| Expert Excerpt :Taxation is a core financial component that sustains government operations and societal welfare. This guide offers essential insights into tax types and their purpose, helping SMEs achieve legal compliance and financial accuracy. |

Taxation stands as a cornerstone of government finance, enabling the provision of essential public services and infrastructure. For small and medium-sized businesses (SMEs), managing tax obligations accurately is vital. Taxes are not just a financial burden; they are a long-term investment in national infrastructure, attracting investment, and fostering economic equilibrium across society.

In this comprehensive guide, we will explore the fundamental concepts of taxes, delve into the various categoriesincluding corporate income tax and e-invoicing-related taxes like VAT, who bears the responsibility of payment, and the strategic reasons behind government taxation policies worldwide.

What is Taxation?

A tax is a compulsory financial charge imposed by a governmental organization upon individuals or businesses to fund public expenditures. These funds are typically allocated to provide essential public services that form the bedrock of societal well-being, such as education, healthcare, infrastructure development, and public safety.

Many countries, in line with global economic diversification goals, have increasingly relied on expanding their tax bases, often including the introduction or adjustment of taxes like the Value-Added Tax (VAT), to reduce dependency on volatile sources and ensure financial sustainability.

Example: The global trend towards implementing or increasing VAT (or GST) on goods and services, often facilitated by mandatory e-invoicing systems, showcases how governments use taxation to expand non-oil or non-commodity-based revenue streams. Businesses must use compliant cloud accounting systems to handle these complex calculations.

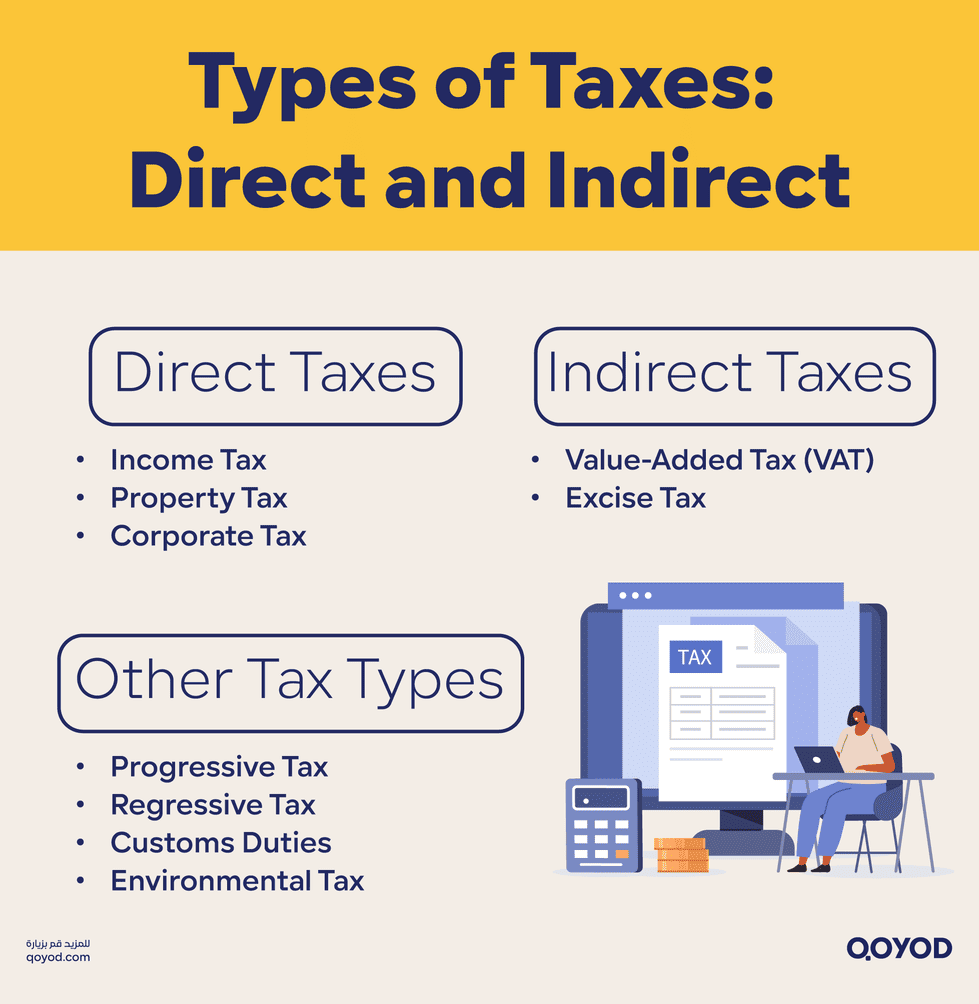

Types of Taxes: Direct and Indirect

Tax systems around the world categorize taxes based on how they are collected and who directly bears the cost. Understanding these distinctions is crucial for SME financial planning.

