| Excerpt:

Accrual accounting is critical for financial accuracy. This analysis clarifies Accrued and Deferred items, ensuring your company’s statements reflect true economic reality, facilitating effective SME financial management. |

Accurate financial reporting is the bedrock of sustainable growth for any entity, especially for Small and Medium-sized Enterprises (SMEs). To achieve this accuracy, one must move beyond mere cash flow tracking and address the challenge of reconciling the timing of cash movement with the actual timing of the underlying economic event. This is where the concepts of Accrued and Deferred Expenses and Revenues become critically important.

Failure to make necessary adjustments leads to the overstatement or understatement of profits, assets, and liabilities. This misrepresentation distorts the true financial picture of the entity and hinders sound decision-making.

This analysis systematically explains the four fundamental concepts: Prepaid Expenses, Unearned Revenue, Accrued Expenses, and Accrued Revenue. We will emphasize their vital role in ensuring compliance with the Accrual Basis of Accounting and the Matching Principle, and demonstrate how modern cloud solutions like Qoyod Accounting Software.

Accounting Foundations: Cash Versus Accrual Basis

To fully grasp the necessity of accruals and deferrals, the difference between the two primary accounting methods must be established.

1.1 Cash Basis Accounting

- Definition: Revenue is recorded only when cash is physically received, and expenses are recorded only when cash is actually paid.

- Limitation: This method fails to reflect a company’s true economic performance or consumption of resources during a specific period. For instance, a significant cash payment received in December for services to be delivered over the following months would incorrectly inflate December’s reported revenue.

- Usage: Primarily utilized by micro-businesses or for specific tax reporting. However, it is not compliant with global financial reporting standards (IFRS/GAAP) for meaningful external reporting.

1.2 Accrual Basis of Accounting (The Global Standard)

- Definition: Revenue is recognized when it is earned (service delivered, goods shipped), and expenses are recognized when they are incurred (service used, cost consumed), irrespective of when cash is exchanged.

- Compliance: The Accrual Basis of Accounting is mandatory for meaningful financial reporting globally and is the standard required by IFRS and GAAP, ensuring comparability and transparency.

- The Matching Principle: This principle mandates that expenses must be recorded in the same period as the revenue they helped generate. Accruals and deferrals are the compulsory Adjusting Entries that execute this principle, ensuring Financial Statements accuracy.

Read More: What are cash basis and accrual basis, and difference between them?

Understanding Deferred Accounts (Prepaid/Unearned)

Deferred accounts involve scenarios where the cash transaction occurs first, and the economic event (earning revenue or incurring expense) occurs subsequently. They necessitate adjustments at period-end to reflect the portion that has been ‘consumed’ or ‘earned’.

2.1 Prepaid Expenses (Deferred Expense)

A Prepaid Expense is cash paid upfront for an asset (a future benefit) that will be consumed or used over a later accounting period.

- The Timing: Cash Outflow ,Expense Incurred (Consumption/Usage)

- Initial Nature: It is recorded as a Current Asset on the Balance Sheet, representing the right to receive future service or benefit.

- Example (Annual Subscription/Insurance): A business pays SAR 12,000 in December for an annual software subscription covering January through December of the next year.

- Initial Entry (December): The cash payment increases an Asset account (Prepaid Expenses) by SAR 12,000 and decreases Cash.

- Adjusting Entry (End of January): By January 31st, one month’s benefit (SAR 1,000) has been consumed. To uphold the Matching Principle, the Adjusting Entry debits the Expense account (Subscription Expense) for SAR 1,000 and credits the Asset account (Prepaid Expenses) for SAR 1,000. The asset is reduced as the benefit is used up.

- Impact: Ensures the Income Statement only reflects the expense relevant to the period (January), and the Balance Sheet correctly states the remaining asset (11 months of benefit remaining).

Learn More About The Types of expenses in commercial and industrial companies

2.2 Unearned Revenue (Deferred Revenue)

Unearned Revenue is cash received upfront from customers for goods or services that the entity has an obligation to deliver in a future period.

- The Timing: Cash Inflow – Revenue Earned (Delivery/Service Rendered)

- Initial Nature: It is recorded as a Current Liability on the Balance Sheet, representing a present obligation to transfer future economic benefits (goods or services) to the customer.

- Example (Retainer Fees/Subscriptions): A firm receives a SAR 6,000 retainer fee in October for work to be completed evenly over November and December.

- Initial Entry (October): The cash receipt increases Cash by SAR 6,000 and increases a Liability account (Unearned Revenue) by SAR 6,000.

