| Excerpt

Are you an entrepreneur running a sole proprietorship in Saudi Arabia? How can you, with minimal resources, implement the E-Invoicing system and avoid ZATCA fines? This guide provides a clear roadmap for a seamless digital transformation and compliance with all Saudi regulations. |

Are you an entrepreneur running a sole proprietorship in Saudi Arabia? Perhaps you manage a small restaurant in Khobar, or offer consulting services in Madinah. Whatever the size of your business, you must have heard about the mandatory implementation of the digital invoicing system. The question that occupies your mind now is: How can I, as a sole proprietorship, with minimal resources, implement the E-Invoicing system in Saudi Arabia and avoid the penalties imposed by the Zakat, Tax and Customs Authority (ZATCA)?

Digital transformation is the future, but for small businesses, it may seem like a complex and costly challenge. Fortunately, it is simpler than you imagine. The purpose of this comprehensive guide is to provide you with the necessary knowledge and tools, from understanding ZATCA requirements to choosing the best accounting software in Saudi Arabia to facilitate the process. We will explain in detail the legal framework and timelines, and offer practical tips for implementing E-Invoicing for Sole Proprietorships efficiently, converting your paper files into organized digital assets.

What is the E-Invoicing System for Sole Proprietorships?

In its simplest form, an E-Invoice for Sole Proprietorships is an invoice that is issued and saved in a structured, standardized electronic format, replacing paper invoices or traditional, non-editable documents. This system ensures a secure exchange of data between the seller and the buyer and is subject to strict technical standards set by the Zakat, Tax and Customs Authority (ZATCA).

Defining Sole Proprietorships vs. Other Business Types

A Sole Proprietorship is defined as a business entity fully owned and operated by a single individual. This person is directly and unlimitedly responsible for the company’s debts and obligations. This contrasts with Joint Stock Companies and Limited Liability Companies (LLC), which have a separate legal and financial entity and are subject to more complex regulation. Despite their simplicity, sole proprietorships are fully subject to the E-Invoicing system in Saudi Arabia, especially if they are registered for Value Added Tax (VAT).

Why is Electronic Invoicing Mandatory in Saudi Arabia?

The transition to a digital invoicing system is part of the Kingdom’s larger economic transformation plan (Vision 2030). This mandate aims to:

- Combat Commercial Concealment: Reduce irregular transactions and enhance transparency in the Saudi market.

- Improve Tax Compliance: Simplify the process of reviewing and declaring Value Added Tax (VAT) through a unified system.

- Facilitate Procedures: Standardizing the electronic format of invoices streamlines transactions between businesses, individuals, and the Authority.

The Legal and Regulatory Framework in the Kingdom

For your sole proprietorship to comply with the law, it is essential to understand the regulatory body and the specific deadlines for implementation.

The Zakat, Tax and Customs Authority (ZATCA) and the E-Invoicing Regulation

ZATCA is the authority mandated to regulate and implement the E-Invoicing system in Saudi Arabia. The Authority issued the E-Invoicing Regulation (known as “FATOORAH”) which specifies the technical and operational requirements and procedures for issuing and saving electronic invoices and notices. Compliance with this regulation is not optional; it is mandatory and entails fines and penalties for non-compliance.

To understand the full technical and procedural rules for implementation, you can watch this video: Integration Process Steps For E-Invoicing Phase 2.

Implementation Timelines for Businesses (Riyadh, Jeddah, Dammam, Khobar, Madinah)

The E-Invoicing system is applied in two main phases, and ZATCA is sequentially notifying the targeted groups:

- Phase One (Generation and Storage): Began on December 4, 2021, for all VAT-registered taxpayers, including most sole proprietorships. This phase required issuing and storing invoices and notices electronically in a specific format and content.

- Phase Two (Integration and Linking): Started gradually on January 1, 2023. This phase requires linking taxpayers’ invoicing systems, including those of E-Invoicing for Sole Proprietorships, with the Authority’s “FATOORAH” platform to obtain a cryptographic Hash and participate in data exchange.

Sole proprietorships in all Saudi cities, whether retail stores in Jeddah, consulting offices in Riyadh, or service companies in Dammam, must monitor ZATCA’s official announcements to determine the specific start date for their group.