1. Direct Taxes

Direct taxes are levied directly on an individual’s or company’s income, profits, or wealth.

- Income Tax: Levied on personal income or the revenue of a business. This is one of the most widespread forms of taxation, collected on earnings from employment or commercial activities.

- Property Tax: Imposed on real estate assets, such as land and buildings. Owners are typically required to pay this tax based on the market or assessed value of the property.

- Corporate Tax (or Corporate Income Tax): Taxes imposed by governments on a company’s profits. The percentage varies significantly by country based on economic and fiscal policies. Accurately tracking taxable profit requires reliable business accounting software.

2. Indirect Taxes

Indirect taxes are levied on goods and services rather than directly on income. They are typically collected by the seller (business) and passed on to the government.

- Value-Added Tax (VAT) / Goods and Services Tax (GST): A consumption tax added to the value of goods and services at each stage of production and distribution. Consumers pay this tax when purchasing products, while businesses collect it and remit it to the government. This is a globally recognized form of indirect tax and often requires specific e-invoicing software capabilities.

- Excise Taxes (Specific Consumption Taxes): Taxes levied on specific goods, often those deemed harmful or luxurious (e.g., tobacco, sugary drinks, fuel).

3. Other Tax Classifications

- Progressive Taxes: Tax rates increase as the taxable income increases, aiming to achieve greater social equity.

- Regressive Taxes: Tax rates decrease as income increases. While often not applied directly to income, examples can be found in flat-rate fees or consumption taxes (like sales tax) that consume a larger proportion of low-income earners’ budgets.

- Customs Duties (Tariffs): Taxes imposed on goods imported from foreign countries. Their purpose is to regulate international trade and often protect domestic production by making imported goods more expensive.

- Environmental Taxes (Green Taxes): Levied to protect the environment and mitigate pollution resulting from industrial or commercial activities (e.g., carbon emissions taxes or taxes on excessive use of natural resources).

Who Pays Taxes? Global Payer Categories

The responsibility for paying taxes falls into several primary categories, which often overlap in practice due to indirect taxation.

| Payer Category | Description | Relevance for SMEs |

| Individuals | Pay taxes on their income or wealth. Although direct income taxes on individuals may vary by country (some may have low or zero personal income tax), individuals are invariably subject to indirect taxes like VAT on their consumption of goods and services. | Individual business owners need to manage their personal tax obligations and VAT/GST paid on business purchases. |

| Corporations / Businesses | Companies, both domestic and international, operating within a jurisdiction are typically subject to Corporate Income Tax on their net profits. They are also responsible for collecting and remitting indirect taxes (like VAT/GST) and payroll taxes. | SMEs must accurately track profits, expenses, and VAT liabilities using compliant accounting software like Qoyod. |

| Local Authorities | While central governments impose major taxes, local or municipal authorities may levy additional charges (e.g., business license fees, property rates, or service fees) that businesses must pay. | These local fees must be tracked as part of a business’s operational expenses. |

Why Do Governments Impose Taxes?

The necessity of taxation stems from multiple national, economic, and social objectives.

- Funding Public Services: The primary reason is to finance the public services and facilities essential for national welfare and business operations (e.g., healthcare, education, defense, infrastructure).

- Achieving Social Equity: Taxes can be a tool for achieving social equity. Through progressive tax structures, higher-income individuals and businesses contribute a proportionally larger share, aiding in wealth redistribution.

- Influencing Behavior: Taxes can be used to influence the behavior of individuals and companies.

Example: Excise taxes on harmful products (like tobacco or soft drinks) are used to discourage consumption and improve public health, which can reduce future healthcare costs.

- Market Regulation and Economic Stability: Taxation contributes to market regulation and economic stability. Tax policy (e.g., adjusting corporate tax rates or customs duties) can be used as a fiscal tool to control inflation, manage demand, and balance the economy.

Key Challenges Related to Taxation for SMEs

Managing taxes presents several challenges that businesses, particularly SMEs, must address.

- Tax Evasion and Avoidance: Some entities attempt to illegally or exploitatively reduce their tax burden, which diminishes government revenues and compromises the principle of fairness.

