trend Analysis)

Horizontal Analysis is a technique that compares the financial line items of the same entity across multiple time periods (years, quarters, months). The percentage change is calculated for each item, such as revenue, expenses, or assets. The benefits of this analysis include:

- Identifying Trends: Such as monitoring growth or decline in revenue and expenses.

- Discovering Patterns: Like seasonal increases in sales or specific costs.

- Evaluating Management Decisions: By tracking the impact of changes in financial or operational policies over time.

- Early Problem Recognition: Sudden spikes or noticeable declines may signal the need for intervention or change.

3. Vertical Analysis (Common-Size Analysis)

Vertical Analysis involves converting every financial element in a statement into a percentage of a base figure within the same statement (e.g., the percentage of each operating expense item relative to total sales, or each asset relative to total assets on the Balance Sheet). Its advantages include:

- Facilitating Comparison between companies regardless of size difference, as every item is expressed as a percentage of the total.

- Highlighting Disproportion or the relative dominance of certain items (e.g., advertising expenses or the percentage of debt to assets).

- Supporting Horizontal Analysis: When combined with data from previous years, structural changes become clear.

4. Comparative Analysis (Benchmarking)

Comparative Analysis aims to benchmark the entity’s financial performance against others in the same sector or against industry averages. Its goals are to:

- Discover Competitive Differences and exceptional strengths or weaknesses within the entity.

- Determine if company performance is above or below the market average for profitability or risk indicators.

- Support investor and lender reports in making informed investment or financing decisions.

- Enhance management policies by adopting best practices prevalent in the markets.

These tools are fundamentally used to analyze year-end accounts and financial performance, as they provide a comprehensive view of business methodology and efficiency, supporting corporate strategic planning and the development of market competitiveness.

Top FAQs on Final Accounts from Qoyod

What are Final Accounts?

Final Accounts are financial reports prepared at the end of the fiscal year to summarize the entity’s business results. They include the Trading Account, Profit and Loss Account, and Balance Sheet, reflecting the financial position and profitable performance over the period.

What is the difference between Final Accounts and Financial Statements?

Final Accounts focus on determining profit, loss, and the financial position, while Financial Statements encompass broader details such as Cash Flow Statements and accounting notes/disclosures, typically adhering to standards like IFRS.

How are Final Accounts prepared?

It starts by posting journal entries to the General Ledger, preparing the Trial Balance, closing temporary accounts (revenues and expenses), and then preparing the Final Accounts and the Balance Sheet.

What is the importance of the Trading Account in Final Accounts?

It determines the gross profit or loss resulting from buying and selling operations, serving as the basis for assessing operational performance.

How is the Profit and Loss Account used?

It shows the net profit or loss after deducting all expenses from revenues, reflecting the entity's final profitability.

What is the goal of preparing the Balance Sheet?

It presents the company's financial position in terms of assets, liabilities, and equity at the end of the period, demonstrating the entity's ability to meet its obligations.

Conclusion: Simplify Your Final Accounts with Qoyod

In conclusion, preparing Final Accounts is one of the most critical steps any business must undertake at the end of a financial period to accurately assess financial performance and make decisions based on clear, reliable data.

Within Qoyod Accounting Software, this process is made easy and smooth through an advanced user interface that ensures accurate recording of accounting entries and the preparation of financial reports quickly and systematically, with full commitment to local and international accounting standards.

Using Qoyod, business owners can manage sales, purchases, inventory, monitor profits and losses, and analyze the financial position efficiently. This enhances the ability to plan for the future and make strategic decisions confidently. Thus, Qoyod Accounting Software is a vital, indispensable tool in the journey of digital accounting transformation, saving time and effort, and minimizing human errors.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.