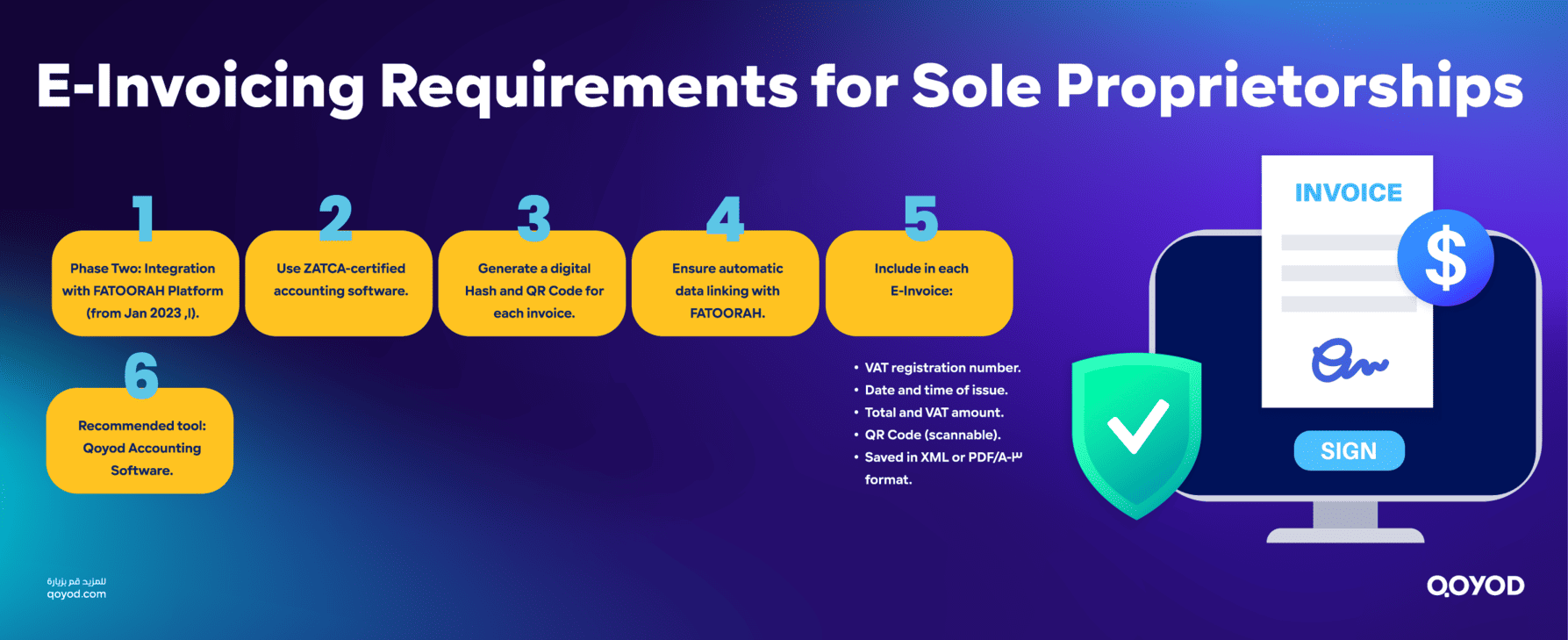

What Sole Proprietorships Must Know: E-Invoicing Requirements

To ensure compliance, the sole proprietor must understand the technical and time-bound requirements for transitioning to the E-Invoicing system.

Phase Two: Linking and Integration with the ‘FATOORAH’ Platform (From January 1, 2023)

This is the most critical stage for your establishment. This phase requires using technically certified accounting software from ZATCA, capable of:

- Generating a unique digital Hash for each invoice.

- Generating a Quick Response Code (QR Code) on the invoice.

- Automated linking and integration with the Authority’s “FATOORAH” platform to transmit data.

Required Fields and Data in the E-Invoice (Tax ID, QR Code, XML Format…)

For your E-Invoice for Sole Proprietorships to be valid and accepted by ZATCA, it must include:

- Supplier’s Value Added Tax (VAT) registration number.