- Perceived Tax Inequity: If tax systems are viewed as unfair (e.g., disproportionate burdens on specific sectors or income levels), it can lead to public discontent and reduced compliance.

- Impact on Economic Growth: Overly high corporate or personal tax rates can potentially discourage investment, reduce competitiveness, or drive businesses to relocate, negatively impacting overall economic growth.

Navigating Tax Impact: A Simplified Overview

Accurate tracking of various tax types is essential. A unified cloud accounting system is indispensable for global tax compliance.

| Type of Tax | Impact on Individuals | Impact on Businesses (SMEs) | General Economic Impact |

| VAT/GST | Increases the cost of living by raising prices on goods/services. | Increases production costs, often leading to higher consumer prices; requires complex collection/remittance. | Encourages revenue diversification for governments; often linked to e-invoicing mandates. |

| Corporate Tax | Indirectly affects prices or service quality if passed onto consumers. | Reduces net profits, potentially impacting investment, expansion, and hiring decisions. | Encourages corporate efficiency; provides a substantial source of public funding. |

| Customs Duties | Increases prices for imported goods, affecting consumer purchasing power. | Increases the cost of importing raw materials or finished goods, leading to higher consumer prices. | Protects and encourages domestic industries; regulates international trade balances. |

Read Also:What is corporate accounting?

Conclusion: Ensuring Compliance with Qoyod

Taxation is a fundamental pillar of any functioning economy, providing the resources necessary for societal progress. From Corporate Income Tax to the globally pervasive VAT, taxes are a legal and economic commitment. Failure to comply can result in significant fines and legal action. For SMEs, navigating these obligations efficiently is crucial for focusing on core business operations.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses. By automating compliance and simplifying your financial records, Qoyod helps your SME stay on top of all global taxation requirements, including those related to e-invoicing and reporting.

Frequently Asked Questions (FAQ)

What is a tax and why is it imposed?

A tax is a compulsory financial charge imposed by government on individuals and businesses to fund public spending, such as education, healthcare, infrastructure, and public safety. Taxes are not only a cost; they are also an investment in the infrastructure and services that economies and businesses rely on.

Why do governments impose taxes?

Governments impose taxes in order to:

Fund public services (roads, hospitals, schools, security).

Promote social equity through progressive taxation where higher-income groups pay a higher rate.

Influence behavior, for example via higher taxes on harmful products such as tobacco (excise taxes).

Support economic stability by adjusting tax policies to manage inflation, demand, and investment.

What is the difference between direct and indirect taxes?

Direct taxes are charged directly on income, profits, or wealth (e.g., personal income tax, corporate income tax). The taxpayer pays them straight to the government.

Indirect taxes are charged on goods and services (e.g., VAT/GST, excise taxes). Businesses collect the tax from customers and remit it to the government, while the final consumer ultimately bears the cost.

What is Value-Added Tax (VAT) and how does it apply to SMEs?

VAT is an indirect consumption tax charged on the value added at each stage of the supply chain.The business charges output VAT on sales.

It deducts input VAT paid on purchases.

The difference is paid to or reclaimed from the tax authority.

For SMEs, VAT usually becomes mandatory once turnover exceeds a specific registration threshold (which varies by country). Registered SMEs must issue compliant (often e-invoicing) VAT invoices and file VAT returns periodically.

Is VAT a real cost to the business or to the customer?

In theory, VAT is borne by the final consumer, while the business acts as a collection agent for the government. However, businesses still face indirect costs, such as system upgrades, compliance work, and potential cash-flow pressure if customers pay late.

What is Corporate Income Tax and how does it affect SMEs?

Corporate Income Tax is a tax on a company’s net profit after deducting allowable business expenses. The basic formula is:

Corporate tax = (Revenue – tax-deductible expenses) × corporate tax rate.

For SMEs, this tax directly reduces the profit available for reinvestment or dividends, so accurate bookkeeping and expense tracking are critical.

How can a small business roughly calculate its main tax obligations?

Very simply:

Corporate Income Tax:

Net profit = total revenue – allowable operating expenses.

Apply the local corporate tax rate to this profit.

VAT/GST:

Sum VAT charged on sales (output VAT).

Subtract VAT paid on purchases (input VAT).

Pay the difference to the tax authority or reclaim it.

Types of Taxes and How to Calcu…

Always check local laws and rates or consult a tax professional, since details and percentages differ by country.