|

In the highly competitive landscape of finance, a job interview for an accounting role is far more than a technical exam; it’s a crucial opportunity to highlight your professional competence, analytical thinking, and communication skills. A common question among job seekers is: “What are the essential questions I might face in an accounting interview? And how can I prepare expert answers?”

This article is dedicated to helping you ace your accounting job interview with confidence and distinction. We will review the most frequently asked questions both technical and behavioral in accounting interviews, complete with realistic examples of appropriate responses. Whether you are a recent graduate or a seasoned accountant, this guide will boost your chances of landing the job you aspire to, especially in environments utilizing modern Cloud accounting systems and tools like Qoyod Accounting Software.

Why Preparing for an Accounting Interview is Crucial

Thorough preparation for an accounting interview is not a luxury; it’s the defining factor for securing the job. Accounting is a precise profession demanding a high level of accuracy, attention to detail, and comprehensive knowledge of financial regulations and universal accounting standards (like IFRS or GAAP). Consequently, interviews typically include technical and behavioral questions designed to test your readiness and your ability to make sound financial decisions under pressure.

Furthermore, preparation boosts your self-confidence, reduces stress, and increases your chance of providing well-thought-out answers that demonstrate a deep understanding of the field and showcase your analysis and communication skills. Today’s businesses, especially small and medium-sized enterprises (SMEs), seek accountants who possess not only certifications but also the professional acumen and ability to deliver real value within the team.

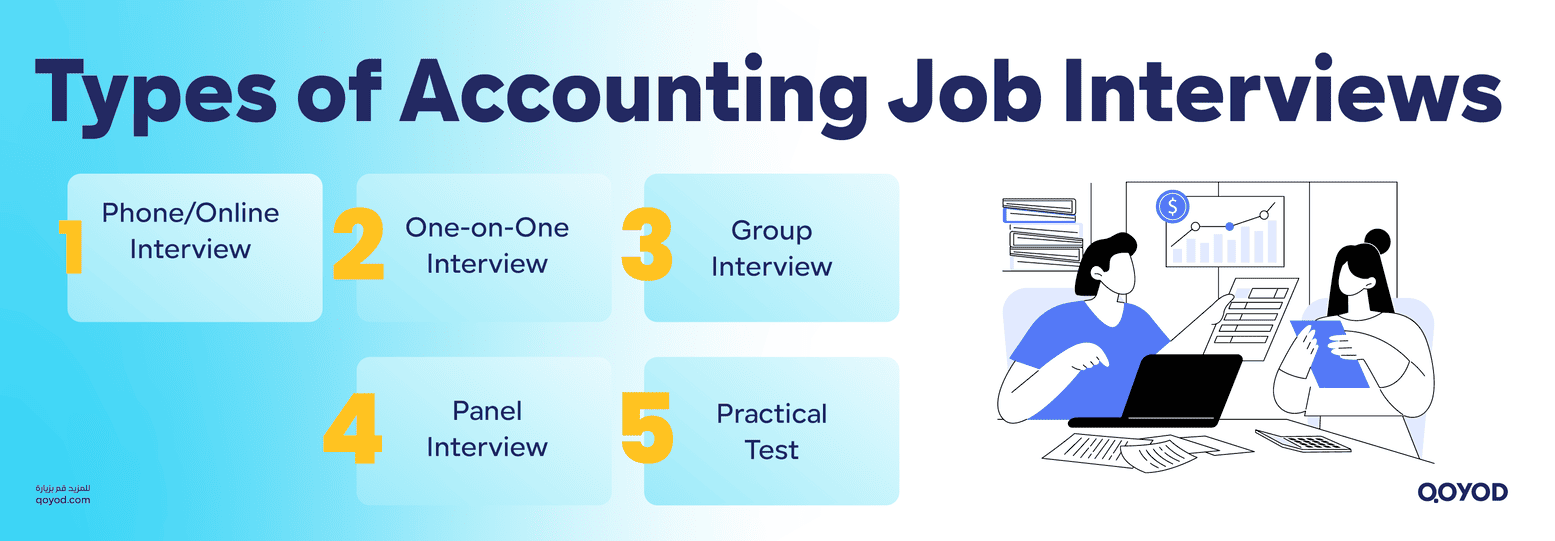

Types of Job Interviews Accountants Experience

When applying for an accounting position, you might go through several types of interviews, which vary depending on the company and the specific job requirements. Understanding these types will help you prepare better for each stage:

| Interview Type | Focus and Purpose |

| Phone or Online Interview | Often the first step to assess general qualifications and CV alignment. May include questions about your experience, salary expectations, and motivation for joining the company. |

| One-on-One Interview | The most common type, focusing on assessing your technical knowledge in accounting, such as accounting standards, report preparation, and financial data analysis. |

| Group Interview | May be used to assess your teamwork and interaction style, particularly if the role requires coordination across multiple departments. |

| Panel Interview | Conducted by several officials (e.g., CFO, HR Manager, Internal Auditor) to evaluate your technical and behavioral competencies from different angles. |

| Practical Accounting Tests | Some companies include short tests to measure your proficiency in basic calculations, financial statement preparation, or using software like Excel or Qoyod Accounting Software. |

Preparing for each interview type significantly increases your chances of success and helps you stand out from other candidates.

Most Common Technical Accounting Interview Questions

Technical questions are the core of an accounting interview, aiming to gauge your knowledge of fundamental accounting principles and your ability to apply them in real-world scenarios. Here are the top questions frequently asked by companies during interviews:

Essential Accounting Interview Questions

- What is the difference between Debits and Credits?

- What is the basic accounting equation, and how is it used?

- How do you prepare a Statement of Cash Flows?

- What is the difference between a Provision and a Reserve?

- How do you handle an unpaid invoice at the end of a fiscal period (Accrual basis)?

- What is Asset Depreciation? How is it calculated?

- What is the difference between Financial Accounting and Management Accounting?

- How do you deal with accounting errors when they are discovered?

These questions test your understanding of theoretical concepts, as well as your ability to analyze financial problems and make accurate decisions.

Examples of Ideal Answers for Technical Questions

- What is the difference between Debits and Credits?

Debits are entries on the left side of a ledger, typically increasing Assets and Expenses, and decreasing Liabilities, Equity, and Revenue. Credits are entries on the right side, typically decreasing Assets and Expenses, and increasing Liabilities, Equity, and Revenue.

- What is the basic accounting equation, and how is it used?

The basic accounting equation is: Assets = Liabilities + Equity. It is used as the foundation for preparing the Balance Sheet, ensuring that the company’s possessions are always balanced by its obligations and ownership claims.

- How do you prepare a Statement of Cash Flows?

A Statement of Cash Flows is prepared using two methods: the Direct Method (records all cash receipts and payments directly) or the Indirect Method (starts with net income and adjusts for non-cash items and changes in working capital). It is divided into three sections: Operating, Investing, and Financing activities.

- What is the difference between a Provision and a Reserve?

A Provision is recorded to meet a probable liability or loss, and it is charged against profits to calculate Net Income (e.g., Provision for Doubtful Accounts). A Reserve is an appropriation of retained earnings set aside for future purposes or to protect the financial position, and it is not an expense.

- How do you handle an unpaid invoice at the end of a fiscal period?

The invoice is recorded as an Accrued Expense under Liabilities, ensuring that the expense is recognized in the correct period, even if cash has not been paid yet, alongside recording the corresponding entry in the related Expense account.

Learn More: What are limited liability companies (L.L.C.)?

- What is Asset Depreciation? How is it calculated?

Asset Depreciation is the systematic allocation of the cost of a fixed asset over its useful life. It is calculated using several methods; the most common is the Straight-Line Method: (Asset Cost – Salvage Value) / Useful Life.

