| Expert Summary

This article defines advance payments, explains their strategic importance in boosting cash flow and managing project risk for small/medium-sized businesses, and details the correct accounting and compliance procedures, highlighting the role of modern cloud accounting software like Qoyod. |

The concept of advance payments is fundamental to the operational and financial health of any business, particularly small and medium-sized businesses (SMBs) worldwide. But how can your company effectively manage these pre-payments, ensure legal compliance (like with e-invoicing and global tax standards), and accurately record them to maintain a healthy cash flow?

Many SMBs struggle with the complexities of properly accounting for these funds, often confusing them with regular revenue. This guide will clarify the definition, underscore the importance of advance payments in optimizing cash flow, detail the essential accounting treatments, and show how utilizing a modern cloud accounting system like Qoyod Accounting Software can automate and simplify this crucial process for businesses globally.

Why Advance Payments are Crucial for Business Operations

Advance payments are a critical mechanism for risk mitigation and financial stability, especially for project-based and service-oriented small/medium-sized businesses.

- Securing Customer Commitment: Requiring an upfront payment ensures the client’s seriousness and commitment to the agreement, significantly reducing the risk of non-payment or cancellation later in the process.

- Providing Necessary Liquidity: Advances provide immediate cash flow, helping fund initial operations and cover preliminary costs, which is vital for large projects or custom orders.

- Mitigating Financial Risk: They act as a security deposit for the supplier or contractor, forming a portion of the upfront financing and supporting the operating budget.

- Accelerating the Work Cycle: Receiving funds early allows the company to rapidly begin manufacturing, purchasing materials, or service delivery without waiting for the full amount to be collected post-delivery.

- Protecting Rights: They are recorded as a liability in the company’s books until the product or service is delivered, ensuring official recognition of the financial transaction and safeguarding the interests of both parties.

Practical Examples of Advance Payment Importance

- Construction/Contracting Firm: A firm receives an advance payment,a fixed percentage of the project value upon contract signing. They use this capital immediately to purchase materials and mobilize work teams.

- Equipment Supplier: A company receives advance payments before shipping specialized equipment. This speeds up the supply process and minimizes financial risks associated with delays or non-payment.

- Long-Term B2B Partnerships: In major commercial agreements, advances serve as a guarantee for the client and build trust in long-term relationships by formally organizing the payment schedule.

Distinguishing Advance Payments from Regular Invoices

Understanding the fundamental difference between an advance payment and a standard invoice is essential for accurate accounting and compliance.

| Element | Advance Payment (Prepayment) | Regular Invoice (Sales Invoice) |

| Definition | A sum paid by the customer before receiving the product or completing the service. | An official document issued after goods or services are delivered, requesting payment. |

| Timing | Before the start of the contract execution or project. | After the complete product or service has been provided. |

| Accounting Status | Registered as a temporary liability (Unearned Revenue) until completion of the service/product. | A binding accounting document registered as revenue or expense. |

| Value Added Tax (VAT) / Sales Tax | A separate advance payment tax invoice may be issued, or it is included in the final invoice. | VAT/Sales Tax is calculated directly on the full invoice amount. |

| Settlement Mechanism | Used to offset the final invoice when it is issued. | Represents a demand for payment of the amount due. |

| Account Impact | Recorded as a liability (Unearned Revenue or Customers’ Advances) on the Balance Sheet. | Recorded as revenue on the Income Statement or Accounts Receivable. |

| Purpose | To secure customer commitment and provide upfront liquidity. | To confirm the sale and request final settlement. |

This distinction is crucial for financial reporting and tax accuracy.

Learn More H ow To Create Sales invoice and purchase invoice from Qoyod

How to Practically Calculate Advance Payments

Calculating advance payments practically involves clear steps based on an agreed-upon percentage of the total contract or service value.

