This article clearly explains the fundamental difference between inventory (physical count) and adjusting entries (accounting adjustments) and why both are crucial for internal review and financial auditing. |

Adjusting entries in accounting are a critical process performed at the end of a fiscal period, after preparing the trial balance and before generating the financial statements. This process aims to modify a business’s accounts to ensure the accuracy and reliability of its financial reports. This operation involves reviewing and updating accounting balances to reflect the true financial position based on the Accrual Basis of Accounting. This principle requires that revenues and expenses be recorded in the period they pertain to, regardless of when cash is received or paid.

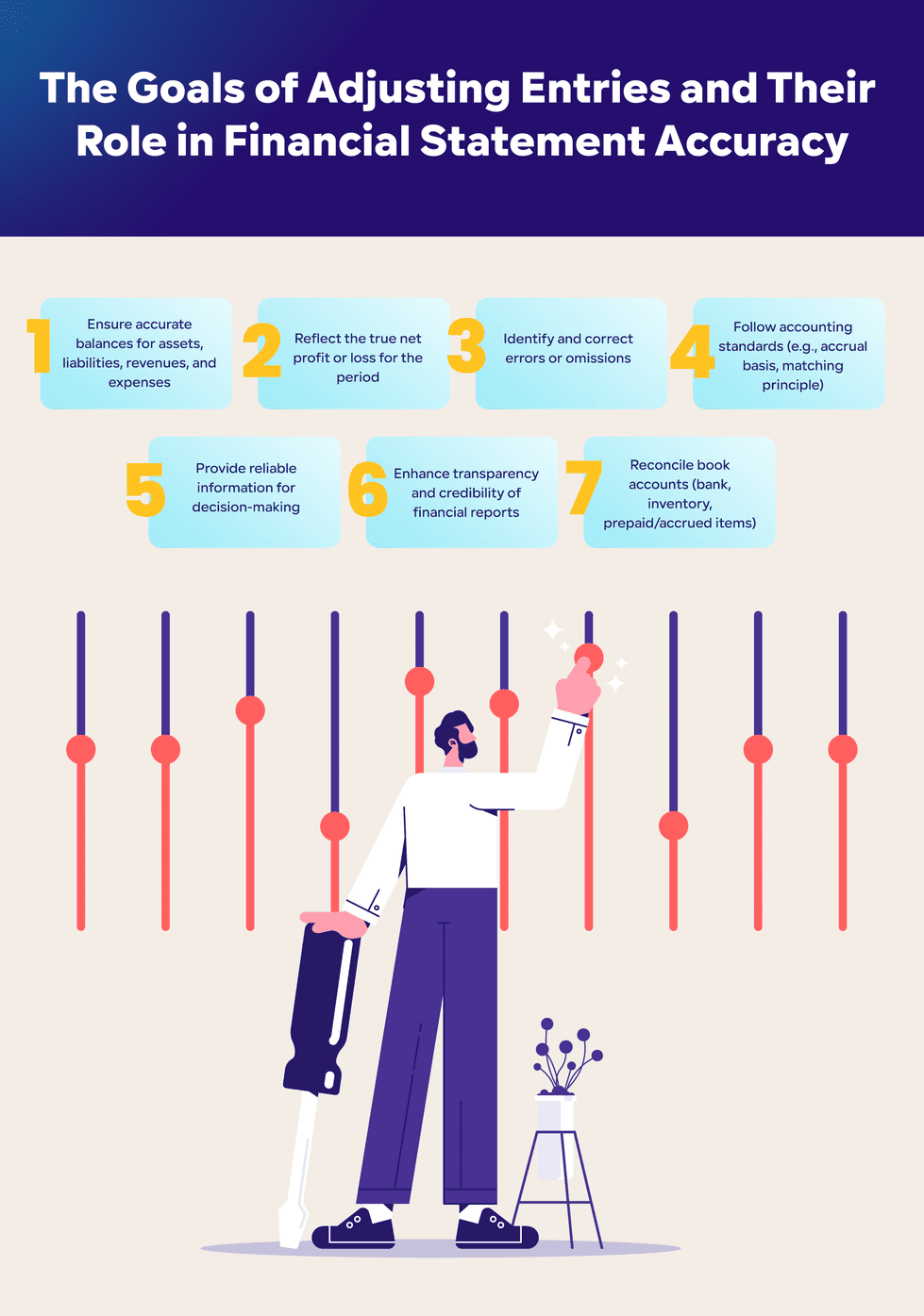

The importance of adjusting entries lies in achieving several key objectives, including:

- Verifying the accuracy of the financial balances representing assets, liabilities, revenues, and expenses.