- Adjusting Entry (End of November): The firm completes half the work (services worth SAR 3,000). To comply with the Revenue Recognition Principle, the Adjusting Entry debits the Liability account (Unearned Revenue) for SAR 3,000 and credits the Revenue account (Service Revenue) for SAR 3,000. The liability is reduced as the obligation is fulfilled.

- Impact: Ensures the Income Statement reflects only the revenue actually earned in the period (November), and the Balance Sheet correctly states the remaining obligation (one month of service remaining).

Understanding Accrued Accounts

Accrued accounts involve scenarios where the economic event occurs first (revenue is earned or expense is incurred), and the cash transaction occurs subsequently.

3.1 Accrued Expenses (Accrued Liability)

An Accrued Expense is an expense that an entity has incurred during the current accounting period but has not yet paid or been billed for.

- The Timing: Expense Incurre – Cash Outflow (Payment)

- Nature: It is recorded as a Current Liability (e.g., Wages Payable) on the Balance Sheet, as the entity owes money for a service or benefit already received.

- Example (Wages/Utilities): Employees work the last week of December, earning SAR 8,000 in wages, but the payday is January 5th.

- Adjusting Entry (December 31st): To uphold the Matching Principle, the expense must be recorded in December. The entry debits the Expense account (Wages Expense) for SAR 8,000 and credits the Liability account (Wages Payable) for SAR 8,000.

- Subsequent Entry (January 5th): When the wages are paid, the entry debits the Liability (Wages Payable) and credits Cash.

- Impact: Omitting this entry results in an overstated Income Statement (too high profit) and an understated Balance Sheet (omitting a liability) for December, undermining Financial Statements accuracy.

3.2 Accrued Revenue (Accrued Asset)

Accrued Revenue is revenue that an entity has earned by delivering goods or services, but for which it has not yet billed the customer or received payment.

- The Timing: Revenue Earned (Delivery/Service Rendered) – Cash Inflow (Payment/Invoicing)

- Nature: It is recorded as a Current Asset (e.g., Accrued Revenue Receivable) on the Balance Sheet, representing the right of the entity to receive cash from the customer.

- Example (Services Completed but Uninvoiced): A marketing agency completes 50\% of a SAR 10,000 project on March 31st. The full invoice is only sent upon 100% completion in April.

- Adjusting Entry (March 31st): To comply with the Revenue Recognition Principle, the earned portion (SAR 5,000) must be recognized in March. The entry debits the Asset account (Accrued Revenue) for SAR 5,000 and credits the Revenue account (Service Revenue) for SAR 5,000.

- Subsequent Entry (April): When the full invoice is sent, the Accrued Revenue is reclassified to Accounts Receivable. When cash is received, the entry credits Accounts Receivable and debits Cash.

- Impact: Omitting this entry results in an understated Income Statement (too low profit) and an understated Balance Sheet (omitting an asset) for March.

Critical Distinctions and Reporting Impact

Understanding the precise relationships between these four accounts is essential for accurate financial reporting.

| Feature | Prepaid Expenses (Deferred Expense) | Unearned Revenue (Deferred Revenue) | Accrued Expenses (Accrued Liability) | Accrued Revenue (Accrued Asset) |

| Cash Timing | Paid before incurred | Received before earned | Paid after incurred | Received after earned |

| B/S Account Type | Asset (Future Benefit) | Liability (Future Obligation) | Liability (Past Obligation) | Asset (Right to Receive Cash) |

| I/S Impact | Recognized as Expense over time | Recognized as Revenue over time | Recognized as Expense now | Recognized as Revenue now |

| Principle | Matching Principle | Revenue Recognition | Matching Principle | Revenue Recognition |

Practical Example: The Matching Principle

The effective implementation of the Matching Principle depends entirely on these adjustments, ensuring costs align precisely with the revenue they helped generate.

Example: An SME earns SAR 50,000 in revenue in June. The associated sales commission expense of SAR 5,000 is paid on July 10th.

- Correct Accrual: A SAR 5,000 Accrued Expense is recorded in June (Debit Commission Expense SAR 5,000; Credit Commission Payable SAR 5,000). June’s Income Statement correctly reflects a net contribution of SAR 45,000 before other costs.

- Incorrect (Cash Basis): The expense would be recorded in July. This artificially inflates June’s profit and suppresses July’s, leading to poor operational analysis.

The correct application of accruals and deferrals ensures the Income Statement reliably reports periodic performance, and the Balance Sheet accurately presents all present assets and obligations.