- What is the difference between Financial Accounting and Management Accounting?

Financial Accounting is concerned with preparing financial reports for external parties (such as investors and banks) and focuses on historical data. Management Accounting is used internally to help management make operational and planning decisions, focusing on the future and analysis.

- How do you deal with accounting errors when they are discovered?

The type of error (computational, transposition, or classification) must be identified, and then corrected with a correcting journal entry in the same period or retrospectively if the error is material. The correction must be documented and explained to maintain transparency in the financial records.

Behavioral and Competency Questions (Soft Skills)

Accounting interviews aren’t limited to technical skills; they also include behavioral questions that assess how you handle practical situations, your problem-solving ability, and your capacity for teamwork. These questions are best answered using the STAR Method (Situation – Task – Action – Result).

Common Behavioral Questions:

- Tell us about a time you encountered a financial error. How did you discover it, and what did you do?

- How do you handle work pressure during monthly or quarterly financial closing periods?

- Have you ever disagreed with a manager or colleague? How did you handle the situation?

- Describe a situation where you had to produce a financial report on a tight deadline. How did you prioritize your tasks?

Examples of Professional Behavioral Answers (Using STAR):

- Tell us about a time you encountered a financial error, and what you did.

Situation: While reviewing the quarter-end reports, I noticed a discrepancy in the bank account balance reconciliation.

Task: To ensure the accuracy of the balances and match them with the bank statements.

Action: I reviewed the journal entries related to the bank account and discovered a duplicate entry that had been mistakenly posted. I then prepared a correcting entry.

Result: The report was corrected before submission to management, and the CFO commended the diligence of the review, preventing a misstatement.

- How do you handle work pressure during financial closing periods?

Situation: At the end of every month, there is significant pressure to complete reconciliations and deliver financial reports accurately and on time.

Task: To organize tasks and ensure delivery without delay or errors.

Action: I rely on a pre-planned work schedule, use checklists to track complex entries, and prioritize critical, high-impact items early on. I also proactively communicate with team members when support is needed.

Result: I successfully delivered all reports by the deadline with high accuracy, which strengthened management’s trust in the department’s process.

- Describe a situation where you had to produce a financial report on a tight deadline.

Situation: I was asked to prepare an updated cash flow report within 24 hours for an urgent executive review.

Task: To create an accurate and comprehensive report in a record timeframe.

Action: I broke down the tasks into stages, focused on the most material data, and utilized templates to save time. I also coordinated with a colleague to gather secondary data.

Result: The report was delivered on time, and its accuracy and organization supported a critical financing decision by the management team.

Miscellaneous Accounting Questions with Sample Answers

- What is the difference between double-entry and single-entry bookkeeping?

Double-entry bookkeeping requires that every financial transaction be recorded in at least two accounts, with equal and corresponding debit and credit amounts. This is the fundamental principle of modern Financial Accounting. Single-entry bookkeeping records transactions in only one account; it is not used for standardized financial reporting.

- How do you prepare a Balance Sheet?

Preparing a Balance Sheet involves classifying Assets into non-current (like property and equipment) and current (like cash and Accounts Receivable). Then, classifying Liabilities into short-term (like Accounts Payable) and long-term (like loans). Finally, calculating Equity, which is the difference between assets and liabilities. The Balance Sheet must always balance: Assets = Liabilities + Equity.

- What is the concept of a Deferred Tax?

Deferred Tax represents the difference between the income tax due based on accounting rules (IFRS/GAAP) and the amount due based on Tax compliance laws. It can be a deferred tax asset or liability, reflecting the tax impact that will reverse in a future financial period.

- What is the significance of the Accrual Basis of Accounting?

The Accrual Basis means that revenues and expenses are recognized when they are earned or incurred, regardless of when cash is received or paid. This principle provides a more accurate picture of a company’s financial performance, reflecting its true financial position independently of cash movement.