- Correcting errors or omissions in accounting records.

- Accurately reflecting the true result of the financial activity (profit or loss).

- Complying with fundamental accounting standards like the Accrual Principle and the Matching Principle, which enhances the credibility of financial statements for owners, investors, and regulatory bodies.

- Providing a precise, realistic view of the company’s financial position, enabling management to make sound financial decisions.

In other words, adjusting entries are a tool for fine-tuning accounts to align with real financial events during the accounting period. This includes reconciling accrued or prepaid revenues and expenses, and updating asset values like depreciation and inventory. They also help prevent misleading financial information resulting from recording transactions at a time different from their actual occurrence.

This process is not just an accounting rule but a necessity for producing transparent financial reports that reflect the business’s true financial health. They bolster the confidence of all stakeholders in the provided financial information. Therefore, adjusting entries are fundamental pillars for any integrated accounting system aiming for accuracy and transparency in reporting business results and financial standing.

The Goals of Adjusting Entries and Their Role in Financial Statement Accuracy

Adjusting entries are designed to meet several essential goals that establish the validity and accuracy of financial information, making them a crucial tool for any business’s accounting system:

-

Ensuring the Accuracy of Account Balances

Adjusting entries help ensure that all assets, liabilities, revenues, and expenses are recorded in the books at their actual values. This is achieved by adjusting differences between book balances and the physical reality, as proven through physical inventory counts or supporting documents.

-

Reflecting the True Result of Operations

Performing correct adjustments leads to determining the actual net profit or loss for the financial period. This prevents the presentation of distorted results due to recording revenues or expenses in incorrect financial periods.

-

Discovery and Correction of Errors

Adjustments enable the identification and correction of errors or omissions in accounting entries, such as unrecorded, duplicated, or incorrectly valued entries, before the financial statements are issued.

-

Adherence to Accounting Standards

Adjustments play a pivotal role in implementing known accounting principles, such as the Accrual Basis, which mandates recording revenues and expenses in the period they relate to regardless of the time of collection or payment, and the Matching Principle between related revenues and expenses.

- Supporting Financial Decision Making

By providing accurate and reliable financial information in the statements, adjustments assist management, investors, and other users in making sound economic decisions based on the company’s true financial condition.

-

Enhancing Transparency and Credibility

Applying adjusting entries results in transparent financial reports acceptable to auditors and regulators, thus increasing confidence in the business’s data.

-

Achieving Financial Balance

This includes reconciling bank and book records, adjusting inventory and assets, and updating prepaid and accrued revenue and expense accounts, reflecting a complete, true financial picture.

Consequently, adjusting entries are not merely accounting journal entries but are the basis for ensuring the quality and accuracy of financial statements. They enhance the entity’s ability for sound financial planning and future performance improvement.

The Difference Between Inventory (Count) and Adjusting Entries

Inventory and adjusting entries are related terms in accounting, but each has a distinct role and function. The difference between them can be detailed as follows:

- Inventory (Physical Count): This is the process of physical review and enumeration of all assets and stock held by the company at the end of the financial period. Its purpose is to verify the actual quantities and values of existing resources compared to what is recorded in the company’s ledgers. Inventory involves a final, comprehensive check of various accounts to determine the true balances the business possesses.

- Adjusting Entries: This is an accounting procedure that follows the inventory count, where accounting records and entries are modified based on the inventory results. Adjustments involve recording entries for the realization or accrual of expenses and revenues, reconciling discrepancies between book values and actual values, calculating the depreciation of fixed assets, and adjusting accounts for inventory, receivables, and notes. The goal is to correct the balances in the ledgers to accurately reflect the true financial position before preparing the financial statements.

In simpler terms, Inventory focuses on the physical enumeration and verification of existing resources, while Adjusting Entries aim to make the necessary accounting modifications based on the inventory results to ensure the accuracy of the financial information.

| Item | Inventory (Physical Count) | Adjusting Entries |

| Definition | Process of physical enumeration and review of assets and stock | Accounting entries to adjust accounts based on inventory results |

| Goal | Verify the actual quantities and values of existing resources | Update financial records to accurately reflect the financial reality |

| Timing | At the end of the financial period | After inventory and before preparing financial statements |

| Focus | Physical verification | Making adjustments to accounts and ledgers |

| Examples | Inventory count, fixed asset review | Accrual and deferral of revenues/expenses, calculating depreciation |

| Effect on F.S. | Determines the actual balances | Corrects balances and ensures accurate financial statements |

Thus, inventory is a technical, physical step to ascertain resources, and adjusting entries are the accounting steps to refine and modify the recorded financial reality based on the results of that inventory.