- Accurate date and time of invoice issuance.

- Total value and the applied VAT amount.

- QR Code: Must be scannable and readable.

- Retention of a copy in a specific electronic format (usually XML or PDF/A-3 format).

These requirements underscore the necessity of relying on advanced, ZATCA-compliant accounting software, such as Qoyod Accounting Software.

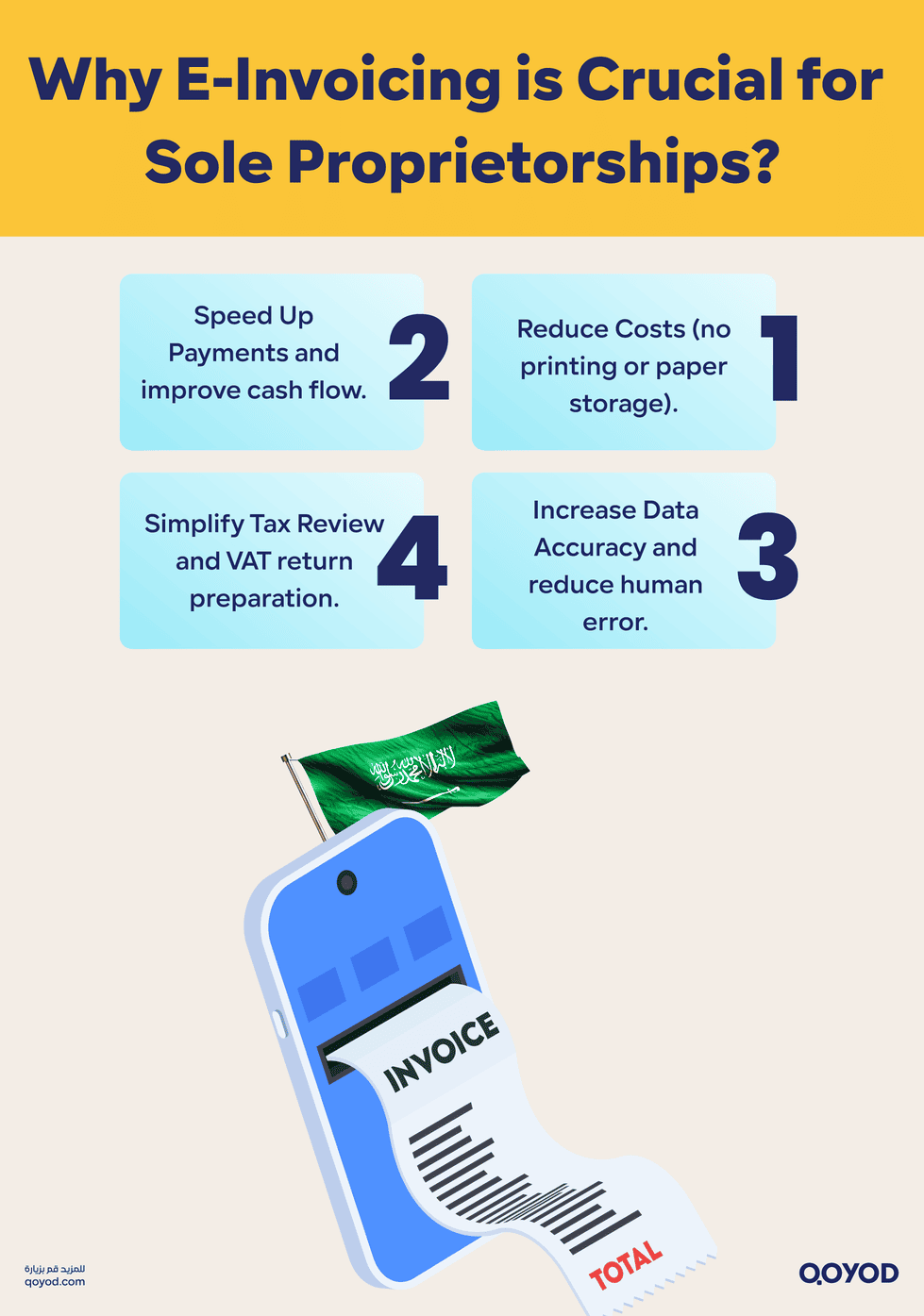

Why E-Invoicing is Crucial for Sole Proprietorships: Benefits and Challenges

Digital transformation presents challenges, but it opens wide doors for growth and efficiency, especially for sole proprietorships looking to expand in the Saudi market.