- What is the concept of “Financial Disclosure”?

Financial Disclosure is the transparent and accurate presentation of a company’s financial activities in reports like the Balance Sheet, Income Statement, and Cash Flow Statement. Its goal is to provide information that assists investors, lenders, and other stakeholders in making informed decisions.

- What are the types of investments reported in financial statements?

There are three main types: Short-term investments (expected to be sold or traded within 12 months), Long-term investments (assets or stocks the company intends to hold for a longer duration), and investments in Fixed Assets (e.g., property and equipment).

- What is the difference between Gross Profit and Net Profit?

Gross Profit is Revenue minus the Cost of Goods Sold (COGS). Net Profit is Gross Profit minus all other operating expenses, interest, Taxes, and exceptional gains or losses.

- What are the steps for the Fiscal Year-End Closing?

Procedures include: Adjusting temporary accounts (Revenue and Expenses), verifying debit and credit balances, preparing final financial statements, reviewing assets and liabilities, ensuring accurate ledger transfers, closing the books, and preparing a final closing report. Cloud accounting systems like Qoyod can significantly automate many of these steps.

- What is the role of an accountant in preparing a Budget?

The role includes: gathering historical data, estimating future revenues and expenses, determining financing needs, ensuring the budget balances, and providing management with reports on variances between actual and projected figures.

- What is the difference between Internal and External Audits?

Internal Audit is performed by the company’s own employees, focusing on internal controls and operational efficiency. External Audit is conducted by an independent auditor to ensure the fairness and compliance of the financial statements according to standards like IFRS or GAAP.

Highlight Your Personal and Professional Skills

- Link Skill to Practical Scenario

Don’t just list a skill; connect it to a real example: “I possess strong data analysis skills; I previously identified a 12% variance in monthly expenditures which helped management reallocate the budget effectively.”

- Show Composure Under Pressure

Interviews test your resilience. When discussing pressure, share a real story with a positive outcome: “During the financial closing period, I was responsible for reconciling five critical accounts in three days and successfully completed them with full accuracy.”

- Demonstrate Attention to Detail

A good accountant doesn’t overlook details. Use supporting examples: “My diligence in reviewing entries helped correct a material accounting error worth $30,000 before the statements were sent to the external body.”

- Communicate Clearly and Confidently

Speak clearly, use precise accounting terminology, and don’t hesitate to ask for clarification if needed.

- Highlight Teamwork Skills

“In a project to implement a new internal Cloud accounting system (like Qoyod), I worked with the IT team to clearly communicate accounting requirements and ensure seamless integration, which streamlined monthly reporting.”

- Mention Continuous Self-Development

“I recently completed an IFRS certification course, and I consistently follow accounting updates to ensure my work quality and tax compliance are current.”

Tips for Acing the Accounting Interview

- Understand the Job Description Thoroughly

- Read the tasks and responsibilities carefully.

- Identify the key skills the employer is seeking (e.g., Financial Analysis, ERP proficiency, Tax Compliance) and prepare practical examples from your career to match.

- Review Accounting Fundamentals and International Standards (IFRS or GAAP)

- Be ready to answer technical questions using precise and reliable accounting terminology.

- Cite real-world instances where you have applied these standards.

- Prepare Behavioral Answers in Advance

- Use the STAR Method (Situation – Task – Action – Result) to present authentic situations that reflect your competence and professional conduct (e.g., handling pressure during financial closing).

- Prioritize Professional Appearance and Punctuality

- A professional look and discipline convey a strong first impression of your accuracy and organization, two essential traits for an accountant.

- Ask Smart Questions at the End of the Interview

- Examples include: “What accounting software or tools does the team rely on?” or “What are the biggest financial challenges the team is currently facing?”

- Practice Answering with Confidence and Clarity

- Practice speaking in front of a mirror or with a friend, focusing on your tone and body language, and avoiding filler words or hesitation.