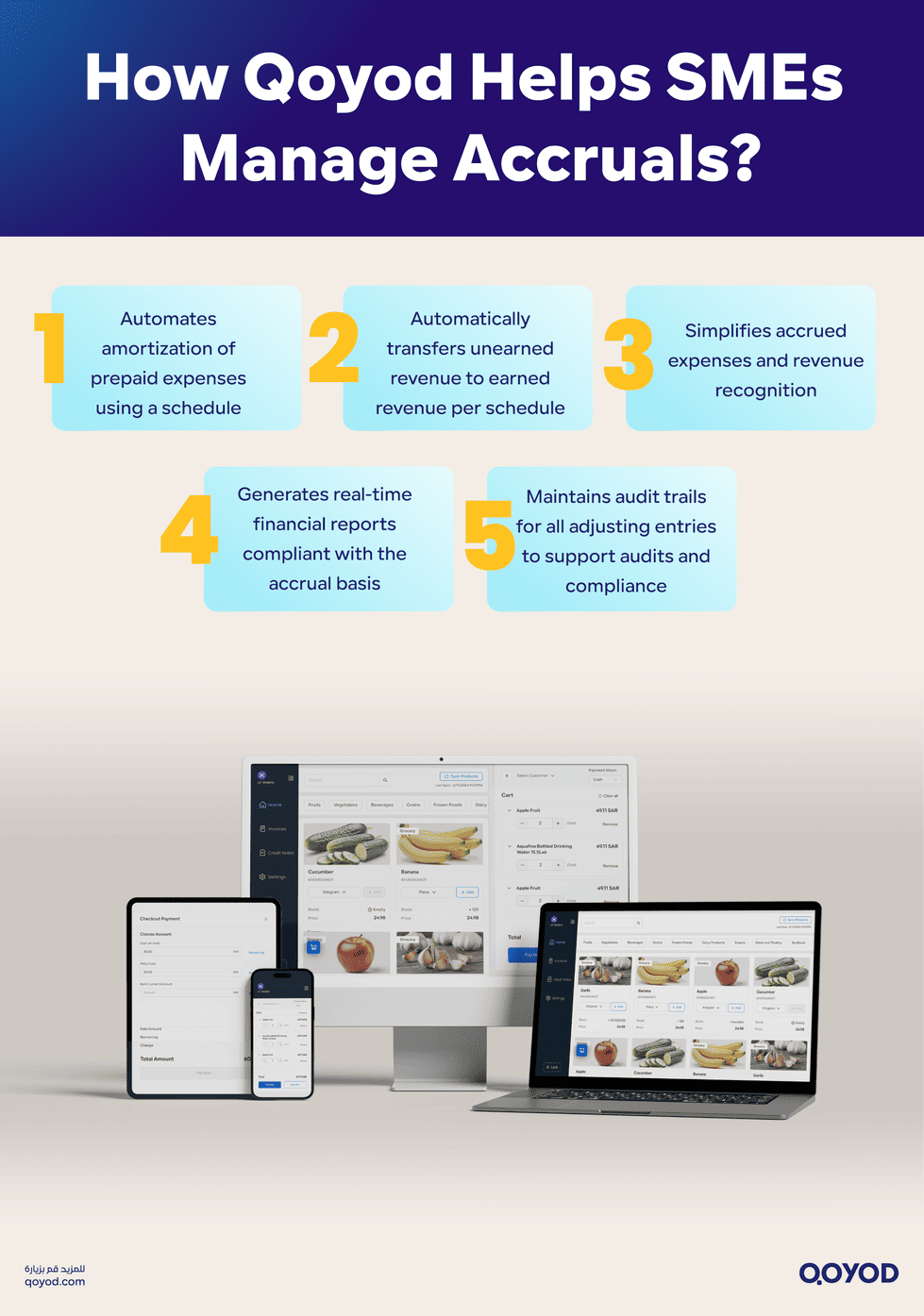

The Role of Qoyod Software in Simplifying Accruals for SMEs

For SMEs, manually managing these sophisticated Adjusting Entries is often a source of error and compliance risk. Cloud accounting software offers the necessary automation and framework to ensure continuous compliance with the Accrual Basis of Accounting.

Seamless Management with Qoyod Accounting Software

Qoyod Accounting Software is engineered to ease the complexity of accrual management for global SMEs, thereby ensuring compliance with the Accrual Basis of Accounting:

Automated Amortization (Deferred Items):

- When recording a large Prepaid Expense (e.g., annual rent or subscription), Qoyod allows the user to define an amortization schedule. The system then automatically generates the required monthly adjusting entry, debiting the expense and crediting the prepaid asset, eliminating manual tracking.