Benefits: Reducing Costs, Speeding Up Payments, Improving Cash Flow

- Cost Savings: Eliminating the costs of printing and paper storage of invoices.

- Faster Payment Processing: Immediate, digital invoice submission reduces payment delays and improves cash flow management.

- Data Accuracy: Reducing human errors in data entry, making accounting reports more precise.

- Easier Review: Reviewing your tax records becomes much simpler in preparation for submitting your VAT return.

Challenges Faced by SMEs (e.g., in Riyadh, Jeddah) and How to Overcome Them

The biggest challenge for sole proprietorships in highly competitive cities like Riyadh and Jeddah lies in:

| Challenge | Practical Solution |

| Initial Setup Cost | Opting for affordable, cloud-based accounting solutions designed for SMEs. |

| Lack of Technical Expertise | Choosing user-friendly software with an intuitive interface and local support. |

| Training Needs | Selecting software that offers comprehensive training and Arabic-language technical support. |

The practical solution is to choose the best accounting software in Saudi Arabia that provides affordable, cloud-based solutions and ease of use, such as software specifically designed for small companies, with available Arabic technical support.

Practical Steps to Implement E-Invoicing in Your Sole Proprietorship

Compliance with the E-Invoicing system is straightforward if you follow practical and well-thought-out steps.

1. Assess the Readiness of Your Accounting System (e.g., “Best Accounting Software in Saudi Arabia”)

Before anything else, evaluate your current system: Are you still using paper invoices or Excel sheets? If the answer is yes, you need to immediately transition to digital accounting solutions. Ensure that the solution you choose (or the accounting software you intend to subscribe to) holds the ZATCA compliance certificate.

2. Choose a ZATCA-Compliant E-Invoicing Provider (e.g., Qoyod Accounting Software)

This step is fundamental to ensuring your compliance. Search for an accounting solution provider that offers ZATCA-certified and tested E-Invoicing systems in Saudi Arabia.

- Criterion: The software must be able to issue a QR Code and generate the XML file in the ZATCA-approved format.

- Advantage: Software like Qoyod Accounting Software offers integrated cloud solutions designed for Saudi businesses, simplifying the process of linking and integrating with the “FATOORAH” platform without technical complications.

3. Training and Launching the Electronic System and Integration

The final step is actual operation. Once you choose powerful accounting software, you must:

- Comprehensive Training: Understand how to correctly input customer and product data to issue the E-Invoice.

- Integration: Activate the ZATCA linking feature in the accounting program to ensure automated and immediate data transmission, giving you peace of mind and full legal compliance.

Frequently Asked Questions (FAQ)

Is E-Invoicing mandatory for all sole proprietorships in Saudi Arabia?

Yes, E-Invoicing is mandatory for all taxpayers registered for VAT, including the majority of sole proprietorships whose revenues exceed the mandatory VAT registration threshold.

What are the fines for not implementing the E-Invoicing system?

ZATCA imposes fines starting from a specific amount, which increase with repeated non-compliance. Fines can reach thousands of riyals and may include the suspension of services for the non-compliant establishment.

What is the difference between a Simplified and a Standard E-Invoice?

The Simplified E-Invoice is typically used for sales to individuals (B2C) and is lower in value, while the Standard E-Invoice is used for business-to-business (B2B) transactions and requires more detailed data, especially buyer information.

Read More: [Frequently Asked Questions

Conclusion

Implementing E-Invoicing for Sole Proprietorships is not just a legal procedure for avoiding fines; it is a genuine investment in the future of your company in the Kingdom of Saudi Arabia. This system guarantees efficiency, accuracy in tax calculations (VAT), and complete transparency in transactions, supporting your business growth and competitiveness in the Saudi market, whether you are in Madinah or Khobar. Do not let technical challenges hold you back.

Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for Saudi companies.