| Expert Summary

E-invoicing is a foundational element for the digital transformation of the global property management sector. It enhances transparency, reduces human error, and is critical for modern tax compliance, with cloud accounting systems like Qoyod supporting smart, sophisticated financial management. |

In the midst of rapid digital transformation worldwide, e-invoicing has become a fundamental pillar for enhancing commercial and administrative operations across various sectors, including property management and real estate. An e-invoice is an electronic financial document issued, transmitted, and stored in a structured digital format, containing all the required information for tax invoices, thereby ensuring its accuracy and legal legitimacy.

The importance of e-invoicing in the property and real estate sector stems from its inherent complexity, which involves diverse financial operations such as issuing rent invoices, service charges, maintenance fees, and various administrative tasks. Utilizing an e-invoicing system allows for the acceleration of the issuance and processing cycle, significantly reducing the time and effort expended compared to traditional paper-based systems.

Furthermore, e-invoicing in real estate enhances data accuracy and minimizes human errors resulting from manual entry, which is critical when dealing with numerous contracts and financial amounts. This technology provides greater transparency in transactions, helping to build stronger trust between all involved parties, whether they are property owners, tenants, or management companies.

From a regulatory standpoint, using e-invoicing helps bolster tax compliance globally. For instance, in many jurisdictions, including Saudi Arabia (under ZATCA requirements), businesses must adopt e-invoicing, reducing the risks associated with tax evasion and transaction manipulation.