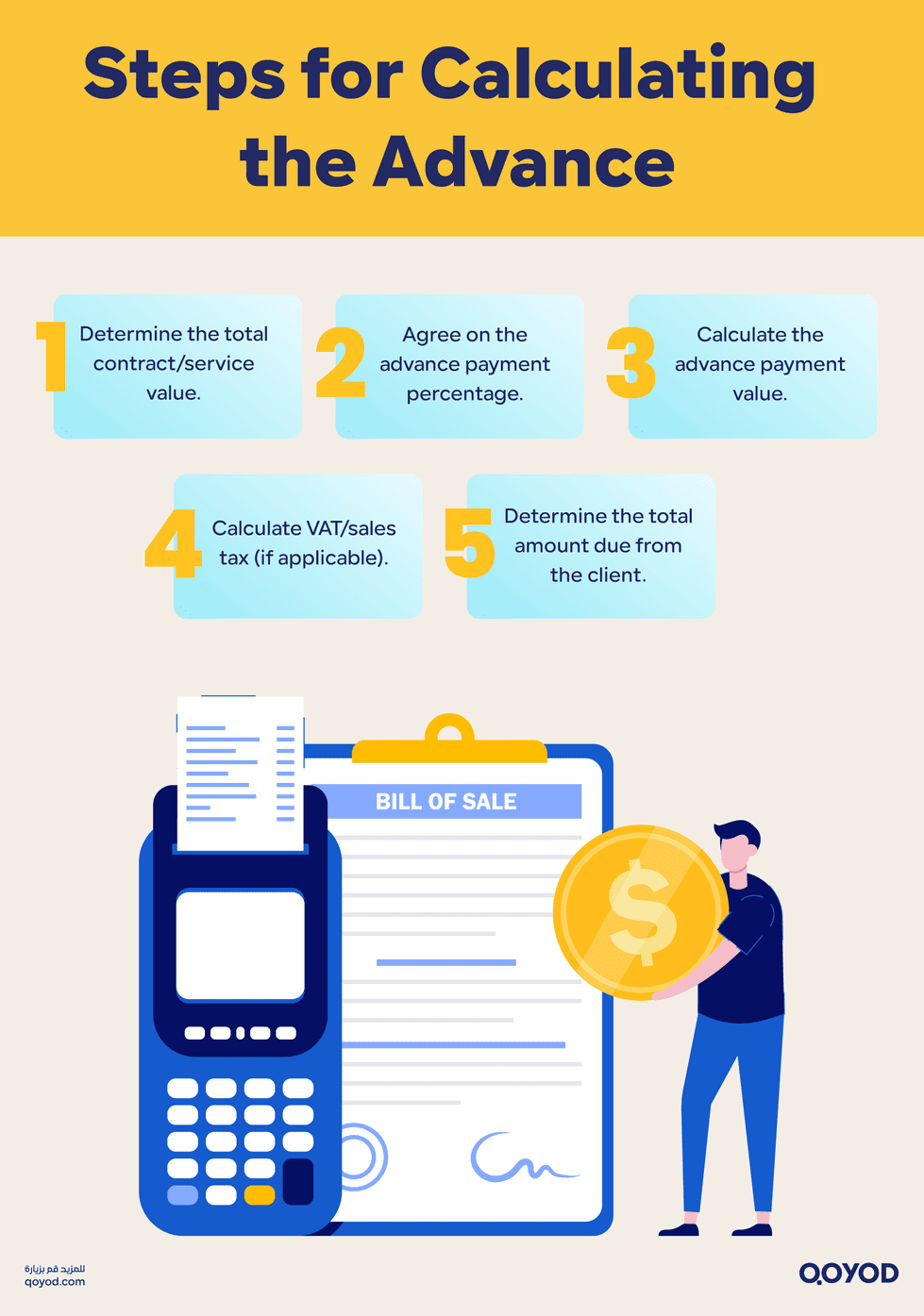

Steps for Calculating the Advance

- Determine the Total Contract/Service Value: Establish the agreed-upon gross amount for the product or service.

- Agree on the Advance Payment Percentage: This is typically a percentage of the total contract value, ranging from 10% to 30% in most cases, depending on the project’s nature and initial costs.

- Calculate the Advance Payment Value: The value is calculated by multiplying the total contract value by the agreed-upon percentage.

Advance Payment Value = Total Contract Value × (Percentage ÷ 100) - Calculate VAT/Sales Tax (If Applicable): If the contract is subject to tax, the relevant tax rate (e.g., 15% VAT in some jurisdictions) is added to the advance payment value.

Tax Due = Advance Payment Value × Tax Rate - Determine the Total Amount Due from the Client: The total is the sum of the advance payment value and the calculated tax.

Total Due = Advance Payment Value + Tax Due

Accounting Treatment of the Advance

- From the Customer’s Side: It is recorded as an Asset (Prepaid Expense) because the customer has a right to receive a product or service.

- From the Supplier’s Side: It is recorded as a temporary Liability (Unearned Revenue) until the product or service is delivered, at which point it is converted into revenue.