- Bring Printed Copies of Your CV and Certifications

- Be prepared to present them upon request, demonstrating your readiness and seriousness.

- Be Honest About What You Know and What You Don’t

- Avoid fabricating answers. Honesty, combined with a demonstrated eagerness to learn, leaves a positive impression.

Issuance of a tax invoice: all you need to know.

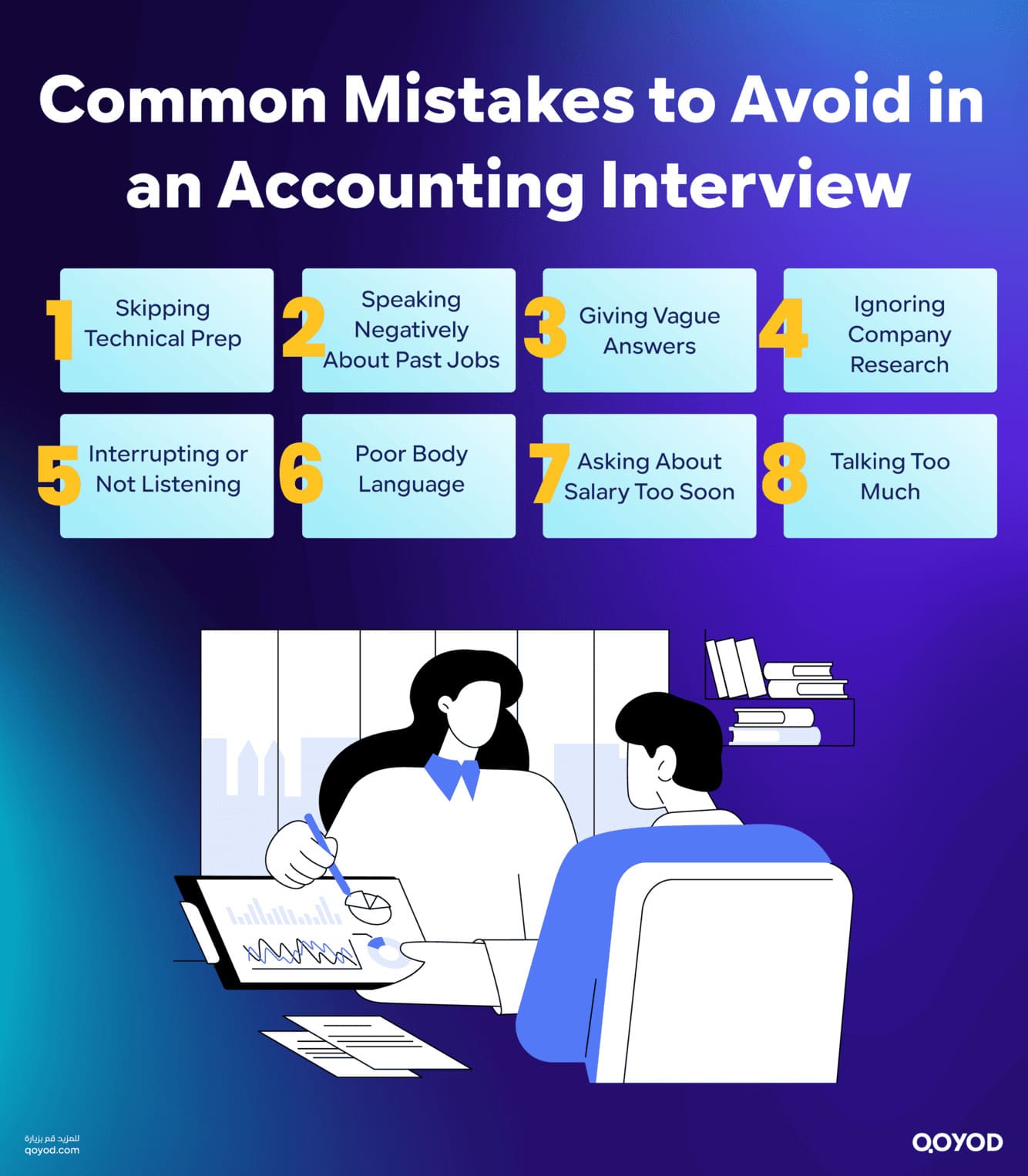

Common Mistakes to Avoid in an Accounting Interview

- Failure to Prepare for Technical Questions: Ignoring a review of accounting principles or international standards may make you seem unprofessional, especially when advanced questions are asked.

- Speaking Negatively About Previous Jobs: Avoid any direct criticism of your former manager or team, as this suggests you might be an uncooperative or resentful team member.

- Providing General and Vague Answers: Saying, “I am very accurate,” without providing specific examples or situations to back it up, undermines your credibility.

- Not Understanding the Company’s Business: Lack of knowledge about the company’s industry or sector can make you appear uninterested or uncommitted to the opportunity.

- Interrupting the Interviewer or Not Listening Fully: You must listen carefully before responding, as rushing to answer can lead to misunderstanding or show a lack of respect.

- Neglecting Eye Contact or Body Language: Sitting sluggishly or avoiding eye contact sends negative signals about your self-confidence.

- Focusing Solely on Salary and Benefits: Asking about financial compensation too early in the interview may be interpreted as being unconcerned with providing real value.

- Talking Too Much or Going Off-Topic: Your answers should be concise, clear, and directly relevant to the question asked.

Questions Recommended for Candidates to Ask the Employer

Asking questions at the end of an interview not only shows your interest but also highlights your professional maturity and understanding of the accountant’s role. Here are examples of intelligent questions you can ask:

- What accounting software or tools does the team rely on?

- What are the current financial challenges facing the company?

- How is the accounting team’s performance evaluated during the year?

- Are there opportunities for training or professional development within the company?