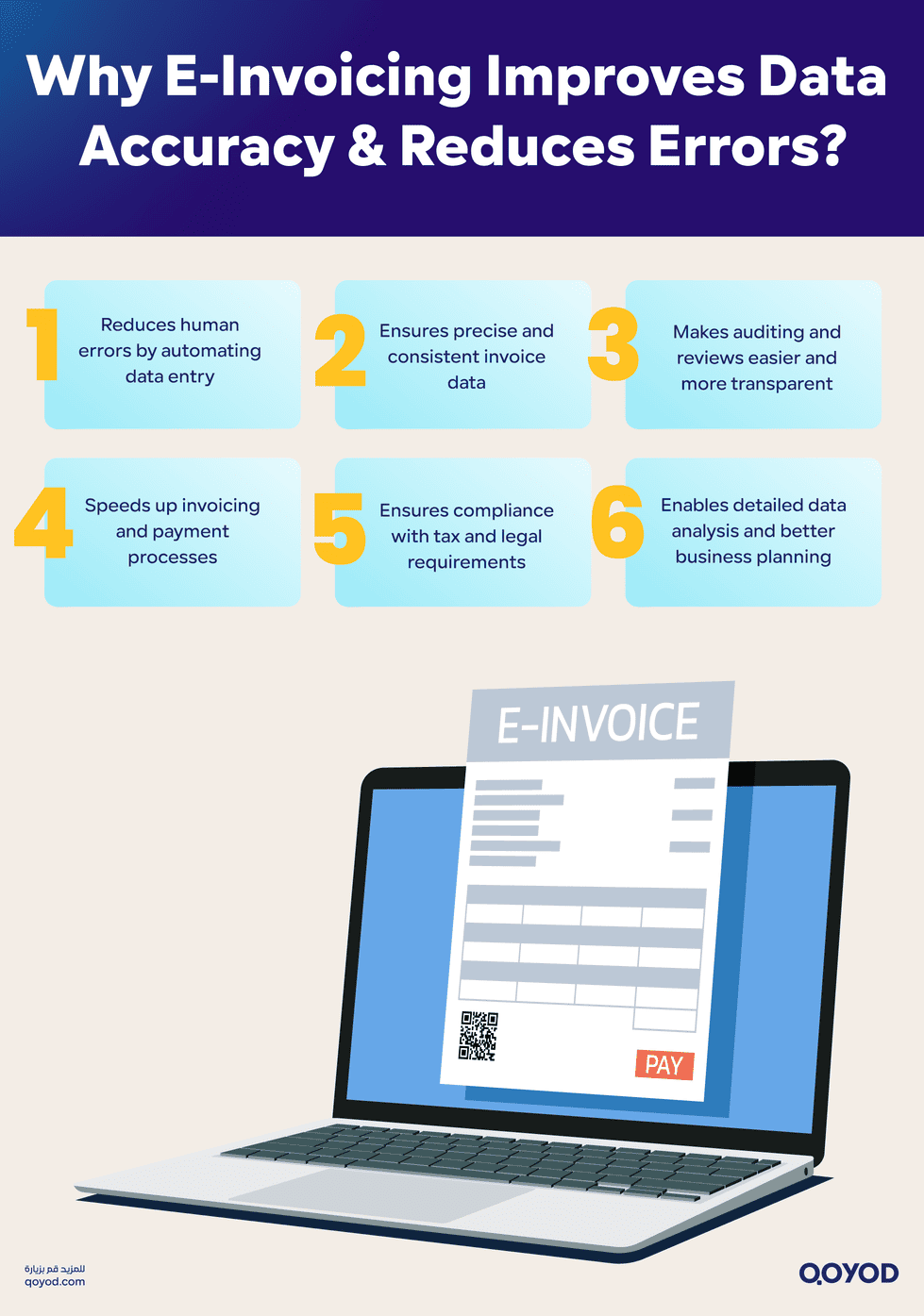

The Role of E-Invoicing in Improving Data Accuracy and Reducing Errors

E-invoicing plays a vital role in promoting data accuracy and reducing errors in financial operations,an essential capability, especially within the property management sector, which is characterized by complexity and a high volume of transactions and stakeholders. The significance of this technology lies in several key aspects:

1. Minimizing Human Error

- Reliance on digital systems limits errors caused by manual data input, which can include mistakes in recording amounts, taxes, or dates.

- The electronic system allows data to be entered once and then automatically replicated in all related invoices, reducing the chance of oversight or unintentional duplication.

2. Increasing Data Precision

- E-invoices contain structured and accurate data, automatically generated by the system, ensuring the information aligns perfectly with the original data for real estate transactions, such as lease agreements or maintenance and sales operations.

- Reducing reliance on paper documents mitigates the risk of damage, manipulation, or duplication in data recording.

3. Streamlining Review and Auditing Processes

- Digitally stored data is easier to review and audit by internal and external regulatory bodies, enhancing transparency and reducing the possibility of fraud or tax evasion.

- The ability to track operations electronically in real-time allows for the rapid and effective detection of any manipulation or error.

4. Accelerating Operations and Reducing Time

- Electronic issuance and documentation of invoices speed up the invoicing, payment reminder, and follow-up processes, significantly boosting operational efficiency.

- The need for manual archiving or searching for old documents is reduced, as everything is stored securely and systematically in a central system.

5. Ensuring Legal and Tax Compliance

- E-invoicing systems help real estate firms adhere completely to national tax regulations (e.g., ZATCA in Saudi Arabia, global VAT/GST rules), ensuring the issuance of invoices that comply with all legal requirements, thus minimizing legal errors or resulting consequences.

6. Data Analysis and Improved Planning

- Digital data allows for the generation of detailed reports and analytics, contributing to the monitoring of revenues, expenses, property performance, and market trends. This supports improved decision-making and future planning.

By adopting e-invoicing, many problems related to manual errors and data discrepancies are eliminated, enhancing accuracy, transparency, and efficiency, especially in the complex real estate management sector. This is necessary to keep pace with market demands and sustainable development aspirations.