- For Unearned Revenue, Qoyod tracks the obligation and, based on the defined schedule or user input, automatically transfers the amount from the Liability (Unearned Revenue) account to the Revenue account.

Simplified Accrual Recognition:

- The platform streamlines the recording of Accrued Expenses (such as estimated utility costs or accrued interest payable) through dedicated liability accounts, ensuring obligations are accurately captured at period-end.

- It also supports proactive tracking of work completed, which instantly generates Accrued Revenue (Accounts Receivable) upon service delivery or milestone achievement, adhering to the Revenue Recognition Principle.

Real-Time, Compliant Reporting:

- Since all four account types are accurately maintained, Qoyod provides instant financial reports (Income Statement, Balance Sheet) that are fully compliant with the Accrual Basis of Accounting. This allows management to base critical decisions on actual financial performance.

Audit Readiness and Compliance:

- Qoyod’s systematic approach ensures a clear audit trail for all Adjusting Entries, significantly reducing the time and expense associated with financial audits and assuring regulatory compliance, a major benefit for scaling SMEs.

How to Record Accrued Expenses and Accrued Revenue in Qoyod Accounting Software?

To ensure your financial statements adhere to the Accrual Basis of Accounting, you must properly record accrued transactions (Accrued Expenses and Accrued Revenue) in Qoyod Accounting Software.

Since accruals are primarily recorded using Adjusting Entries (Journal Entries) at the end of a period, the most direct method in Qoyod is typically through the General Journals module.

Here is the accurate and systematic procedure for recording these key financial adjustments in Saudi Riyals (SAR):

1. Recording Accrued Expenses (Accrued Liabilities)

Accrued Expenses are costs incurred by the business but not yet paid (e.g., salaries earned by employees but not yet paid, or utilities used but not yet billed). This ensures the expense is recognized in the period it was incurred, satisfying the Matching Principle.

| Account Type | Action | Purpose |

| Expense (e.g., Salaries Expense) | Debit (Increase) | To recognize the cost on the Income Statement. |

| Liability (e.g., Salaries Payable) | Credit (Increase) | To record the obligation on the Balance Sheet. |

Steps in Qoyod:

- Log In and Navigate: Access the Qoyod web application and navigate to the “Accounting” module.

- Access Journal Entries: Select “Journal Entries” or the option to “Add Journal Entry”.

- Set Date and Description:

- Date: Enter the last day of the accounting period (e.g., 31/12/2025) to book the expense in the correct period.

- Description/Memo: Clearly describe the accrual (e.g., “Accrual for December Wages” or “Accrual for Estimated Electricity Cost”).

Record the Adjustment:

- Line 1 (Debit): Select the relevant Expense Account (e.g., Wages Expense) and enter the amount (e.g., SAR 8,000) in the Debit column.

- Line 2 (Credit): Select the corresponding Accrued Liability Account (e.g., Wages Payable) and enter the same amount (e.g., SAR 8,000) in the Credit column.

Review and Save:

- Verify that the total Debits equal the total Credits.

- Save and Confirm the Journal Entry.

2. Recording Accrued Revenue (Accrued Assets)

Accrued Revenue is revenue earned by providing goods or services but not yet invoiced or collected (e.g., consulting work completed but the invoice has not been issued). This ensures the revenue is recognized in the period it was earned, satisfying the Revenue Recognition Principle.

| Account Type | Action | Purpose |

| Asset (e.g., Accrued Revenue Receivable) | Debit (Increase) | To record the right to receive cash on the Balance Sheet. |

| Revenue (e.g., Service Revenue) | Credit (Increase) | To recognize the income on the Income Statement. |

Steps in Qoyod:

- Log In and Navigate: Access the Qoyod web application and navigate to the “Accounting” module.

- Access Journal Entries: Select “Journal Entries” or the option to “Add Journal Entry”.

- Set Date and Description:

- Date: Enter the last day of the period (e.g., 31/12/2025) to recognize the revenue in the period it was earned.

- Description/Memo: Clearly describe the accrual (e.g., “Accrual for Unbilled Services” or “Accrual for Monthly Commission Earned”).

Record the Adjustment:

- Line 1 (Debit): Select the Accrued Asset Account (e.g., Accrued Revenue Receivable) and enter the amount (e.g., SAR 5,000) in the Debit column.

- Line 2 (Credit): Select the corresponding Revenue Account (e.g., Service Revenue) and enter the same amount (e.g., SAR 5,000) in the Credit column.

Review and Save:

- Ensure the total Debits equal the total Credits.