- What is the organizational structure of the accounting team, and who would I report to directly?

- What does your monthly or annual financial closing cycle typically look like?

- Will I be granted oversight of specific accounts or special projects?

Choose two or three questions at most, and avoid questions whose answers can easily be found on the company’s website.

How to Leave a Lasting Professional Impression

The interview is over, but your role isn’t. To leave a strong and professional impact:

- Thank the interviewer gracefully immediately after the interview, expressing your gratitude for the opportunity to learn about the company and the role.

- Send a thank-you email within 24 hours, reiterating your genuine interest in the position and confirming your readiness to contribute.

- Maintain professionalism until the end; don’t appear overly anxious for the result, and remain available for any follow-up inquiries from the employer.

The final impression can be the deciding factor between you and other candidates, so ensure your departure is as confident, professional, and polished as your arrival.

Key Accounting Interview Questions and Professional Answers (Simplified Format)

This guide compiles the most essential technical and behavioral questions for accountant interviews in 2025, reflecting search engine trends and AI recommendations, along with the best methods for professional answers that capture the attention of recruiters.

Technical Questions and Answers

What is the difference between Accounts Receivable and Accounts Payable? Answer: Accounts Receivable represents money owed to the company by customers. Accounts Payable represents the company’s obligations to suppliers and unpaid expenses.

What is the basic accounting equation and how is it used? Answer: The equation is: Assets = Liabilities + Equity. It is used to prepare the Balance Sheet and ensure the company’s financial balance is maintained.

How do you prepare a Statement of Cash Flows? Answer: This can be done via the Direct Method (recording cash receipts and payments) or the Indirect Method (adjusting net income for non-cash items and working capital changes).

What is the difference between a Provision and a Reserve? Answer: A Provision is recorded as an expense to meet probable liabilities (e.g., doubtful accounts). A Reserve is set aside from retained earnings for future strategic goals.