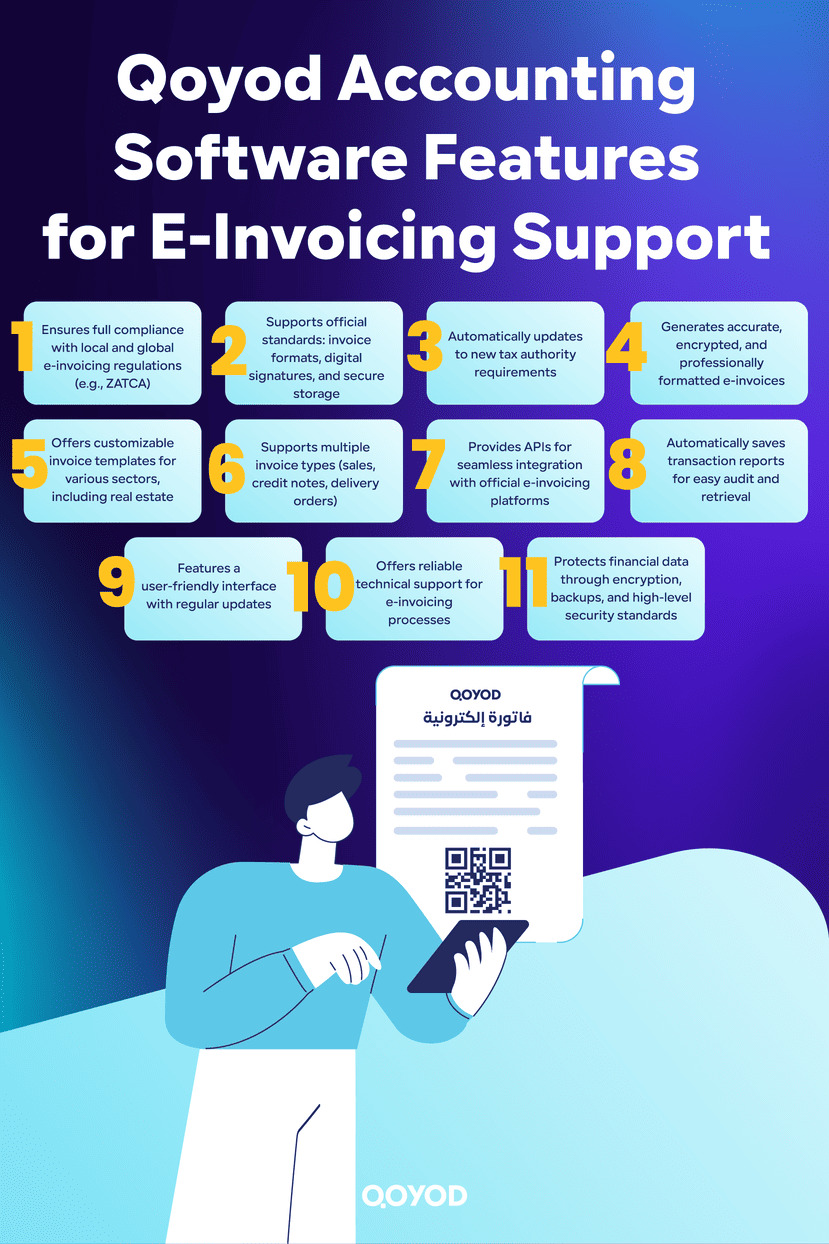

Qoyod Accounting Software Features for E-Invoicing Support

Qoyod Accounting Software offers integrated support for e-invoicing, ensuring full compatibility with the requirements of relevant tax authorities, such as ZATCA in Saudi Arabia. This makes it an ideal solution for SMBs globally seeking to achieve tax and administrative compliance with high efficiency.

1. Full Regulatory Compliance

- Qoyod is designed to align with official digital invoicing platforms, allowing for the issuance of e-invoices that are fully compatible with local and global regulations and legislation.

- The software adheres to all standards regarding the design, transmission, and storage of e-invoices, including invoice formats, digital signatures, and record-keeping requirements.

- The program continuously tracks updates from tax authorities and automatically implements new conditions, shielding users from legal issues or penalties due to non-compliance.

2. Accurate and Professional E-Invoice Issuance

- Full support for creating automatic e-invoices linked to financial operations, with the ability to customize invoices to suit different sectors (e.g., property management and real estate).

- Invoices issued by Qoyod are encrypted and digitally signed, ensuring their credibility and data integrity, fostering trust between transacting parties.

- The ability to issue multiple types of invoices, such as sales invoices, credit notes, and delivery orders, covering all necessary accounting and commercial scenarios.

3. Seamless Platform Integration

- The software is equipped with Application Programming Interfaces (APIs) that allow for instant and direct communication with official e-invoicing platforms to ensure timely data flow and submission.

- Reports and receipts for transactions are automatically saved within the system, ensuring they can be retrieved at any time for review and auditing purposes.