Accounting Entries for Recording Advance Payments

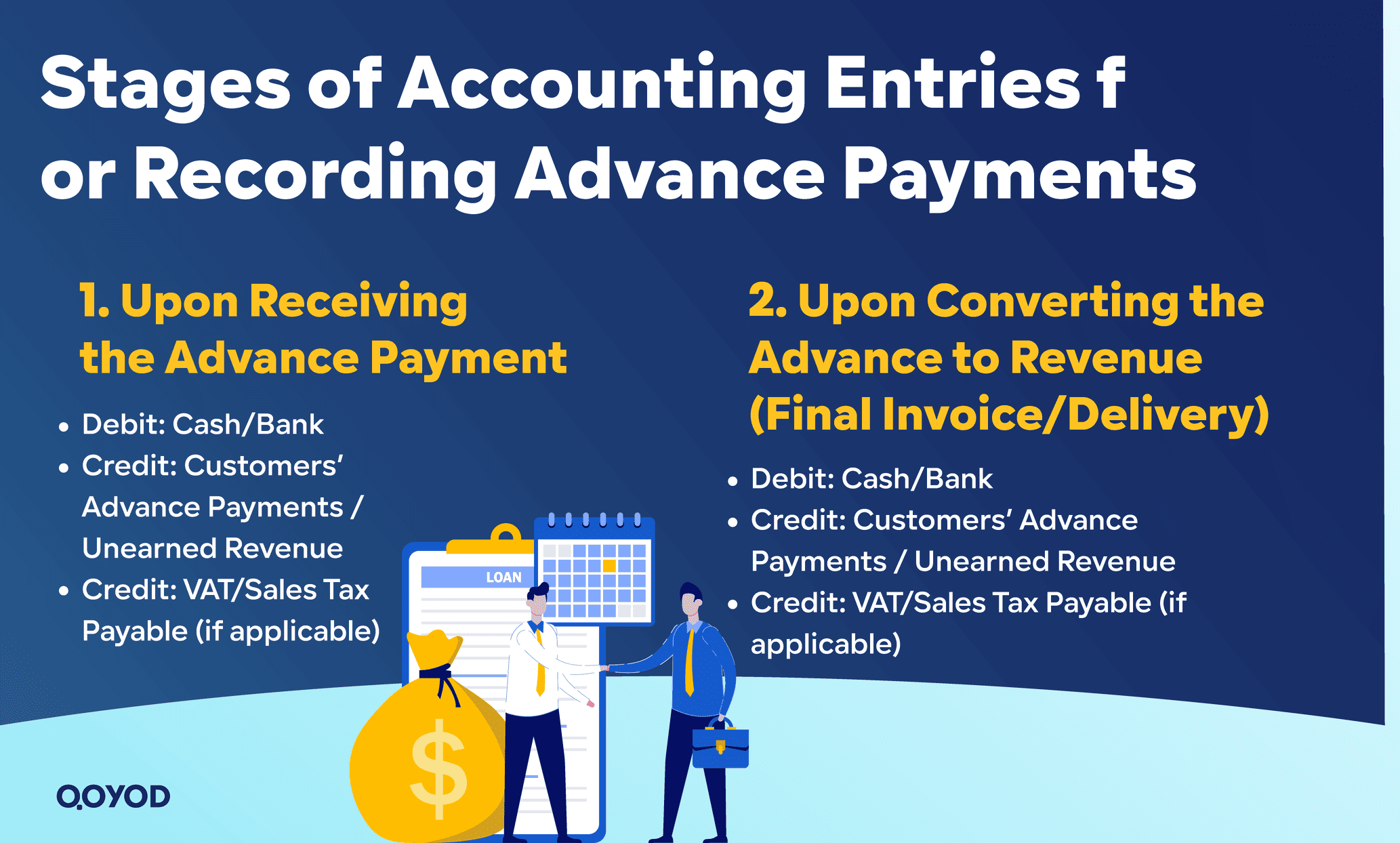

The accounting entries associated with recording advance payments occur in two main stages: recording the payment as a current liability upon receipt and then converting it to revenue upon delivery of the service or product.

1. Recording the Advance Payment Upon Receipt

A journal entry is created when the advance payment is received from the customer.

- Debit: Cash or Bank Account (Current Assets) for the total amount received.

- Credit: “Customers’ Advance Payments” / Unearned Revenue (Current Liabilities) for the value of the advance.

- Credit: “VAT/Sales Tax Payable” for the tax component (if applicable).

2. Converting the Advance to Revenue Upon Final Invoicing/Delivery

A new accounting entry reflects the conversion of the liability into earned revenue.

- Debit: “Customers’ Advance Payments” / Unearned Revenue for the amount of the advance payment (to reduce the liability).

- Debit: Accounts Receivable (for any remaining balance due on the final invoice).

- Credit: Sales Revenue (or Service Revenue) for the total gross sale value of the final invoice.

- Credit/Debit: The VAT/Sales Tax accounts are adjusted to settle the final tax liability, netting out the tax previously collected on the advance.

Simplified Example: A company receives a $50,000 advance payment (ignoring tax for simplicity).