How do you handle an unpaid invoice at the end of a fiscal period? Answer: It is recorded as an Accrued Expense under Liabilities to ensure the expense is recognized in the correct period, adhering strictly to the Accrual Basis of Accounting.

What is Asset Depreciation? How is it calculated? Answer: Depreciation is the systematic allocation of an asset’s cost over its useful life. The Straight-line or diminishing balance methods are the most common calculation approaches.

What is the difference between Financial and Management Accounting? Answer: Financial Accounting is for external reports and focuses on past performance. Management Accounting is for internal support, focusing on data analysis and future operational decision-making.

How do you deal with accounting errors when discovered? Answer: I correct errors using a documented correcting entry, based on the type of error (e.g., transposition, classification), to ensure transparency and maintain compliance in the records.

What is the difference between Double-Entry and Single-Entry Bookkeeping? Answer: Double-Entry requires recording every transaction in at least two accounts (Debit and Credit). Single-Entry records in only one account and is not financially recognized under modern standards.

What are the types of investments in financial reports? Answer: These are typically categorized as Short-term investments, Long-term investments, and investments in Fixed Assets.

Modern Questions on AI and Digital Trends (2026 Focus)

- How do you use AI technology in your accounting work? Answer:

I utilize smart analytical tools to review financial data, detect non-traditional patterns, and implement automation features to reduce manual errors and increase efficiency.

- What is your opinion on simulation tests and digital platforms for accountant interviews? Answer:

I believe they increase the accuracy of the assessment process and allow candidates to be tested in realistic scenarios, which better evaluates their response capabilities beyond just theoretical knowledge.

- Have you worked with a modern AI-driven ERP system? What is your evaluation? Answer:

Yes, I have. My evaluation is that these systems significantly facilitate teamwork, streamline workflows, and reduce the time required for data collection and consolidation.

- How do you keep up with digital changes in accounting systems? Answer:

I continuously monitor technological developments, such as the rise of Cloud accounting systems, and ensure I attend periodic training to automate processes and update my technical skills.

Behavioral Questions (LSI Keywords: Teamwork, Problem-Solving)

- Tell us about a time you discovered a financial error and how you handled it (STAR Method).

Answer: I noticed a discrepancy during bank reconciliation. I investigated, found a duplicate journal entry, corrected the error with a documented entry, and promptly reported the resolution to management.

- How do you handle work pressure during monthly financial closing periods?

Answer: I manage pressure by pre-allocating tasks, using detailed checklists for complex entries, and proactively supporting the team when needed to ensure rapid and accurate completion of the financial closing.

- Describe a situation where you disagreed with a colleague on accounting treatment. How did you resolve it?

Answer: I initiated a calm professional discussion supported by reference to current accounting standards. We then collectively consulted the Financial Manager for a final, system-compliant decision, maintaining positive teamwork.

- How do you ensure compliance with modern financial regulations and Tax Compliance?

Answer: I achieve this by continuously tracking regulatory updates, implementing robust internal controls, regularly reviewing financial operations, and facilitating smooth internal audits.

At Sum Up:

Achieving success in an accounting job interview depends not only on technical knowledge but on comprehensive preparation that involves understanding the job’s nature, grasping the company’s requirements, and expressing your skills and experiences confidently and persuasively.

Throughout this article, we reviewed the types of interviews you might encounter, the most important technical and behavioral questions with ideal responses, along with practical tips and common pitfalls to avoid.

Remember always that every interview is an opportunity to prove your excellence; never leave room for randomness or hesitation. Prior training, self-confidence, and honesty in presenting your qualifications will make you a strong and eligible candidate.

Finally, be certain that every interview, even if not immediately successful, is a step closer to the job you deserve. Make every experience a new point of learning and professional development in your career path.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for modern small/medium-sized businesses.

Join our inspiring community! Follow us on LinkedIn and X (Twitter) to be the first to see the latest articles and updates. A perfect opportunity for learning and development in the world of accounting and finance. Don’t miss out, join today!