4. Ease of Use and Continuous Updates

- Regular software updates include enhancements related to compatibility with new and smart e-invoicing requirements.

- A user-friendly interface allows users to manage e-invoices with ease and speed, without requiring deep technical expertise.

- Technical customer support assists businesses in overcoming challenges related to the e-invoicing process.

5. Data Security and Preservation

- Qoyod provides a secure environment for saving invoice data and accounting operations, in line with international cybersecurity and privacy standards.

- Backup and encryption processes ensure data protection from loss or manipulation.

Qoyod’s full compliance feature makes it a reliable choice for businesses, ensuring continued legal alignment, reducing financial and administrative risks, while offering a robust and flexible e-invoicing system that constantly adapts to legislative developments without complexity or interruption.

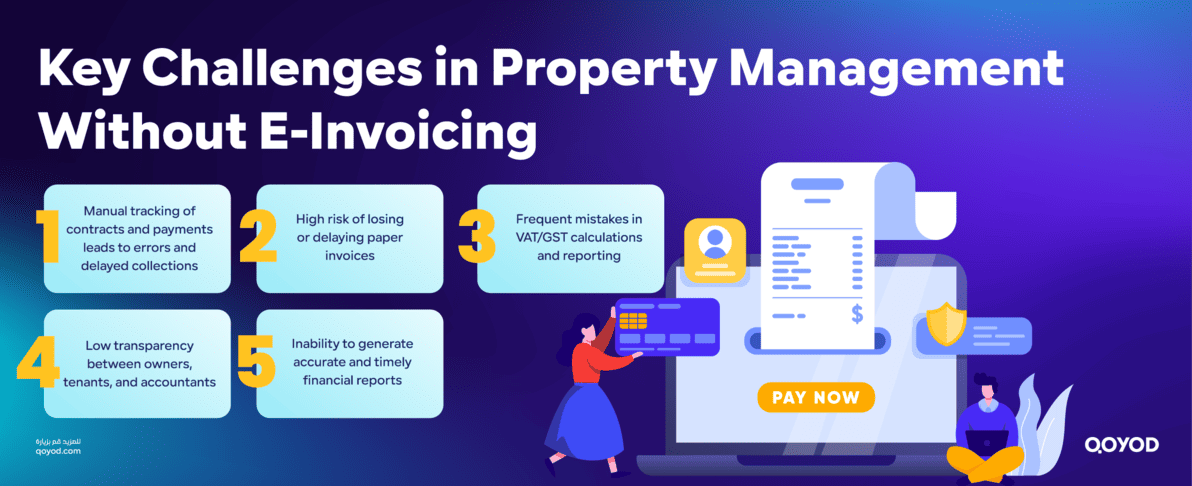

Challenges in Property Management Without E-Invoicing

The property management and real estate sector is one of the most financially and administratively complex, given the multitude of parties and the variety of daily operations involving contracts, revenues, expenses, and tax obligations. As property portfolios expand, managing this system manually becomes incredibly difficult, especially when businesses lack a unified system linking operational and accounting processes.

1. Multiplicity of Stakeholders and Difficult Manual Tracking

Real estate firms often deal with dozens, or even hundreds, of diverse contracts, varying in value, payment method, and collection periods. This variety makes manual tracking,using spreadsheets or traditional registers,an exhausting process that lacks data accuracy. The result is a loss of control over cash flows and an increase in arrears, particularly when managing multi-city or multi-owner portfolios.

2. Delays or Loss of Paper Invoices

Reliance on traditional paper invoices involves a long cycle of preparation, printing, signing, and delivery. These steps often lead to collection delays, especially if invoices are sent by mail or delivered manually. Lost or late invoices confuse tenants and delay payments. The absence of an official invoice copy can lead to disputes. Over time, unpaid invoices accumulate, directly impacting the cash flow cycle.

3. Issues Related to Tax Reconciliation and VAT/GST Calculation

In the real estate sector, the application of Value Added Tax (VAT) or Goods and Services Tax (GST) often varies based on the asset type, contract nature, and service provided. This complexity makes manual tax calculation prone to errors, especially with credit/debit notes and contract amendments. Any slight mistake in tax calculation or reporting can lead to financial differences and fines from tax authorities.