- Save and Confirm the Journal Entry.

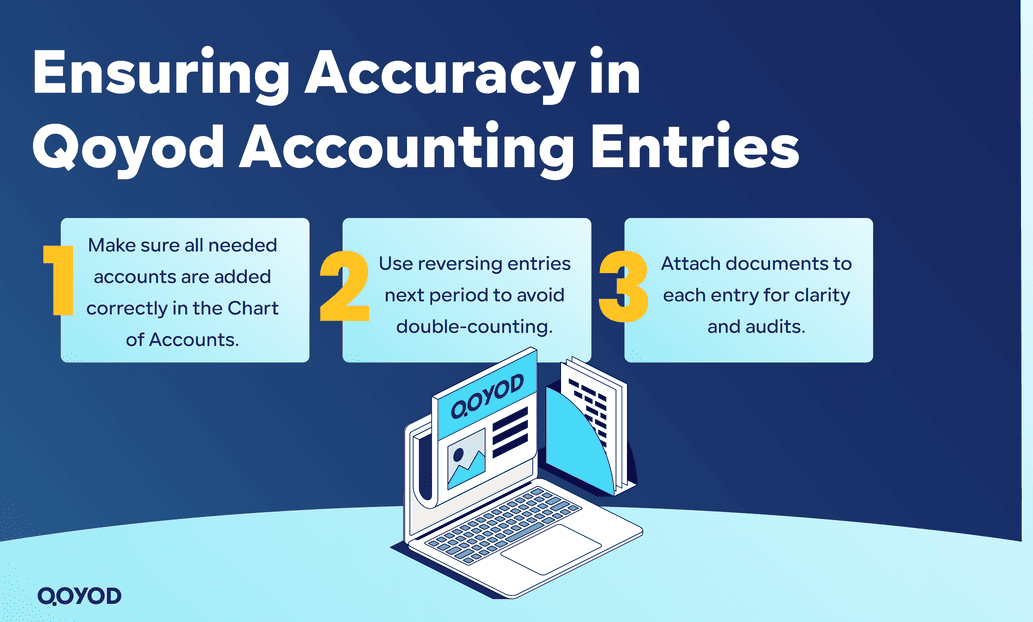

Important Considerations for Accuracy in Qoyod

- Chart of Accounts Setup: Before recording, confirm that the necessary accounts (e.g., Wages Payable or Accrued Revenue Receivable) are correctly set up under Liabilities and Assets in your Chart of Accounts.

- Reversing Entries: To avoid double-counting the revenue or expense when the cash transaction finally occurs, you can often create a Reversing Entry in Qoyod on the first day of the subsequent period. This automatically cancels out the accrual and simplifies the final cash transaction recording.

- Documentation: Always attach relevant supporting documents (e.g., time logs, service completion proofs, estimated bill amounts) to the Journal Entry for transparency and audit readiness.

Frequently Asked Questions (FAQ)

Why must my SME use the accrual basis of accounting?

The accrual basis is necessary because it adheres to the Matching Principle and Revenue Recognition Principle, providing a more accurate measure of profitability than the cash basis. It is required for reliable external reporting, compliance with global accounting standards (IFRS/GAAP), and sound SME financial management.

What is the main difference between deferred and accrued accounts?

The difference is defined by the timing of the cash flow relative to the economic event:

Deferred Accounts (Prepaid/Unearned): Cash is exchanged before the service is used or delivered. They adjust asset (prepaid) or liability (unearned) accounts.

Accrued Accounts (Expense/Revenue): Cash is exchanged after the service is used or delivered. They record unbilled assets (accrued revenue) or unpaid liabilities (accrued expense).

How often should adjusting entries for accruals and deferrals be made?

Adjusting Entries should be made at the end of every accounting period (monthly, quarterly, or annually) before financial statements are issued. This ensures the statements reflect the most accurate position and performance for that specific reporting period.

How is Unearned Revenue different from Accounts Payable?

Unearned Revenue is a liability representing an obligation to provide a future good or service because cash was received in advance. Accounts Payable is a liability representing an obligation to pay in the future for a good or service already received.

In Conclusion

The accurate management of Accrued and Deferred Expenses and Revenues is not just an administrative task; it is fundamental to effective SME financial management. These four entries are the mechanism that transitions a business from simple cash tracking to the sophisticated and globally mandated Accrual Basis of Accounting. By correctly implementing these Adjusting Entries, your financial statements will reliably reflect economic reality, providing the precise data needed for successful strategy and sustained growth.

Embrace the modern solution designed for accuracy and compliance. Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.