Accounting Principles Related to Adjusting Entries

The accounting principles associated with adjusting entries, such as the Accrual Basis, the Matching Principle, and the Conservatism Principle, play a fundamental role in ensuring the accuracy and reliability of financial statements.

1- Accrual Basis of Accounting

This principle mandates that revenues and expenses be recorded in the financial period they occur, regardless of when the cash is received or paid. This principle ensures that financial statements reflect the true economic activity of the accounting period, as revenues are recorded when earned and expenses when incurred, helping to accurately determine the entity’s profitability.

2-Matching Principle

This principle is fundamentally related to recording expenses associated with the revenues generated in the same financial period. Its objective is to balance the revenues and expenses pertaining to the same period to accurately determine the net profit or loss. Adjusting entries help apply this principle by recording accrued and prepaid expenses and recognizing depreciation.

Learn More About: Financial statements: a transparent window into the financial success

3- Conservatism Principle (Prudence)

This principle dictates that caution should be exercised when recording revenues, avoiding overstatement. At the same time, expenses and losses should be recognized as soon as there is a probability of their occurrence. This principle helps safeguard the company’s financial position and enhances transparency by recording expenses and accruals even if they are anticipated or potential, not just certain.

These principles collectively form a framework to ensure that financial data accurately and objectively reflects the economic reality. Adjusting entries are one of the executive tools for implementing these principles in accounting practice.

Types of Adjusting Entries in Accounting

The types of adjusting entries in accounting cover several key categories, each with a specific role in fine-tuning accounts and ensuring the accuracy of financial statements. Here is a detailed explanation of each type:

1-Prepaid Expenses

These are expenses paid during the financial period but not yet consumed or considered an expense, such as rent or insurance paid in advance for a future period. They are recorded as an asset in the books and allocated as an expense over the period when the service or goods are utilized. At the end of the period, an adjusting entry is made to transfer the consumed portion to an expense account.

2-Accrued Expenses

These are expenses incurred during the financial period but not yet paid, such as salaries payable or utility bills that were not settled by the end of the period. They are recorded in the books as a liability (credit account) to update the actual expenses and comply with the Accrual Principle.

3-Unearned Revenue (Deferred Revenue)

This consists of revenue received by the company during the financial period for services or goods not yet delivered, such as customer down payments. It is recorded as a liability (unearned revenue account) and then adjusted when the service or delivery is completed, where it is transferred to actual revenue.

4-Accrued Revenue

This is revenue earned by the company during the financial period but not yet received in cash or recorded, such as services rendered but not yet paid for. It is recorded in the books as an account receivable (debtor) to reflect the accrued revenue and meet the Accrual Principle.

5-Inventory Adjustments

These are made to match the physical inventory count value with the book value of the inventory. If there is a shortage or surplus due to damage, theft, or recording error, the accounts are adjusted to reflect the true value, which impacts the Cost of Goods Sold (COGS) and profit.

6-Depreciation of Assets

Depreciation is calculated to allocate the cost of fixed assets over their useful life, according to specific methods (e.g., straight-line or diminishing balance). The adjusting entry here means updating the accounting records to register the depreciation expense due for the period, reflecting the true book value of the assets and the consumption cost.

All these types of adjustments aim to apply accounting principles and update records to accurately reflect the true financial position.

This summary outlines the basics of the main types of adjusting entries:

| Type | Description | Goal |

| Prepaid Expenses | Expenses paid but not yet consumed | Allocate cost over the periods benefited |

| Accrued Expenses | Expenses incurred but not yet paid | Record the liability and apply the Accrual Principle |

| Unearned Revenue | Revenue received for services/goods not yet delivered | Record the liability and defer revenue to the appropriate period |

| Accrued Revenue | Revenue earned but not yet received | Record the receivables and apply the Accrual Principle |

| Inventory Adjustments | Adjusting inventory value based on the physical count | Match value to the actual inventory status |

| Depreciation | Allocating the cost of fixed assets over their economic life | Record asset consumption and reduce book value |

These adjusting entries help provide an accurate and transparent financial picture when preparing financial statements.