4. Lack of Transparency Among Owner, Tenant, and Accountant

When operations are managed manually or haphazardly, document versions multiply and figures differ between parties. This ambiguity leads to a loss of trust and frequent disputes. Accountants often spend hours clarifying discrepancies or gathering documents to prove the accuracy of figures, reducing their operational efficiency and delaying core business activities.

5. Difficulty in Extracting Accurate Financial Reports for Decision-Makers

Senior management requires a clear view of financial performance, occupancy rates, monthly returns, and collection rates. However, the lack of integration between property management and accounting systems leads to delayed or inaccurate reports. This affects strategic decisions like expanding into new projects or adjusting pricing policies.

This data scattering, reliance on manual operations, and weak system integration lead to slow collections, errors in tax reports, lack of transparency, and delayed strategic decisions. Hence, the urgent need for a shift to e-invoicing, which provides a radical solution by automating issuance, linking contracts to the accounting system, and unifying the format in a transparent and secure digital environment.

Learn More About: Real Estate Accounting Software

FAQ: E-Invoicing in Property Management

What is E-Invoicing?

E-invoicing is a digital financial document issued, transmitted, and stored electronically in a structured format approved by relevant tax authorities (e.g., ZATCA). It contains all traditional invoice data (supplier, beneficiary, amount, VAT/GST) but is generated from an electronic system. It is a legal replacement for paper invoices, digitally signed for authenticity, aiming to simplify tax procedures, increase collection efficiency, and achieve full transparency.

Why is E-Invoicing Important in Property Management and Real Estate?

This sector involves recurring and complex contracts, revenues, and expenses (rents, maintenance, services). E-invoices automate these operations and prevent errors from manual entry. They ensure timely invoice issuance, link directly to contracts, facilitate financial tracking, and enhance transparency among owner, tenant, and management company, reducing financial disputes.

What are the Main Challenges for Real Estate Firms Without E-Invoicing?

Key challenges include delays in invoice issuance, lost documents, weak control over cash flows, and difficulty reconciling tax data. Companies relying on paper systems also face issues tracking dues and expenses and are vulnerable to human errors in recording amounts and taxes. These gaps diminish client trust and increase the likelihood of tax penalties due to incomplete compliance.

How Does E-Invoicing Improve Financial Data Accuracy?

E-invoices are automatically generated and stored systematically by the accounting system, eliminating the need for repeated manual data entry. This reduces the probability of errors in figures, dates, or tax percentages. The system links each invoice to its original contract or transaction, ensuring complete consistency between accounting data and real-world operations, leading to accurate financial reports and more informed managerial decisions.

How Do E-Invoices Speed Up Financial Collection?

By automating invoice issuance and sending them instantly to tenants or clients, delays are minimized, improving cash flow. The system allows for automatic payment reminders and links the invoice to electronic payment gateways, making the payment process faster and easier. Companies can also track invoice status in real-time (paid, overdue, under review), enhancing collection control and reducing bad debts.

What is the Relationship Between E-Invoicing and Tax Compliance?

It is a direct relationship, as many tax authorities mandate electronic invoice issuance through integrated systems. This linkage ensures accurate VAT/GST calculation and prevents fraud or incorrect invoicing. It also allows authorities to monitor commercial operations in real-time, reducing tax evasion. Compliance through e-invoicing protects companies from fines and raises transparency and credibility.

In Conclusion

E-invoicing is no longer just a modern accounting tool; it has become an essential pillar for developing the efficiency of the property management and real estate sector globally. It represents a strategic step toward complete digital transformation by enhancing transparency, accelerating financial operations, and improving tax compliance.

Adopting e-invoicing in the real estate sector is not limited to reducing errors or facilitating collection; it contributes to building a reliable digital financial environment that enables owners, tenants, and companies to manage their transactions with confidence and smoothness. It is a comprehensive shift in the work method, laying the foundation for a more efficient and sustainable future.

With advanced accounting solutions like Qoyod Accounting Software, businesses can easily manage their e-invoices and fully comply with regulatory requirements without technical complexities or regulatory risks. The transition to e-invoicing today is not an option but a necessity to remain competitive in a real estate market steadily moving toward a digital future.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.