- Upon Receipt:

- Debit: Cash/Bank $50,000

- Credit: Customers’ Advance Payments $50,000

- Upon Final Service Delivery (Invoice Value $200,000):

- Debit: Customers’ Advance Payments $50,000

- Debit: Accounts Receivable (Remaining) $150,000

- Credit: Sales Revenue $200,000

Managing Advance Payments in Qoyod Accounting Software

Using cloud accounting software like Qoyod Accounting Software simplifies the management of advance payments by automating the complex linking and settlement processes.

The Qoyod Process:

- Recording the Advance: When the advance is received, the system automatically generates a journal entry debiting Cash/Bank and crediting the “Customers’ Advance Payments” liability account, including any applicable VAT/Sales Tax.

- Linking to Final Invoices: When the final invoice is created, the software allows the user to select the pre-recorded advance payments that should be applied against this specific invoice.

- Automatic Settlement: Qoyod automatically deducts the advance payment value from the final invoice amount to determine the net amount due. Crucially, it simultaneously converts the advance value from the liability account (Unearned Revenue) to the appropriate Revenue account.

- Tax Compliance and Adjustment: The system manages the complex VAT/Sales Tax adjustments between the advance tax invoice and the final tax invoice, ensuring full compliance with tax regulations globally.

- Monitoring and Reporting: Qoyod Accounting Software provides detailed reports showing the remaining balance of advance payments, which payments have been allocated, and their relationship to specific customers and invoices, allowing for easy tracking and audit.

Why choose an automated system? Qoyod Accounting Software minimizes manual errors in calculations and financial settlements, streamlines compliance, and ensures accurate cash flow and financial reporting for growing SMBs.

Boosting Cash Flow & Liquidity Management with Advance Payments

Advance payments play a significant strategic role in improving cash flow and financial liquidity for companies, particularly for businesses that rely on project-based or staged payments.

- Immediate Cash Flow Injection: Receiving an advance provides the company with immediate funds before starting work, enhancing its ability to cover short-term financial obligations (e.g., purchasing inventory, paying salaries) without relying on debt.

- Self-Financing Operations: Advances help fund operational needs and projects efficiently, reducing the need for external financing like bank loans, which carry interest and additional costs. This improves profitability and lowers financial expense.

- Mitigating Non-Payment Risk: They significantly reduce the risk of customer non-payment or delayed payment, lessening financial pressure and increasing the stability of cash inflows.

- Enabling Strategic Investment: The positive cash flows generated by advance payments allow the company to allocate resources toward strategic investments, such as product development or market expansion, instead of worrying about daily liquidity.

- Building Financial Credibility: Good liquidity, supported by upfront payments, helps the company meet its financial obligations on time, enhancing its financial reputation and the confidence of suppliers and lenders.

In short, advance payments are an effective mechanism for improving cash flow and ensuring financial stability, which is essential for the success and sustainability of all small/medium-sized businesses.

Frequently Asked Questions (FAQ)

What are advance payments?

Advance payments are sums of money paid by a customer before the product is delivered or the service is completed, acting as a guarantee of the contract's seriousness and a source of liquidity for the supplier.

What is the importance of advance payments in commercial projects?

They provide companies with immediate liquidity to start a project, cover initial costs, and mitigate financial risks, ultimately speeding up the business cycle between the parties.

How is the value of an advance payment calculated?

It is typically set as a percentage of the total contract value (often 10). The value is calculated by multiplying the contract value by the agreed-upon percentage, plus any applicable VAT/Sales Tax.

Are advance payments subject to VAT/Sales Tax?

Yes. If the contract is subject to VAT/Sales Tax, a tax invoice must be issued for the payment amount. The tax is then settled against the final invoice's total tax liability.

How are advance payments recorded in a company's books?

For the Supplier: Recorded as a temporary liability (Unearned Revenue) and converted to revenue upon service/product completion. For the Customer: Recorded as an asset (Prepaid Expense).

What is the difference between an advance payment and a regular invoice?

An advance payment is paid before work begins and recorded as a temporary liability. A regular invoice is issued after the service/delivery and recorded as final revenue or expense.

How do modern accounting systems link advances to final invoices?

The system automatically records the advance as a liability. Upon generating the final invoice, the system allows the advance to be selected, deducting it from the total and automatically converting the corresponding amount from the liability to the final revenue account.

Conclusion

In conclusion, advance payments are a strategic financial tool that directly contributes to enhancing cash flow and managing liquidity for small/medium-sized businesses. By systematically organizing the receipt of advance payments and accurately linking them to final invoices through cloud accounting software like Qoyod Accounting Software, companies ensure a steady inflow of funds. This boosts their capacity to cover operational costs and execute projects efficiently. Furthermore, adhering to global best practices for recording and reporting these payments ensures transparency and compliance with financial and tax laws. A solid understanding and implementation of sound accounting principles for advance payments are critical factors for financial stability and sustainable business growth.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.