How to Prepare Adjusting Entries with Practical Examples

Preparing adjusting entries is a pivotal step to ensure the accuracy of financial statements and reflect the reality of revenues and expenses in the correct periods. These entries are typically made at the end of the financial period after reviewing accounts and verifying that all transactions requiring balance adjustments have been recorded.

Steps for Preparing Adjusting Entries:

- Account Review: Verify all recorded accounts and confirm if any transactions were unrecorded or need adjustment.

- Determine Necessary Adjustments: Identify required adjustments such as accrued revenues, accrued expenses, asset depreciation, and inventory adjustments.

- Analyze Amounts and Affected Accounts: Select the debit and credit accounts for each adjustment.

- Record the Adjusting Entries: The entry is made in the general journal, accurately recording the debit and credit accounts to reflect the required adjustment.

- Review the Entry: To ensure compliance with accounting standards and accrual requirements, and to guarantee the accuracy of the financial statement.

Practical Examples of Adjusting Entries:

| Adjustment Type | Scenario | Adjusting Entry |

| Accrued Revenue | A company provided services worth $5,000 but hasn’t received payment yet. | Debit: Accounts Receivable $5,000 / Credit: Service Revenue $5,000 |

| Accrued Expenses | A company owes a December electricity bill of $1,200 by year-end. | Debit: Electricity Expense $1,200 / Credit: Utilities Payable $1,200 |

| Prepaid Expenses | Rent for January, $3,000, was included in Prepaid Expenses in December. (Adjustment for December’s use) | Debit: Rent Expense $3,000 / Credit: Prepaid Expenses $3,000 |

| Depreciation | Calculated depreciation for computer equipment is $10,000 for the year. | Debit: Depreciation Expense $10,000 / Credit: Accumulated Depreciation $10,000 |

| Inventory Adjustment | A shortage of $2,000 in inventory was found after the physical count. | Debit: Loss from Inventory Shortage $2,000 / Credit: Inventory $2,000 |

In this way, accounts are adjusted to reflect the company’s true position, which ensures the accuracy of financial statements, the basis for making correct decisions.

FAQ: 10 Common Questions About Adjusting Entries in Accounting

What are adjusting entries?

Adjusting entries are accounting modifications made at the end of a financial period to update accounts and ensure financial statements reflect the true financial position.

Why are adjusting entries important?

They ensure the accuracy of financial statements and reflect revenues and expenses in the correct period, which aids in making sound financial decisions.

What is the difference between Adjusting Entries and Inventory?

Inventory is a physical count of assets and stock, while adjusting entries are journal entries that modify accounts based on inventory results and the Accrual Principle.

What are the main types of adjusting entries?

Prepaid and accrued expenses, unearned and accrued revenues, inventory adjustments, and depreciation of fixed assets.

When should adjusting entries be prepared?

They are typically prepared at the end of every financial period after reviewing accounts and before preparing the financial statements.

How do adjusting entries affect financial statements?

They adjust assets, liabilities, revenues, and expenses to accurately reflect the actual financial situation.

What is the Accrual Principle and its relation to adjusting entries?

It mandates recording revenues and expenses in the period they occur, not when paid or received, which necessitates making these adjustments.

Are adjusting entries performed monthly or annually?

They can be performed at the end of any financial cycle, monthly, quarterly, or annually, depending on the business's needs.

How is asset depreciation recorded in adjusting entries?

A depreciation entry is recorded to allocate the asset's cost over its economic life and update the book value.

What issues prevent the accuracy of adjusting entries?

Failure to record accrued invoices, errors in the physical count, or neglecting accounting principles like the Accrual Basis.

Conclusion

Adjusting entries are a vital accounting process that guarantees the accuracy and reliability of financial data for businesses and organizations. By preparing adjusting entries, errors or omissions in financial records can be corrected, and compliance with accounting principles like the Accrual and Matching principles can be achieved. This enhances the transparency of financial statements and reveals the true financial position.

The importance of using a system for adjusting entries lies in ensuring that all accounting modifications are performed in an organized and systematic manner that guarantees consistency and transparency. An accounting software solution can accurately control these operations, document every adjustment according to the rules, allowing for precise review, easy auditing, and compliance with regulatory standards.

In short, Adjusting Entries and their systematic recording are the cornerstone of healthy financial reports and support sound financial decision-making. It is an indispensable investment for maintaining financial stability and fostering the confidence of investors and stakeholders in the organization.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern businesses.